Chart Of Accounts In SAP: The Basis Of Monetary Reporting

By admin / August 13, 2024 / No Comments / 2025

Chart of Accounts in SAP: The Basis of Monetary Reporting

Associated Articles: Chart of Accounts in SAP: The Basis of Monetary Reporting

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Chart of Accounts in SAP: The Basis of Monetary Reporting. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Chart of Accounts in SAP: The Basis of Monetary Reporting

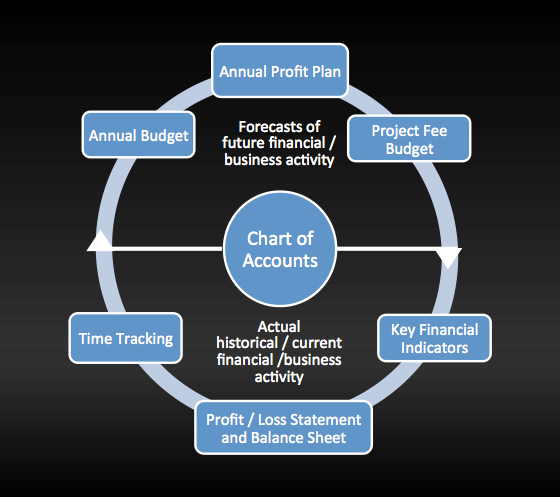

The Chart of Accounts (COA) in SAP is the spine of its monetary accounting performance. It is a structured, hierarchical listing of all of the accounts utilized by a company to document its monetary transactions. Consider it because the blueprint for the way an organization organizes and tracks its cash – from income and bills to belongings and liabilities. Understanding the SAP COA is essential for anybody concerned in monetary administration, accounting, or auditing inside an SAP surroundings. This text delves deep into the which means, construction, performance, and significance of the Chart of Accounts throughout the SAP system.

What’s a Chart of Accounts in SAP?

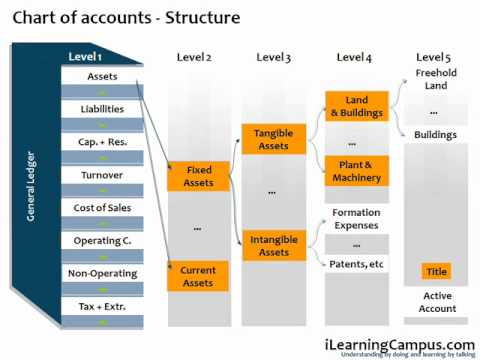

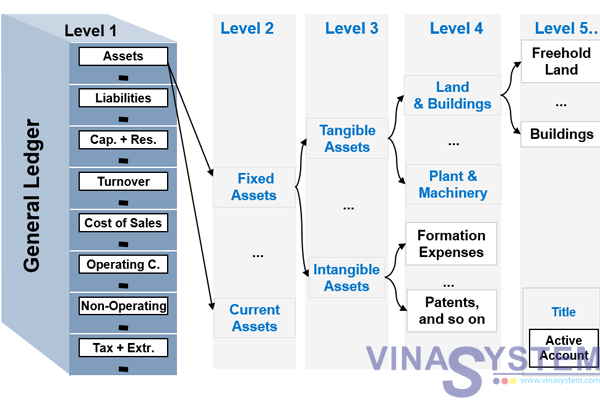

In easy phrases, the SAP COA is a complete catalog of basic ledger accounts. Every account represents a selected class of monetary exercise. These accounts are organized in a hierarchical construction, permitting for detailed monitoring and reporting. The hierarchy allows the categorization of transactions at varied ranges of granularity, from high-level summaries to extremely particular particulars. This granular method permits for detailed monetary evaluation and reporting, essential for decision-making.

In contrast to easier accounting methods, SAP’s flexibility permits for a number of COAs to exist inside a single system. This function caters to the various wants of multinational firms, subsidiaries, and even completely different departments inside a single group, every doubtlessly working below completely different accounting requirements or regulatory necessities. The power to handle a number of COAs is a key energy of SAP’s monetary accounting capabilities.

The Construction of an SAP Chart of Accounts:

The construction of an SAP COA is very customizable however usually follows a hierarchical mannequin. This hierarchical nature permits for environment friendly categorization and aggregation of monetary knowledge. The commonest construction entails a number of ranges:

-

Firm Code: That is the best stage within the hierarchy. An organization code represents a legally unbiased entity inside a company. Every firm code should have its personal chart of accounts.

-

Chart of Accounts (COA): This defines the general construction and account numbers. It is the template upon which the accounts are constructed. A single firm code can solely use one chart of accounts.

-

Account Teams: These group comparable accounts collectively, simplifying the creation and upkeep of accounts. For instance, all steadiness sheet accounts is perhaps in a single account group, whereas all revenue assertion accounts are in one other.

-

G/L Accounts: These are the person accounts used to document monetary transactions. Every account has a novel quantity and a descriptive identify. The account quantity usually displays its place throughout the hierarchical construction.

-

Account Sub-accounts: These present additional granularity inside a G/L account. They permit for extra detailed monitoring of particular points of a transaction.

This hierarchical construction ensures that the information is organized logically and permits for straightforward reporting at varied ranges of element. Stories may be generated on the firm code stage, displaying aggregated monetary knowledge, or on the particular person G/L account stage, offering detailed transaction data.

Key Traits of SAP Chart of Accounts:

-

Flexibility: SAP COAs are extremely customizable, permitting organizations to tailor them to their particular wants and accounting practices.

-

Scalability: The system can deal with a lot of accounts and transactions, making it appropriate for even the biggest enterprises.

-

Integration: The COA is built-in with different SAP modules, reminiscent of supplies administration (MM), gross sales and distribution (SD), and manufacturing planning (PP), guaranteeing constant and correct monetary knowledge throughout the whole system.

-

Multi-Forex Assist: SAP helps a number of currencies, permitting organizations to handle transactions and reviews in numerous currencies.

-

Compliance: The system may be configured to adjust to varied accounting requirements, reminiscent of GAAP (Usually Accepted Accounting Rules) and IFRS (Worldwide Monetary Reporting Requirements).

Creating and Sustaining an SAP Chart of Accounts:

Creating and sustaining an SAP COA entails a number of steps:

-

Defining the Chart of Accounts: This entails specifying the construction, account numbers, and account names.

-

Defining Account Teams: This teams comparable accounts collectively for simpler administration.

-

Creating G/L Accounts: This entails assigning account numbers, names, and different related attributes to every account.

-

Assigning Account Teams to G/L Accounts: This hyperlinks the person accounts to the suitable account teams.

-

Defining Account Quantity Ranges: This ensures that account numbers are assigned systematically and persistently.

-

Sustaining the Chart of Accounts: This entails repeatedly updating the COA to replicate adjustments within the group’s accounting practices or regulatory necessities.

The Significance of a Nicely-Outlined Chart of Accounts:

A well-defined and maintained COA is essential for a number of causes:

-

Correct Monetary Reporting: A correctly structured COA ensures that monetary knowledge is precisely recorded and reported, offering a dependable foundation for decision-making.

-

Improved Monetary Management: An in depth COA allows higher monitoring of monetary transactions, serving to to stop errors and fraud.

-

Enhanced Compliance: A well-defined COA helps organizations adjust to accounting requirements and regulatory necessities.

-

Environment friendly Auditing: A well-structured COA simplifies the auditing course of, making it simpler to confirm the accuracy and completeness of monetary data.

-

Higher Determination-Making: Correct and well timed monetary knowledge, facilitated by a well-defined COA, empowers administration to make knowledgeable enterprise selections.

-

Streamlined Processes: A well-designed COA simplifies varied accounting processes, reminiscent of posting transactions, producing reviews, and performing monetary evaluation.

Troubleshooting and Frequent Points:

Regardless of its strong nature, points can come up with SAP COAs. Frequent issues embody:

-

Incorrect Account Assignments: Transactions posted to incorrect accounts can result in inaccurate monetary reviews.

-

Lacking Accounts: The absence of essential accounts can hinder correct monetary reporting.

-

Inconsistent Account Numbering: Inconsistent numbering could make it tough to trace and analyze monetary knowledge.

-

Lack of Common Upkeep: Outdated COAs can result in inaccuracies and compliance points.

Addressing these points requires cautious planning, thorough testing, and common upkeep of the COA. Common reconciliation and audits are essential to make sure the accuracy and reliability of the monetary knowledge.

Conclusion:

The Chart of Accounts in SAP is way over only a listing of accounts; it is the basic constructing block of the whole monetary accounting system. Its correct design, implementation, and upkeep are vital for correct monetary reporting, efficient inside controls, regulatory compliance, and knowledgeable decision-making. Understanding the intricacies of the SAP COA is important for anybody concerned in managing and using the SAP system for monetary functions. By implementing a well-structured and persistently maintained COA, organizations can leverage the total potential of SAP’s monetary accounting capabilities and acquire useful insights into their monetary efficiency. The funding in a strong and well-maintained COA pays dividends when it comes to accuracy, effectivity, and knowledgeable decision-making, finally contributing to the general success of the group.

Closure

Thus, we hope this text has supplied useful insights into Chart of Accounts in SAP: The Basis of Monetary Reporting. We thanks for taking the time to learn this text. See you in our subsequent article!