Chart Patterns: A Complete Information (PDF Notes)

By admin / August 6, 2024 / No Comments / 2025

Chart Patterns: A Complete Information (PDF Notes)

Associated Articles: Chart Patterns: A Complete Information (PDF Notes)

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Chart Patterns: A Complete Information (PDF Notes). Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Chart Patterns: A Complete Information (PDF Notes)

Chart patterns, recurring formations on worth charts, present helpful insights into market sentiment and potential future worth actions. Whereas not foolproof predictors, understanding and accurately figuring out these patterns can considerably improve a dealer’s decision-making course of. This complete information explores numerous chart patterns, their traits, and interpret them. This info can be utilized to create your personal PDF notes for future reference.

I. Introduction to Chart Patterns

Chart patterns emerge from the interaction of provide and demand forces inside a market. They signify visually identifiable traits in worth motion, reflecting the collective habits of consumers and sellers. Recognizing these patterns permits merchants to anticipate potential breakouts, reversals, or continuations of present traits. It is essential to keep in mind that chart patterns are handiest when used along side different types of technical evaluation, akin to indicators and quantity evaluation.

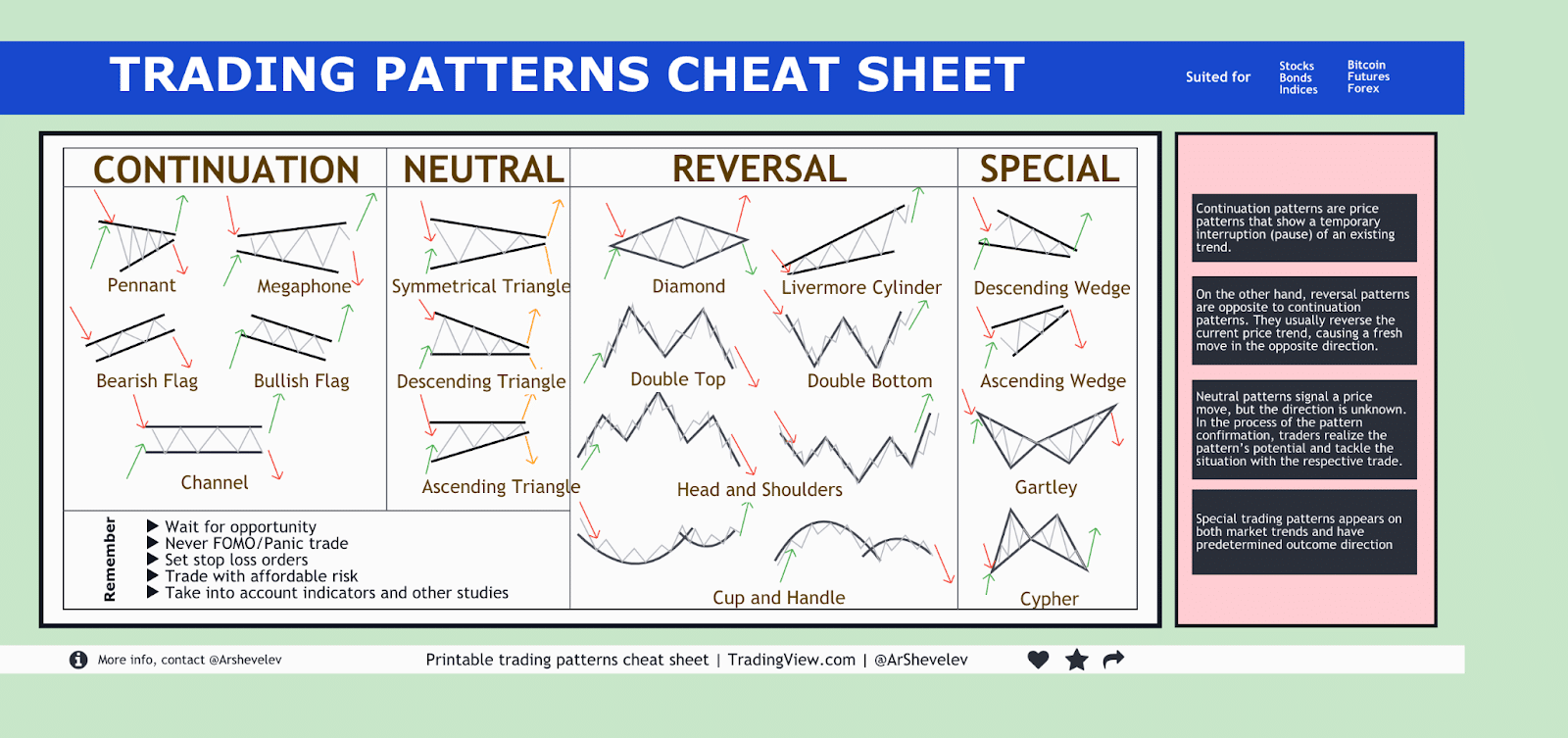

The patterns we’ll focus on are broadly categorized into two principal teams: continuation patterns and reversal patterns.

- Continuation Patterns: These patterns recommend a short lived pause in an present pattern earlier than its resumption. The pattern’s path stays unchanged after the sample completes.

- Reversal Patterns: These patterns sign a possible change within the prevailing pattern’s path. They point out a shift in market sentiment from bullish to bearish, or vice versa.

II. Continuation Patterns

A number of widespread continuation patterns present helpful insights into the market’s momentum:

A. Triangles: Triangles are characterised by converging trendlines, indicating a interval of consolidation. There are three principal varieties:

-

Symmetrical Triangle: Costs oscillate between two converging trendlines, with neither facet exhibiting a transparent dominance. A breakout above the higher trendline confirms the continuation of an uptrend, whereas a breakdown beneath the decrease trendline suggests a continuation of a downtrend. The breakout goal is usually measured by the peak of the triangle projected from the breakout level.

-

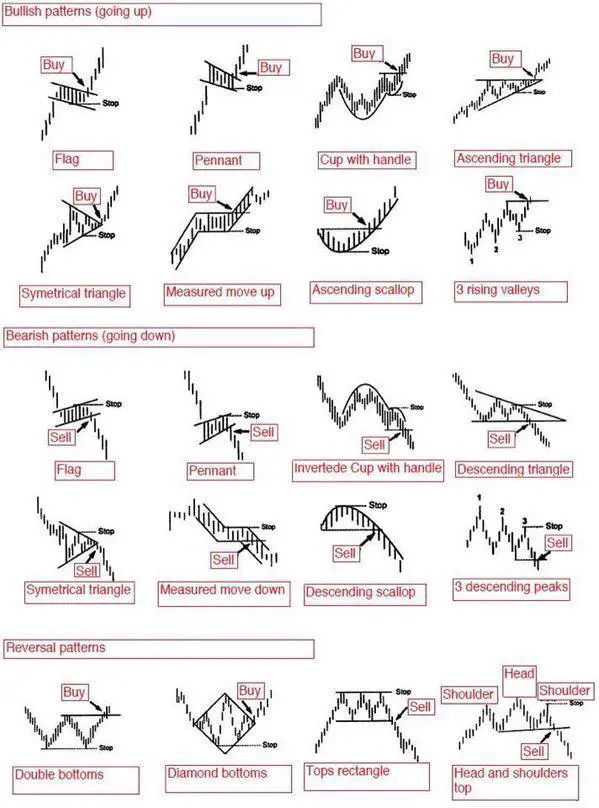

Ascending Triangle: The higher trendline is horizontal, whereas the decrease trendline slopes upwards. This sample usually signifies shopping for strain throughout a interval of consolidation, suggesting a bullish continuation. A breakout above the horizontal resistance confirms the uptrend.

-

Descending Triangle: The decrease trendline is horizontal, whereas the higher trendline slopes downwards. This sample normally suggests promoting strain throughout consolidation and signifies a bearish continuation. A breakdown beneath the horizontal help confirms the downtrend.

B. Rectangles: Rectangles signify a interval of consolidation inside an outlined horizontal vary. The worth motion oscillates between two horizontal help and resistance ranges. A breakout above the resistance confirms the continuation of an uptrend, whereas a breakout beneath the help confirms the continuation of a downtrend. The breakout goal is usually measured by the peak of the rectangle projected from the breakout level.

C. Flags and Pennants: These are short-term continuation patterns that resemble flags or pennants on a pole. They’re characterised by a pointy worth transfer (the "pole") adopted by a interval of consolidation (the "flag" or "pennant").

- Flags: These patterns have parallel trendlines, indicating a interval of consolidation with comparatively low volatility.

- Pennants: These patterns have converging trendlines, just like triangles, however on a smaller scale and inside a shorter timeframe.

D. Wedges: Wedges are characterised by converging trendlines, just like triangles, however with each trendlines sloping in the identical path.

- Rising Wedge: Each trendlines slope upwards, sometimes indicating a bearish continuation sample. A breakdown beneath the decrease trendline confirms the downtrend.

- Falling Wedge: Each trendlines slope downwards, sometimes indicating a bullish continuation sample. A breakout above the higher trendline confirms the uptrend.

III. Reversal Patterns

Reversal patterns sign a possible shift within the prevailing pattern. Figuring out these patterns requires cautious remark and affirmation by means of different technical indicators.

A. Head and Shoulders: This can be a traditional reversal sample characterised by three peaks (left shoulder, head, proper shoulder). The top is the very best peak, and the shoulders are roughly equal in top. A neckline connects the troughs between the peaks. A breakdown beneath the neckline confirms the bearish reversal. The goal worth is usually measured by the peak of the pinnacle above the neckline, projected downwards from the neckline breakout.

B. Inverse Head and Shoulders: That is the mirror picture of the pinnacle and shoulders sample, indicating a possible bullish reversal. It consists of three troughs (left shoulder, head, proper shoulder), with the pinnacle being the bottom trough. A breakout above the neckline confirms the bullish reversal. The goal worth is usually measured by the peak of the pinnacle beneath the neckline, projected upwards from the neckline breakout.

C. Double Tops and Double Bottoms: These patterns are less complicated than head and shoulders.

- Double High: Two peaks of roughly equal top are fashioned, adopted by a decline. A breakdown beneath the neckline (connecting the 2 troughs) confirms the bearish reversal.

- Double Backside: Two troughs of roughly equal low are fashioned, adopted by an increase. A breakout above the neckline (connecting the 2 peaks) confirms the bullish reversal.

D. Triple Tops and Triple Bottoms: These patterns are just like double tops and bottoms however contain three peaks or troughs of roughly equal top/low. They provide stronger affirmation of a reversal.

IV. Quantity Evaluation and Chart Patterns

Quantity evaluation is essential in confirming chart patterns. Usually, a big enhance in quantity throughout a breakout confirms the sample’s validity and will increase the chance of a profitable commerce. Conversely, low quantity breakouts are sometimes thought-about weak and fewer dependable.

V. Affirmation and Danger Administration

No chart sample ensures success. Due to this fact, it is important to make use of different technical indicators and elementary evaluation to substantiate the sample’s validity earlier than coming into a commerce. Moreover, correct threat administration strategies, together with stop-loss orders and place sizing, are essential to guard capital and restrict potential losses.

VI. Observe and Expertise

Mastering chart sample recognition requires constant apply and expertise. Start by finding out historic charts and figuring out patterns. Step by step refine your expertise by backtesting your buying and selling methods and adjusting your strategy based mostly in your outcomes. Keep in mind, profitable buying and selling entails steady studying and adaptation.

VII. Conclusion

Chart patterns are helpful instruments for merchants, providing insights into market sentiment and potential worth actions. By understanding the traits of varied continuation and reversal patterns and mixing this data with different technical and elementary evaluation strategies, merchants can enhance their decision-making course of and improve their buying and selling efficiency. Keep in mind to all the time apply correct threat administration and repeatedly refine your expertise by means of research and expertise. This information serves as a basis; additional analysis and sensible utility are important for attaining proficiency in utilizing chart patterns for profitable buying and selling. Use this info to create your complete PDF notes, including examples and your personal observations for a personalised studying expertise. Keep in mind to all the time seek the advice of with a monetary advisor earlier than making any funding selections.

![Chart Patterns Book with PDF Cheat Sheet [FREE Download]](https://forexindicatormt4.com/wp-content/uploads/2023/05/chart-patterns-pdf.jpg)

Closure

Thus, we hope this text has offered helpful insights into Chart Patterns: A Complete Information (PDF Notes). We thanks for taking the time to learn this text. See you in our subsequent article!