Chart Of Accounts Reporting: A Complete Information

By admin / October 30, 2024 / No Comments / 2025

Chart of Accounts Reporting: A Complete Information

Associated Articles: Chart of Accounts Reporting: A Complete Information

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Chart of Accounts Reporting: A Complete Information. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Chart of Accounts Reporting: A Complete Information

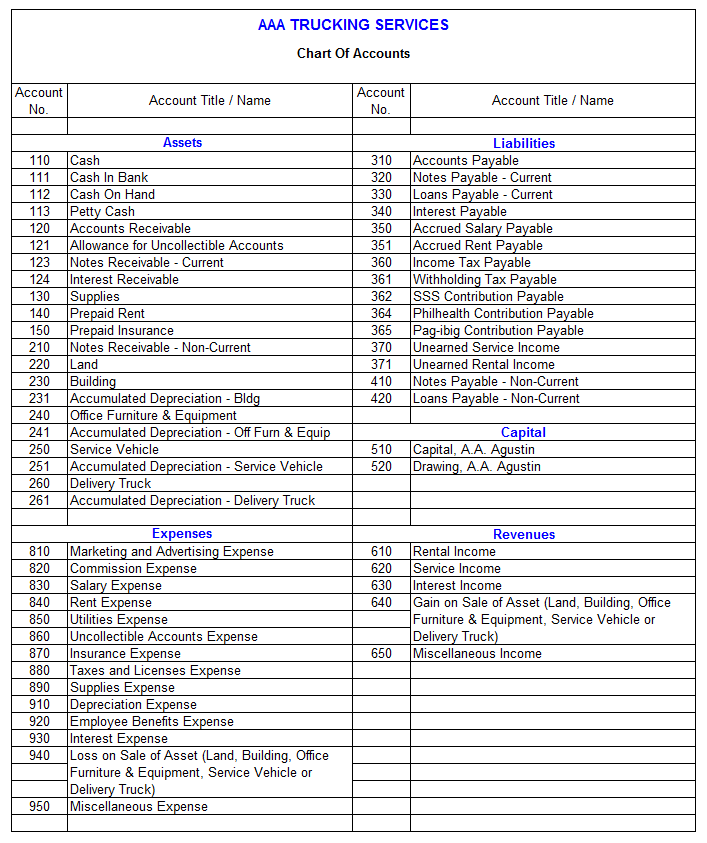

The chart of accounts (COA) is the spine of any group’s monetary reporting system. It is a structured record of all of the accounts used to file monetary transactions, offering a framework for classifying and summarizing monetary information. Efficient chart of accounts reporting is essential for correct monetary statements, knowledgeable decision-making, and compliance with accounting requirements. This text delves into the intricacies of chart of accounts reporting, exploring its goal, design issues, reporting strategies, and greatest practices.

Tags: #ChartOfAccounts, #FinancialReporting, #Accounting, #FinancialStatements, #DataAnalysis, #BusinessIntelligence, #AccountingSoftware, #FinancialManagement, #Compliance

1. Understanding the Chart of Accounts:

The COA is basically a hierarchical construction categorizing all monetary accounts. A typical COA consists of accounts for property, liabilities, fairness, revenues, and bills. Every account has a novel identifier (account quantity) and a descriptive title. The extent of element inside the COA can fluctuate relying on the scale and complexity of the group. A small enterprise may need a comparatively easy COA, whereas a big multinational company would require a way more detailed and complicated construction.

Instance of a Easy Chart of Accounts:

- Property:

- 1000 Money

- 1100 Accounts Receivable

- 1200 Stock

- 1300 Fastened Property

- Liabilities:

- 2000 Accounts Payable

- 2100 Loans Payable

- Fairness:

- 3000 Proprietor’s Fairness

- Revenues:

- 4000 Gross sales Income

- 4100 Service Income

- Bills:

- 5000 Value of Items Bought

- 5100 Salaries Expense

- 5200 Hire Expense

- 5300 Utilities Expense

2. Designing an Efficient Chart of Accounts:

Designing a sturdy COA requires cautious planning and consideration. Key components embody:

- Trade Requirements: The COA ought to align with trade greatest practices and regulatory necessities. Sure industries might have particular account classifications wanted for compliance.

- Enterprise Wants: The extent of element ought to mirror the group’s particular wants for monetary evaluation and reporting. An organization with numerous product strains would require a extra granular COA than an organization with a single product.

- Scalability: The COA needs to be designed to accommodate future development and adjustments within the enterprise. It needs to be versatile sufficient to deal with new merchandise, providers, or departments.

- Account Numbering System: A constant and logical numbering system is essential for simple navigation and reporting. A hierarchical system, utilizing a constant variety of digits for every degree, improves readability and group.

- Common Evaluation and Updates: The COA isn’t a static doc. It needs to be reviewed and up to date periodically to make sure it stays related and correct. Adjustments in accounting requirements, enterprise operations, or strategic objectives might necessitate changes to the COA.

3. Chart of Accounts Reporting Strategies:

Efficient COA reporting depends on numerous strategies to extract significant insights from the monetary information. These strategies embody:

- Trial Stability: A trial stability is a report summarizing all debit and credit score balances within the COA. It verifies the equality of debits and credit, guaranteeing the accuracy of the accounting information.

- Earnings Assertion: The earnings assertion makes use of information from the income and expense accounts within the COA to current a abstract of the group’s profitability over a selected interval.

- Stability Sheet: The stability sheet makes use of information from the asset, legal responsibility, and fairness accounts to show the group’s monetary place at a selected cut-off date.

- Money Movement Assertion: The money movement assertion tracks the motion of money out and in of the enterprise, utilizing info from numerous accounts within the COA.

- Monetary Ratios: Monetary ratios, calculated utilizing information from the COA, present insights into the group’s liquidity, profitability, and solvency.

- Customized Studies: Accounting software program typically permits for the creation of customized experiences, tailor-made to particular wants, drawing information from the COA. This enables for detailed evaluation of particular areas of the enterprise.

- Information Visualization: Presenting COA information visually by means of charts and graphs can considerably enhance understanding and communication of economic efficiency.

4. Using Accounting Software program for COA Reporting:

Trendy accounting software program performs a vital function in COA reporting. These methods automate many elements of economic information entry, processing, and reporting. Key options embody:

- Automated Information Entry: Decreasing guide information entry minimizes errors and improves effectivity.

- Actual-Time Reporting: Entry to up-to-date monetary info permits for well timed decision-making.

- Customizable Studies: Generate experiences tailor-made to particular wants and necessities.

- Information Integration: Seamless integration with different enterprise methods streamlines information movement and improves accuracy.

- Auditing Capabilities: Software program typically consists of options to trace adjustments and guarantee information integrity.

5. Finest Practices for Chart of Accounts Reporting:

- Preserve Information Integrity: Accuracy is paramount. Implement sturdy inner controls to stop errors and fraud.

- Common Reconciliation: Frequently reconcile financial institution statements and different accounts to make sure accuracy.

- Phase Reporting: For bigger organizations, section reporting permits for evaluation of various enterprise items or departments.

- Use a Constant Chart of Accounts: Consistency throughout totally different reporting durations and departments is crucial for correct comparisons.

- Doc Your Chart of Accounts: Preserve detailed documentation explaining the aim and construction of every account.

- Keep Up to date on Accounting Requirements: Maintain abreast of adjustments in accounting requirements and laws to make sure compliance.

- Spend money on Coaching: Be certain that workers liable for monetary reporting are adequately skilled on the usage of the COA and accounting software program.

6. Challenges in Chart of Accounts Reporting:

Regardless of its significance, COA reporting can current a number of challenges:

- Complexity: Giant and complicated COAs could be tough to handle and navigate.

- Information Inconsistency: Inconsistent information entry can result in inaccurate experiences.

- Lack of Integration: Poor integration between totally different methods can hinder information movement and reporting.

- Lack of Experience: Inadequate information of accounting ideas and software program can hamper efficient reporting.

- Maintaining with Adjustments: Adapting the COA to adjustments in enterprise operations or accounting requirements could be time-consuming.

7. Future Tendencies in Chart of Accounts Reporting:

- Elevated Automation: Additional automation by means of AI and machine studying will enhance accuracy and effectivity.

- Cloud-Based mostly Options: Cloud-based accounting software program will turn out to be more and more prevalent, providing enhanced accessibility and collaboration.

- Information Analytics: Integration of information analytics instruments will present deeper insights from monetary information.

- Actual-time Reporting and Dashboards: Actual-time dashboards will present instant entry to key monetary metrics.

- Improved Information Visualization: Extra subtle information visualization strategies will improve communication and understanding of economic info.

Conclusion:

Efficient chart of accounts reporting is crucial for the monetary well being and success of any group. By rigorously designing the COA, using applicable reporting strategies, and leveraging accounting software program, companies can achieve precious insights into their monetary efficiency and make knowledgeable choices. Staying abreast of greatest practices and future tendencies will be certain that the COA stays a robust device for monetary administration and compliance. Common evaluation, upkeep, and adaptation are essential to maximise the worth of this elementary accounting system.

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

Closure

Thus, we hope this text has supplied precious insights into Chart of Accounts Reporting: A Complete Information. We hope you discover this text informative and useful. See you in our subsequent article!