Candle Chart Patterns: A Complete Information (PDF Downloadable)

By admin / August 12, 2024 / No Comments / 2025

Candle Chart Patterns: A Complete Information (PDF Downloadable)

Associated Articles: Candle Chart Patterns: A Complete Information (PDF Downloadable)

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Candle Chart Patterns: A Complete Information (PDF Downloadable). Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Candle Chart Patterns: A Complete Information (PDF Downloadable)

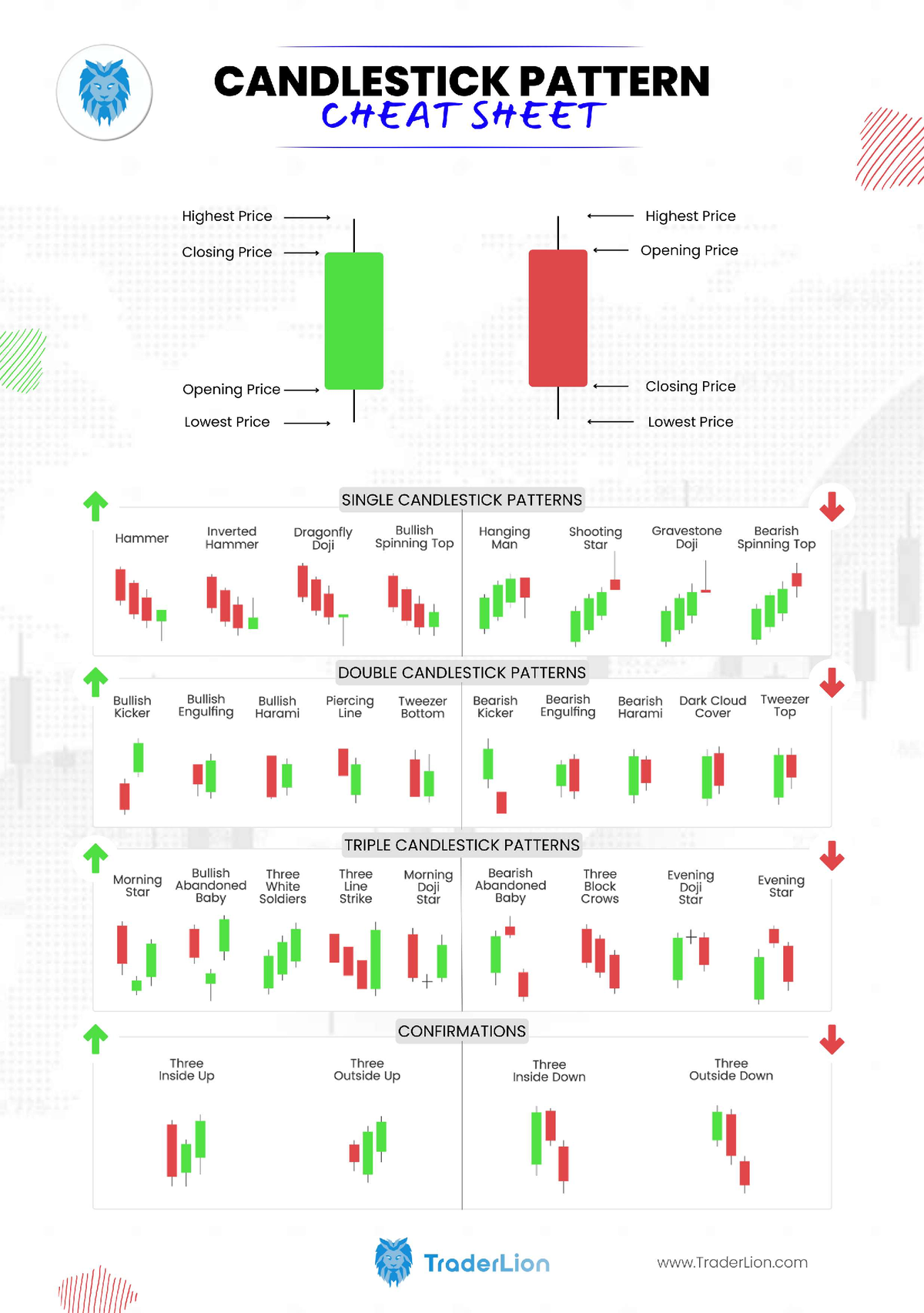

Candle charts, a visually wealthy illustration of worth motion, supply merchants a singular perspective on market sentiment and potential future actions. In contrast to bar charts, candlesticks present a transparent image of the opening, closing, excessive, and low costs inside a selected timeframe, revealing invaluable details about the shopping for and promoting stress at play. This information delves into the world of candle chart patterns, explaining their formation, interpretation, and sensible software in buying and selling. A downloadable PDF model of this information is obtainable on the finish of the article.

Understanding Candlestick Formation:

Earlier than diving into particular patterns, it is essential to grasp the fundamental elements of a candlestick:

-

Physique: The oblong a part of the candlestick represents the value distinction between the opening and shutting costs. A white or inexperienced physique signifies a closing worth larger than the opening worth (bullish), whereas a black or purple physique signifies a closing worth decrease than the opening worth (bearish). The size of the physique displays the magnitude of the value change.

-

Wicks (Shadows): The traces extending above and beneath the physique characterize the excessive and low costs of the interval. Lengthy wicks point out vital worth rejection, suggesting robust resistance or help ranges. Brief or absent wicks point out a powerful directional transfer with minimal worth fluctuation.

Widespread Bullish Candle Patterns:

Bullish patterns sign a possible upward worth motion. These patterns usually seem after a interval of bearish stress and counsel a shift in market sentiment in the direction of shopping for.

-

Hammer: A small physique with an extended decrease wick, indicating robust shopping for stress close to the low of the interval. The absence of an higher wick reinforces the bullish sign.

-

Inverted Hammer: Much like a hammer, however with an extended higher wick and a small physique. This sample suggests shopping for stress overcame promoting stress, pushing costs larger.

-

Bullish Engulfing Sample: A two-candle sample the place a big inexperienced candle utterly engulfs a previous smaller black candle. This means a major shift in purchaser dominance.

-

Piercing Sample: A two-candle sample the place a black candle is adopted by a inexperienced candle that closes at the very least midway up the black candle’s physique. This implies a possible reversal of the downtrend.

-

Morning Star: A 3-candle sample consisting of a black candle, adopted by a small physique (both black or white), and at last a big white candle. This sample usually alerts a bullish reversal on the backside of a downtrend.

Widespread Bearish Candle Patterns:

Bearish patterns counsel a possible downward worth motion. They usually comply with a interval of bullish stress and point out a shift in the direction of promoting.

-

Hanging Man: A small physique with an extended decrease wick, showing on the high of an uptrend. It alerts potential weak point and a doable reversal.

-

Capturing Star: A small physique with an extended higher wick, showing on the high of an uptrend. It suggests promoting stress overcoming shopping for stress.

-

Bearish Engulfing Sample: A two-candle sample the place a big black candle utterly engulfs a previous smaller white candle. This means a powerful shift in vendor dominance.

-

Darkish Cloud Cowl: A two-candle sample the place a white candle is adopted by a black candle that opens above the white candle’s shut and closes at the very least midway down the white candle’s physique. This implies a possible reversal of the uptrend.

-

Night Star: A 3-candle sample consisting of a white candle, adopted by a small physique (both black or white), and at last a big black candle. This sample usually alerts a bearish reversal on the high of an uptrend.

Affirmation and Context are Key:

Whereas candle patterns present invaluable insights, they shouldn’t be interpreted in isolation. Profitable buying and selling requires contemplating varied components:

-

Quantity: Excessive quantity accompanying a candle sample confirms its power and will increase the probability of a profitable commerce. Low quantity suggests weak conviction and should result in false alerts.

-

Development: Candle patterns are most dependable once they align with the prevailing pattern. A bullish sample in a powerful uptrend is extra more likely to succeed than a bullish sample in a downtrend.

-

Assist and Resistance Ranges: Figuring out help and resistance ranges may help affirm potential breakouts or reversals indicated by candle patterns.

-

Different Technical Indicators: Combining candle patterns with different technical indicators, similar to shifting averages, RSI, or MACD, can enhance accuracy and scale back threat.

-

Basic Evaluation: Whereas candle patterns deal with worth motion, incorporating basic evaluation can present a extra complete understanding of market dynamics.

Superior Candle Patterns and Combos:

Past the fundamental patterns, many extra complicated formations exist, usually combining a number of candlestick patterns or incorporating different technical indicators. Some examples embody:

-

Three White Troopers: Three consecutive white candles with progressively larger closes, suggesting robust bullish momentum.

-

Three Black Crows: Three consecutive black candles with progressively decrease closes, suggesting robust bearish momentum.

-

Doji: A candle with just about no physique, indicating indecision out there. Dojis could be present in varied contexts and may sign potential reversals or continuations.

-

Harami: A two-candle sample the place the second candle is totally contained throughout the physique of the primary candle. Harami patterns could be bullish or bearish relying on the colours of the candles.

Danger Administration and Buying and selling Methods:

Profitable buying and selling utilizing candle patterns requires a disciplined strategy to threat administration:

-

Cease-Loss Orders: All the time use stop-loss orders to restrict potential losses. Place your stop-loss order beneath the low of a bullish sample or above the excessive of a bearish sample.

-

Place Sizing: By no means threat greater than a small share of your buying and selling capital on any single commerce.

-

Commerce Administration: Develop a transparent buying and selling plan that outlines your entry and exit methods, stop-loss ranges, and revenue targets.

Conclusion:

Candle chart patterns are a robust software for technical evaluation, offering invaluable insights into market sentiment and potential worth actions. Nevertheless, it is essential to keep in mind that no sample is foolproof. Combining candle patterns with different technical indicators, basic evaluation, and sound threat administration methods is important for profitable buying and selling. By mastering the artwork of candlestick interpretation, merchants can considerably improve their means to establish high-probability buying and selling alternatives.

(PDF Obtain Hyperlink: [Insert Link Here – This would be a link to a PDF version of this article. You would need to create the PDF separately using a word processor or PDF creation software])

This text offers a complete overview of candle chart patterns. Keep in mind that constant studying and observe are key to mastering their interpretation and software in your buying and selling methods. All the time conduct thorough analysis and contemplate your threat tolerance earlier than making any buying and selling selections. The data supplied right here is for instructional functions solely and shouldn’t be thought of monetary recommendation.

Closure

Thus, we hope this text has supplied invaluable insights into Candle Chart Patterns: A Complete Information (PDF Downloadable). We thanks for taking the time to learn this text. See you in our subsequent article!