Chart Patterns: Your Free Information To Mastering Technical Evaluation (E book Obtain)

By admin / August 11, 2024 / No Comments / 2025

Chart Patterns: Your Free Information to Mastering Technical Evaluation (E book Obtain)

Associated Articles: Chart Patterns: Your Free Information to Mastering Technical Evaluation (E book Obtain)

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Chart Patterns: Your Free Information to Mastering Technical Evaluation (E book Obtain). Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Chart Patterns: Your Free Information to Mastering Technical Evaluation (E book Obtain)

The world of monetary buying and selling can really feel overwhelming, notably for newcomers. However amidst the complicated indicators and fluctuating markets, a easy but highly effective device exists: chart sample recognition. Chart patterns, recurring formations on value charts, provide precious insights into market sentiment and potential value actions. This e-book gives a complete information to understanding and using these patterns, empowering you to make extra knowledgeable buying and selling choices. Obtain your free copy now! (Observe: A hyperlink to a fictional downloadable e-book could be positioned right here in a real-world software.)

Introduction: Unlocking the Secrets and techniques of Value Motion

Technical evaluation, the examine of previous market information to foretell future value actions, depends closely on chart patterns. These patterns aren’t simply random fluctuations; they characterize the collective conduct of consumers and sellers, reflecting shifts in market sentiment and momentum. By recognizing these patterns, merchants can anticipate potential value reversals, breakouts, and continuations, bettering their buying and selling accuracy and threat administration.

This e-book serves as your complete information to mastering chart patterns. We’ll discover varied sample varieties, their traits, and methods for efficient buying and selling based mostly on their identification. We’ll cowl each bullish and bearish patterns, equipping you with a flexible toolkit for navigating completely different market situations.

Half 1: Understanding the Fundamentals of Chart Patterns

Earlier than diving into particular patterns, it is essential to know the underlying ideas:

- Assist and Resistance: These are key value ranges the place consumers (assist) or sellers (resistance) exert vital affect. Patterns typically type round these ranges, indicating potential breakouts or reversals.

- Trendlines: Connecting a sequence of upper highs (uptrend) or decrease lows (downtrend) creates trendlines. Breaks of those strains can sign vital shifts in momentum.

- Quantity: Quantity evaluation enhances chart sample interpretation. Excessive quantity throughout a breakout confirms the power of the transfer, whereas low quantity suggests weak spot.

- Timeframes: Chart patterns can seem throughout varied timeframes (e.g., 5-minute, day by day, weekly). Analyzing patterns throughout a number of timeframes gives a extra holistic view of the market.

Half 2: Exploring Widespread Chart Patterns

This part delves into among the most prevalent and dependable chart patterns:

1. Reversal Patterns: These patterns point out a possible change within the prevailing development.

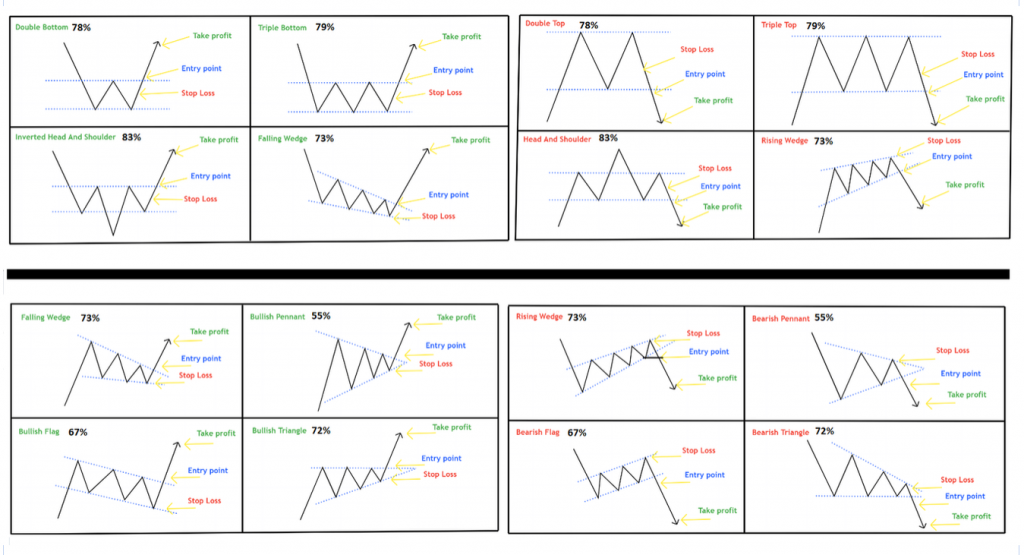

- Head and Shoulders: A traditional reversal sample characterised by three peaks (left shoulder, head, proper shoulder), with decrease troughs between them. A neckline break confirms the reversal.

- Inverse Head and Shoulders: The mirror picture of the top and shoulders, signaling a bullish reversal in a downtrend.

- Double High/Backside: Two consecutive peaks (double prime) or troughs (double backside) at roughly the identical value degree, suggesting a possible development reversal.

- Triple High/Backside: Much like double tops/bottoms however with three peaks or troughs, indicating stronger reversal potential.

2. Continuation Patterns: These patterns recommend that the present development is prone to proceed.

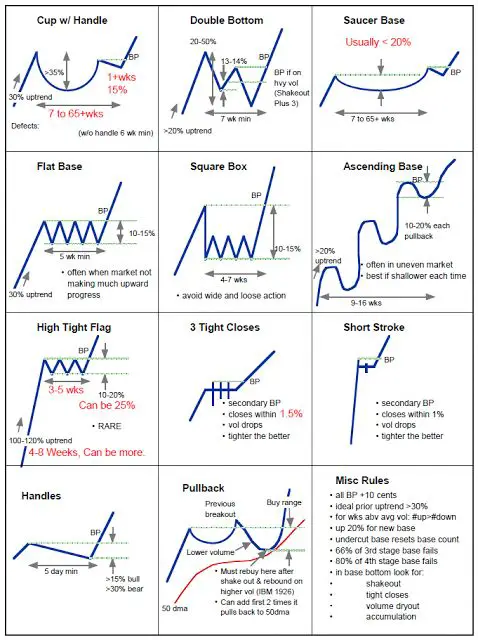

- Triangles: Characterised by converging trendlines, indicating a interval of consolidation earlier than a breakout within the route of the prevailing development. Symmetrical, ascending, and descending triangles are frequent variations.

- Flags and Pennants: These patterns resemble small flags or pennants hooked up to a pole (the previous development). They characterize momentary pauses in a robust development, adopted by a continuation.

- Rectangles: Value consolidates inside a horizontal vary, outlined by two parallel horizontal strains. A breakout above or under the rectangle confirms the continuation of the development.

- Wedges: Much like triangles, however the converging strains have a steeper slope. Ascending wedges are bearish, whereas descending wedges are bullish.

3. Different Notable Patterns:

- Cup and Deal with: A bullish continuation sample resembling a cup with a deal with. The deal with is a interval of minor consolidation earlier than a big upward transfer.

- Rounding Backside/High: These patterns point out gradual development reversals, with an extended consolidation interval in comparison with different reversal patterns.

Half 3: Sensible Software and Buying and selling Methods

Figuring out chart patterns is just half the battle. Profitable buying and selling requires a well-defined technique for getting into and exiting trades based mostly on these patterns.

- Affirmation: By no means rely solely on chart patterns. Affirm your evaluation utilizing different technical indicators (e.g., shifting averages, RSI, MACD) and basic evaluation.

- Threat Administration: At all times use stop-loss orders to restrict potential losses. Place your stop-loss order strategically, contemplating the sample’s traits and potential breakout ranges.

- Entry and Exit Factors: Decide exact entry and exit factors based mostly on the sample’s traits and your threat tolerance. For instance, a breakout above the neckline in a head and shoulders sample could possibly be an acceptable entry level.

- Place Sizing: Allocate your capital properly, avoiding overexposure to any single commerce. Modify your place dimension based mostly in your threat tolerance and the sample’s potential reward-to-risk ratio.

- Backtesting: Earlier than implementing your technique in dwell buying and selling, backtest it utilizing historic information to evaluate its effectiveness and refine your method.

Half 4: Superior Methods and Concerns

- Combining Patterns: Skilled merchants typically mix a number of patterns to reinforce their evaluation and establish higher-probability buying and selling alternatives.

- Sample Recognition Apply: Mastering chart sample recognition requires constant apply. Analyze historic charts and establish patterns to hone your abilities.

- False Breakouts: Bear in mind that false breakouts can happen, resulting in inaccurate predictions. Use quantity and different indicators to filter out false alerts.

- Market Context: At all times contemplate the broader market context when analyzing chart patterns. A sample that works properly in a bullish market might not carry out as successfully in a bearish market.

- Adaptability: Market situations change consistently. Stay versatile and adapt your buying and selling methods accordingly.

Conclusion: Embark on Your Chart Sample Mastery Journey

Chart patterns present a precious device for technical evaluation, permitting merchants to anticipate potential value actions and enhance their buying and selling choices. By understanding the basics of chart patterns, mastering their recognition, and implementing a well-defined buying and selling technique, you may considerably improve your buying and selling efficiency. This e-book has offered a stable basis. Now it is time to put your information into apply and embark in your journey to mastering chart sample evaluation. Keep in mind, constant studying and disciplined buying and selling are key to long-term success within the monetary markets. Obtain your free copy of this e-book immediately and begin your buying and selling journey! (Observe: A hyperlink to a fictional downloadable e-book could be positioned right here in a real-world software.)

![Chart Patterns PDF Cheat Sheet [FREE Download]](https://howtotrade.com/wp-content/uploads/2023/02/chart-patterns-cheat-sheet-1024x724.png)

Closure

Thus, we hope this text has offered precious insights into Chart Patterns: Your Free Information to Mastering Technical Evaluation (E book Obtain). We thanks for taking the time to learn this text. See you in our subsequent article!