Chart Patterns: A Deep Dive Into Technical Evaluation Instruments On Wikipedia (Hypothetical Article)

By admin / September 18, 2024 / No Comments / 2025

Chart Patterns: A Deep Dive into Technical Evaluation Instruments on Wikipedia (Hypothetical Article)

Associated Articles: Chart Patterns: A Deep Dive into Technical Evaluation Instruments on Wikipedia (Hypothetical Article)

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Chart Patterns: A Deep Dive into Technical Evaluation Instruments on Wikipedia (Hypothetical Article). Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Chart Patterns: A Deep Dive into Technical Evaluation Instruments on Wikipedia (Hypothetical Article)

Introduction:

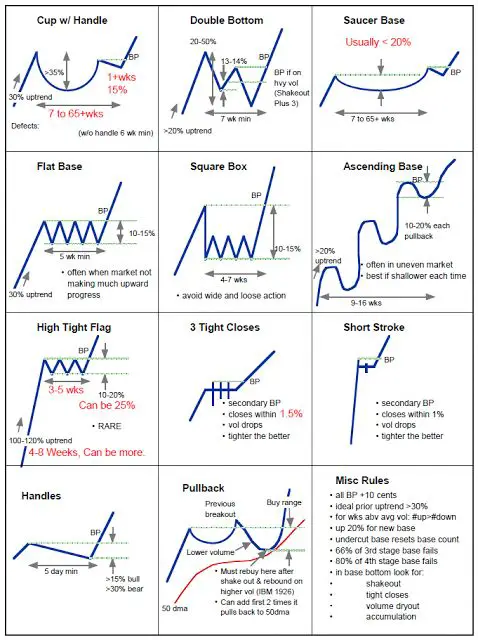

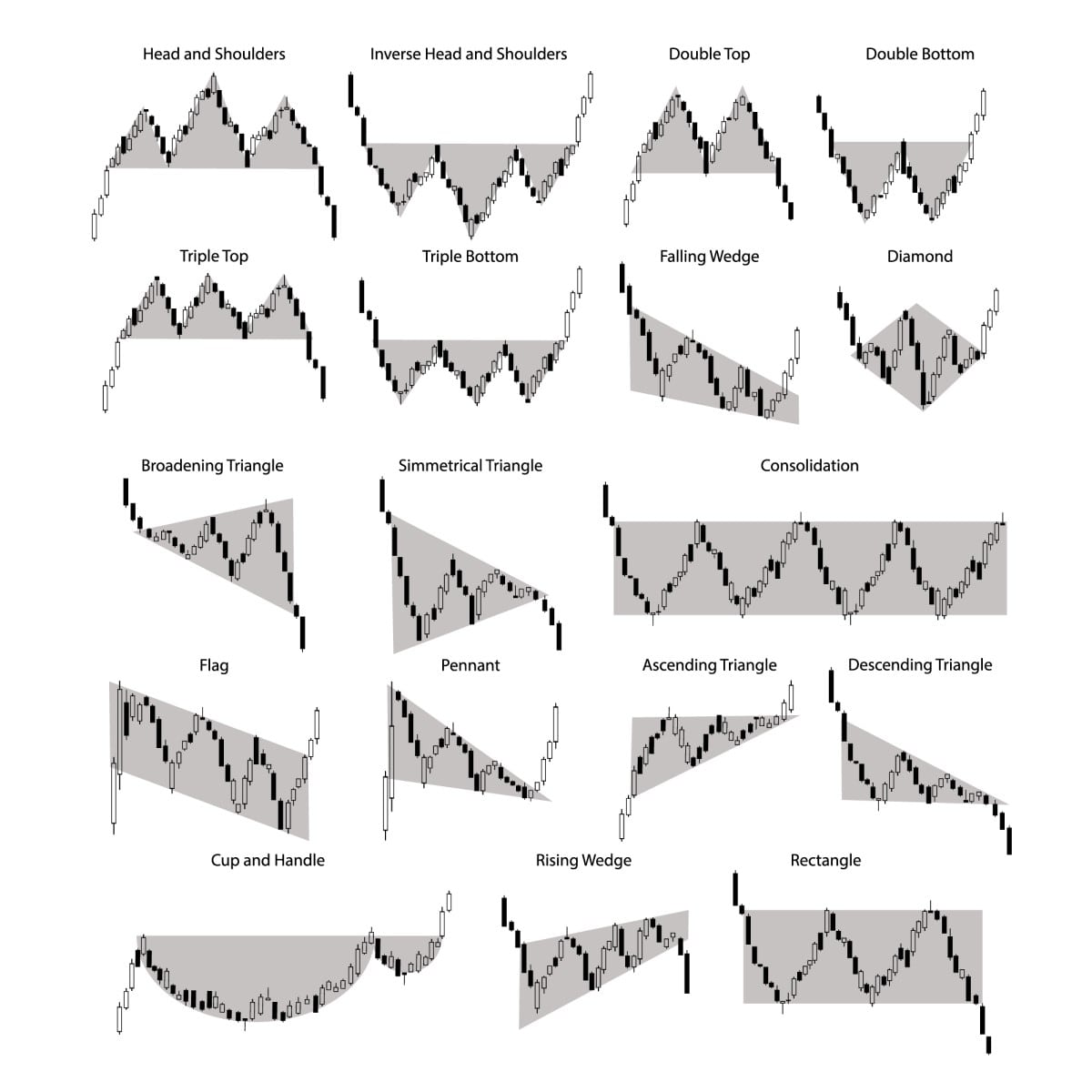

Technical evaluation, a cornerstone of monetary market buying and selling, depends closely on decoding value charts to foretell future value actions. Chart patterns, recurring formations on value charts, are a basic aspect of this evaluation. Whereas not foolproof predictors, recognizing and understanding these patterns can present invaluable insights into potential market sentiment and path. This text goals to discover numerous chart patterns, their traits, and their implications for merchants, drawing parallels to the knowledge one would possibly discover on a complete Wikipedia web page devoted to the topic. We are going to look at each bullish and bearish patterns, specializing in their identification, interpretation, and limitations.

I. Primary Chart Sample Classes:

Chart patterns are broadly categorized into a number of teams, based mostly on their form and the underlying market sentiment they symbolize. The first classes embody:

-

Continuation Patterns: These patterns counsel a brief pause in an present development earlier than its resumption. The development’s path stays unchanged after the sample’s completion. Examples embody triangles (symmetrical, ascending, descending), flags, pennants, and rectangles.

-

Reversal Patterns: These patterns point out a possible shift within the prevailing development. A bullish reversal sample signifies a shift from a downtrend to an uptrend, whereas a bearish reversal sample marks a transition from an uptrend to a downtrend. Examples embody head and shoulders (each bullish and bearish variations), double tops and bottoms, and triple tops and bottoms.

-

Breakout Patterns: These patterns sign a major value transfer after a interval of consolidation. They’re typically related to excessive volatility and might happen at the side of different patterns. Examples embody triangles (as talked about above, their breakout may be thought-about a breakout sample), rectangles, and flags/pennants.

II. Detailed Examination of Particular Chart Patterns:

A. Continuation Patterns:

-

Triangles: Triangles are characterised by converging trendlines, suggesting a interval of consolidation. Symmetrical triangles have equally sloped trendlines, indicating uncertainty in regards to the future path. Ascending triangles present larger lows, suggesting bullish bias, whereas descending triangles exhibit decrease highs, suggesting bearish bias. Breakouts sometimes happen within the path of the prevailing development.

-

Flags and Pennants: These patterns resemble flags or pennants connected to a flagpole (the prior development). They’re characterised by a quick interval of consolidation, typically with parallel trendlines, adopted by a continuation of the unique development. Flags are sometimes rectangular, whereas pennants are triangular.

-

Rectangles: Rectangles exhibit horizontal assist and resistance ranges, creating an oblong value vary. They symbolize a interval of sideways consolidation earlier than a breakout, often within the path of the prevailing development.

B. Reversal Patterns:

-

Head and Shoulders: It is a vital reversal sample. The "head" represents a value peak, flanked by two smaller "shoulders." A neckline connects the lows of the shoulders. A bearish head and shoulders sample alerts a possible downtrend after the worth breaks under the neckline. The inverse, a bullish head and shoulders, alerts a possible uptrend after a break above the neckline.

-

Double and Triple Tops/Bottoms: These patterns contain two or three peaks (tops) or troughs (bottoms) at roughly the identical value degree. A double prime alerts a possible bearish reversal after the worth breaks under the assist degree of the 2 peaks. A double backside suggests a bullish reversal after a break above the resistance degree of the 2 troughs. Triple tops and bottoms operate equally however with elevated affirmation.

C. Breakout Patterns:

As talked about beforehand, triangles, rectangles, and flags/pennants can all be thought-about breakout patterns when a value decisively breaks by the established assist or resistance ranges. The power of the breakout is usually indicated by quantity; larger quantity typically signifies a extra vital value motion.

III. Figuring out and Decoding Chart Patterns:

Figuring out chart patterns requires observe and expertise. Merchants typically use technical indicators alongside chart patterns to boost their evaluation. Key elements to contemplate embody:

-

Quantity: Excessive quantity throughout a breakout typically confirms the sample’s validity. Low quantity breakouts are usually thought-about much less dependable.

-

Trendline Help and Resistance: The accuracy of the recognized trendlines performs a vital function in sample identification.

-

Affirmation: Affirmation from different technical indicators, comparable to shifting averages or oscillators, can strengthen the sign generated by a chart sample.

-

Timeframe: The timeframe used (e.g., every day, weekly, month-to-month) influences the sample’s significance and potential impression. Patterns on longer timeframes usually maintain extra weight.

IV. Limitations of Chart Patterns:

It is essential to know the constraints of chart patterns:

-

Subjectivity: Figuring out chart patterns may be subjective, resulting in totally different interpretations amongst merchants.

-

False Alerts: Chart patterns can generate false alerts, resulting in incorrect predictions.

-

Context is Essential: Chart patterns shouldn’t be interpreted in isolation. They need to be thought-about throughout the broader market context, together with financial elements and information occasions.

-

Affirmation Bias: Merchants could also be susceptible to affirmation bias, selectively specializing in patterns that assist their present beliefs.

V. Superior Chart Sample Ideas:

Past the essential patterns, extra complicated formations exist, typically involving mixtures of easier patterns or variations on established themes. These can embody:

-

Broadening Formations: These patterns present increasing value ranges, indicating growing volatility.

-

Harmonic Patterns: These patterns are based mostly on Fibonacci ratios and geometric relationships, aiming to foretell exact reversal factors.

-

Candlestick Patterns: Whereas technically distinct, candlestick patterns are sometimes built-in with chart sample evaluation to offer further affirmation and perception.

VI. Conclusion:

Chart patterns are invaluable instruments for technical analysts, offering insights into potential market actions. Nonetheless, they aren’t predictive instruments in themselves. Profitable utilization of chart patterns requires a mixture of expertise, cautious remark, and a nuanced understanding of their limitations. Combining chart sample evaluation with different types of technical and basic evaluation is essential for making knowledgeable buying and selling selections. Whereas a devoted Wikipedia web page would increase on the small print and complexities of every sample, this text offers a foundational understanding of the important thing ideas and classes inside this important facet of technical evaluation. Do not forget that buying and selling entails threat, and no technique ensures revenue. Thorough analysis and threat administration are paramount for any dealer using chart patterns or another technical evaluation method.

:max_bytes(150000):strip_icc()/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-05-a19b59070c434400988fca7fa83898dd.jpg)

Closure

Thus, we hope this text has offered invaluable insights into Chart Patterns: A Deep Dive into Technical Evaluation Instruments on Wikipedia (Hypothetical Article). We recognize your consideration to our article. See you in our subsequent article!