Deciphering The Groww Nifty Chart: A Complete Information For Traders

By admin / July 15, 2024 / No Comments / 2025

Deciphering the Groww Nifty Chart: A Complete Information for Traders

Associated Articles: Deciphering the Groww Nifty Chart: A Complete Information for Traders

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Deciphering the Groww Nifty Chart: A Complete Information for Traders. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Deciphering the Groww Nifty Chart: A Complete Information for Traders

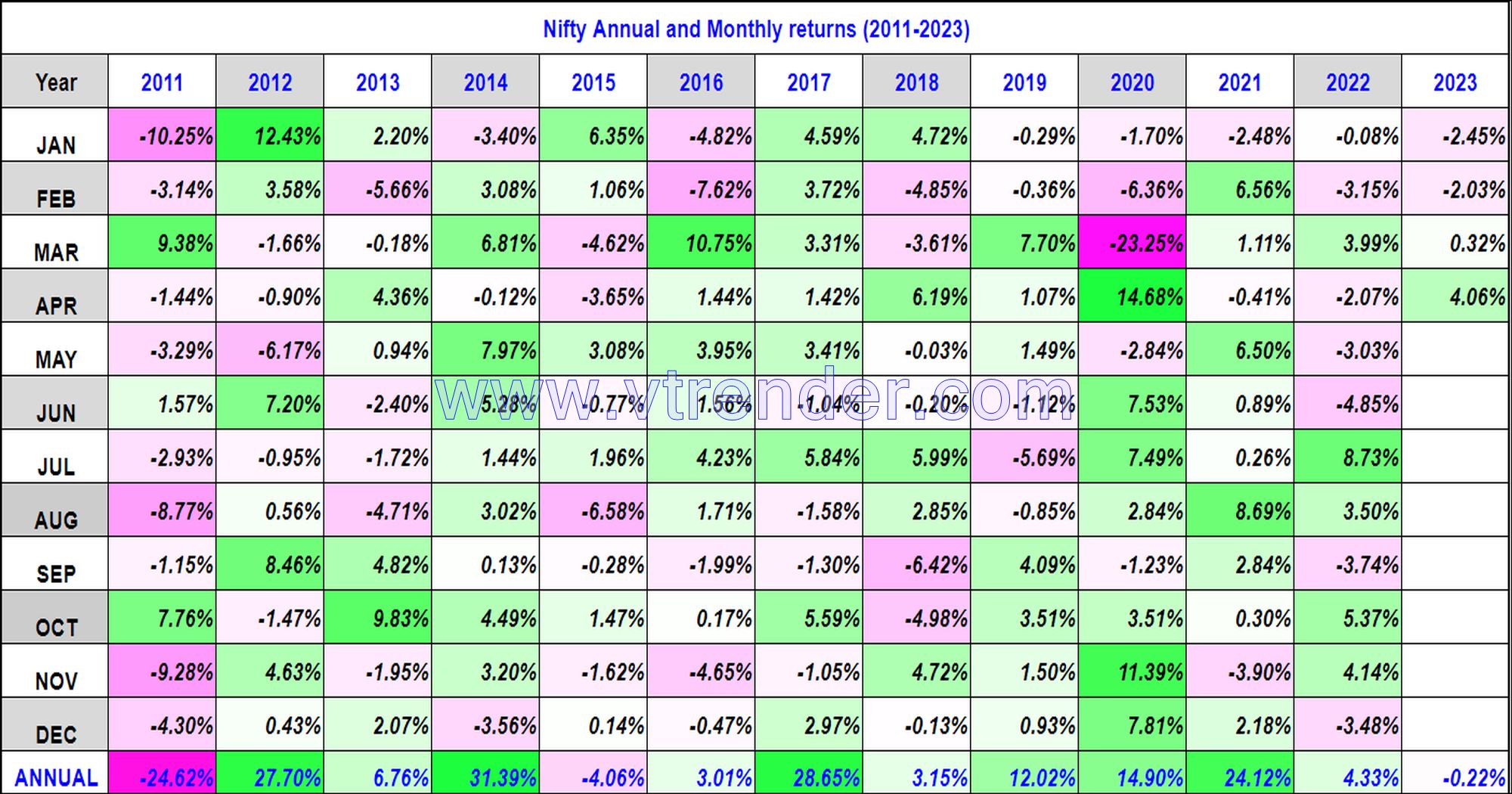

The Groww platform, a well-liked funding app in India, gives customers with entry to a wealth of market information, together with an in depth chart for the Nifty 50 index. Understanding this chart is essential for anybody navigating the Indian inventory market, whether or not a seasoned investor or a novice. This text delves deep into the Groww Nifty chart, explaining its parts, the right way to interpret the information, and the way this info can be utilized to make knowledgeable funding selections.

Understanding the Nifty 50 Index

Earlier than diving into the specifics of the Groww Nifty chart, it is important to know what the Nifty 50 index represents. The Nifty 50 is a benchmark index of the 50 largest Indian firms listed on the Nationwide Inventory Alternate of India (NSE). These firms symbolize a various vary of sectors, together with banking, know-how, vitality, and client items. The index’s efficiency displays the general well being and path of the Indian economic system. Monitoring the Nifty 50 is subsequently a vital facet of understanding the broader market developments.

Navigating the Groww Nifty Chart: Key Parts

The Groww Nifty chart, like most inventory charts, presents a visible illustration of the index’s worth actions over time. The particular options might range barely relying on the chart’s settings, however usually, you will discover the next key parts:

-

Value Axis (Y-axis): This vertical axis shows the Nifty 50 index worth at totally different time limits. The dimensions usually ranges from the bottom to the very best worth noticed inside the chosen timeframe.

-

Time Axis (X-axis): This horizontal axis represents the time interval being displayed, starting from a couple of minutes to a number of years, relying on the consumer’s choice. You’ll be able to usually swap between totally different timeframes (e.g., 1-day, 1-week, 1-month, 1-year, 5-year).

-

Candlesticks or Line Graph: Groww provides the choice to view the chart as both a candlestick chart or a line graph.

-

Candlesticks: Every candlestick represents a particular time interval (e.g., a day, an hour, or a minute). The physique of the candlestick reveals the value vary between the opening and shutting costs. A inexperienced (or generally white) candlestick signifies a closing worth greater than the opening worth (an upward development), whereas a pink (or generally black) candlestick signifies a closing worth decrease than the opening worth (a downward development). The "wicks" or "shadows" extending above and under the physique symbolize the excessive and low costs reached throughout that interval.

-

Line Graph: A line graph merely connects the closing costs of the Nifty 50 over the chosen time interval, offering a smoother illustration of the value development.

-

-

Transferring Averages: Groww doubtless permits customers to overlay transferring averages on the chart. Transferring averages clean out worth fluctuations and assist determine developments. Generally used transferring averages embody the 50-day transferring common and the 200-day transferring common. A worth crossing above a transferring common could be interpreted as a bullish sign, whereas a worth crossing under is usually a bearish sign.

-

Technical Indicators: Extra superior customers may make the most of technical indicators accessible on the Groww platform. These indicators, similar to Relative Power Index (RSI), Transferring Common Convergence Divergence (MACD), and Bollinger Bands, present extra insights into momentum, development power, and potential overbought or oversold circumstances. Understanding these indicators requires a deeper data of technical evaluation.

-

Quantity: The chart usually features a separate panel displaying buying and selling quantity. Quantity represents the variety of shares traded throughout every time interval. Excessive quantity throughout a worth improve can verify the power of an uptrend, whereas excessive quantity throughout a worth lower can verify the power of a downtrend. Low quantity can point out indecision or an absence of conviction available in the market.

Decoding the Groww Nifty Chart: Sensible Purposes

The Groww Nifty chart gives a strong instrument for understanding market developments and making knowledgeable funding selections. Listed below are some sensible functions:

-

Figuring out Tendencies: By observing the path of the candlesticks or the road graph, traders can determine whether or not the Nifty 50 is in an upward development (bullish), a downward development (bearish), or a sideways development (consolidation). Transferring averages can additional verify these developments.

-

Recognizing Assist and Resistance Ranges: Assist ranges symbolize worth factors the place the index has traditionally discovered shopping for strain and bounced again. Resistance ranges symbolize worth factors the place the index has traditionally encountered promoting strain and failed to interrupt via. Figuring out these ranges can assist predict potential worth reversals.

-

Analyzing Momentum: Technical indicators like RSI and MACD can assist assess the momentum of the Nifty 50. Excessive RSI values (above 70) may counsel an overbought situation, whereas low RSI values (under 30) may counsel an oversold situation. These circumstances can sign potential worth corrections.

-

Assessing Volatility: The scale of the value swings and the amount can point out the volatility of the market. Excessive volatility suggests higher threat, whereas low volatility suggests decrease threat.

-

Timing Entry and Exit Factors: Whereas not a foolproof methodology, the Groww Nifty chart, mixed with technical evaluation and elementary evaluation, can assist traders determine potential entry and exit factors for his or her investments. For instance, a bullish breakout above a resistance degree may be thought of a purchase sign, whereas a bearish breakdown under a assist degree may be thought of a promote sign.

Limitations and Cautions

Whereas the Groww Nifty chart provides beneficial insights, it is essential to recollect its limitations:

-

Previous Efficiency is Not Indicative of Future Outcomes: The chart solely reveals historic information. Previous worth actions don’t assure future efficiency.

-

Technical Evaluation is Subjective: Decoding technical indicators and figuring out patterns could be subjective and vulnerable to bias.

-

Market Sentiment Performs a Function: Market sentiment, information occasions, and financial components can considerably affect the Nifty 50’s worth, no matter technical indicators.

-

Threat Administration is Essential: Investing within the inventory market at all times includes threat. By no means make investments greater than you may afford to lose. Diversification is vital to mitigating threat.

Conclusion:

The Groww Nifty chart is a strong instrument for traders searching for to know and navigate the Indian inventory market. By understanding its parts, deciphering the information successfully, and mixing chart evaluation with elementary analysis and threat administration methods, traders can enhance their decision-making course of and doubtlessly obtain higher funding outcomes. Nonetheless, do not forget that the chart is only one piece of the puzzle. Thorough analysis, cautious consideration of threat, and a long-term perspective are important for profitable investing. All the time seek the advice of with a certified monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has supplied beneficial insights into Deciphering the Groww Nifty Chart: A Complete Information for Traders. We recognize your consideration to our article. See you in our subsequent article!