Deciphering The Candlestick: A Complete Information To Charting Success

By admin / October 2, 2024 / No Comments / 2025

Deciphering the Candlestick: A Complete Information to Charting Success

Associated Articles: Deciphering the Candlestick: A Complete Information to Charting Success

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Deciphering the Candlestick: A Complete Information to Charting Success. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Deciphering the Candlestick: A Complete Information to Charting Success

Candlestick charts, a cornerstone of technical evaluation, provide a visually intuitive technique to perceive value actions and market sentiment. In contrast to easy bar charts, which solely show the excessive, low, open, and shut costs, candlestick charts characterize this data in a visually compelling method, revealing patterns and insights that may inform buying and selling choices. This text delves into the intricacies of candlestick charts, exploring their formation, interpretation, and utility in numerous buying and selling contexts.

Understanding the Anatomy of a Candlestick:

Every candlestick represents the value motion of an asset over a particular time interval (e.g., one minute, 5 minutes, one hour, in the future, and so forth.). The important thing parts are:

-

Physique: The oblong portion of the candlestick represents the vary between the open and shutting costs. A "bullish" or "inexperienced" candlestick signifies that the closing value was larger than the opening value, signifying shopping for strain. Conversely, a "bearish" or "pink" candlestick reveals a closing value decrease than the opening value, suggesting promoting strain. The physique’s size displays the magnitude of the value change between the open and shut.

-

Wicks (Shadows or Tails): These are the skinny traces extending above and beneath the physique. The higher wick represents the very best value reached throughout the interval, whereas the decrease wick reveals the bottom value. Lengthy wicks point out vital value rejection at both the excessive or low, suggesting robust resistance or assist. Brief or absent wicks indicate a comparatively consolidated value motion inside the interval.

Decoding Candlestick Patterns:

The ability of candlestick evaluation lies in its skill to establish patterns fashioned by the interaction of particular person candlesticks. These patterns typically predict future value actions primarily based on the historic context. Listed below are a number of the mostly acknowledged patterns:

Single Candlestick Patterns:

-

Doji: A doji candlestick has a gap value just about equal to the closing value, leading to a really small or non-existent physique. It signifies indecision or a steadiness between patrons and sellers. The size of the wicks gives extra context. A protracted-legged doji suggests robust indecision, whereas a dragonfly doji (lengthy decrease wick, small higher wick) signifies robust shopping for strain overcoming preliminary promoting.

-

Hammer: A hammer candlestick has a small physique on the prime of the value vary and a protracted decrease wick, signifying a reversal of a downtrend. The lengthy decrease wick signifies robust shopping for strain close to the low, suggesting patrons are stepping in to assist the value.

-

Hanging Man: Much like a hammer, however showing on the prime of an uptrend, the hanging man suggests a possible reversal to the draw back. The lengthy decrease wick signifies a short lived dip, however the incapacity to maintain the upward momentum raises considerations.

-

Taking pictures Star: This candlestick has a small physique on the backside of the value vary and a protracted higher wick, indicating a possible reversal of an uptrend. The lengthy higher wick reveals that sellers pushed the value up, however patrons did not maintain the rally.

-

Engulfing Sample: A bullish engulfing sample happens when a big inexperienced candlestick utterly engulfs a previous pink candlestick. This implies that purchasing strain has overcome promoting strain, doubtlessly signaling a bullish reversal. The bearish engulfing sample is the alternative, with a big pink candlestick engulfing a earlier inexperienced one.

A number of Candlestick Patterns:

-

Two-Candlestick Patterns: These patterns contain the interaction of two consecutive candlesticks, offering a extra nuanced view of market sentiment. Examples embrace the piercing line (bullish) and darkish cloud cowl (bearish).

-

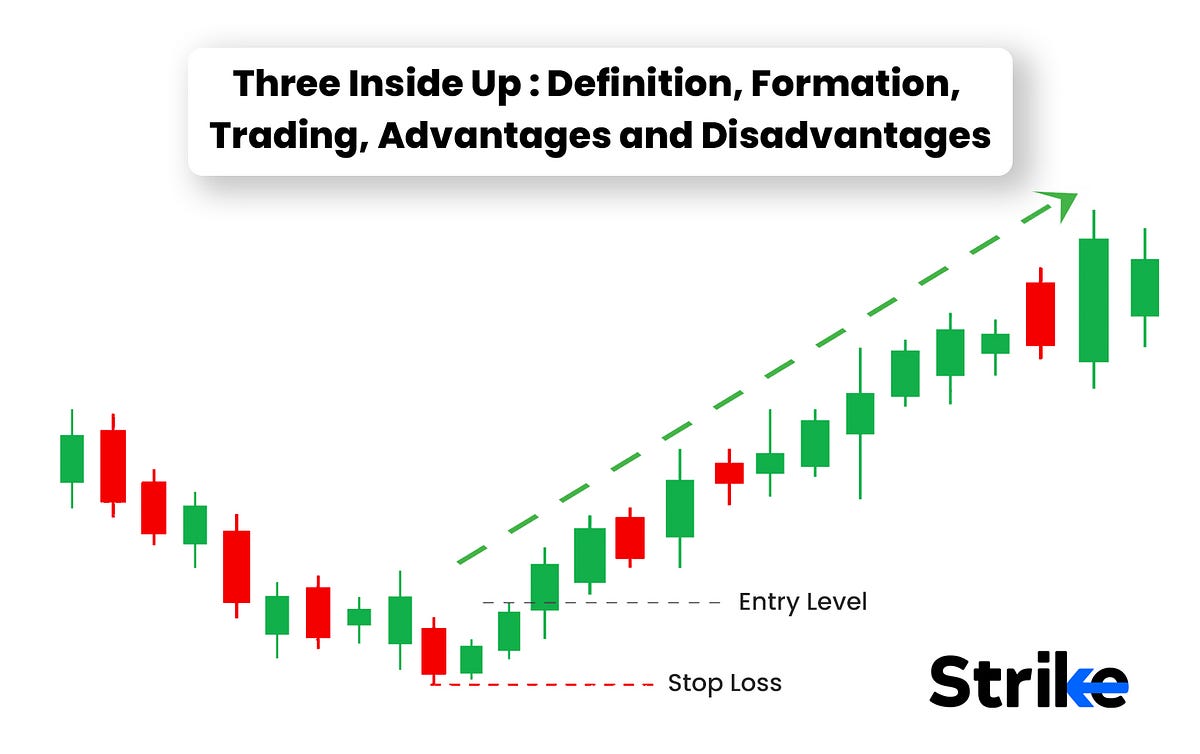

Three-Candlestick Patterns: Patterns just like the morning star (bullish) and night star (bearish) require three candlesticks to kind an entire sample. These patterns present stronger alerts than two-candlestick patterns because of their extra elaborate construction.

-

Extra Complicated Patterns: Many different candlestick patterns exist, involving extra candlesticks and infrequently incorporating different technical indicators for affirmation. These patterns require a deeper understanding of market dynamics and technical evaluation.

Combining Candlestick Evaluation with Different Methods:

Candlestick patterns are simplest when used along with different technical evaluation instruments. This gives a extra holistic and strong method to buying and selling. Some frequent combos embrace:

-

Candlestick patterns and shifting averages: Figuring out candlestick patterns at key assist and resistance ranges outlined by shifting averages can strengthen the sign’s validity.

-

Candlestick patterns and quantity: Excessive quantity accompanying a candlestick sample confirms the energy of the transfer and will increase the likelihood of the sample’s prediction.

-

Candlestick patterns and indicators: Combining candlestick patterns with indicators like RSI, MACD, or Bollinger Bands can present extra affirmation and filter out false alerts.

Limitations of Candlestick Evaluation:

Whereas candlestick patterns provide useful insights, it is essential to acknowledge their limitations:

-

Subjectivity: Decoding candlestick patterns may be subjective, particularly for much less skilled merchants. Completely different merchants may understand the identical sample otherwise.

-

Affirmation bias: Merchants could selectively deal with patterns that verify their current biases, resulting in inaccurate interpretations.

-

False alerts: Candlestick patterns can generate false alerts, particularly in uneven or sideways markets. It is essential to make use of different technical indicators for affirmation.

-

Context is Key: The importance of a candlestick sample relies upon closely on the broader market context, together with total developments, information occasions, and financial indicators.

Sensible Utility and Methods:

Candlestick evaluation may be utilized throughout numerous buying and selling methods and timeframes. Day merchants may deal with intraday candlestick patterns to establish short-term alternatives, whereas swing merchants may use them to establish longer-term developments and potential entry/exit factors. Lengthy-term traders may use candlestick patterns to gauge the general market sentiment and establish potential turning factors.

Conclusion:

Candlestick evaluation is a robust instrument for understanding market dynamics and making knowledgeable buying and selling choices. Nonetheless, it’s essential to method it with a balanced perspective, recognizing its limitations and mixing it with different technical and basic evaluation methods. Mastering candlestick evaluation requires apply, endurance, and a willingness to be taught from each successes and failures. By understanding the anatomy of candlesticks, recognizing frequent patterns, and integrating them right into a broader buying and selling technique, merchants can considerably improve their market insights and enhance their buying and selling efficiency. Keep in mind that constant studying and disciplined danger administration are important for achievement in any buying and selling endeavor. Steady research of market habits and refinement of your candlestick interpretation abilities will in the end result in a extra nuanced and worthwhile buying and selling expertise.

Closure

Thus, we hope this text has supplied useful insights into Deciphering the Candlestick: A Complete Information to Charting Success. We thanks for taking the time to learn this text. See you in our subsequent article!