A Historic Journey: Charting The USD To INR Trade Fee (2000 Phrases)

By admin / August 30, 2024 / No Comments / 2025

A Historic Journey: Charting the USD to INR Trade Fee (2000 Phrases)

Associated Articles: A Historic Journey: Charting the USD to INR Trade Fee (2000 Phrases)

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to A Historic Journey: Charting the USD to INR Trade Fee (2000 Phrases). Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

A Historic Journey: Charting the USD to INR Trade Fee (2000 Phrases)

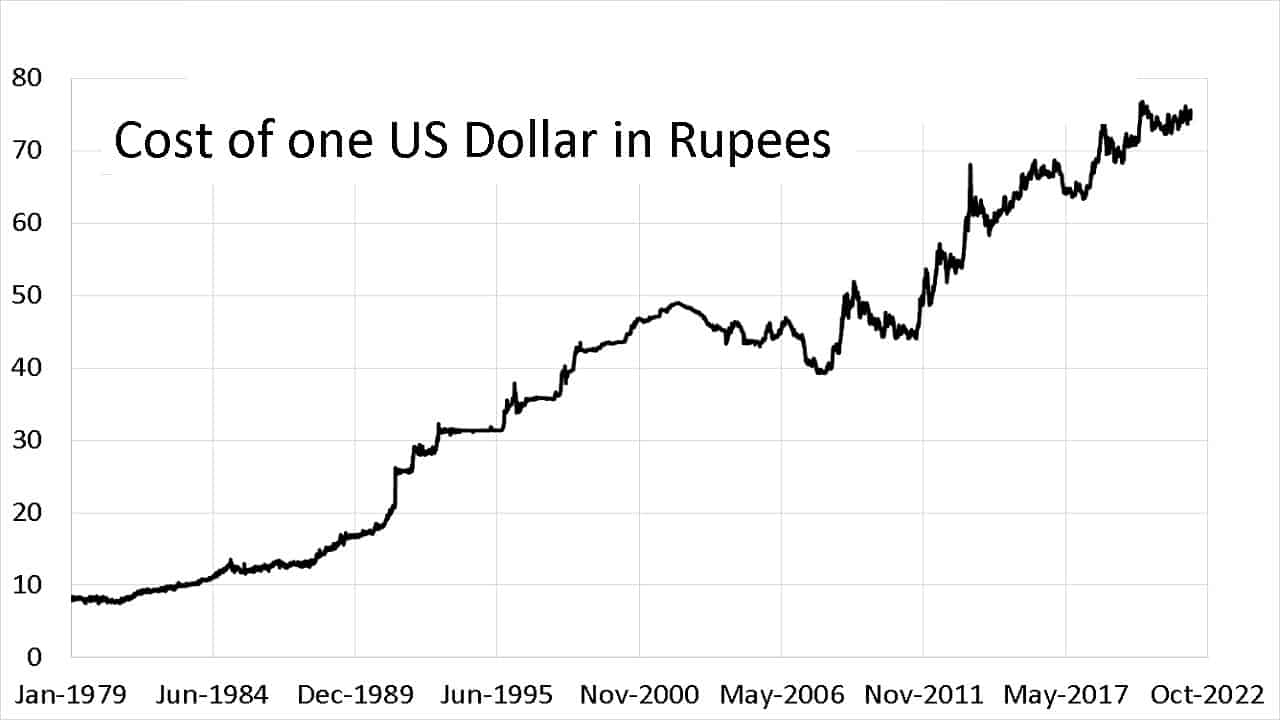

The Indian Rupee (INR) and the US Greenback (USD) have a posh and dynamic relationship, mirrored within the ever-fluctuating alternate fee between the 2 currencies. Understanding this historic trajectory requires analyzing varied financial, political, and international components which have formed its motion over time. This text delves into the historic USD/INR alternate fee, analyzing key durations and the underlying forces driving the fluctuations.

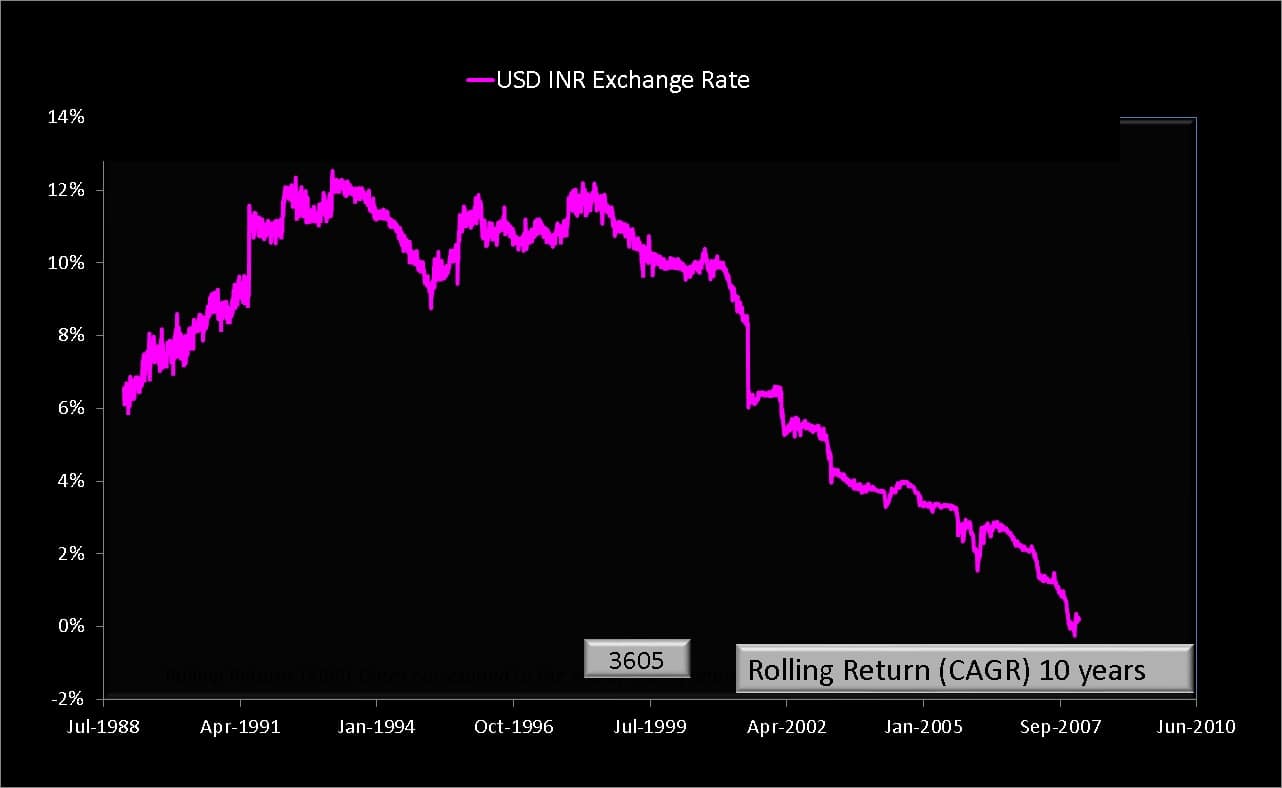

Early 2000s: A Comparatively Steady Interval with Gradual Depreciation

The early 2000s noticed a comparatively secure, albeit progressively depreciating, INR in opposition to the USD. The alternate fee hovered round 45-50 INR per USD for a good portion of this era. A number of components contributed to this development:

- India’s Financial Liberalization: The continued reforms initiated within the Nineteen Nineties continued to impression the financial system. Whereas liberalization spurred development, it additionally resulted in elevated import dependence, placing downward stress on the Rupee. The present account deficit, although manageable, performed a task on this gradual depreciation.

- World Financial Circumstances: The worldwide financial panorama throughout this time was comparatively secure, with reasonable development in main economies. Nonetheless, occasions just like the dot-com bubble burst and the following slowdown impacted investor sentiment, influencing foreign money markets.

- Authorities Insurance policies: The Reserve Financial institution of India (RBI) adopted a managed float regime, intervening within the international alternate market to handle volatility however usually permitting for a gradual adjustment of the alternate fee.

Mid-2000s: The Affect of World Progress and Inflation

The mid-2000s witnessed a interval of strong international development, fueled by rising economies like China and India. This era, nevertheless, additionally noticed rising inflation globally, together with in India. The impression on the USD/INR alternate fee was important:

- Elevated Capital Inflows: Sturdy international development attracted important international direct funding (FDI) and international portfolio funding (FPI) into India, boosting demand for the Rupee and resulting in appreciation. The alternate fee moved in direction of 40 INR per USD in sure durations.

- Inflationary Pressures: Concurrently, rising inflation in India eroded the Rupee’s buying energy, placing downward stress on the alternate fee. The RBI’s financial coverage responses, aimed toward controlling inflation, additionally influenced the foreign money’s motion.

- Commodity Costs: The surge in international commodity costs, significantly oil, considerably impacted India’s present account deficit, placing stress on the Rupee. This highlighted the vulnerability of the Indian financial system to exterior shocks.

Late 2000s: The World Monetary Disaster and its Aftermath

The worldwide monetary disaster of 2008-2009 had a profound impression on the USD/INR alternate fee. The disaster triggered an enormous flight to security, with traders transferring their funds to perceived protected haven belongings just like the US greenback.

- Sharp Depreciation: The Rupee skilled a pointy depreciation in opposition to the USD, reaching ranges above 50 INR per USD and even breaching 60 INR per USD at occasions. This mirrored the worldwide uncertainty and the withdrawal of international capital from rising markets.

- RBI Intervention: The RBI intervened closely within the international alternate market to stop extreme volatility and handle the depreciation. This concerned utilizing its international alternate reserves to help the Rupee.

- Financial Slowdown: The worldwide disaster led to a major slowdown within the Indian financial system, additional impacting the Rupee’s worth. Diminished export demand and decreased capital inflows contributed to the depreciation.

2010s: A Decade of Volatility and Reform

The 2010s had been characterised by appreciable volatility within the USD/INR alternate fee, influenced by a mixture of home and international components:

- Fiscal Deficit Issues: India’s persistent fiscal deficit and considerations about its macroeconomic stability contributed to durations of Rupee weak spot. Investor sentiment performed a vital position in these fluctuations.

- World Financial Coverage: The quantitative easing insurance policies adopted by main central banks, significantly the US Federal Reserve, impacted international liquidity and foreign money values, influencing the USD/INR alternate fee.

- Reform Initiatives: The Indian authorities carried out varied financial reforms aimed toward boosting development and attracting funding. These reforms, whereas constructive in the long term, typically created short-term uncertainty within the foreign money market.

- Geopolitical Occasions: World geopolitical occasions, such because the Eurozone disaster and the rise of protectionist sentiments, additionally influenced the alternate fee.

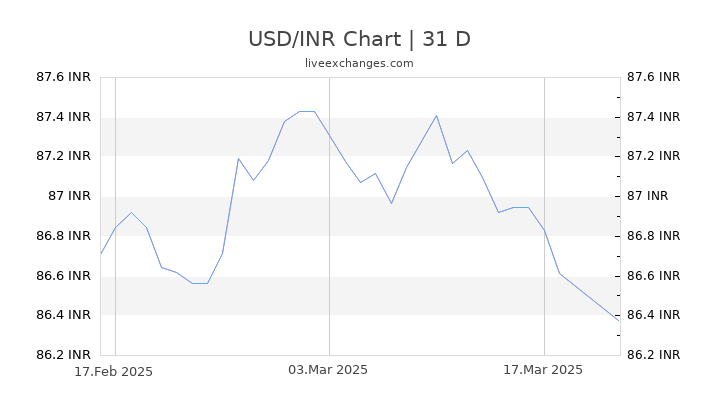

2020s: Pandemic, Restoration, and Geopolitical Tensions

The 2020s started with the unprecedented COVID-19 pandemic, which initially brought about important volatility within the USD/INR alternate fee.

- Pandemic-Induced Volatility: The pandemic triggered a worldwide financial slowdown, resulting in capital flight from rising markets. The Rupee depreciated in opposition to the USD initially, reflecting the uncertainty and financial disruption.

- Restoration and Inflation: As the worldwide financial system started to recuperate, the USD/INR alternate fee stabilized considerably. Nonetheless, rising inflation globally, together with in India, and the following financial coverage tightening by the RBI, influenced the alternate fee.

- Geopolitical Components: The continued Russia-Ukraine battle and its impression on international power costs and provide chains have launched additional volatility into the USD/INR alternate fee. The battle’s impression on inflation and international development continues to play a major position.

Components Influencing the USD/INR Trade Fee:

A number of key components affect the USD/INR alternate fee, together with:

- Curiosity Fee Differentials: Variations in rates of interest between the US and India have an effect on capital flows. Greater rates of interest in India have a tendency to draw international funding, strengthening the Rupee.

- Inflation Differentials: Greater inflation in India in comparison with the US tends to weaken the Rupee.

- Present Account Deficit: A big present account deficit places downward stress on the Rupee, because it signifies a better demand for international foreign money.

- Authorities Insurance policies: Authorities insurance policies relating to fiscal administration, commerce, and international funding considerably impression the alternate fee.

- World Financial Circumstances: World financial development, geopolitical occasions, and commodity costs all affect the USD/INR alternate fee.

- Hypothesis and Market Sentiment: Speculative buying and selling and general market sentiment can create short-term volatility within the alternate fee.

Conclusion:

The historic USD/INR alternate fee reveals a posh interaction of home and international components. Whereas durations of relative stability have occurred, the general development has been considered one of gradual depreciation, punctuated by important fluctuations because of financial crises, international occasions, and coverage choices. Understanding these historic patterns is essential for traders, companies, and policymakers alike, because it offers useful insights into the potential future actions of the alternate fee and the challenges and alternatives it presents. Predicting future actions stays difficult, nevertheless, because of the inherent complexity and interconnectedness of the worldwide financial system. Continued monitoring of the aforementioned components is crucial for navigating the dynamic panorama of the USD/INR alternate fee.

Closure

Thus, we hope this text has supplied useful insights into A Historic Journey: Charting the USD to INR Trade Fee (2000 Phrases). We thanks for taking the time to learn this text. See you in our subsequent article!