Chart Of Accounts: A Complete Revision For Enhanced Monetary Reporting

By admin / September 28, 2024 / No Comments / 2025

Chart of Accounts: A Complete Revision for Enhanced Monetary Reporting

Associated Articles: Chart of Accounts: A Complete Revision for Enhanced Monetary Reporting

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Chart of Accounts: A Complete Revision for Enhanced Monetary Reporting. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Chart of Accounts: A Complete Revision for Enhanced Monetary Reporting

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

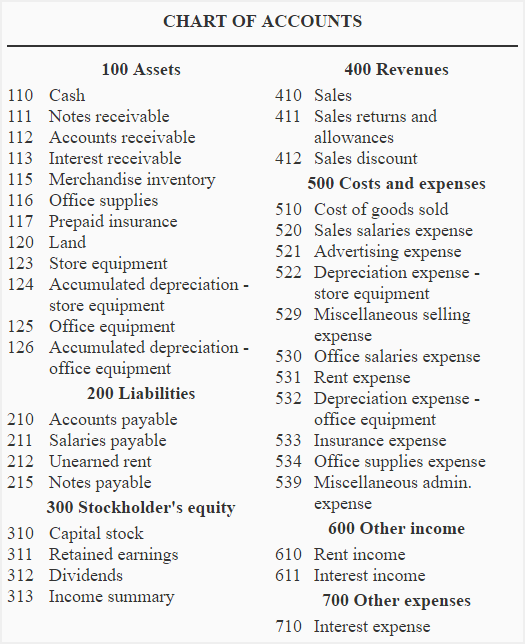

The chart of accounts (COA) is the spine of any group’s monetary reporting system. It is a structured itemizing of all of the accounts used to document monetary transactions, appearing as a vital hyperlink between the day-to-day operations and the technology of significant monetary statements. A well-designed COA ensures accuracy, consistency, and effectivity in monetary reporting, whereas a poorly structured one can result in errors, inconsistencies, and difficulties in evaluation. This text delves into the method of revising a chart of accounts, highlighting the important thing concerns, steps concerned, and the advantages of a strong and up to date system.

The Want for Revision:

A number of elements necessitate a revision of the chart of accounts. These embrace:

-

Enterprise Progress and Enlargement: As an organization grows, its operations grow to be extra complicated. New product strains, departments, or geographical places might require the addition of latest accounts to precisely replicate the expanded enterprise actions. Current accounts may also want modifications to accommodate the elevated scale of operations.

-

Technological Developments: The implementation of latest accounting software program or enterprise useful resource planning (ERP) techniques typically necessitates a evaluation and restructuring of the COA to optimize compatibility and performance. The brand new system might need completely different account constructions or require particular account codes for environment friendly knowledge processing.

-

Adjustments in Accounting Requirements: Updates to Usually Accepted Accounting Rules (GAAP) or Worldwide Monetary Reporting Requirements (IFRS) can mandate modifications in the best way sure transactions are recorded, requiring corresponding modifications to the COA. Failure to adjust to these requirements can result in vital monetary and authorized repercussions.

-

Improved Reporting Necessities: The necessity for extra granular and insightful monetary reviews may necessitate a revision of the COA. Including new accounts or sub-accounts can present a extra detailed breakdown of revenues, bills, and belongings, enabling higher decision-making.

-

Mergers and Acquisitions: When firms merge or purchase different entities, their respective COAs should be built-in. This course of requires cautious planning and coordination to make sure consistency and compatibility between the completely different accounting techniques.

-

Inner Management Enhancements: A evaluation of the COA can determine weaknesses within the inside management system. Revising the account construction may help enhance segregation of duties, improve authorization procedures, and strengthen total monetary management.

Steps in Revising a Chart of Accounts:

Revising a COA is a meticulous course of that requires cautious planning and execution. The next steps define a complete method:

-

Evaluation of Present COA: Step one includes an intensive analysis of the prevailing COA. This contains figuring out outdated, redundant, or inefficient accounts. Analyze the present account construction, its effectiveness in supporting enterprise operations, and its compliance with accounting requirements.

-

Outline Targets: Clearly outline the objectives of the revision. What are the particular enhancements you goal to realize? This might embrace improved accuracy, enhanced reporting capabilities, higher compliance, or streamlined processes.

-

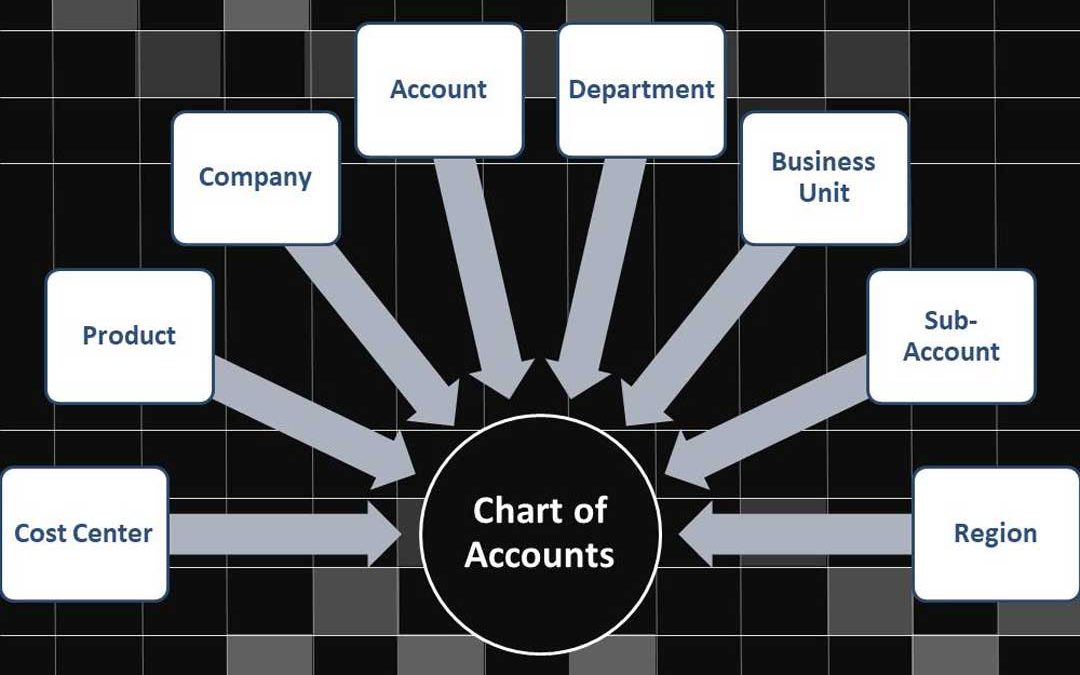

Develop a New Chart of Accounts Construction: Primarily based on the evaluation and outlined aims, design a brand new COA construction. This includes figuring out the suitable stage of element, deciding on an acceptable numbering system (e.g., hierarchical, segmented), and defining the particular accounts wanted to seize all related monetary transactions. Think about using a standardized chart of accounts framework, such because the industry-specific ones, to make sure consistency and comparability.

-

Account Naming and Coding: Select descriptive and constant account names. Implement a transparent and logical coding system that facilitates simple identification and retrieval of knowledge. The coding system needs to be versatile sufficient to accommodate future progress and modifications.

-

Mapping and Migration: Develop an in depth mapping plan to hyperlink the outdated COA to the brand new one. That is essential for seamlessly migrating knowledge from the outdated system to the brand new one. The mapping course of ensures that historic knowledge stays constant and accessible.

-

Testing and Implementation: Totally check the brand new COA earlier than implementing it. This includes working check transactions to make sure that all accounts perform appropriately and that the reporting mechanisms are correct. A phased implementation method can reduce disruption to day by day operations.

-

Coaching and Documentation: Present complete coaching to all personnel concerned in utilizing the brand new COA. Create detailed documentation, together with a chart of accounts guide, to clarify the construction, coding system, and account definitions.

-

Ongoing Monitoring and Evaluate: Repeatedly monitor the effectiveness of the revised COA. Determine any areas for enchancment and make obligatory changes to make sure the system stays related and environment friendly.

Advantages of a Revised Chart of Accounts:

A well-revised COA gives quite a few advantages, together with:

-

Improved Accuracy: A transparent and constant COA minimizes errors in recording transactions, resulting in extra correct monetary statements.

-

Enhanced Reporting: An in depth COA permits for the technology of extra complete and insightful monetary reviews, enabling higher decision-making.

-

Higher Compliance: A revised COA ensures compliance with accounting requirements and laws, lowering the danger of penalties and authorized points.

-

Streamlined Processes: A well-structured COA simplifies accounting processes, bettering effectivity and lowering the time spent on guide duties.

-

Improved Inner Management: A strong COA strengthens inside controls, lowering the danger of fraud and errors.

-

Facilitated Auditing: A well-organized COA simplifies the audit course of, lowering the time and price related to exterior audits.

-

Higher Knowledge Evaluation: The improved knowledge group permits for simpler knowledge evaluation, enabling higher understanding of the enterprise’s monetary efficiency.

Conclusion:

Revising a chart of accounts is a strategic endeavor that calls for cautious planning, thorough execution, and ongoing monitoring. Whereas it requires vital effort and sources, the advantages far outweigh the prices. A well-designed and frequently up to date COA is important for correct monetary reporting, efficient decision-making, and the general success of any group. By following the steps outlined on this article, companies can be sure that their chart of accounts stays a strong and dependable basis for his or her monetary administration system. Ignoring the necessity for revision can result in vital issues down the road, hindering progress and doubtlessly jeopardizing the monetary well being of the group. Proactive revision is, due to this fact, a vital factor of accountable monetary administration.

Closure

Thus, we hope this text has supplied invaluable insights into Chart of Accounts: A Complete Revision for Enhanced Monetary Reporting. We hope you discover this text informative and helpful. See you in our subsequent article!