Deciphering The Bulls’ Blueprint: A Complete Information To Bullish Chart Patterns

By admin / September 14, 2024 / No Comments / 2025

Deciphering the Bulls’ Blueprint: A Complete Information to Bullish Chart Patterns

Associated Articles: Deciphering the Bulls’ Blueprint: A Complete Information to Bullish Chart Patterns

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Deciphering the Bulls’ Blueprint: A Complete Information to Bullish Chart Patterns. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Deciphering the Bulls’ Blueprint: A Complete Information to Bullish Chart Patterns

The inventory market, a dynamic ecosystem of fluctuating costs, can really feel overwhelming to navigate. Nevertheless, inside its seemingly chaotic ebb and movement, lie discernible patterns – visible clues that skilled merchants make the most of to anticipate future value actions. Amongst these are bullish chart patterns, formations that usually precede value will increase, providing potential entry factors for these seeking to capitalize on upward traits. This text delves into a variety of those patterns, explaining their formation, interpretation, and potential pitfalls.

Understanding Chart Patterns: A Basis for Evaluation

Chart patterns are graphical representations of value motion over time, reflecting the interaction of provide and demand. Bullish patterns emerge when the shopping for stress persistently outweighs promoting stress, resulting in a attribute form that implies a possible upward trajectory. These patterns should not foolproof predictions, however somewhat probabilistic indicators that, when used at the side of different technical and elementary evaluation instruments, can improve buying and selling selections.

Key Concerns Earlier than Diving In:

- Context is Essential: Chart patterns shouldn’t be seen in isolation. Think about the broader market circumstances, sector efficiency, and the corporate’s fundamentals earlier than making buying and selling selections.

- Affirmation is Key: A sample’s validity is commonly confirmed by different technical indicators like transferring averages, quantity, and relative energy index (RSI).

- Threat Administration is Paramount: At all times implement applicable threat administration methods, together with stop-loss orders, to restrict potential losses.

- Sample Recognition Requires Follow: Mastering the identification of chart patterns requires diligent examine and observe. Start with easy patterns and steadily progress to extra advanced formations.

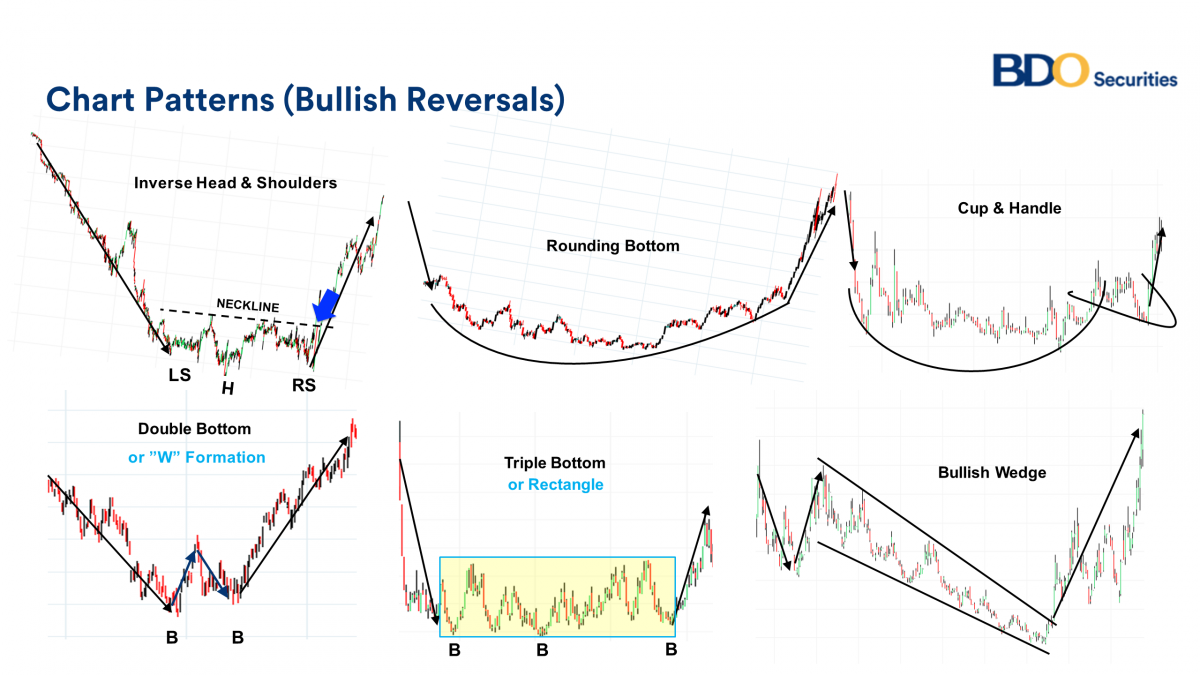

Exploring Main Bullish Chart Patterns:

A number of bullish chart patterns provide worthwhile insights into potential value will increase. Let’s discover a number of the most prevalent:

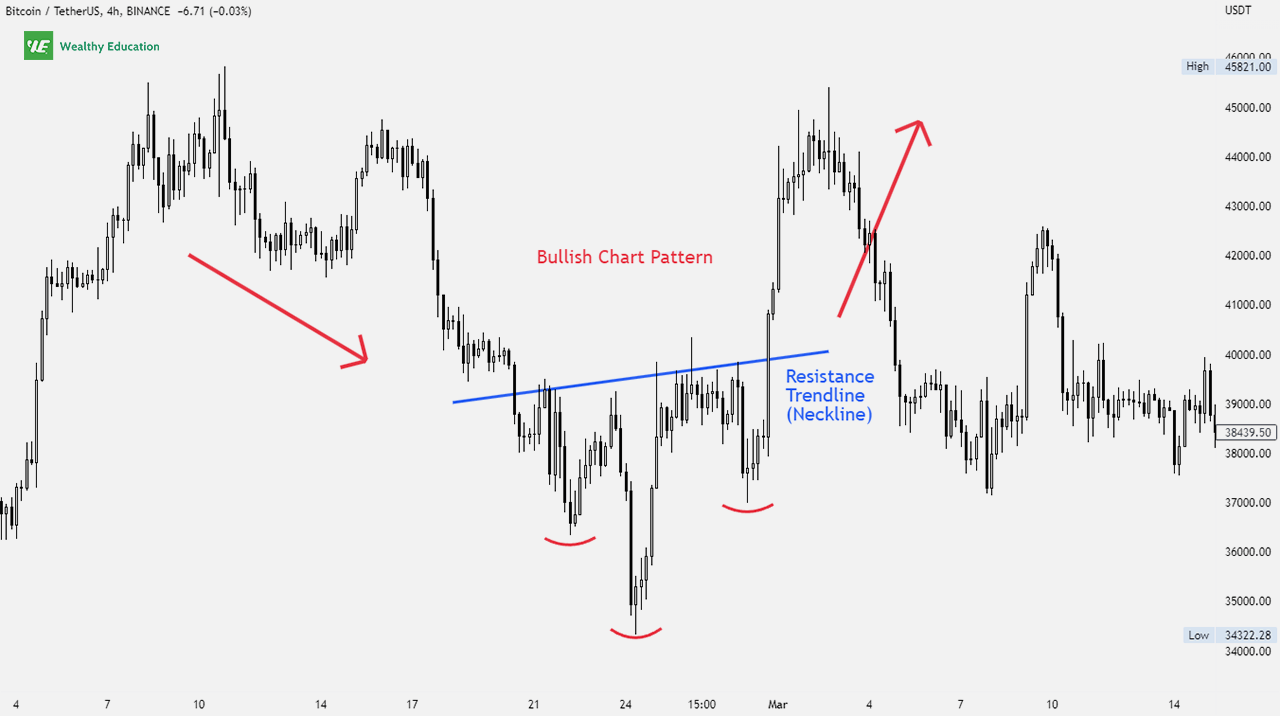

1. Head and Shoulders Backside:

This traditional reversal sample signifies a possible shift from a downtrend to an uptrend. It is characterised by three distinct troughs:

- Left Shoulder: A trough representing a interval of relative weak point.

- Head: A decrease trough, representing a major value decline.

- Proper Shoulder: A trough comparable in depth to the left shoulder, marking the potential finish of the downtrend.

A neckline, a horizontal trendline connecting the troughs of the left and proper shoulders, is essential. A breakout above the neckline confirms the sample and indicators a possible upward transfer. The goal value is commonly estimated by measuring the space between the top and the neckline and projecting it upwards from the breakout level.

2. Double Backside:

This sample reveals two consecutive lows at roughly the identical value stage, forming a "W" form. The lows characterize durations of robust shopping for stress that prevented additional value declines. A breakout above the neckline (connecting the 2 lows) indicators a bullish reversal. The goal value is commonly calculated by including the space between the neckline and the low level to the breakout value.

3. Triple Backside:

Much like a double backside, however with three lows at roughly the identical stage, forming a extra pronounced "W" form. This sample strengthens the bullish sign, suggesting a stronger reversal potential. The neckline and goal value calculation are much like the double backside.

4. Inverse Head and Shoulders:

That is the mirror picture of the top and shoulders sample. It is a bullish reversal sample shaped throughout a downtrend, characterised by three peaks:

- Left Shoulder: A peak representing a interval of relative energy.

- Head: The next peak, representing a short lived value enhance.

- Proper Shoulder: A peak comparable in top to the left shoulder, marking the potential finish of the downtrend.

A neckline, a horizontal trendline connecting the peaks of the left and proper shoulders, is essential. A breakout above the neckline confirms the sample and indicators a possible upward transfer. The goal value is commonly estimated by measuring the space between the top and the neckline and projecting it upwards from the breakout level.

5. Cup and Deal with:

This sample resembles a cup with a deal with. The cup represents a interval of consolidation, adopted by a slight downward pullback (the deal with). A breakout above the deal with’s excessive indicators a bullish continuation. The goal value is commonly estimated by measuring the depth of the cup and projecting it upwards from the breakout level.

6. Ascending Triangle:

This sample is characterised by a collection of upper highs and a horizontal resistance line. The upward sloping trendline connecting the upper lows signifies rising shopping for stress. A breakout above the resistance line confirms the sample and indicators a bullish continuation. The goal value is commonly projected by measuring the width of the triangle and including it to the breakout value.

7. Bullish Flag:

This sample consists of a pointy upward transfer (the flagpole) adopted by a interval of consolidation (the flag). The consolidation usually happens inside parallel trendlines, making a pennant or rectangular form. A breakout above the higher trendline confirms the sample and indicators a bullish continuation. The goal value is commonly projected by measuring the size of the flagpole and including it to the breakout value.

8. Bullish Pennant:

A bullish pennant is a continuation sample characterised by a interval of consolidation after a pointy value enhance. The consolidation resembles a triangle that converges in the direction of some extent. A breakout above the higher trendline confirms the sample and suggests a continuation of the upward development. The goal value is often projected by measuring the peak of the previous value surge (the flagpole) and including it to the breakout level.

Understanding Quantity and Affirmation:

Quantity evaluation performs a vital function in confirming bullish chart patterns. Elevated quantity throughout breakouts above resistance ranges strengthens the bullish sign, indicating robust shopping for stress. Conversely, low quantity throughout breakouts suggests weak conviction and should point out a false breakout. Different technical indicators, equivalent to transferring averages (e.g., 50-day and 200-day transferring averages) and RSI, may present affirmation and assist filter out false indicators.

Pitfalls and Limitations:

Whereas bullish chart patterns provide worthwhile insights, it is essential to pay attention to their limitations:

- Subjectivity: Figuring out chart patterns might be subjective, and totally different merchants could interpret the identical sample in a different way.

- False Breakouts: Breakouts could not all the time result in sustained value will increase. False breakouts may end up in vital losses if not managed correctly.

- Timeframes: The timeframe used for evaluation considerably impacts the interpretation of chart patterns. Patterns that seem bullish on a each day chart is probably not so on a weekly or month-to-month chart.

Conclusion:

Bullish chart patterns present worthwhile instruments for figuring out potential value will increase. Nevertheless, they need to be used at the side of different technical and elementary evaluation instruments, and all the time inside a complete threat administration framework. Diligent examine, observe, and a disciplined strategy are important for efficiently using these patterns in buying and selling selections. Keep in mind that mastering chart sample recognition is a journey, not a vacation spot. Steady studying and adaptation are key to reaching constant success within the dynamic world of monetary markets. At all times prioritize threat administration and search skilled recommendation if wanted.

Closure

Thus, we hope this text has supplied worthwhile insights into Deciphering the Bulls’ Blueprint: A Complete Information to Bullish Chart Patterns. We hope you discover this text informative and useful. See you in our subsequent article!