Chart Patterns: Downloading, Figuring out, And Using Highly effective Predictive Instruments

By admin / August 29, 2024 / No Comments / 2025

Chart Patterns: Downloading, Figuring out, and Using Highly effective Predictive Instruments

Associated Articles: Chart Patterns: Downloading, Figuring out, and Using Highly effective Predictive Instruments

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Chart Patterns: Downloading, Figuring out, and Using Highly effective Predictive Instruments. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Chart Patterns: Downloading, Figuring out, and Using Highly effective Predictive Instruments

Chart patterns, recurring formations on worth charts, provide invaluable insights for merchants of all ranges. These patterns, starting from easy triangles to advanced head and shoulders formations, can sign potential worth reversals, breakouts, or continuations. Whereas basic evaluation examines an organization’s intrinsic worth, technical evaluation, relying closely on chart patterns, focuses on worth motion and quantity to foretell future actions. This text delves into the world of chart patterns, exploring the place to obtain them, find out how to determine them successfully, and find out how to combine them into a strong buying and selling technique.

I. Downloading Chart Sample Recognition Instruments:

Accessing and using chart patterns successfully requires the precise instruments. Whereas handbook identification is feasible, it is usually time-consuming and liable to subjective interpretation. Happily, quite a few software program functions and on-line platforms provide automated chart sample recognition, considerably enhancing the effectivity and accuracy of study. These instruments vary from free, primary indicators to classy, subscription-based platforms with superior options.

A. Buying and selling Platforms:

Most respected on-line brokerage platforms incorporate built-in charting instruments with various levels of chart sample recognition capabilities. These built-in options usually present a seamless workflow, permitting you to investigate charts instantly inside your buying and selling setting. Options might embody:

- Automated Sample Recognition: These instruments routinely scan charts, figuring out potential patterns like head and shoulders, triangles, flags, and wedges. They usually spotlight the recognized patterns instantly on the chart, saving you vital effort and time.

- Customizable Parameters: Many platforms enable customization of the sample recognition parameters, enabling you to fine-tune sensitivity and modify thresholds primarily based in your buying and selling model and preferences. This lets you filter out much less dependable alerts and give attention to higher-probability patterns.

- Backtesting Capabilities: Some platforms let you backtest your methods utilizing the recognized patterns, assessing their historic efficiency and optimizing parameters for improved future outcomes. That is essential for validating the effectiveness of your sample recognition method.

Examples of platforms with sturdy charting and sample recognition capabilities embody TradingView, MetaTrader 4/5, NinjaTrader, and thinkorswim. Every platform affords a novel set of options and functionalities, so it is important to analysis and evaluate choices earlier than making a range.

B. Standalone Software program:

Past built-in platform instruments, a number of standalone software program functions specialise in chart sample recognition. These functions usually provide superior options not present in primary platform integrations, together with:

- A number of Chart Sample Libraries: These packages might determine a wider vary of patterns in comparison with built-in platform instruments, together with much less widespread or advanced formations.

- Superior Sample Metrics: They could present detailed metrics for every recognized sample, reminiscent of sample dimension, length, and energy, aiding in danger administration and commerce choice.

- Integration with Different Instruments: Some standalone software program can combine with different buying and selling platforms and knowledge feeds, streamlining your workflow and eliminating the necessity for knowledge duplication.

Whereas these functions usually include a subscription payment, the improved options and superior analytics can justify the price for severe merchants.

C. Free On-line Instruments and Indicators:

A number of free on-line assets and open-source indicators present primary chart sample recognition. Whereas these choices might lack the sophistication of paid options, they could be a invaluable start line for newcomers or these on a decent funds. Nevertheless, it is essential to grasp the restrictions of free instruments, as they might lack accuracy, customization choices, and sturdy backtesting capabilities.

II. Figuring out Chart Patterns:

Recognizing chart patterns requires follow and a eager eye for element. Whereas automated instruments can help, understanding the underlying rules of every sample is essential for efficient interpretation. Listed here are some key issues:

- Worth Motion: Give attention to the value motion and its relationship to quantity. Search for clear traits, reversals, and consolidations.

- Help and Resistance Ranges: Determine key assist and resistance ranges, as these usually outline the boundaries of chart patterns.

- Quantity Affirmation: Verify sample formations with quantity evaluation. Elevated quantity throughout breakouts or vital worth actions usually validates the sample’s significance.

- Sample Affirmation: Do not rely solely on one sample. Search for affirmation from different indicators, reminiscent of shifting averages, oscillators, or candlestick patterns.

- Context is Key: Contemplate the broader market context. A sample that may sign a reversal in a bullish development might merely be a brief pullback in a robust uptrend.

III. Using Chart Patterns in Buying and selling Methods:

As soon as you’ve got recognized a chart sample, you want a well-defined buying and selling plan to capitalize on it. This contains:

- Entry and Exit Methods: Decide your entry and exit factors primarily based on the sample’s traits. For instance, a breakout from a triangle sample could be a purchase sign, whereas a breakdown could possibly be a promote sign. Set clear stop-loss and take-profit ranges to handle danger.

- Threat Administration: At all times use acceptable danger administration strategies, reminiscent of setting stop-loss orders to restrict potential losses. By no means danger greater than a small share of your buying and selling capital on any single commerce.

- Place Sizing: Decide the suitable place dimension primarily based in your danger tolerance and account dimension. Keep away from over-leveraging, which may result in vital losses.

- Backtesting and Optimization: Backtest your buying and selling methods utilizing historic knowledge to guage their effectiveness and optimize parameters for improved efficiency.

- Adaptability: No buying and selling technique is foolproof. Be ready to adapt your method primarily based on market circumstances and altering patterns.

IV. Widespread Chart Patterns:

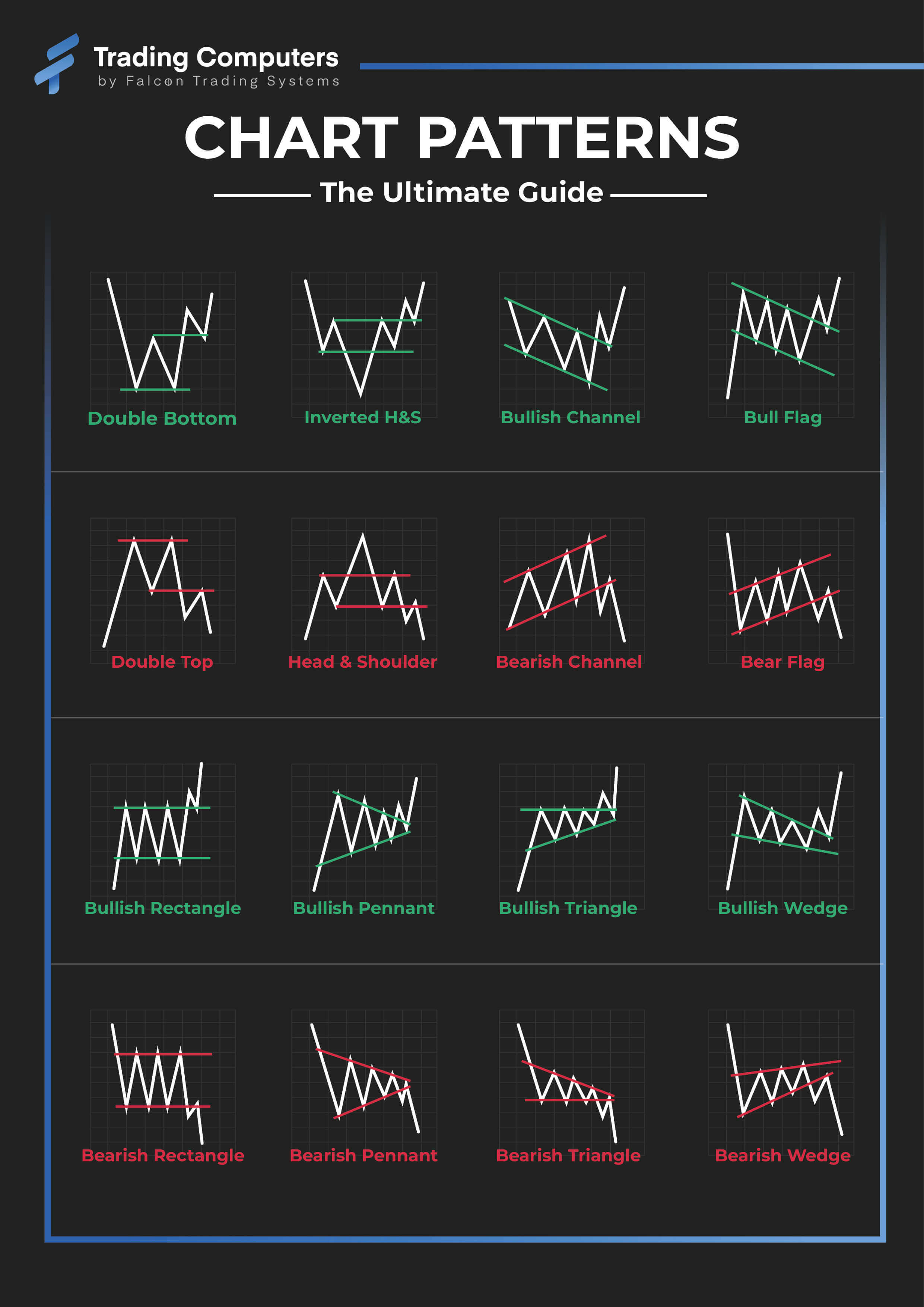

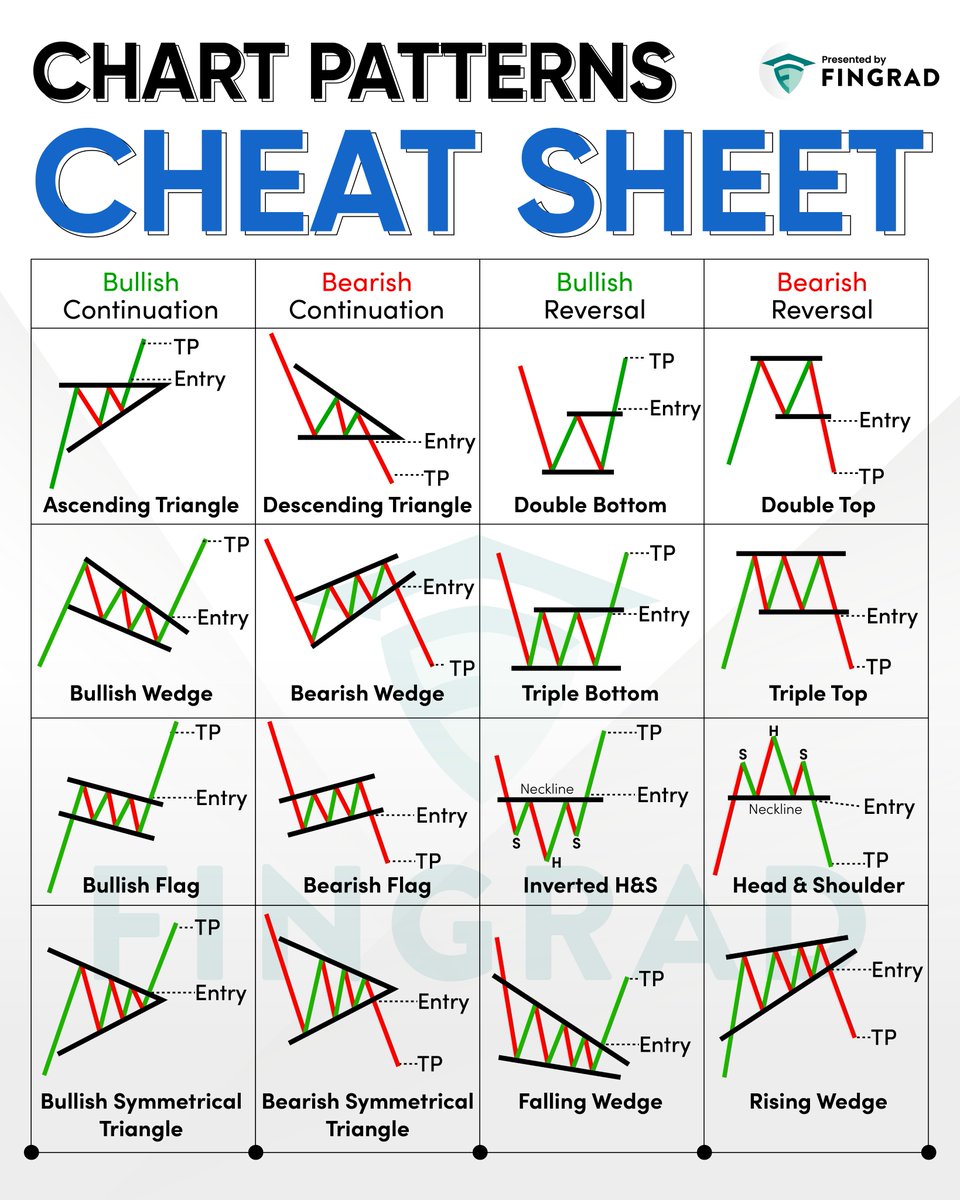

A number of recurring chart patterns provide invaluable predictive alerts:

- Triangles: Consolidation patterns characterised by converging trendlines. Breakouts from triangles usually sign a continuation of the previous development.

- Head and Shoulders: Reversal patterns characterised by three peaks, with the center peak (the pinnacle) being the very best. A breakdown beneath the neckline usually alerts a bearish reversal.

- Double Tops/Bottoms: Reversal patterns characterised by two related worth peaks (double prime) or troughs (double backside). A breakdown beneath the double prime or a breakout above the double backside can sign a development reversal.

- Flags and Pennants: Continuation patterns that symbolize non permanent pauses in a robust development. Breakouts from flags and pennants usually sign a continuation of the development.

- Wedges: Consolidation patterns characterised by converging trendlines. Wedges may be both bullish or bearish, relying on the course of the trendlines.

- Rectangles: Consolidation patterns characterised by horizontal assist and resistance ranges. Breakouts from rectangles usually sign a continuation of the previous development.

V. Conclusion:

Chart patterns are highly effective instruments for technical evaluation, providing invaluable insights into potential worth actions. Whereas automated sample recognition software program can considerably improve effectivity, understanding the underlying rules of every sample is essential for efficient interpretation and utilization. By combining automated instruments with a well-defined buying and selling technique, incorporating danger administration strategies, and constantly studying and adapting, merchants can leverage chart patterns to enhance their buying and selling efficiency. Keep in mind that chart patterns are usually not foolproof, and profitable buying and selling requires a holistic method combining technical evaluation with basic evaluation and sound danger administration practices. At all times conduct thorough analysis and take into account consulting with a monetary advisor earlier than making any funding choices.

![Chart Patterns Cheat Sheet PDF 2024 [FREE DOWNLOAD]](https://www.stockmarkethindi.in/wp-content/uploads/2023/08/20230822_214443_4321.webp)

Closure

Thus, we hope this text has supplied invaluable insights into Chart Patterns: Downloading, Figuring out, and Using Highly effective Predictive Instruments. We respect your consideration to our article. See you in our subsequent article!