Chart Buying and selling In MT5: Mastering The Artwork Of Visible Evaluation

By admin / November 13, 2024 / No Comments / 2025

Chart Buying and selling in MT5: Mastering the Artwork of Visible Evaluation

Associated Articles: Chart Buying and selling in MT5: Mastering the Artwork of Visible Evaluation

Introduction

With enthusiasm, let’s navigate by the intriguing matter associated to Chart Buying and selling in MT5: Mastering the Artwork of Visible Evaluation. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Chart Buying and selling in MT5: Mastering the Artwork of Visible Evaluation

MetaTrader 5 (MT5) is a strong buying and selling platform famend for its superior charting capabilities. Chart buying and selling, the observe of analyzing worth charts to determine buying and selling alternatives, kinds a cornerstone of many profitable buying and selling methods. This text delves into the intricacies of chart buying and selling throughout the MT5 setting, exploring numerous chart varieties, indicators, drawing instruments, and techniques to empower merchants of all ranges.

Understanding the MT5 Charting Interface:

MT5 presents a extremely customizable charting interface. Merchants can entry numerous chart varieties, timeframes, and indicators with ease. The core parts embrace:

-

Chart Sorts: MT5 helps a wide selection of chart varieties, every providing distinctive views on worth motion:

- Candlestick Charts: The most well-liked selection, displaying worth actions over particular time intervals (e.g., 1-minute, 5-minute, every day). Candlesticks visually characterize the open, excessive, low, and shut (OHLC) costs.

- Bar Charts: Much like candlestick charts, however less complicated, representing OHLC knowledge with vertical bars.

- Line Charts: Show solely the closing costs, connecting them with a line, offering a clean illustration of worth developments.

- Space Charts: Much like line charts however fill the world beneath the road, highlighting the value vary.

- Heikin Ashi Charts: A modified candlestick chart that smooths out worth fluctuations, making developments simpler to determine.

-

Timeframes: Selecting the suitable timeframe is essential. Merchants can swap between numerous timeframes (from seconds to months) to research worth motion at totally different scales:

- Quick-term Timeframes (e.g., M1, M5, M15): Ultimate for scalping and day buying and selling, specializing in short-term worth fluctuations.

- Medium-term Timeframes (e.g., H1, H4): Appropriate for swing buying and selling, capturing intermediate-term worth actions.

- Lengthy-term Timeframes (e.g., D1, W1, MN1): Used for long-term investing, specializing in main developments and long-term worth patterns.

-

Indicators: MT5 supplies an enormous library of technical indicators, including one other layer of study to cost charts. These indicators assist determine developments, momentum, volatility, and potential reversal factors. In style examples embrace:

- Shifting Averages (MA): Easy out worth fluctuations, highlighting developments and potential help/resistance ranges.

- Relative Power Index (RSI): Measures the magnitude of latest worth adjustments to judge overbought and oversold circumstances.

- Shifting Common Convergence Divergence (MACD): Identifies adjustments in momentum by evaluating two shifting averages.

- Bollinger Bands: Show worth volatility by plotting customary deviations round a shifting common.

- Stochastic Oscillator: Measures the momentum of worth adjustments, indicating overbought and oversold circumstances.

-

Drawing Instruments: MT5 presents a complete set of drawing instruments to annotate charts and determine key ranges:

- Pattern Strains: Join vital worth factors to determine the path of a pattern.

- Assist and Resistance Ranges: Horizontal strains drawn at worth ranges the place worth has traditionally bounced or damaged by.

- Fibonacci Retracements and Extensions: Primarily based on the Fibonacci sequence, these instruments predict potential worth reversal factors.

- Channels: Enclose worth actions inside parallel strains, highlighting potential pattern continuation or reversals.

- Gann Strains: Primarily based on Gann’s theories, these strains determine potential help, resistance, and worth targets.

Chart Buying and selling Methods in MT5:

Efficient chart buying and selling requires a well-defined technique. Listed here are a number of examples:

-

Pattern Following: Figuring out and buying and selling within the path of the prevailing pattern. Indicators like shifting averages and pattern strains may also help determine the pattern. Merchants can use breakouts from consolidation patterns as entry indicators.

-

Imply Reversion: Buying and selling on the belief that costs will revert to their common. Indicators like RSI and Bollinger Bands may also help determine overbought and oversold circumstances, signaling potential reversal factors.

-

Scalping: A brief-term buying and selling technique specializing in small worth actions inside a brief timeframe. Scalpers depend on fast entries and exits, aiming for small earnings.

-

Swing Buying and selling: Holding positions for a number of days to some weeks, capturing intermediate-term worth swings. Swing merchants use a mixture of technical evaluation and chart patterns to determine entry and exit factors.

-

Worth Motion Buying and selling: Focusing solely on worth actions and chart patterns, with out relying closely on indicators. Merchants analyze candlestick patterns, help/resistance ranges, and pattern strains to determine buying and selling alternatives.

Danger Administration in Chart Buying and selling:

Profitable chart buying and selling necessitates a strong danger administration plan. Key points embrace:

-

Place Sizing: Figuring out the suitable quantity of capital to allocate to every commerce, limiting potential losses.

-

Cease-Loss Orders: Setting automated orders to shut a place at a predetermined loss stage, defending capital from vital drawdowns.

-

Take-Revenue Orders: Setting automated orders to shut a place at a predetermined revenue stage, securing earnings.

-

Cash Administration: Creating a complete technique for managing buying and selling capital, together with danger tolerance and diversification.

Superior Charting Methods in MT5:

MT5 presents superior options to boost chart evaluation:

-

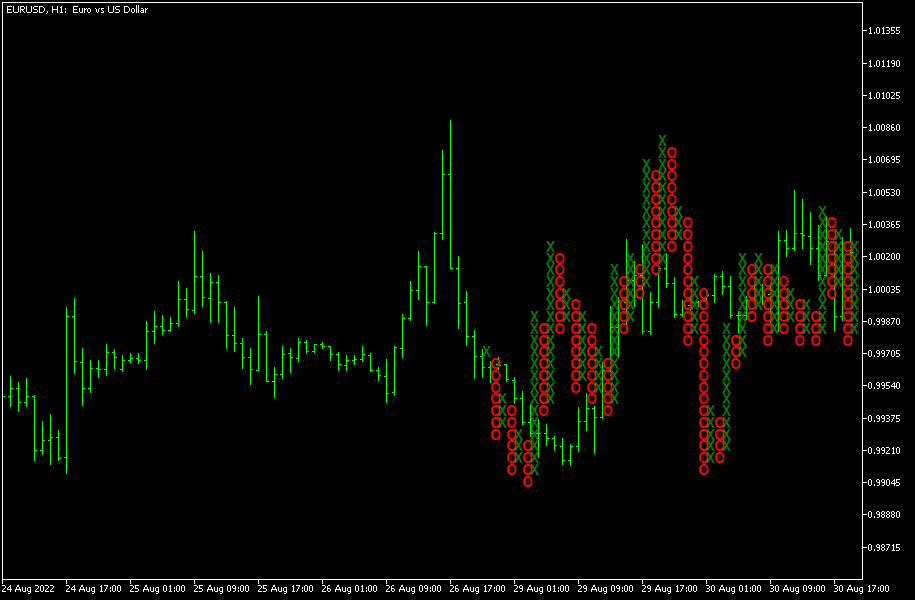

A number of Timeframe Evaluation: Analyzing charts throughout totally different timeframes to substantiate buying and selling indicators and determine higher-probability setups.

-

Customized Indicators: Creating and utilizing customized indicators tailor-made to particular buying and selling methods. MT5’s MQL5 programming language permits for creating customized indicators and Professional Advisors (EAs).

-

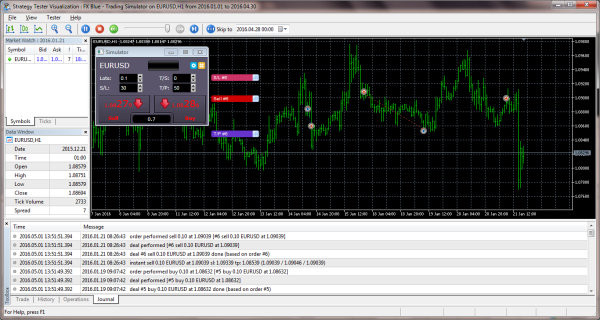

Automated Buying and selling: Utilizing Professional Advisors (EAs) to automate buying and selling methods, executing trades based mostly on predefined guidelines.

-

Backtesting: Testing buying and selling methods on historic knowledge to judge their efficiency and optimize parameters.

Conclusion:

Chart buying and selling in MT5 presents a flexible and highly effective method to buying and selling. By mastering the platform’s charting instruments, indicators, and techniques, merchants can improve their evaluation and enhance their buying and selling outcomes. Nevertheless, it is essential to do not forget that chart buying and selling just isn’t a assured path to riches. Constant studying, disciplined danger administration, and a well-defined buying and selling plan are important for achievement. Steady observe, backtesting, and adaptation to market circumstances are important for refining buying and selling expertise and reaching long-term profitability. Moreover, understanding the constraints of technical evaluation and incorporating basic evaluation can present a extra holistic and knowledgeable buying and selling method. By no means commerce with cash you can’t afford to lose, and at all times search skilled monetary recommendation if wanted.

Closure

Thus, we hope this text has offered invaluable insights into Chart Buying and selling in MT5: Mastering the Artwork of Visible Evaluation. We thanks for taking the time to learn this text. See you in our subsequent article!