Chartink Screener: Your Intraday Buying and selling Edge? A Deep Dive

By admin / June 16, 2024 / No Comments / 2025

Chartink Screener: Your Intraday Buying and selling Edge? A Deep Dive

Associated Articles: Chartink Screener: Your Intraday Buying and selling Edge? A Deep Dive

Introduction

With enthusiasm, let’s navigate by the intriguing matter associated to Chartink Screener: Your Intraday Buying and selling Edge? A Deep Dive. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Chartink Screener: Your Intraday Buying and selling Edge? A Deep Dive

Chartink has emerged as a preferred platform for inventory screening and evaluation, notably amongst intraday merchants. Its highly effective screener, boasting an enormous array of customizable filters and indicators, guarantees to assist merchants determine potential buying and selling alternatives rapidly and effectively. However is all of it it is cracked as much as be? This in-depth article explores Chartink’s intraday screener, its capabilities, limitations, and whether or not it really supplies a aggressive edge within the fast-paced world of intraday buying and selling.

Understanding the Energy of Chartink’s Intraday Screener

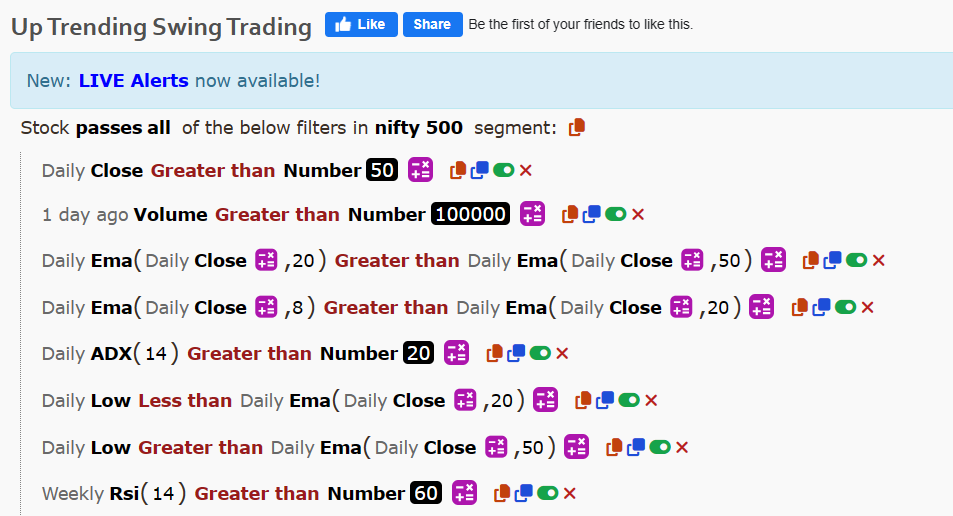

Chartink’s power lies in its flexibility. In contrast to many pre-packaged screening instruments that provide restricted customization, Chartink lets you construct extremely particular standards in your inventory choice. That is essential for intraday buying and selling the place fleeting alternatives demand instant identification. The screener lets you mix technical indicators, basic knowledge, and value motion filters to create refined screening methods.

Key Options for Intraday Buying and selling:

-

Huge Indicator Library: Chartink boasts a complete library of technical indicators, starting from broadly used instruments like RSI, MACD, and Bollinger Bands to extra esoteric indicators. This enables merchants to create screens primarily based on advanced mixtures of indicators tailor-made to their particular buying and selling types and techniques. The power to simply add, take away, and modify indicator parameters is a big benefit.

-

Value Motion Filters: Past indicators, Chartink lets you filter shares primarily based on value motion. This consists of standards like value change proportion, quantity adjustments, candlestick patterns (like hammer, engulfing, and many others.), and excessive/low value breakouts. These filters are important for figuring out shares exhibiting sturdy momentum or potential reversal patterns.

-

Basic Information Integration: Whereas primarily centered on technical evaluation, Chartink additionally integrates some basic knowledge. This lets you incorporate components like market capitalization, P/E ratio, quantity, and others into your screening course of. That is helpful for filtering out shares which may not be appropriate in your intraday technique primarily based on their underlying traits.

-

Customizable Alerts: Actual-time alerts are essential for intraday buying and selling. Chartink supplies the power to arrange customized alerts that notify you when a inventory meets your predefined standards. These alerts may be delivered by way of e-mail, SMS, or push notifications, making certain you do not miss probably profitable alternatives.

-

Backtesting Capabilities: Whereas not as in depth as devoted backtesting platforms, Chartink presents some primary backtesting performance. This lets you check your screening methods in opposition to historic knowledge to evaluate their effectiveness and refine your method. That is important for optimizing your screening standards and enhancing your total buying and selling efficiency.

-

A number of Alternate Assist: Chartink helps a number of inventory exchanges, permitting merchants to scan throughout completely different markets concurrently. That is notably worthwhile for merchants who diversify their portfolios throughout numerous exchanges.

Constructing Efficient Intraday Screens on Chartink:

Establishing a profitable intraday display screen on Chartink requires a strategic method. Listed here are some key concerns:

-

Outline Your Buying and selling Model: Earlier than constructing any display screen, clearly outline your buying and selling fashion. Are you a scalper, day dealer, or swing dealer? Your chosen fashion will dictate the indications and filters you must prioritize.

-

Deal with Related Indicators: Do not overload your display screen with too many indicators. Choose a number of key indicators that align together with your buying and selling fashion and supply probably the most related info in your technique. Overcomplicating your display screen can result in false indicators and missed alternatives.

-

Optimize Your Filters: Experiment with completely different filter mixtures to seek out the optimum stability between sensitivity and specificity. A extremely delicate display screen might generate many false indicators, whereas a extremely particular display screen might miss potential alternatives. Backtesting is essential for optimizing your filters.

-

Handle Danger: Even with probably the most refined screening instruments, intraday buying and selling is inherently dangerous. At all times incorporate danger administration methods into your buying and selling technique, corresponding to stop-loss orders and place sizing.

Limitations of Chartink’s Intraday Screener:

Whereas Chartink presents many highly effective options, it is important to acknowledge its limitations:

-

Information Delays: Like every on-line platform, Chartink might expertise slight knowledge delays. This may be essential in fast-moving intraday markets, probably resulting in missed alternatives.

-

Over-Reliance on Technical Evaluation: Chartink’s deal with technical evaluation may neglect basic components that might considerably affect a inventory’s value. Relying solely on technical indicators may be dangerous.

-

False Indicators: No screening software is ideal. Chartink’s screens can generate false indicators, resulting in shedding trades. Thorough backtesting and danger administration are essential to mitigate this danger.

-

Studying Curve: The platform’s superior options and customization choices can have a steep studying curve, particularly for novice merchants.

-

Subscription Prices: Entry to Chartink’s full options requires a subscription, which is usually a barrier for some merchants.

Chartink vs. Different Intraday Screening Instruments:

Chartink competes with a number of different intraday screening instruments, every with its strengths and weaknesses. Direct comparisons depend upon particular person wants and preferences. Some platforms may provide extra superior backtesting capabilities, whereas others might combine extra basic knowledge. The only option depends upon your particular buying and selling fashion and necessities.

Conclusion:

Chartink’s intraday screener is a robust software that may considerably improve a dealer’s workflow. Its customizable filters, in depth indicator library, and real-time alerts provide vital benefits. Nonetheless, it’s essential to do not forget that it isn’t a magic bullet. Profitable intraday buying and selling requires a mix of technical expertise, danger administration, and a deep understanding of the markets. Chartink is usually a worthwhile asset in your arsenal, but it surely should not change your individual judgment and buying and selling self-discipline. Cautious consideration of its limitations and a radical understanding of your buying and selling technique are important for maximizing its effectiveness. Deal with Chartink as a software to help your decision-making, not as a assured path to earnings within the inherently risky world of intraday buying and selling. In the end, the success you obtain utilizing Chartink will rely in your skill to combine it successfully right into a well-defined and disciplined buying and selling plan.

Closure

Thus, we hope this text has supplied worthwhile insights into Chartink Screener: Your Intraday Buying and selling Edge? A Deep Dive. We respect your consideration to our article. See you in our subsequent article!