Chart Patterns: A Complete Information (PDF Obtain Obtainable – Tamil Translation In Progress)

By admin / November 8, 2024 / No Comments / 2025

Chart Patterns: A Complete Information (PDF Obtain Obtainable – Tamil Translation in Progress)

Associated Articles: Chart Patterns: A Complete Information (PDF Obtain Obtainable – Tamil Translation in Progress)

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Chart Patterns: A Complete Information (PDF Obtain Obtainable – Tamil Translation in Progress). Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Chart Patterns: A Complete Information (PDF Obtain Obtainable – Tamil Translation in Progress)

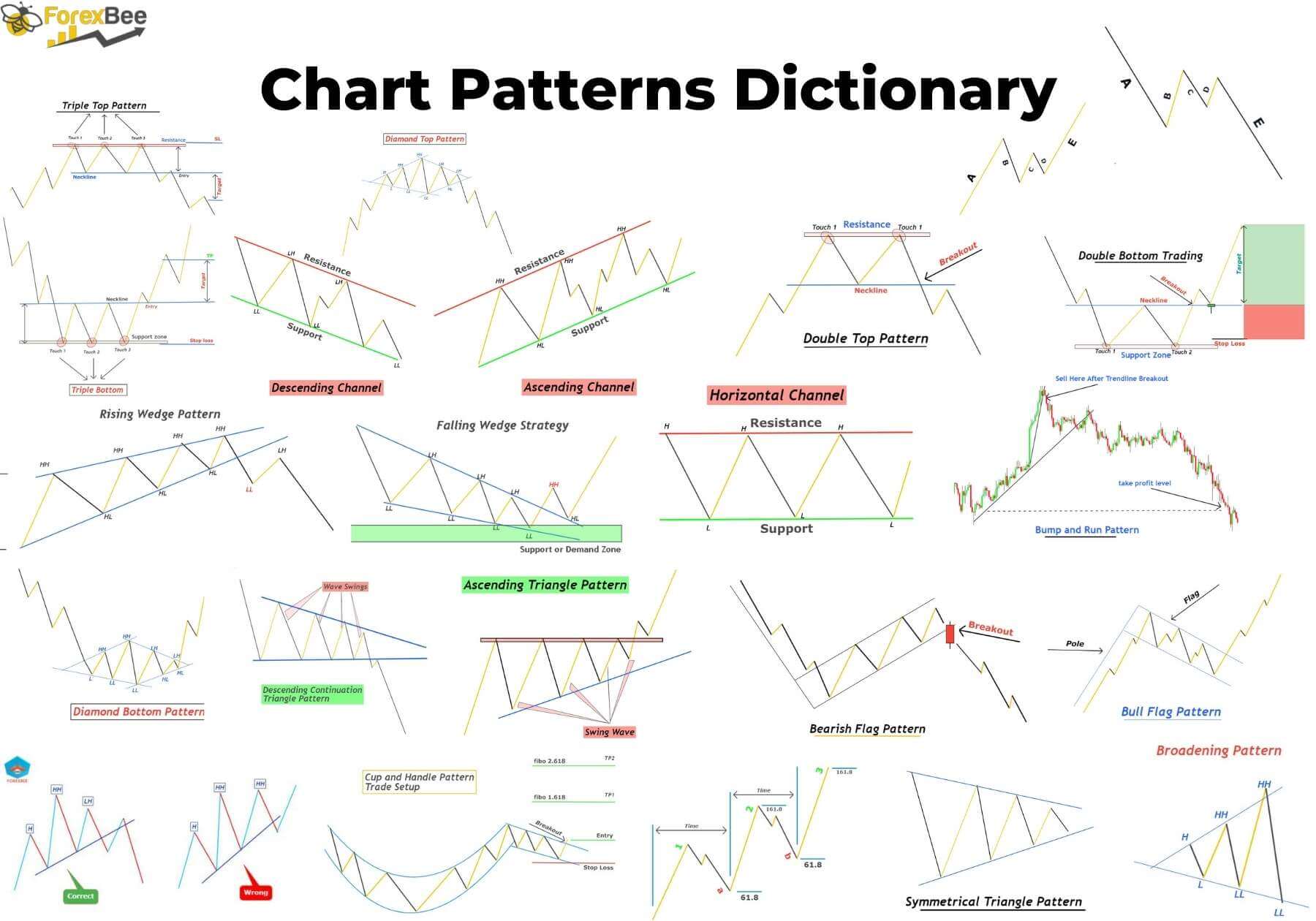

![Chart Patterns PDF Cheat Sheet [FREE Download]](https://howtotrade.com/wp-content/uploads/2023/02/chart-patterns-cheat-sheet-1024x724.png)

Chart patterns are visible representations of worth actions on a monetary chart, providing insights into potential future worth course. Understanding and decoding these patterns is a vital ability for technical analysts, permitting them to anticipate market traits and make knowledgeable buying and selling choices. This text offers a complete overview of frequent chart patterns, their traits, and find out how to establish them, with a concentrate on making this data accessible, and ultimately out there in Tamil through a downloadable PDF.

Why Chart Patterns Matter:

Chart patterns are primarily based on the precept of market psychology. They reveal the collective habits of merchants and buyers, reflecting durations of indecision, accumulation, or distribution. Recognizing these patterns may also help merchants:

- Determine potential entry and exit factors: Chart patterns typically sign potential breakouts or reversals, offering alternatives for worthwhile trades.

- Verify current traits: Patterns can reinforce the power or weak spot of an ongoing development, serving to merchants to handle threat and capitalize on prevailing market situations.

- Gauge market sentiment: The form and formation of a sample can supply clues concerning the general market sentiment, whether or not bullish or bearish.

- Scale back reliance on elementary evaluation: Whereas elementary evaluation is significant, chart patterns present a complementary strategy, providing a visible illustration of worth motion.

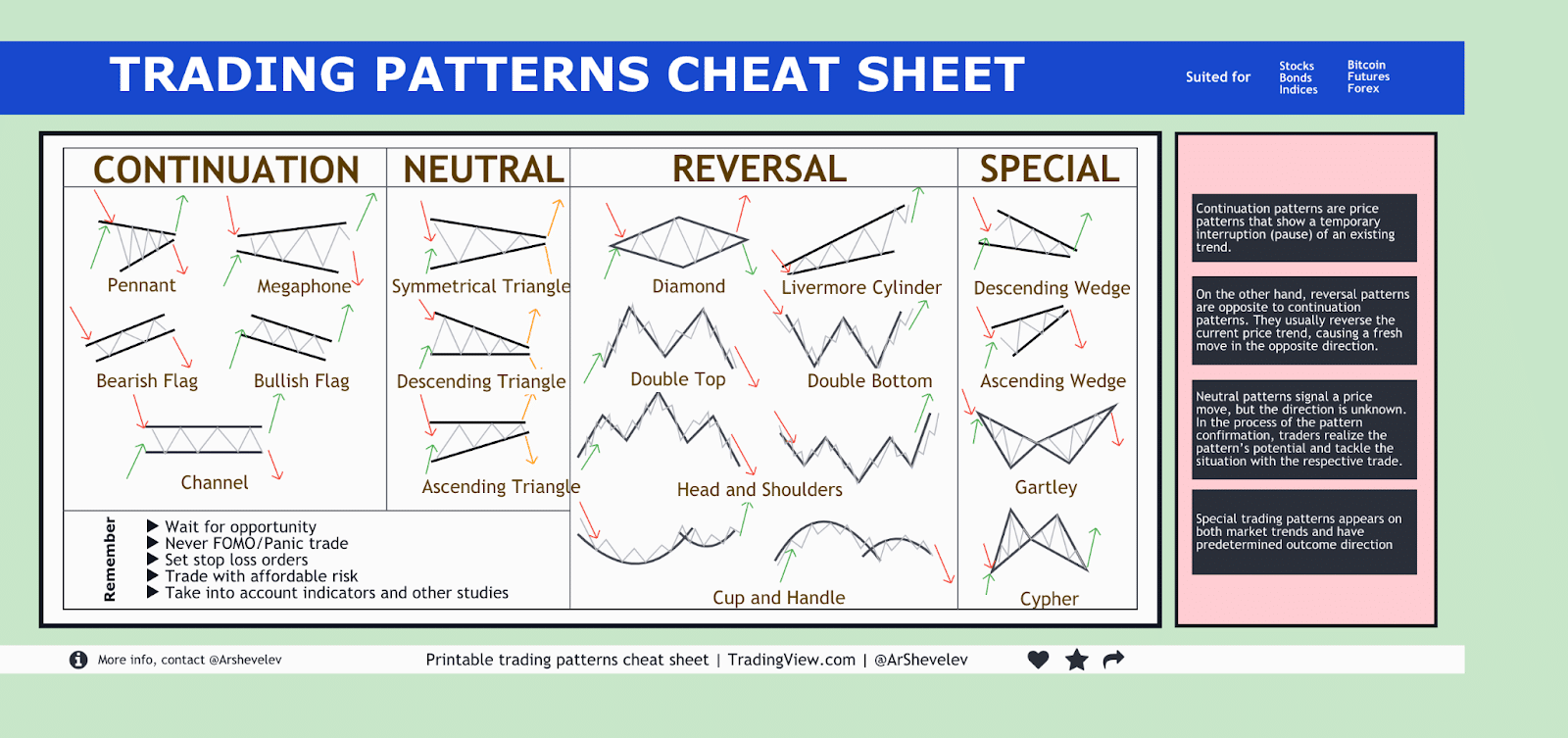

Varieties of Chart Patterns:

Chart patterns are broadly categorized into two essential teams: continuation patterns and reversal patterns.

1. Continuation Patterns: These patterns recommend that the present development will possible proceed after a brief pause or consolidation. Frequent continuation patterns embrace:

- Triangles: Triangles are characterised by converging trendlines, indicating a interval of consolidation earlier than a breakout. There are three essential sorts: symmetrical, ascending, and descending triangles. Symmetrical triangles recommend a continuation of the earlier development, whereas ascending triangles are bullish and descending triangles are bearish.

- Rectangles: Rectangles are characterised by horizontal help and resistance ranges. A breakout above the resistance degree is taken into account bullish, whereas a breakout beneath the help degree is bearish. Rectangles typically sign a continuation of the earlier development.

- Flags and Pennants: These patterns resemble flags or pennants connected to a flagpole (the previous development). They point out a brief pause in a robust development, adopted by a continuation in the identical course. Flags are usually rectangular, whereas pennants are triangular.

- Wedges: Wedges are characterised by converging trendlines, just like triangles. Nonetheless, wedges might be both bullish or bearish relying on the slope of the trendlines. An ascending wedge is bearish, whereas a descending wedge is bullish.

2. Reversal Patterns: These patterns recommend a possible change within the course of the present development. Frequent reversal patterns embrace:

- Head and Shoulders: This can be a traditional reversal sample characterised by three peaks, with the center peak (the "head") being the best. A neckline connects the troughs of the left and proper shoulders. A break beneath the neckline indicators a bearish reversal. The inverse sample, head and shoulders backside, indicators a bullish reversal.

- Double Tops and Double Bottoms: These patterns include two comparable peaks (double high) or troughs (double backside). A break beneath the neckline of a double high is bearish, whereas a break above the neckline of a double backside is bullish.

- Triple Tops and Triple Bottoms: Just like double tops and bottoms, however with three peaks or troughs. They affirm stronger reversal indicators than double tops and bottoms.

- Rounding Tops and Rounding Bottoms: These patterns are characterised by a gradual curve, forming a rounded high or backside. Rounding tops are bearish, indicating a reversal from an uptrend, whereas rounding bottoms are bullish.

Figuring out and Deciphering Chart Patterns:

Figuring out chart patterns requires apply and expertise. Listed here are some key concerns:

- Timeframe: Chart patterns can type on varied timeframes, from short-term (intraday) to long-term (years). The timeframe chosen impacts the interpretation of the sample.

- Quantity: Quantity evaluation is essential in confirming chart patterns. A major enhance in quantity throughout a breakout can strengthen the sign.

- Help and Resistance Ranges: Understanding help and resistance ranges is crucial for figuring out potential breakout factors.

- Affirmation: It is advisable to search for affirmation from different technical indicators or elementary elements earlier than making buying and selling choices primarily based on chart patterns.

Limitations of Chart Patterns:

Whereas chart patterns might be worthwhile instruments, it is necessary to acknowledge their limitations:

- Subjectivity: Figuring out chart patterns might be subjective, with completely different analysts decoding the identical sample in a different way.

- False Alerts: Chart patterns can generally generate false indicators, resulting in incorrect buying and selling choices.

- Not a standalone technique: Chart patterns ought to be used along side different technical evaluation instruments and threat administration methods.

Conclusion:

Chart patterns are a robust software for technical analysts, providing worthwhile insights into market habits and potential worth actions. Nonetheless, they need to be used cautiously and along side different evaluation strategies. Mastering the artwork of figuring out and decoding chart patterns requires apply, endurance, and a disciplined strategy to threat administration. We’re at the moment engaged on translating this complete information into Tamil and making it out there as a free downloadable PDF. Keep tuned for updates!

(Notice: The Tamil PDF is at the moment beneath improvement. As soon as accomplished, a hyperlink might be supplied right here without cost obtain.)

(This part would get replaced with a hyperlink to the Tamil PDF as soon as it is prepared.)

This text offers a basis for understanding chart patterns. Additional analysis into particular patterns, their nuances, and sensible utility is extremely advisable. Bear in mind to at all times apply threat administration and contemplate consulting with a monetary advisor earlier than making any funding choices.

![Chart Patterns PDF Free Download [11 MB] – (हिंदी में डाउनलोड करें)](https://www.stockmarkethindi.in/wp-content/uploads/2023/08/20230815_013123_2996-1024x560.webp)

Closure

Thus, we hope this text has supplied worthwhile insights into Chart Patterns: A Complete Information (PDF Obtain Obtainable – Tamil Translation in Progress). We recognize your consideration to our article. See you in our subsequent article!