Chart Buying and selling In MT4: Mastering The Artwork Of Visible Evaluation

By admin / August 16, 2024 / No Comments / 2025

Chart Buying and selling in MT4: Mastering the Artwork of Visible Evaluation

Associated Articles: Chart Buying and selling in MT4: Mastering the Artwork of Visible Evaluation

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Chart Buying and selling in MT4: Mastering the Artwork of Visible Evaluation. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Chart Buying and selling in MT4: Mastering the Artwork of Visible Evaluation

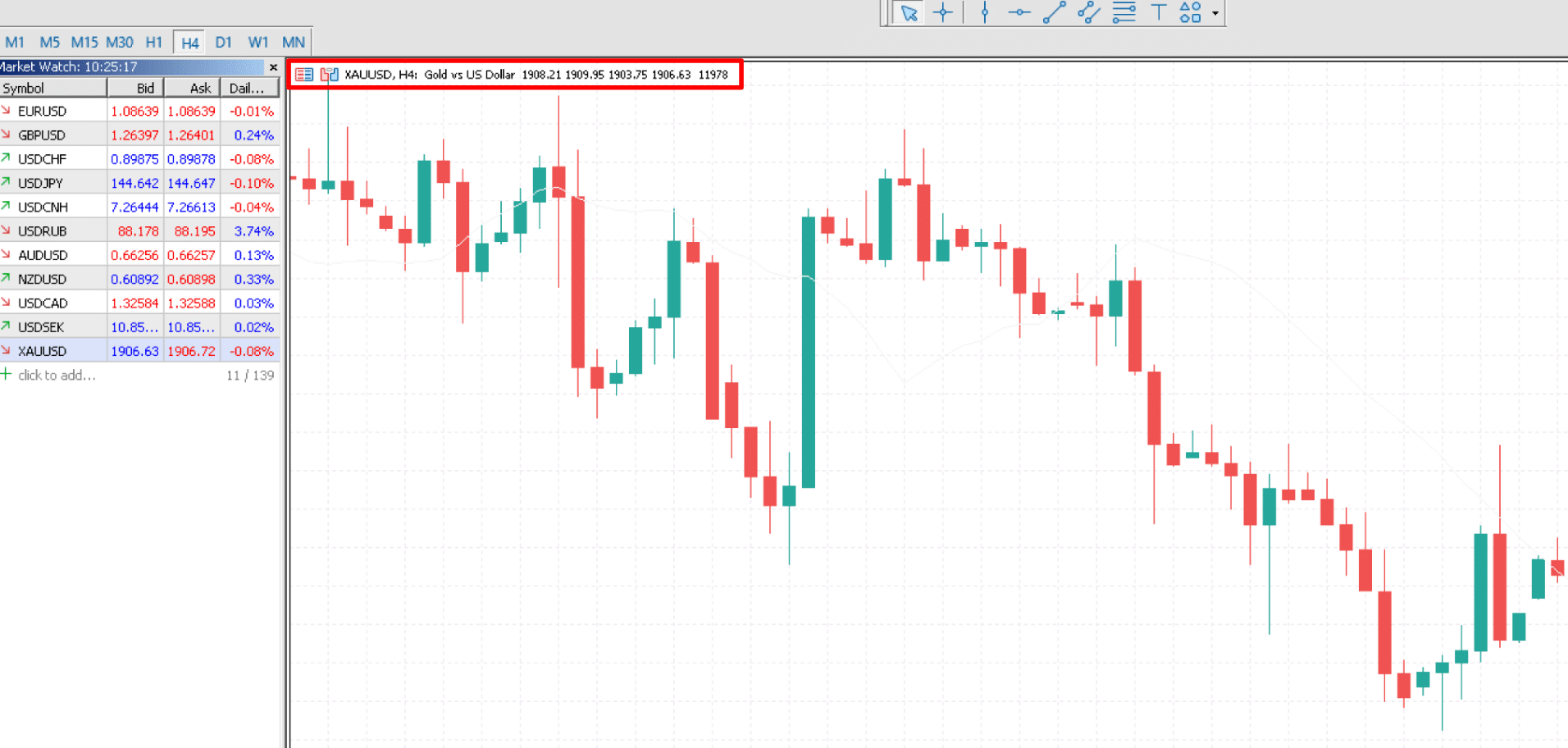

MetaTrader 4 (MT4) is a widely-used foreign currency trading platform famend for its strong charting capabilities. Chart buying and selling, the observe of analyzing value charts to establish buying and selling alternatives, is a core part of many profitable buying and selling methods. MT4 supplies a complete suite of instruments and indicators to facilitate this evaluation, enabling merchants of all ranges to visualise market tendencies, establish potential entry and exit factors, and handle danger successfully. This text delves deep into chart buying and selling inside the MT4 atmosphere, protecting important elements from primary chart varieties to superior technical evaluation strategies.

Understanding Chart Sorts in MT4:

MT4 presents quite a lot of chart varieties, every offering a novel perspective on value motion. The selection of chart kind is dependent upon the dealer’s most popular analytical model and the timeframe being analyzed. The most typical chart varieties are:

-

Bar Charts: These show the open, excessive, low, and shut (OHLC) value for a particular interval. The vertical line represents the worth vary (excessive to low), whereas the left and proper sides of the bar point out the open and shut costs respectively. Bar charts are wonderful for visualizing value fluctuations and figuring out candlestick patterns.

-

Candlestick Charts: Just like bar charts, candlestick charts show OHLC knowledge, however in a extra visually interesting and informative method. The physique of the candlestick represents the worth vary between the open and shut, whereas the wicks (shadows) prolong to the excessive and low costs. The colour of the candlestick sometimes signifies whether or not the worth closed increased (bullish, usually inexperienced) or decrease (bearish, usually crimson) than it opened. Candlestick charts are extensively used for sample recognition and figuring out potential reversals or continuations.

-

Line Charts: These charts join the closing costs of successive durations with a steady line. Whereas easier than bar or candlestick charts, they’re helpful for visualizing general tendencies and figuring out important value actions over longer timeframes. They’re much less efficient for detailed evaluation of intraday value motion.

Navigating the MT4 Charting Interface:

The MT4 charting interface is intuitive and user-friendly. Merchants can simply change between chart varieties, alter timeframes, add indicators, and draw varied drawing instruments. Key options embrace:

-

Timeframe Choice: MT4 permits merchants to investigate value motion throughout a variety of timeframes, from seconds to months. This flexibility is essential for adapting to completely different buying and selling types and market circumstances. Brief-term merchants usually give attention to minute or hourly charts, whereas longer-term merchants would possibly want every day or weekly charts.

-

Chart Zoom and Panning: The flexibility to zoom out and in and pan throughout the chart is crucial for detailed evaluation. This permits merchants to give attention to particular value actions or look at the broader market context.

-

Indicator Library: MT4 boasts an unlimited library of technical indicators, starting from easy shifting averages to advanced oscillators and momentum indicators. These indicators assist merchants establish tendencies, assist and resistance ranges, and potential buying and selling alerts.

-

Drawing Instruments: A complete set of drawing instruments, together with trendlines, Fibonacci retracements, horizontal traces, and channels, allows merchants to visually establish patterns, assist and resistance ranges, and potential value targets.

Technical Evaluation with MT4 Charts:

Chart buying and selling in MT4 closely depends on technical evaluation, the examine of previous market knowledge to foretell future value actions. Key elements of technical evaluation inside the MT4 atmosphere embrace:

-

Pattern Identification: Figuring out the prevailing pattern (uptrend, downtrend, or sideways) is essential for figuring out the route of potential trades. Trendlines, shifting averages, and different indicators will help establish the dominant pattern.

-

Assist and Resistance Ranges: These are value ranges the place the worth has traditionally struggled to interrupt via. Assist ranges signify potential shopping for alternatives, whereas resistance ranges signify potential promoting alternatives. Drawing horizontal traces, Fibonacci retracements, and different instruments will help establish these ranges.

-

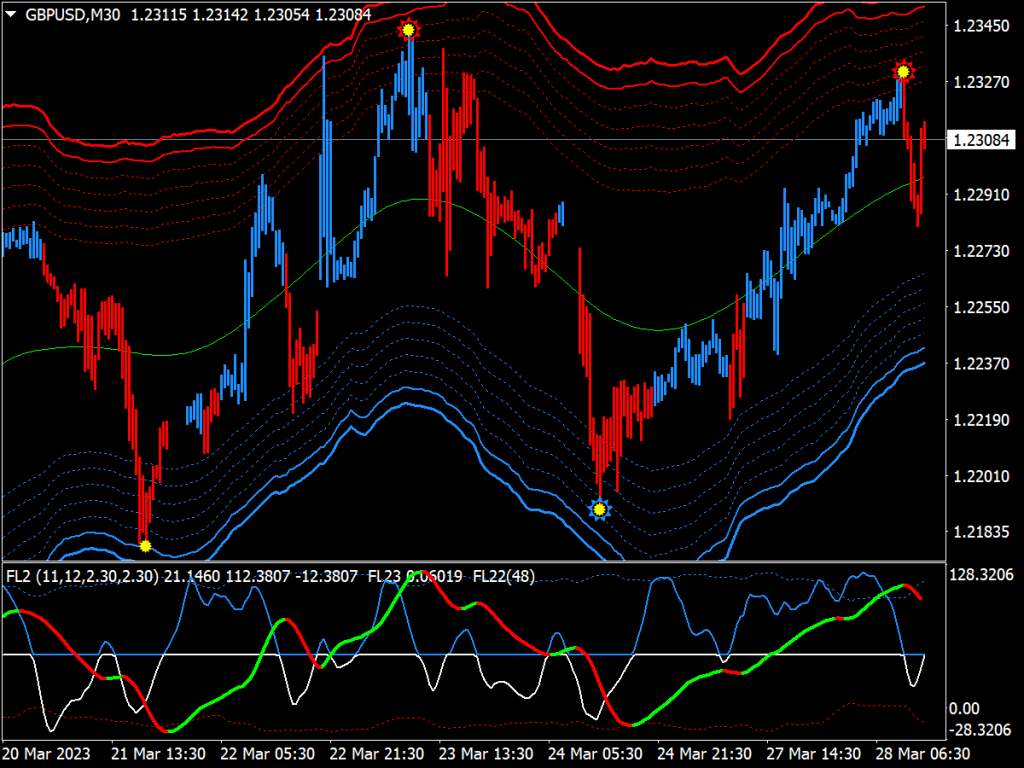

Candlestick Sample Recognition: Recognizing candlestick patterns, similar to engulfing patterns, hammer formations, and taking pictures stars, can present invaluable insights into potential value reversals or continuations. MT4’s charting capabilities make it simple to identify these patterns.

-

Indicator Evaluation: Utilizing a mix of indicators can present a extra complete image of the market. For instance, combining shifting averages with oscillators just like the Relative Energy Index (RSI) or the Stochastic Oscillator will help affirm pattern route and establish potential overbought or oversold circumstances.

-

Fibonacci Retracements and Extensions: These instruments, based mostly on the Fibonacci sequence, will help establish potential assist and resistance ranges in addition to value targets. They’re notably helpful for figuring out potential retracements inside a bigger pattern.

Threat Administration and Chart Buying and selling:

Efficient danger administration is essential for profitable chart buying and selling. MT4 supplies instruments to assist merchants handle danger, together with:

-

Cease-Loss Orders: These orders mechanically shut a commerce if the worth strikes towards the dealer’s place, limiting potential losses. Putting stop-loss orders at key assist or resistance ranges is a typical danger administration method.

-

Take-Revenue Orders: These orders mechanically shut a commerce if the worth strikes within the dealer’s favor, securing earnings. Putting take-profit orders at predetermined value targets or Fibonacci extensions is a typical observe.

-

Place Sizing: Figuring out the suitable dimension of a commerce is crucial for managing danger. Merchants ought to solely danger a small share of their buying and selling capital on any single commerce.

Superior Chart Buying and selling Methods in MT4:

Past the fundamentals, skilled merchants can leverage superior strategies inside MT4:

-

A number of Timeframe Evaluation: Analyzing value motion throughout a number of timeframes supplies a extra holistic view of the market. This permits merchants to establish long-term tendencies whereas on the lookout for short-term entry factors.

-

Automated Buying and selling with Professional Advisors (EAs): MT4 helps the event and implementation of EAs, which might mechanically execute trades based mostly on predefined guidelines and indicators. This could be a highly effective instrument for automating buying and selling methods.

-

Customized Indicators: Merchants can create and use customized indicators to investigate the market in distinctive methods. This permits for personalised evaluation and the event of proprietary buying and selling methods.

-

Backtesting: MT4 permits for backtesting of buying and selling methods on historic knowledge. This helps merchants consider the efficiency of their methods earlier than risking actual capital.

Conclusion:

Chart buying and selling in MT4 is a strong and versatile method to foreign currency trading. By mastering the platform’s charting capabilities, using technical evaluation strategies, and implementing sound danger administration practices, merchants can considerably enhance their buying and selling efficiency. Nevertheless, it’s essential to do not forget that no buying and selling technique ensures success, and steady studying and adaptation are important for long-term success within the dynamic foreign exchange market. Thorough understanding of the market, constant observe, and disciplined danger administration are key to maximizing the potential of chart buying and selling in MT4.

Closure

Thus, we hope this text has offered invaluable insights into Chart Buying and selling in MT4: Mastering the Artwork of Visible Evaluation. We admire your consideration to our article. See you in our subsequent article!