Ascending Triangle Breakout: A Complete Information To Chart Sample Recognition And Buying and selling Methods

By admin / June 10, 2024 / No Comments / 2025

Ascending Triangle Breakout: A Complete Information to Chart Sample Recognition and Buying and selling Methods

Associated Articles: Ascending Triangle Breakout: A Complete Information to Chart Sample Recognition and Buying and selling Methods

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Ascending Triangle Breakout: A Complete Information to Chart Sample Recognition and Buying and selling Methods. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Ascending Triangle Breakout: A Complete Information to Chart Sample Recognition and Buying and selling Methods

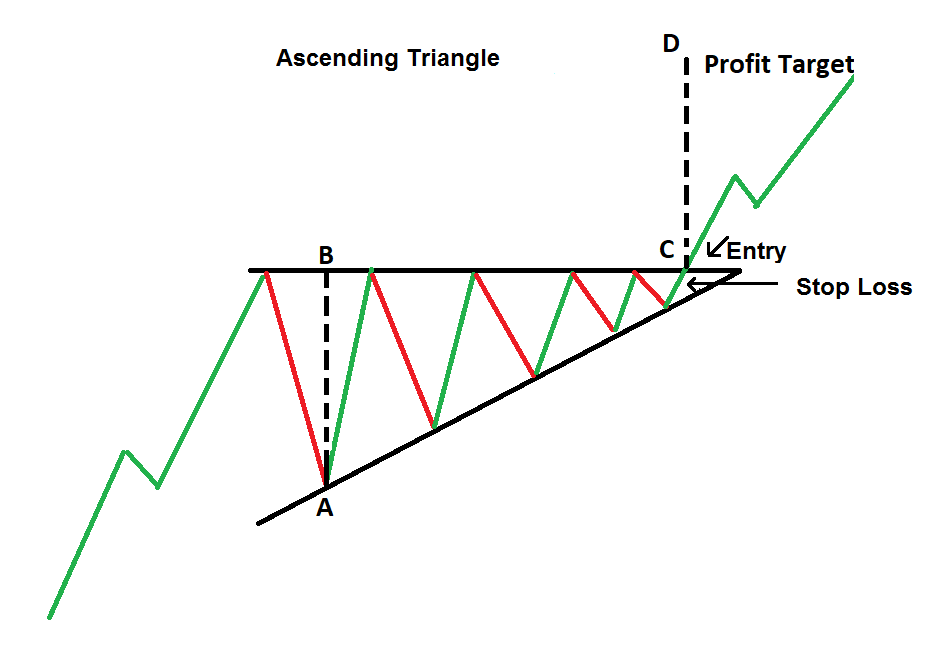

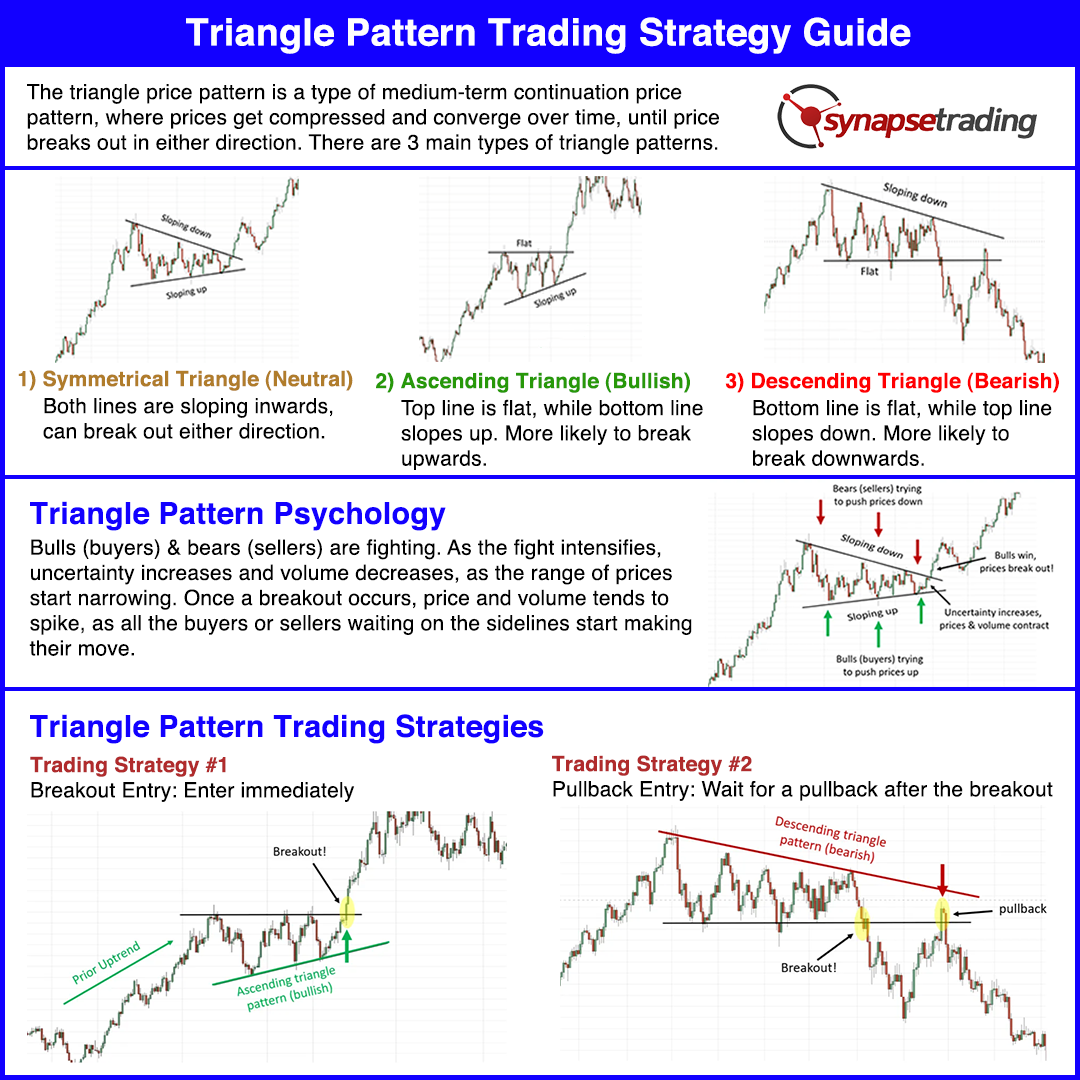

The ascending triangle, a strong chart sample in technical evaluation, alerts a possible bullish breakout. Characterised by a flat higher trendline and an ascending decrease trendline, it signifies a interval of consolidation the place consumers are progressively absorbing promoting stress. Understanding the best way to determine, interpret, and commerce this sample can considerably improve a dealer’s success. This text delves deep into the ascending triangle, masking its formation, affirmation methods, danger administration methods, and varied buying and selling approaches.

Understanding the Formation of an Ascending Triangle

The ascending triangle is shaped by two converging trendlines:

- Horizontal Resistance: A horizontal line connecting a collection of swing highs, representing a stage of value resistance the place sellers are constantly lively. This line marks the higher boundary of the sample.

- Ascending Help: An upward-sloping line connecting a collection of upper lows, indicating rising shopping for stress. This line represents the decrease boundary of the sample.

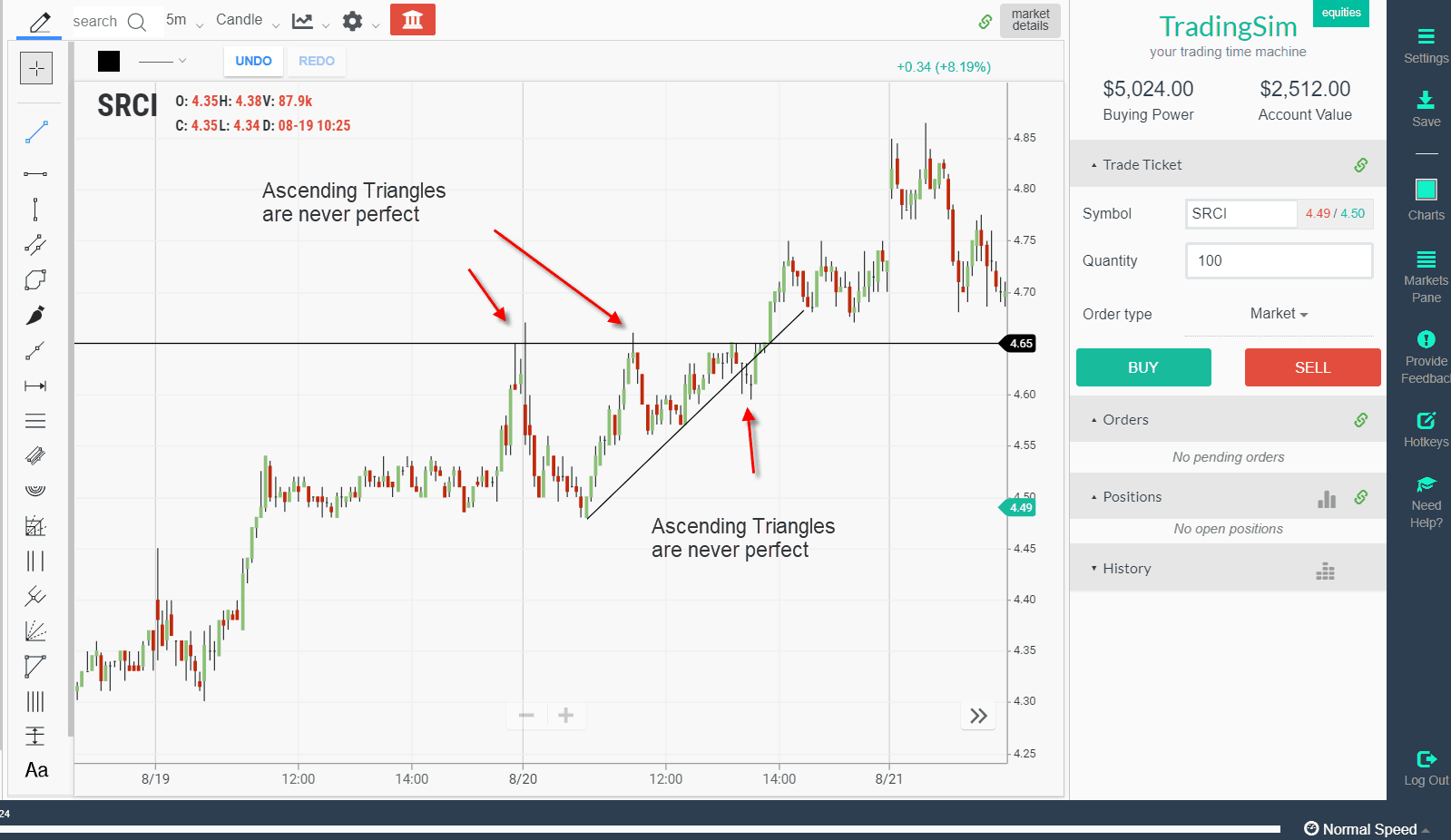

The sample’s formation signifies a battle between consumers and sellers. Sellers are constantly stopping the value from breaking above the resistance stage, whereas consumers are progressively pushing the value greater, stopping it from falling beneath the ascending help. This gradual enhance within the decrease help line creates a wedge-like form, therefore the identify "ascending triangle."

Figuring out a Legitimate Ascending Triangle:

Whereas the visible illustration is essential, a number of components contribute to validating an ascending triangle sample:

- Clear Trendlines: The trendlines needs to be clearly outlined, with no less than two swing highs and two swing lows touching every line. Extra touches strengthen the sample’s validity.

- Constant Worth Motion: The value motion inside the triangle ought to exhibit consolidation, with comparatively smaller value swings in comparison with the previous development. Excessive volatility inside the triangle weakens the sample’s predictive energy.

- Symmetry: Whereas not strictly required, a comparatively symmetrical form, the place the horizontal resistance line and the ascending help line converge at the same angle, will increase the sample’s reliability.

- Quantity Evaluation: Quantity sometimes decreases as the value consolidates inside the triangle. A surge in quantity accompanying the breakout confirms the sample’s validity and the energy of the transfer.

- Timeframe Consideration: Ascending triangles can type throughout varied timeframes, from minutes to years. The timeframe influences the potential magnitude and period of the post-breakout transfer.

Affirmation Methods for Ascending Triangle Breakouts:

Figuring out the sample is barely half the battle. Affirmation is essential to attenuate false alerts and enhance buying and selling accuracy. A number of methods may be employed:

- Breakout Above Resistance: The obvious affirmation is a decisive break above the horizontal resistance line. This break needs to be accompanied by a major enhance in quantity, indicating robust shopping for stress.

- Candlestick Patterns: Affirmation may be enhanced by observing bullish candlestick patterns on the breakout level, similar to a powerful bullish engulfing candle or a piercing line candle.

- Transferring Common Affirmation: A breakout above a key shifting common (e.g., 20-day or 50-day MA) provides additional validation to the bullish sign.

- Relative Energy Index (RSI): A divergence between value and RSI can precede the breakout. A rising value with a falling RSI suggests weakening promoting stress and a possible bullish reversal.

- MACD Affirmation: A bullish crossover of the MACD strains (MACD and sign line) can affirm the breakout and the potential for upward momentum.

Buying and selling Methods for Ascending Triangle Breakouts:

As soon as the ascending triangle breakout is confirmed, a number of buying and selling methods may be applied:

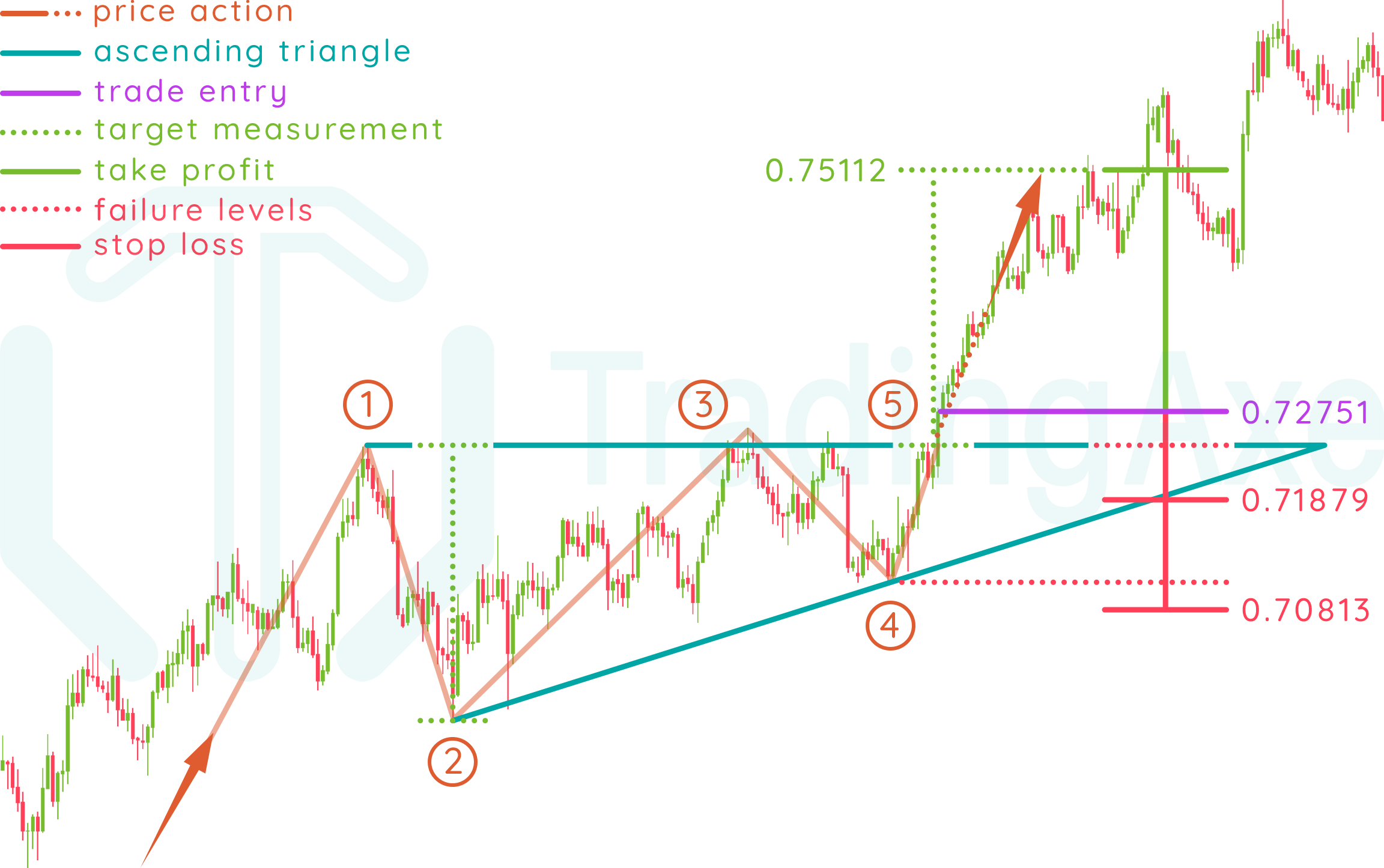

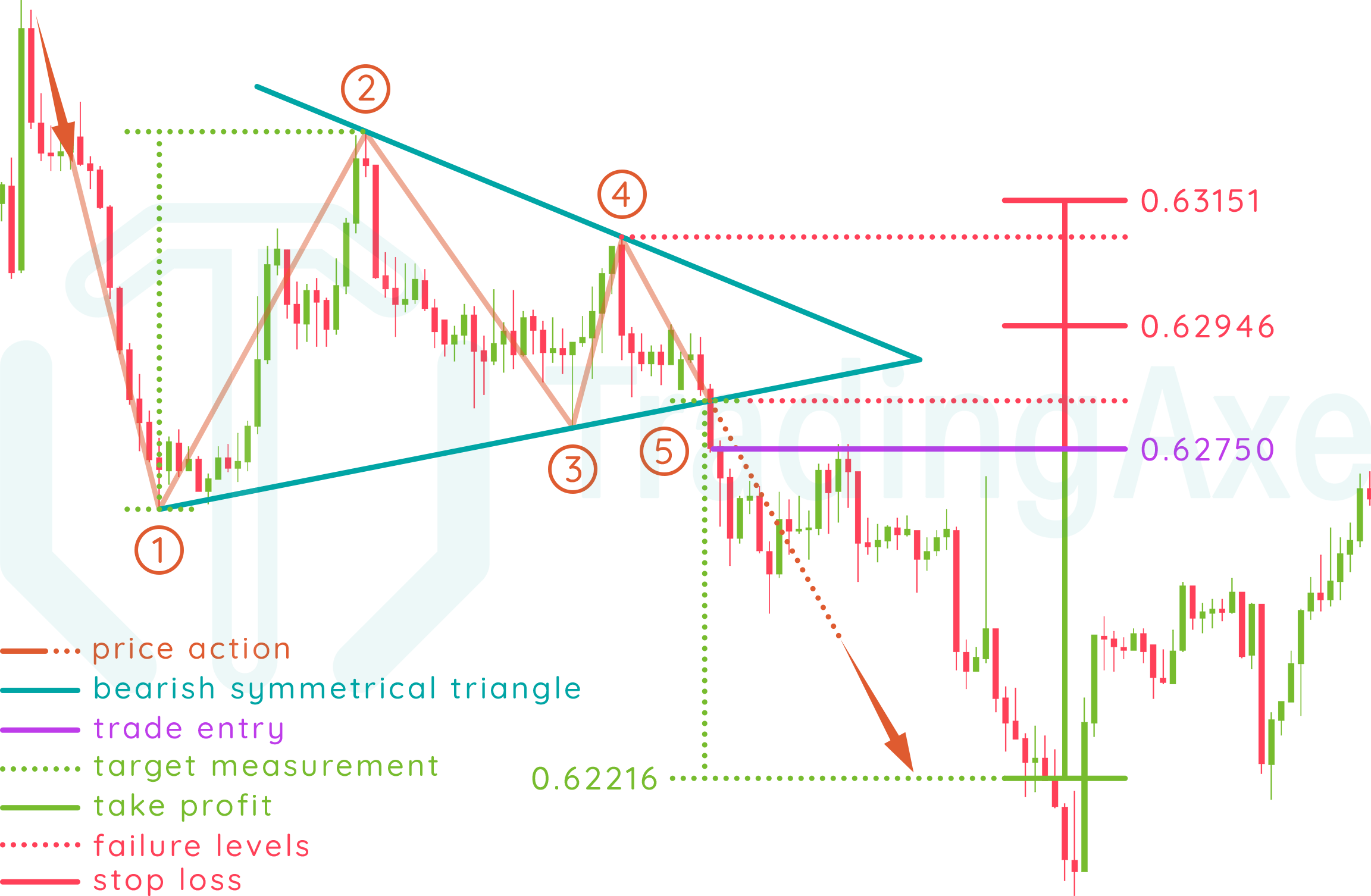

- Lengthy Place Entry: Enter an extended place as soon as the value decisively breaks above the resistance line, ideally with affirmation from quantity and different indicators.

- Cease-Loss Placement: Place a stop-loss order barely beneath the decrease trendline or the latest swing low, limiting potential losses if the breakout fails.

- Revenue Goal: The revenue goal may be decided utilizing varied strategies:

- Measurement Method: Mission the peak of the triangle upwards from the breakout level. It is a frequent approach, however its accuracy varies.

- Fibonacci Retracement: Use Fibonacci retracement ranges to determine potential revenue targets primarily based on the earlier value motion.

- Help/Resistance Ranges: Determine potential help and resistance ranges primarily based on prior value motion to set revenue targets.

- Trailing Cease-Loss: As soon as the value strikes favorably, think about using a trailing stop-loss order to guard income and experience the development.

Danger Administration in Ascending Triangle Buying and selling:

Efficient danger administration is paramount in any buying and selling technique. When buying and selling ascending triangle breakouts:

- Place Sizing: By no means danger greater than a small share of your buying and selling capital on a single commerce. This limits potential losses even when the commerce goes in opposition to your expectations.

- Cease-Loss Order: At all times use a stop-loss order to guard in opposition to sudden value reversals. Place the stop-loss order strategically, making an allowance for the sample’s traits and general market situations.

- Danger-Reward Ratio: Goal for a good risk-reward ratio (e.g., 1:2 or 1:3). Which means for each greenback risked, you goal to doubtlessly revenue two or three {dollars}.

- Diversification: Do not put all of your eggs in a single basket. Diversify your buying and selling portfolio throughout completely different belongings and techniques to cut back general danger.

False Breakouts and Avoiding Traps:

It is essential to remember that not all ascending triangle patterns lead to profitable breakouts. False breakouts can happen, resulting in losses if not managed correctly. Search for these indicators:

- Lack of Quantity Affirmation: A breakout with out a important enhance in quantity is a pink flag, suggesting a weak transfer and a possible pullback.

- Fast Reversal: A fast reversal after a seemingly profitable breakout signifies a false sign.

- Weak Breakout: A hesitant or indecisive breakout above the resistance line suggests a scarcity of shopping for stress.

Conclusion:

The ascending triangle sample is a helpful instrument for merchants looking for to determine potential bullish breakouts. By understanding its formation, affirmation methods, and danger administration rules, merchants can considerably enhance their buying and selling accuracy and profitability. Nevertheless, it is essential to keep in mind that no buying and selling technique ensures success. Thorough analysis, disciplined danger administration, and steady studying are important for long-term success in buying and selling. Combining the ascending triangle sample with different technical indicators and elementary evaluation can additional improve the reliability of buying and selling choices. At all times observe accountable buying and selling and by no means make investments greater than you’ll be able to afford to lose.

Closure

Thus, we hope this text has offered helpful insights into Ascending Triangle Breakout: A Complete Information to Chart Sample Recognition and Buying and selling Methods. We thanks for taking the time to learn this text. See you in our subsequent article!