Chart Patterns And Candlestick Patterns: A Complete Information

By admin / July 30, 2024 / No Comments / 2025

Chart Patterns and Candlestick Patterns: A Complete Information

Associated Articles: Chart Patterns and Candlestick Patterns: A Complete Information

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Chart Patterns and Candlestick Patterns: A Complete Information. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Chart Patterns and Candlestick Patterns: A Complete Information

Technical evaluation is a cornerstone of profitable buying and selling, counting on the interpretation of value charts to foretell future market actions. Two essential parts of technical evaluation are chart patterns and candlestick patterns. Whereas distinct, they typically work in tandem to supply a extra strong buying and selling sign. This complete information delves into each, explaining their formation, interpretation, and sensible utility. A downloadable PDF summarizing key ideas will likely be out there on the finish.

I. Chart Patterns: The Huge Image

Chart patterns characterize the visible depiction of value motion over an extended timeframe, typically spanning a number of weeks or months. They reveal the underlying sentiment and momentum of the market, offering clues about potential value reversals or continuations. These patterns are fashioned by connecting vital highs and lows, creating recognizable shapes that merchants use to anticipate future value actions.

A. Continuation Patterns: These patterns counsel that the present development will doubtless proceed after a short lived pause.

-

Triangles: Triangles are characterised by converging trendlines, representing a interval of consolidation. There are three important varieties: symmetrical, ascending, and descending. Symmetrical triangles counsel a continuation of the previous development, with the breakout occurring in both course. Ascending triangles point out bullish continuation, whereas descending triangles trace at bearish continuation. The breakout normally happens across the apex of the triangle.

-

Flags and Pennants: Flags and pennants are short-term consolidations that happen inside a robust development. Flags are characterised by parallel trendlines, forming an oblong form. Pennants resemble triangles however are extra condensed and seem as a mini-triangle inside a robust development. Breakouts from flags and pennants usually verify the continuation of the prevailing development.

-

Rectangles: Rectangles are characterised by horizontal assist and resistance ranges, with value fluctuating between these ranges. Breakouts above the resistance counsel a bullish continuation, whereas breakouts under assist point out a bearish continuation.

B. Reversal Patterns: These patterns sign a possible change within the prevailing development.

-

Head and Shoulders: This can be a basic reversal sample characterised by three peaks, with the center peak (the top) being the very best. The 2 outer peaks (the shoulders) are roughly equal in top. A neckline connects the troughs between the peaks. A break under the neckline confirms a bearish reversal. The goal value is usually estimated by measuring the gap between the top and the neckline and projecting it downwards from the neckline.

-

Inverse Head and Shoulders: That is the mirror picture of the top and shoulders sample, signaling a bullish reversal. It options three troughs, with the center trough being the bottom. A break above the neckline confirms a bullish reversal.

-

Double Tops and Double Bottoms: Double tops happen when value reaches the identical resistance degree twice, failing to interrupt via. This implies a bearish reversal. Double bottoms are the other, indicating a bullish reversal. A break under the neckline (for double tops) or above the assist degree (for double bottoms) confirms the reversal.

II. Candlestick Patterns: The Advantageous Element

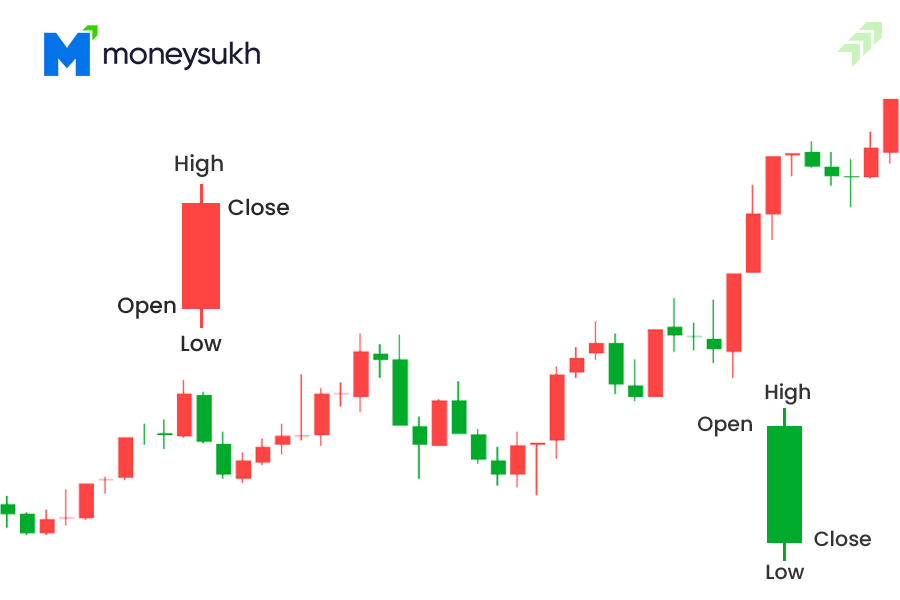

Candlestick patterns supply a extra granular evaluation of value motion, specializing in the open, excessive, low, and shut costs of a single interval (e.g., a day, an hour). They supply insights into the interaction of shopping for and promoting strain inside a shorter timeframe, typically complementing the data gleaned from chart patterns.

A. Bullish Candlestick Patterns: These patterns counsel a possible upward value motion.

-

Hammer: A hammer incorporates a small physique on the prime of an extended decrease shadow, indicating sturdy shopping for strain that overcame preliminary promoting strain.

-

Inverted Hammer: Just like a hammer however with a small physique on the backside and an extended higher shadow. It suggests sturdy shopping for strain that failed to beat sturdy promoting strain. Whereas typically bullish, it may be much less dependable than a hammer.

-

Bullish Engulfing Sample: This sample consists of two candles. The primary candle is bearish, and the second candle is bullish and utterly engulfs the primary candle’s physique. This implies a shift in momentum from bearish to bullish.

-

Morning Star: A 3-candle sample consisting of a bearish candle, adopted by a small indecisive candle (doji or spinning prime), after which a robust bullish candle. This signifies a possible reversal from a downtrend.

B. Bearish Candlestick Patterns: These patterns counsel a possible downward value motion.

-

Hanging Man: A small physique on the prime of an extended decrease shadow, showing on the prime of an uptrend. It suggests a possible reversal.

-

Taking pictures Star: Just like a dangling man however with an extended higher shadow and a small physique on the backside. It seems on the prime of an uptrend and suggests a possible reversal.

-

Bearish Engulfing Sample: The other of the bullish engulfing sample. A bullish candle is adopted by a bearish candle that utterly engulfs the primary candle’s physique.

-

Night Star: A 3-candle sample, the other of the morning star, indicating a possible reversal from an uptrend. It consists of a bullish candle, adopted by a small indecisive candle, after which a robust bearish candle.

III. Combining Chart and Candlestick Patterns:

The facility of technical evaluation lies in combining totally different patterns to substantiate buying and selling alerts. For instance, a head and shoulders sample confirmed by bearish candlestick patterns like taking pictures stars or night stars on the neckline supplies a a lot stronger bearish sign than both sample alone. Equally, a bullish breakout from a triangle sample bolstered by bullish engulfing patterns considerably will increase the chance of a profitable lengthy place.

IV. Danger Administration and Sensible Utility:

Whereas chart and candlestick patterns present invaluable insights, they aren’t foolproof predictors of market actions. All the time incorporate danger administration strategies, corresponding to stop-loss orders and place sizing, to guard your capital. Moreover, contemplate the general market context, financial indicators, and basic evaluation earlier than making any buying and selling selections. Patterns needs to be seen as one piece of the puzzle, not your entire image.

V. Conclusion:

Chart patterns and candlestick patterns are highly effective instruments for technical merchants. Understanding their formation, interpretation, and utility, together with incorporating sound danger administration, can considerably enhance buying and selling efficiency. Do not forget that constant studying and apply are essential to mastering these strategies and adapting them to totally different market situations.

(Downloadable PDF will likely be out there right here – This part would include a hyperlink to a downloadable PDF summarizing the important thing factors of the article. Because of the limitations of this text-based format, the PDF creation will not be attainable right here.) The PDF would come with concise descriptions of every sample with illustrative diagrams.

Closure

Thus, we hope this text has supplied invaluable insights into Chart Patterns and Candlestick Patterns: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!