Chart Of Accounts For Development Firms: A Complete Information

By admin / August 9, 2024 / No Comments / 2025

Chart of Accounts for Development Firms: A Complete Information

Associated Articles: Chart of Accounts for Development Firms: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Chart of Accounts for Development Firms: A Complete Information. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Chart of Accounts for Development Firms: A Complete Information

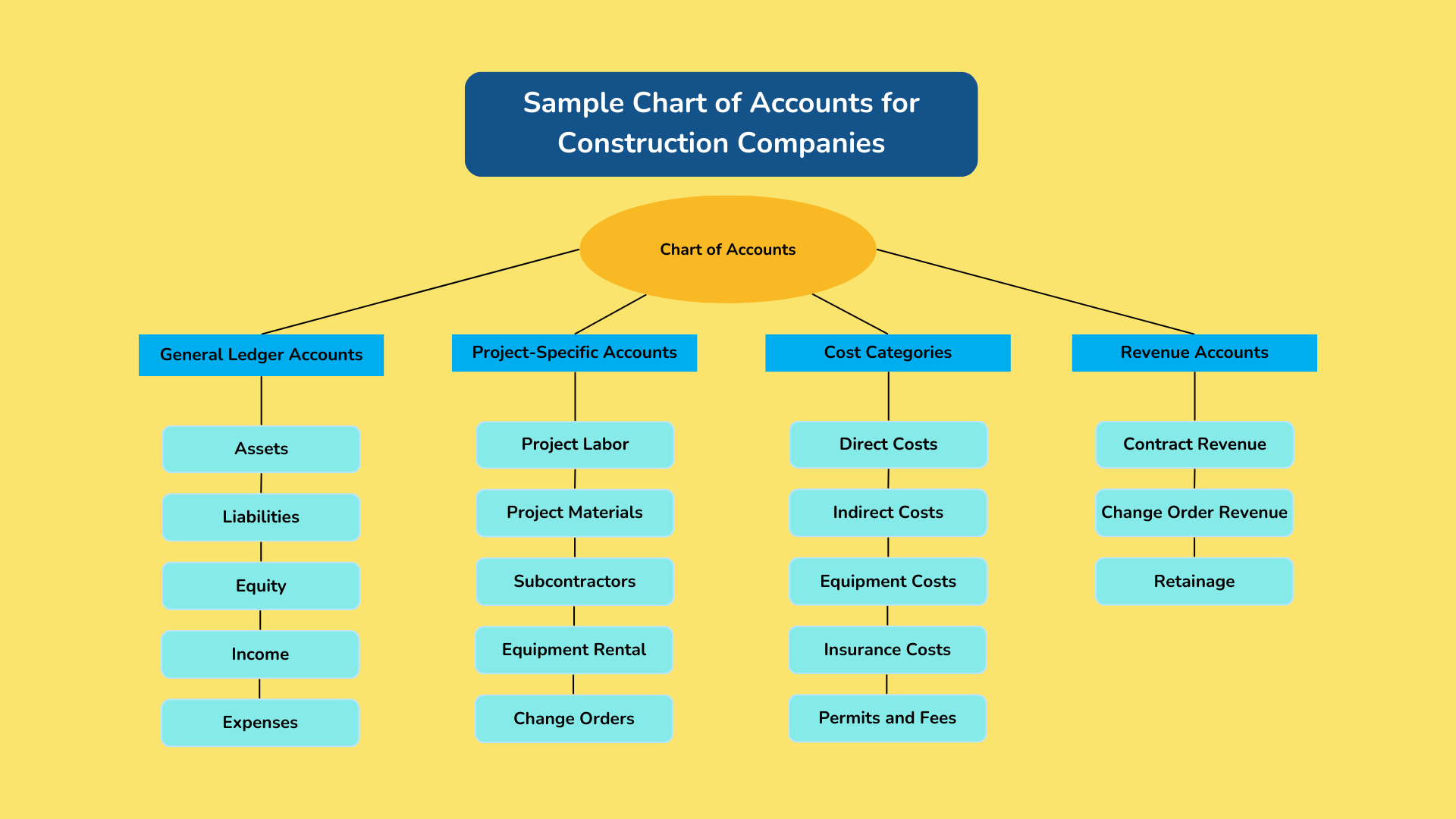

The development {industry} is advanced, involving quite a few tasks, subcontractors, supplies, and tools. Efficient monetary administration is essential for achievement, and a well-structured chart of accounts (COA) is the muse of this administration. A correctly designed COA offers a scientific framework for recording and classifying all monetary transactions, permitting building corporations to trace prices, income, and profitability precisely. This text will delve into the particular necessities and finest practices for creating and using a chart of accounts within the building {industry}.

Understanding the Chart of Accounts

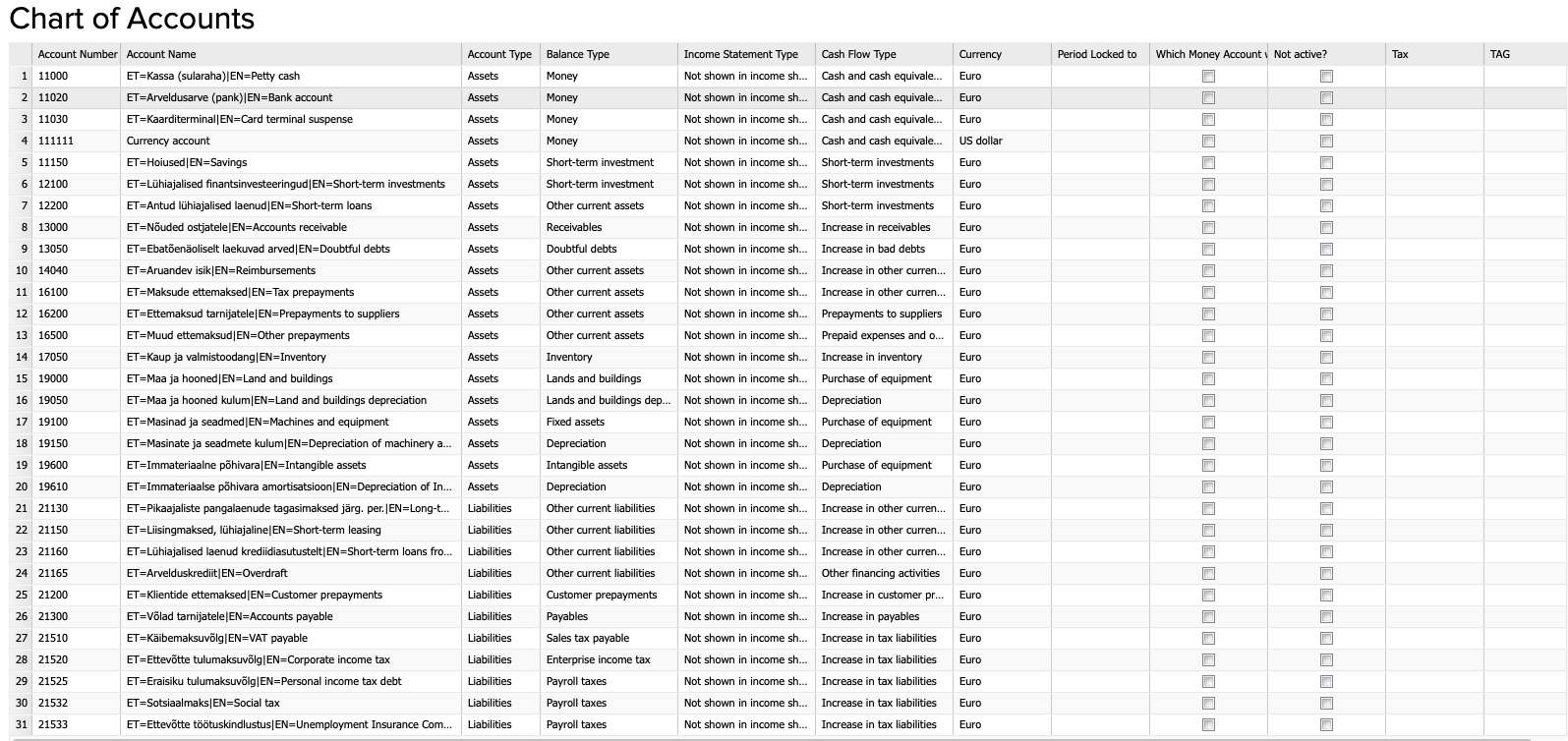

A chart of accounts is a structured record of all accounts utilized by a enterprise to document its monetary transactions. Every account represents a selected class of belongings, liabilities, fairness, income, or bills. The COA serves as a central repository for all monetary knowledge, offering a transparent and arranged view of the corporate’s monetary place. For building corporations, the COA must be notably detailed to accommodate the distinctive points of the {industry}.

Key Concerns for Development Firm COAs

Development corporations face distinctive challenges that necessitate particular issues when designing their COAs. These embrace:

-

Venture-Primarily based Accounting: Development tasks are sometimes long-term and contain quite a few transactions. The COA should facilitate correct monitoring of prices and income for every particular person venture. This typically entails utilizing a system of venture codes or numbers to determine and categorize all transactions associated to a selected venture.

-

Value Segregation: Development tasks contain a variety of prices, together with labor, supplies, tools, subcontractors, permits, and overhead. The COA should enable for detailed segregation of those prices to facilitate correct value management and reporting. This requires a granular degree of element within the expense accounts.

-

Stock Administration: Development corporations typically keep inventories of supplies and tools. The COA ought to embrace accounts for monitoring the worth of those inventories, together with purchases, utilization, and changes for obsolescence or injury.

-

Income Recognition: Income recognition in building follows particular accounting requirements (like ASC 606). The COA must assist correct income recognition, typically requiring accounts to trace proportion of completion, billings, and collections for every venture.

-

Job Costing: Job costing is crucial for building corporations to find out the profitability of particular person tasks. The COA should allow the correct monitoring of all direct and oblique prices related to every job.

-

Compliance: Development corporations should adjust to numerous rules and reporting necessities. The COA must be designed to facilitate compliance with these necessities, together with tax rules and industry-specific requirements.

Construction of a Development Firm Chart of Accounts

A typical COA for a building firm will observe an ordinary accounting framework, sometimes utilizing a 5 or six-digit numbering system for accounts. Nevertheless, the particular accounts might be tailor-made to the corporate’s operations. A pattern construction would possibly embrace:

I. Belongings:

- 1000 – Present Belongings:

- 1100 – Money

- 1200 – Accounts Receivable (damaged down by venture)

- 1300 – Stock (supplies, provides, tools)

- 1400 – Pay as you go Bills

- 2000 – Non-Present Belongings:

- 2100 – Property, Plant, and Tools (PPE)

- 2200 – Accrued Depreciation

- 2300 – Investments

II. Liabilities:

- 3000 – Present Liabilities:

- 3100 – Accounts Payable (damaged down by vendor and venture)

- 3200 – Salaries Payable

- 3300 – Taxes Payable

- 3400 – Brief-Time period Loans

- 4000 – Non-Present Liabilities:

- 4100 – Lengthy-Time period Loans

- 4200 – Bonds Payable

III. Fairness:

- 5000 – Proprietor’s Fairness:

- 5100 – Capital Inventory

- 5200 – Retained Earnings

IV. Income:

- 6000 – Development Income: (damaged down by venture and contract kind)

- 6100 – Billings

- 6200 – Progress Billings

- 6300 – Change Orders

V. Bills:

- 7000 – Value of Items Bought (COGS):

- 7100 – Direct Supplies

- 7200 – Direct Labor

- 7300 – Subcontractor Prices

- 8000 – Working Bills:

- 8100 – Salaries and Wages (damaged down by job and division)

- 8200 – Lease

- 8300 – Utilities

- 8400 – Insurance coverage

- 8500 – Advertising and marketing and Promoting

- 8600 – Workplace Provides

- 8700 – Depreciation

- 8800 – Authorized and Skilled Charges

- 8900 – Journey Bills

- 9000 – Venture Overhead (damaged down by venture)

Particular Accounts for Development Initiatives:

The COA ought to embrace particular accounts for monitoring venture prices and income. These accounts may be structured utilizing a venture code system, permitting for simple identification and segregation of prices by venture. Examples embrace:

- Venture X – Direct Labor: Tracks direct labor prices particularly assigned to Venture X.

- Venture X – Supplies: Tracks supplies prices particularly used on Venture X.

- Venture X – Subcontractor Prices: Tracks funds made to subcontractors engaged on Venture X.

- Venture X – Tools Rental: Tracks tools rental prices for Venture X.

- Venture X – Overhead: Tracks overhead prices allotted to Venture X.

- Venture X – Billings: Tracks billings to the consumer for Venture X.

Software program and Expertise

Development accounting software program performs a crucial function in managing the chart of accounts successfully. These software program options automate many accounting duties, together with:

- Information entry: Simplifying the method of recording transactions.

- Reporting: Producing personalized studies on venture profitability, value management, and monetary efficiency.

- Integration: Connecting with different enterprise techniques, similar to payroll and venture administration software program.

- Compliance: Helping with compliance with accounting requirements and rules.

Common Evaluate and Updates

The chart of accounts just isn’t a static doc. It must be often reviewed and up to date to mirror adjustments within the firm’s operations, accounting requirements, and {industry} finest practices. Annual critiques are beneficial to make sure the COA stays related and efficient.

Conclusion

A well-designed and maintained chart of accounts is crucial for the monetary success of any building firm. By offering a structured framework for recording and classifying monetary transactions, the COA allows correct value management, venture profitability evaluation, and compliance with accounting requirements. Development corporations ought to make investments time and assets in creating a complete COA that meets their particular wants and make the most of accounting software program to maximise its effectiveness. Common evaluate and updates are essential to make sure the COA stays a beneficial device for managing the complexities of the development {industry}.

:max_bytes(150000):strip_icc()/chart-accounts.asp_final-438b76f8e6e444dd8f4cd8736b0baa6a.png)

Closure

Thus, we hope this text has supplied beneficial insights into Chart of Accounts for Development Firms: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!