Chart Of Accounts And Journal Entries: The Basis Of Correct Monetary Reporting

By admin / August 8, 2024 / No Comments / 2025

Chart of Accounts and Journal Entries: The Basis of Correct Monetary Reporting

Associated Articles: Chart of Accounts and Journal Entries: The Basis of Correct Monetary Reporting

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Chart of Accounts and Journal Entries: The Basis of Correct Monetary Reporting. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Chart of Accounts and Journal Entries: The Basis of Correct Monetary Reporting

Correct monetary reporting is the spine of any profitable enterprise, massive or small. Understanding the basic constructing blocks of this course of – the chart of accounts and journal entries – is essential for sustaining monetary well being and making knowledgeable enterprise selections. This text delves into the intricacies of each, explaining their interrelationship and demonstrating their sensible software.

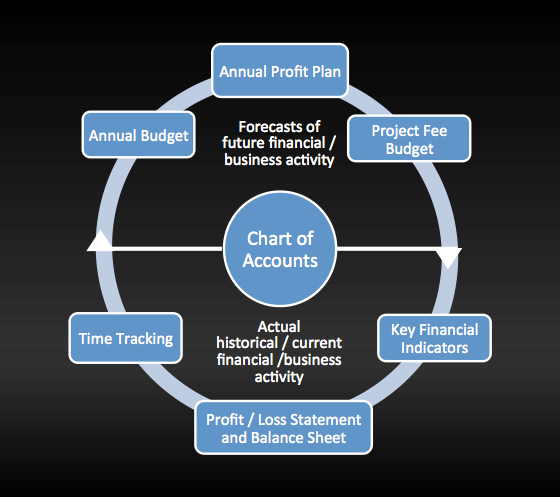

The Chart of Accounts: A Structured System of Classification

The chart of accounts is a complete record of all of the accounts utilized by a enterprise to report its monetary transactions. Consider it as an in depth organizational framework for all monetary knowledge. Every account represents a selected facet of the enterprise’s monetary actions, categorized to facilitate reporting and evaluation. A well-designed chart of accounts is essential for correct record-keeping, streamlining monetary reporting, and guaranteeing consistency throughout completely different durations.

Key Traits of a Chart of Accounts:

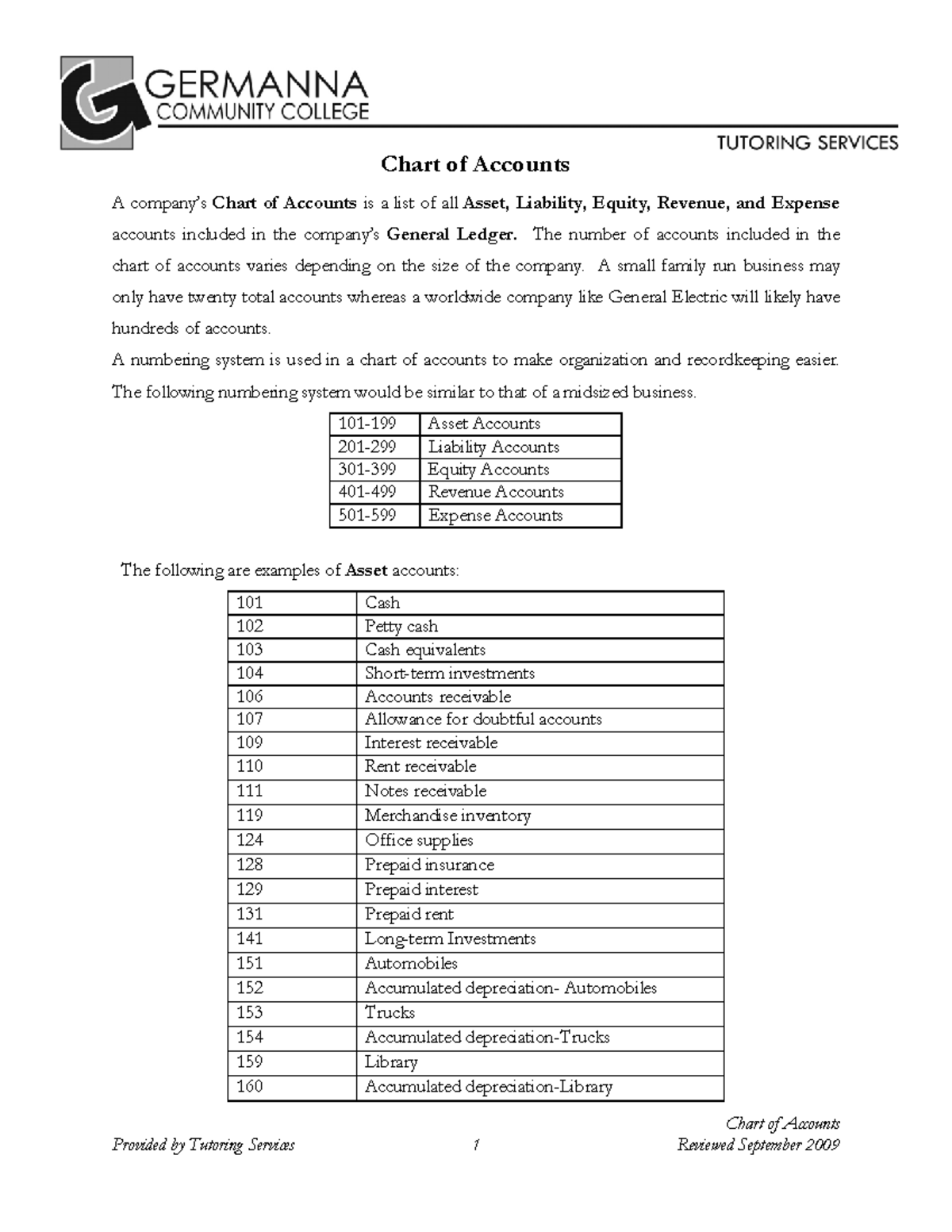

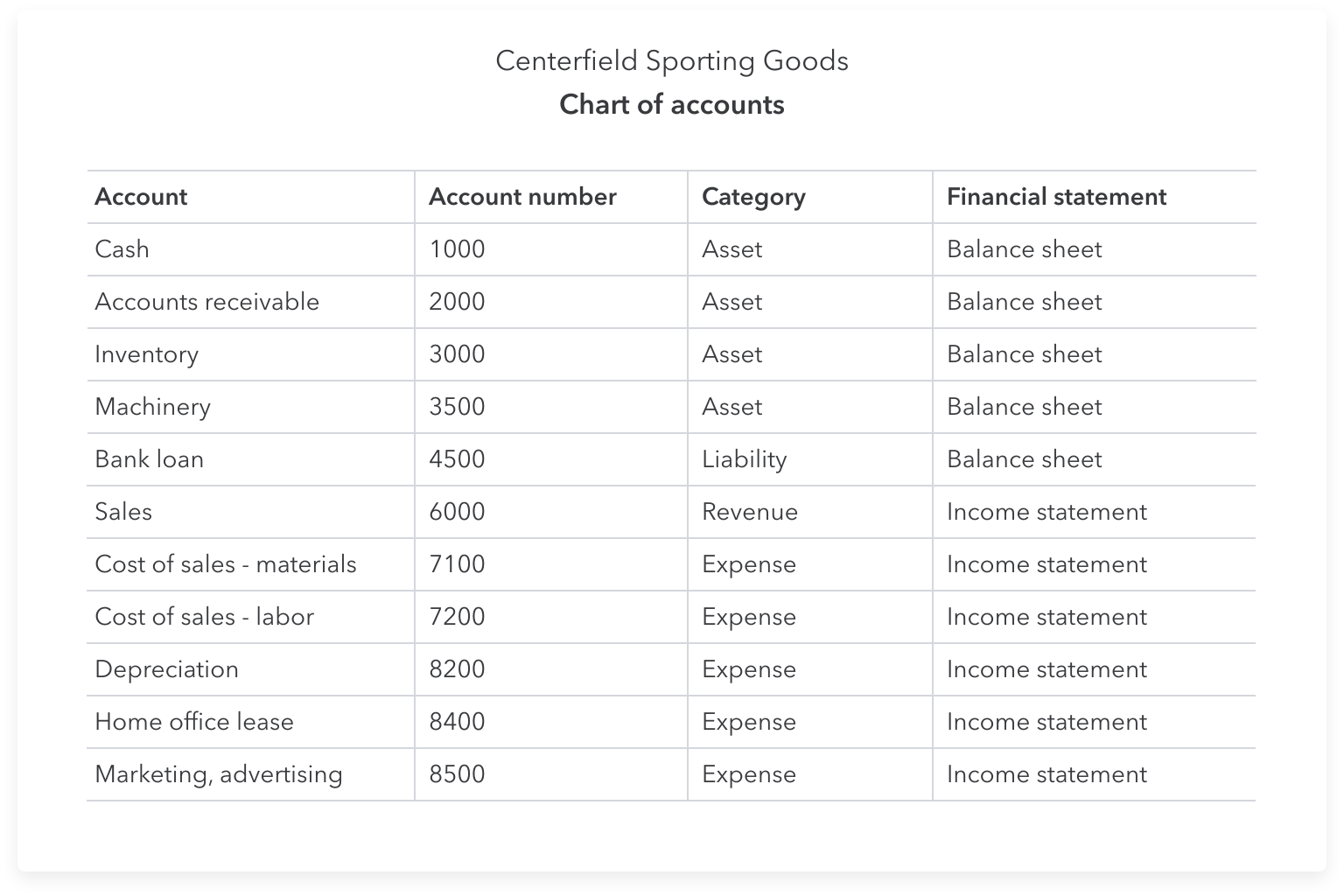

- Organized Construction: Accounts are usually organized utilizing a hierarchical construction, usually using a numbering system to point the account sort and sub-account degree. This permits for simple identification and classification of transactions. Widespread classes embody belongings, liabilities, fairness, income, and bills.

- Account Sorts: Every account sort serves a selected goal:

- Property: Assets owned by the enterprise, comparable to money, accounts receivable (cash owed to the enterprise), stock, and tools.

- Liabilities: Obligations owed by the enterprise to others, together with accounts payable (cash owed to suppliers), loans payable, and salaries payable.

- Fairness: The proprietor’s funding within the enterprise, representing the residual curiosity after deducting liabilities from belongings. This contains retained earnings (gathered income) and capital contributions.

- Income: Earnings generated from the enterprise’s major operations, comparable to gross sales income, service income, and curiosity earnings.

- Bills: Prices incurred in producing income, together with value of products bought, salaries expense, lease expense, and utilities expense.

- Consistency and Standardization: Sustaining consistency in account utilization is paramount. Utilizing the identical account for a similar sort of transaction all through the accounting interval ensures accuracy and comparability of economic knowledge.

- Customization: Whereas commonplace account classes exist, the particular accounts inside these classes are sometimes custom-made to mirror the distinctive nature of a enterprise. A retail retailer, for example, might need detailed stock accounts, whereas a service-based enterprise may give attention to accounts associated to skilled providers.

Instance of a Easy Chart of Accounts:

| Account Quantity | Account Title | Account Kind |

|---|---|---|

| 101 | Money | Asset |

| 102 | Accounts Receivable | Asset |

| 103 | Stock | Asset |

| 201 | Accounts Payable | Legal responsibility |

| 202 | Loans Payable | Legal responsibility |

| 301 | Proprietor’s Fairness | Fairness |

| 401 | Gross sales Income | Income |

| 501 | Value of Items Bought | Expense |

| 502 | Salaries Expense | Expense |

| 503 | Hire Expense | Expense |

Journal Entries: Recording the Monetary Impression of Transactions

Journal entries are the basic constructing blocks of the accounting course of. They supply a chronological report of all monetary transactions, detailing the accounts affected and the quantities concerned. Every entry follows a selected format, guaranteeing readability and accuracy.

Key Parts of a Journal Entry:

- Date: The date the transaction occurred.

- **Account

Closure

Thus, we hope this text has supplied precious insights into Chart of Accounts and Journal Entries: The Basis of Correct Monetary Reporting. We hope you discover this text informative and useful. See you in our subsequent article!