Charting The Course Of US Credit score Card Debt: A Deep Dive Into The Numbers

By admin / June 17, 2024 / No Comments / 2025

Charting the Course of US Credit score Card Debt: A Deep Dive into the Numbers

Associated Articles: Charting the Course of US Credit score Card Debt: A Deep Dive into the Numbers

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Charting the Course of US Credit score Card Debt: A Deep Dive into the Numbers. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Charting the Course of US Credit score Card Debt: A Deep Dive into the Numbers

The ever present bank card. A logo of comfort, a software for monetary flexibility, and, for a lot of, a supply of crippling debt. Understanding the trajectory of US bank card debt is essential for people, policymakers, and monetary establishments alike. This text will delve into the historic traits, contributing elements, and potential penalties of the ever-evolving panorama of bank card debt in america. We are going to make the most of knowledge visualization as an instance key factors and supply insights into the way forward for this important financial indicator.

A Historic Perspective: The Rise and Fall (and Rise Once more?) of Credit score Card Debt

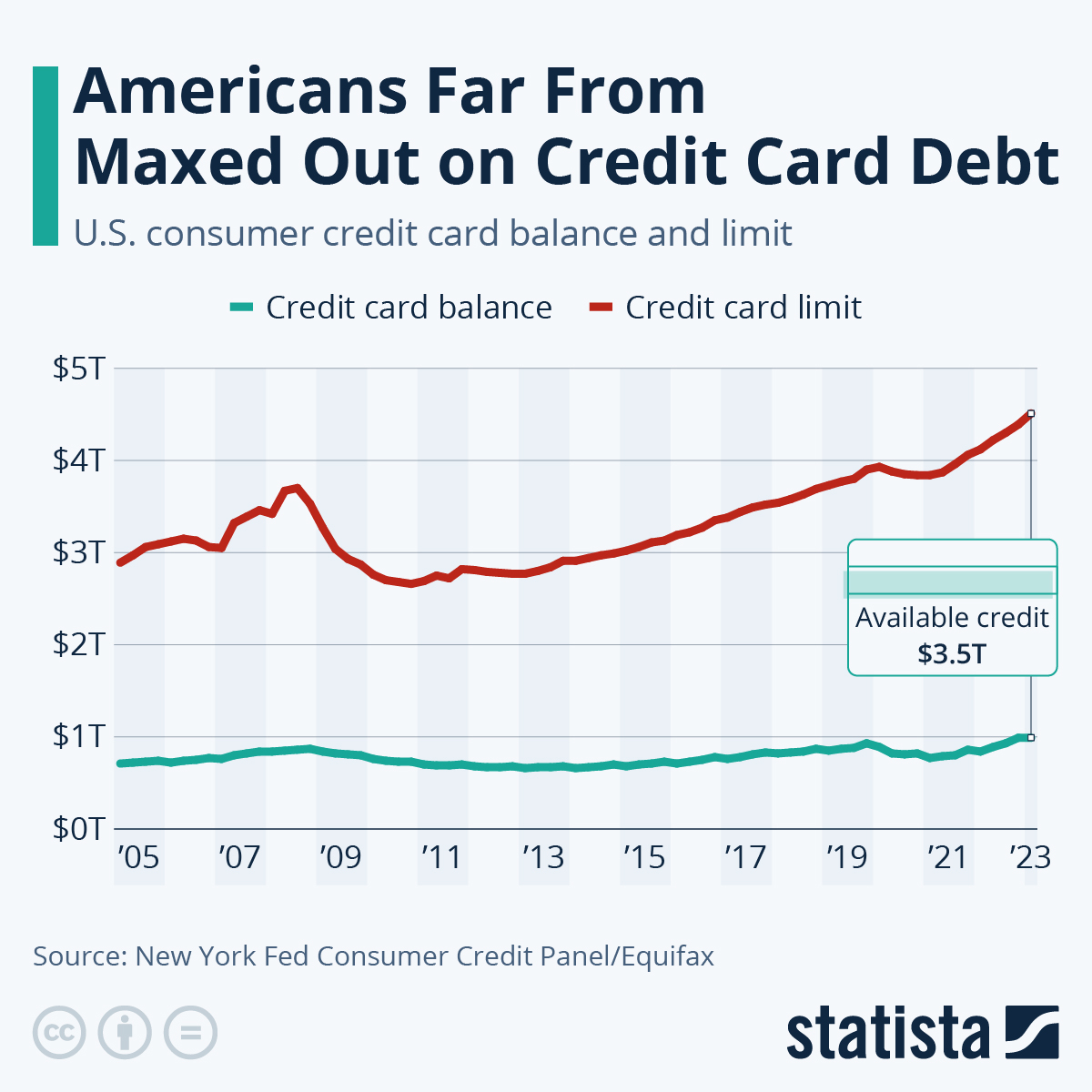

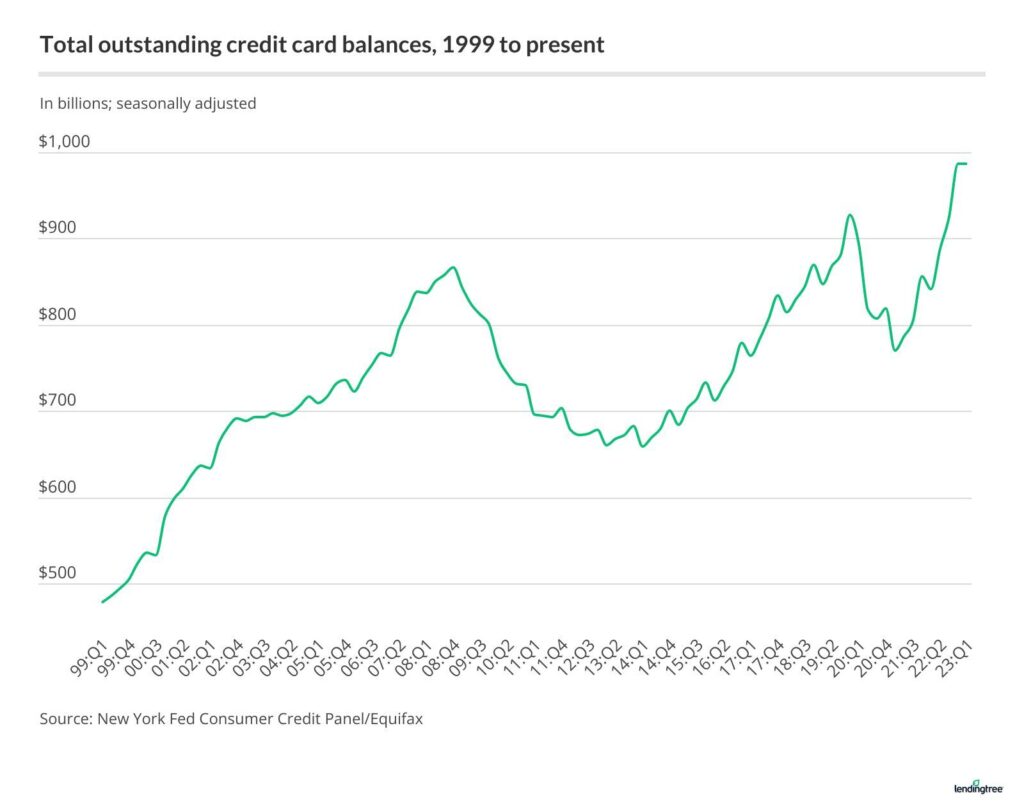

Bank card debt within the US hasn’t adopted a linear path. As an alternative, it is characterised by intervals of fast progress punctuated by intervals of contraction, usually mirroring broader financial cycles. The next chart illustrates the full excellent bank card debt in america from 1990 to the current (knowledge sourced from the Federal Reserve and the New York Federal Reserve Financial institution):

(Insert Chart 1 right here: A line graph displaying whole US bank card debt from 1990 to current. Ideally, this could be an interactive chart permitting zooming and knowledge level choice.)

Chart 1 reveals a number of key traits:

- Regular Progress (Nineteen Nineties – Early 2000s): The last decade following the Nineteen Nineties noticed a major improve in bank card debt, fueled by elements like growing client spending, available credit score, and aggressive advertising and marketing by bank card firms.

- The Nice Recession (2008-2009): The monetary disaster triggered a interval of contraction in bank card debt as customers tightened their belts and lenders turned extra cautious. Many people confronted job losses and decreased earnings, resulting in a decline in spending and debt accumulation.

- Submit-Recession Restoration and Progress (2010s – Current): Following the recession, bank card debt regularly rebounded and continued to rise, though at a slower tempo than earlier than. This resurgence is attributed to quite a lot of elements, together with financial restoration, low rates of interest, and continued reliance on credit score for on a regular basis bills. Current years have seen a very sharp improve, significantly accelerated by the financial disruptions of the COVID-19 pandemic.

Contributing Components to the Progress of US Credit score Card Debt:

A number of elements contribute to the persistent progress of bank card debt within the US:

- Simple Entry to Credit score: The proliferation of bank card affords, usually with attractive introductory charges and rewards applications, makes it simpler for people to build up debt. Pre-approved affords and on-line purposes additional decrease the obstacles to entry.

- Low Curiosity Charges (Traditionally): Intervals of low rates of interest, whereas helpful for borrowing typically, may encourage elevated spending on bank cards, as the price of borrowing seems comparatively low. Nevertheless, this may be misleading, as rates of interest can improve considerably, resulting in a fast accumulation of debt.

- Client Spending Habits: The American tradition usually emphasizes rapid gratification and consumerism. Bank cards facilitate this by enabling purchases past rapid means, probably resulting in overspending and debt accumulation.

- Minimal Fee Traps: Many people solely pay the minimal quantity due on their bank cards every month. This technique, whereas seemingly handy, can result in important curiosity expenses over time, making it tough to repay the stability.

- Excessive Curiosity Charges: Bank card rates of interest are notoriously excessive, usually exceeding 20%. This makes it difficult to pay down debt, particularly when going through surprising bills or monetary setbacks.

- Lack of Monetary Literacy: A good portion of the inhabitants lacks the monetary literacy to successfully handle bank cards and keep away from accumulating debt. Understanding APRs, curiosity calculations, and debt administration methods is essential however usually neglected.

- Financial Shocks: Sudden financial occasions, such because the Nice Recession and the COVID-19 pandemic, can considerably impression people’ monetary stability, resulting in elevated reliance on bank cards and issue in managing current debt.

(Insert Chart 2 right here: A bar chart evaluating the typical bank card rate of interest over the previous decade.)

Chart 2 illustrates the fluctuation in common bank card rates of interest, highlighting how adjustments within the financial local weather immediately impression the price of borrowing.

Penalties of Excessive Credit score Card Debt:

Excessive ranges of bank card debt can have extreme penalties for people and the financial system as a complete:

- Monetary Stress and Anxiousness: The burden of managing important debt may cause appreciable stress and nervousness, negatively impacting psychological and bodily well being.

- Decreased Credit score Rating: Excessive credit score utilization and late funds can considerably injury credit score scores, making it tough to acquire loans, hire an condo, and even safe a job in some instances.

- Chapter: In excessive instances, unmanageable bank card debt can result in chapter, leading to important monetary and private hardship.

- Influence on the Economic system: Excessive ranges of family debt can stifle financial progress, as customers are much less more likely to spend cash when burdened by debt repayments.

Addressing the Subject: Methods for Debt Administration and Prevention:

A number of methods could be employed to handle the problem of bank card debt:

- Budgeting and Monetary Planning: Creating a practical funds and creating a complete monetary plan are essential first steps in managing bank card debt.

- Debt Consolidation: Consolidating a number of bank card money owed right into a single mortgage with a decrease rate of interest can simplify reimbursement and scale back total curiosity expenses.

- Debt Administration Plans: Working with a credit score counseling company may help develop a debt administration plan, negotiating decrease rates of interest and establishing a manageable reimbursement schedule.

- Monetary Literacy Packages: Enhancing monetary literacy by instructional applications and sources can empower people to make knowledgeable choices about credit score and debt administration.

- Authorities Laws: Policymakers can play a task in regulating the bank card trade, defending customers from predatory lending practices and selling accountable borrowing.

The Way forward for US Credit score Card Debt:

Predicting the way forward for US bank card debt is difficult, because it relies on a posh interaction of financial, social, and political elements. Nevertheless, a number of traits recommend potential future situations:

- Continued Progress?: The current surge in bank card debt raises considerations about potential future progress, particularly if rates of interest stay excessive and financial uncertainty persists.

- Elevated Regulation?: Elevated regulatory scrutiny of the bank card trade is feasible, aiming to guard customers and stop predatory lending practices.

- Technological Developments: Technological developments, reminiscent of AI-powered monetary administration instruments, might assist people higher handle their bank card debt and make extra knowledgeable monetary choices.

Conclusion:

Understanding the historic traits and contributing elements to US bank card debt is crucial for creating efficient methods for debt administration and prevention. By using a multi-pronged strategy involving particular person accountability, trade regulation, and improved monetary literacy, we are able to work in direction of a future the place bank cards function instruments for monetary empowerment quite than devices of economic hardship. Continued monitoring of key indicators, reminiscent of whole excellent debt, rates of interest, and client spending habits, is essential for monitoring progress and adapting methods to fulfill the evolving challenges of the US bank card debt panorama. The journey in direction of accountable credit score utilization requires a collective effort from people, monetary establishments, and policymakers alike.

Closure

Thus, we hope this text has supplied worthwhile insights into Charting the Course of US Credit score Card Debt: A Deep Dive into the Numbers. We hope you discover this text informative and helpful. See you in our subsequent article!