Chart Of Depreciation To Firm Code Project In SAP: A Complete Information

By admin / October 25, 2024 / No Comments / 2025

Chart of Depreciation to Firm Code Project in SAP: A Complete Information

Associated Articles: Chart of Depreciation to Firm Code Project in SAP: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Chart of Depreciation to Firm Code Project in SAP: A Complete Information. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Chart of Depreciation to Firm Code Project in SAP: A Complete Information

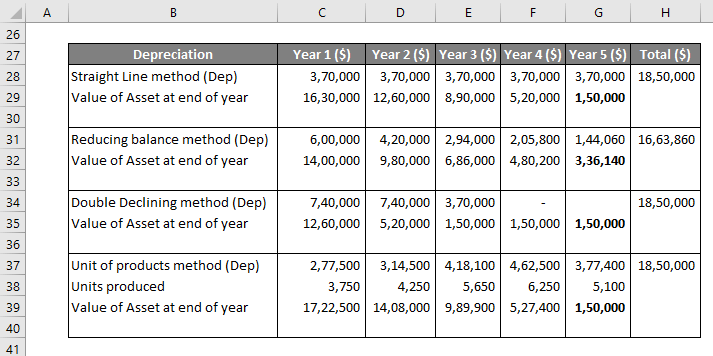

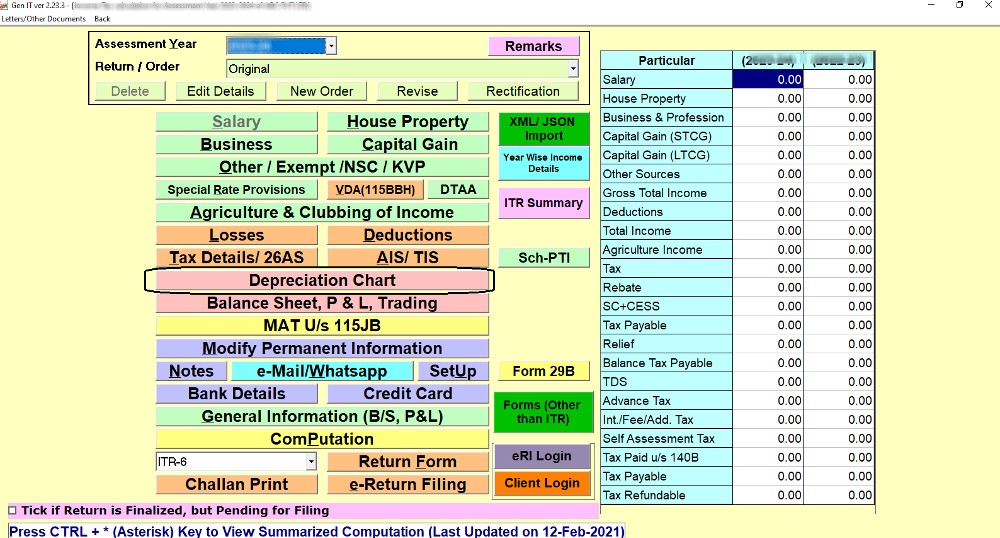

Depreciation, the systematic allocation of an asset’s value over its helpful life, is an important side of economic accounting. In SAP, the correct and constant utility of depreciation strategies is important for producing dependable monetary statements. This course of closely depends on the project of a Chart of Depreciation (CoC) to a selected firm code. This text delves into the intricacies of this project, exploring its significance, the steps concerned, and the potential implications of incorrect configuration.

Understanding the Key Gamers: Chart of Depreciation and Firm Code

Earlier than diving into the project course of, let’s outline the important thing parts:

-

Firm Code (KOKRS): The corporate code is the basic organizational unit in SAP’s monetary accounting. It represents a legally unbiased entity with its personal chart of accounts, foreign money, and monetary reporting necessities. Every firm code operates independently and maintains its personal monetary information.

-

Chart of Depreciation (001): The Chart of Depreciation (CoC) is a grasp document that defines the depreciation strategies, calculation guidelines, and different parameters used to depreciate belongings. It acts as a blueprint, containing varied depreciation keys (which specify the precise depreciation technique and parameters) that may be assigned to completely different asset courses. A single CoC can be utilized by a number of firm codes, however every firm code should explicitly assign a CoC. This enables for flexibility – an organization might use a number of CoCs, for instance, to cater to completely different accounting requirements or regulatory necessities.

The Significance of Chart of Depreciation Project

The project of a CoC to an organization code just isn’t merely a technical configuration; it is a basic step that immediately impacts the accuracy and consistency of depreciation calculations. An incorrect project can result in a number of critical penalties:

-

Incorrect Depreciation Calculations: Utilizing an inappropriate CoC will lead to faulty depreciation quantities, doubtlessly distorting the corporate’s monetary statements and impacting profitability calculations.

-

Non-Compliance with Accounting Requirements: Completely different international locations and areas have various accounting requirements and laws concerning depreciation. Assigning an incorrect CoC may result in non-compliance, leading to penalties and authorized repercussions.

-

Inconsistent Reporting: If a number of firm codes use completely different CoCs and not using a clear rationale, it may possibly create inconsistencies in monetary reporting throughout the group, making it tough to consolidate monetary information and carry out correct evaluation.

-

Auditing Challenges: Auditors will scrutinize the depreciation course of and its configuration. Inconsistent or incorrect CoC assignments will elevate pink flags and will necessitate in depth corrective actions.

Steps for Assigning a Chart of Depreciation to a Firm Code

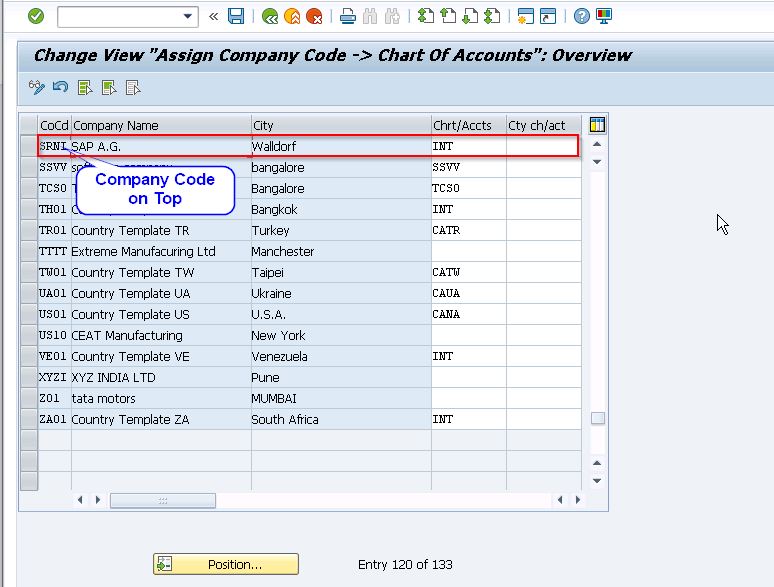

The project of a CoC to an organization code is usually carried out utilizing transaction code OBB9 (Assign Chart of Depreciation to Firm Code). The steps concerned are simple however require cautious consideration to element:

-

Accessing the Transaction: Open transaction OBB9 within the SAP system.

-

Firm Code Choice: The system will immediate you to enter the corporate code to which you need to assign a CoC. Enter the related firm code and press Enter.

-

Chart of Depreciation Choice: You’ll then be offered with a display screen to pick the suitable Chart of Depreciation. Use the search assist (F4) to find the specified CoC. The choice ought to be based mostly on elements such because the relevant accounting requirements, the corporate’s depreciation insurance policies, and the asset courses used.

-

Saving the Project: After you have chosen the right CoC, save the project. The system will then hyperlink the chosen CoC to the required firm code.

-

Verification: After saving, it is essential to confirm the project by navigating again to the corporate code grasp information (transaction XK02) and checking the assigned CoC beneath the related tab.

Issues for Chart of Depreciation Choice

Selecting the best CoC is a crucial determination. A number of elements ought to be thought-about:

-

Accounting Requirements: The CoC should adjust to the related accounting requirements (e.g., GAAP, IFRS) relevant to the corporate code.

-

Business Greatest Practices: Think about industry-specific depreciation strategies and practices.

-

Firm Insurance policies: The CoC ought to replicate the corporate’s inner depreciation insurance policies and procedures.

-

Asset Courses: Make sure the CoC helps the depreciation strategies required for all asset courses used inside the firm code.

-

Future Scalability: Select a CoC that may adapt to future adjustments in accounting requirements or firm insurance policies.

Troubleshooting Frequent Points

Throughout the project course of, a number of points may come up:

-

CoC not discovered: This means the CoC may not exist within the system. It requires creating the CoC utilizing transaction 001.

-

Project already exists: This implies the corporate code already has a CoC assigned. Modifying the project requires cautious consideration of the implications.

-

Inconsistencies in Depreciation Calculations: If inconsistencies come up after assigning the CoC, it is essential to evaluate the depreciation keys inside the CoC and guarantee they’re appropriately configured for the related asset courses.

Significance of Common Evaluation and Upkeep

The project of a CoC to an organization code just isn’t a one-time exercise. Common evaluate and upkeep are essential to make sure the continued accuracy and relevance of the depreciation calculations. Modifications in accounting requirements, firm insurance policies, or asset courses might necessitate updating the CoC project or the CoC itself. Common audits and reconciliation processes ought to be in place to detect and rectify any discrepancies.

Conclusion

The project of a Chart of Depreciation to an organization code in SAP is a crucial course of that impacts the accuracy and reliability of economic reporting. A radical understanding of the method, cautious number of the suitable CoC, and common evaluate and upkeep are important to make sure compliance with accounting requirements, correct depreciation calculations, and constant monetary reporting throughout the group. Ignoring these elements can result in important monetary and authorized implications. By following the rules outlined on this article, organizations can guarantee the graceful and correct execution of depreciation accounting inside their SAP programs. Bear in mind to all the time seek the advice of with skilled SAP consultants and monetary professionals to make sure the right configuration and adherence to greatest practices.

Closure

Thus, we hope this text has offered worthwhile insights into Chart of Depreciation to Firm Code Project in SAP: A Complete Information. We hope you discover this text informative and useful. See you in our subsequent article!