Deciphering The MCX Silver Worth Chart: A Complete Information For Merchants And Traders

By admin / June 10, 2024 / No Comments / 2025

Deciphering the MCX Silver Worth Chart: A Complete Information for Merchants and Traders

Associated Articles: Deciphering the MCX Silver Worth Chart: A Complete Information for Merchants and Traders

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Deciphering the MCX Silver Worth Chart: A Complete Information for Merchants and Traders. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Deciphering the MCX Silver Worth Chart: A Complete Information for Merchants and Traders

Silver, a treasured steel with a historical past as wealthy as its luster, has all the time held a big place in funding portfolios. Its worth, nevertheless, is notoriously unstable, influenced by a fancy interaction of things starting from industrial demand to investor sentiment and macroeconomic circumstances. Understanding the MCX (Multi Commodity Trade of India) silver worth chart is essential for anybody seeking to navigate this dynamic market. This text gives a complete evaluation of the MCX silver worth chart, exploring its historic tendencies, influencing components, technical evaluation strategies, and methods for profitable buying and selling and funding.

Historic Tendencies and Key Worth Ranges:

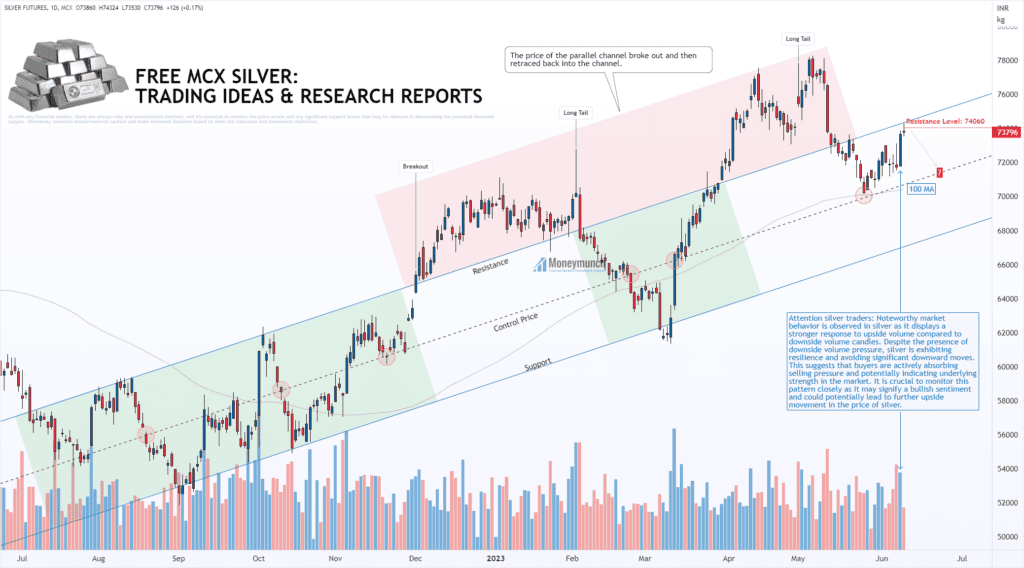

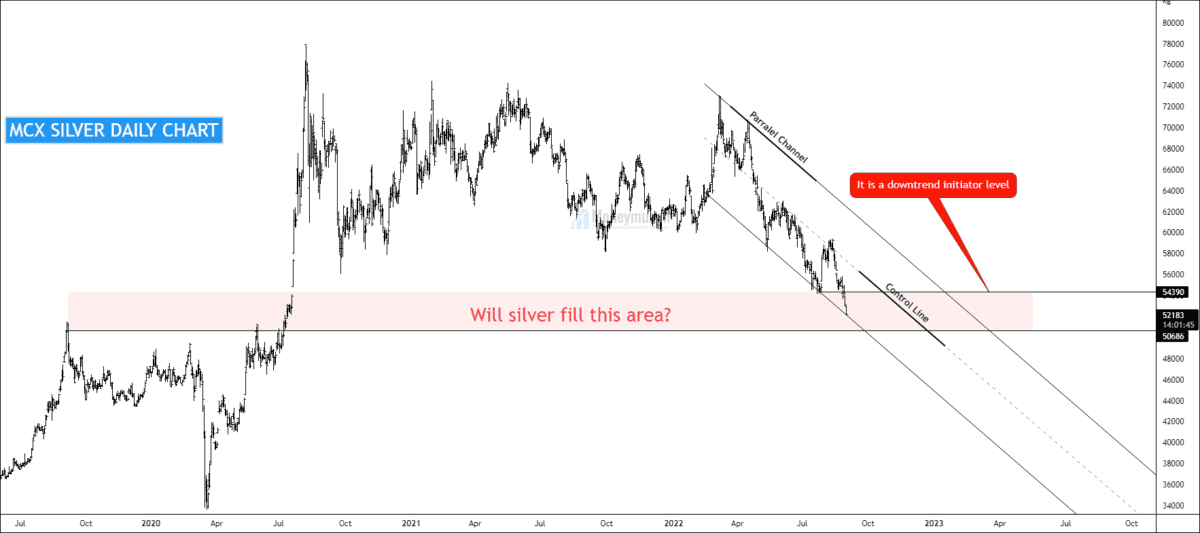

The MCX silver worth chart displays a historical past of serious worth fluctuations. Over the previous decade, we have witnessed intervals of sharp rises pushed by components like industrial progress, inflation hedging, and investor hypothesis, in addition to intervals of decline influenced by financial downturns, technological developments, and modifications in investor confidence. Analyzing historic worth knowledge on the MCX chart is essential for figuring out potential help and resistance ranges. These ranges characterize worth factors the place the worth has traditionally struggled to interrupt by, providing precious insights for potential entry and exit factors.

As an example, inspecting the chart may reveal key help ranges round ₹60,000 per kg and ₹70,000 per kg, which have traditionally offered shopping for alternatives. Equally, resistance ranges round ₹80,000 per kg and ₹90,000 per kg may point out potential promoting alternatives. Nevertheless, it is important to do not forget that these ranges are dynamic and may shift primarily based on prevailing market circumstances. Merely counting on historic help and resistance with out contemplating present market dynamics is a recipe for poor buying and selling choices.

Elements Influencing MCX Silver Costs:

The MCX silver worth will not be decided in isolation. Quite a few components work together to form its trajectory. Understanding these components is important for making knowledgeable buying and selling choices:

-

Industrial Demand: Silver’s industrial functions are intensive, starting from electronics and photo voltaic vitality to automotive and medical industries. Robust international industrial progress usually interprets into greater silver demand, pushing costs upward. Conversely, a slowdown in industrial exercise can result in decrease costs. Monitoring industrial manufacturing indices and international financial progress forecasts is essential for anticipating silver worth actions.

-

Funding Demand: Silver is taken into account a safe-haven asset, very like gold. Throughout instances of financial uncertainty or geopolitical instability, traders usually flock to treasured metals as a hedge towards inflation and forex devaluation. This elevated funding demand can considerably enhance silver costs. Monitoring investor sentiment by varied market indices and information stories is significant.

-

Foreign money Fluctuations: The Indian Rupee’s worth towards the US greenback (USD) immediately impacts the MCX silver worth, as silver is primarily traded in USD globally. A weakening Rupee makes silver dearer in India, driving up costs on the MCX. Conversely, a strengthening Rupee can result in decrease costs.

-

Inflation: Silver is usually seen as an inflation hedge. During times of excessive inflation, traders have a tendency to purchase silver as a retailer of worth, anticipating that its worth will rise quicker than the speed of inflation. Monitoring inflation charges and central financial institution insurance policies is essential for understanding silver’s potential as an inflation hedge.

-

Hypothesis and Market Sentiment: Speculative buying and selling performs a big position in silver worth volatility. Market sentiment, influenced by information occasions, analyst stories, and social media tendencies, can dramatically influence worth actions, resulting in short-term worth spikes or dips.

-

Provide and Demand Dynamics: The worldwide provide and demand stability for silver additionally influences costs. Sudden disruptions to silver mining operations or modifications in silver recycling charges can considerably influence the market. Monitoring international silver manufacturing and consumption knowledge is important.

-

Authorities Insurance policies and Rules: Authorities insurance policies associated to mining, taxation, and import/export laws can affect silver costs. Modifications in these insurance policies can create uncertainty and volatility out there.

Technical Evaluation of the MCX Silver Worth Chart:

Technical evaluation includes learning previous worth and quantity knowledge to foretell future worth actions. Varied technical indicators will be utilized to the MCX silver worth chart to determine potential buying and selling alternatives:

-

Transferring Averages: Transferring averages (MA) easy out worth fluctuations and assist determine tendencies. A generally used MA is the 20-day MA, which might point out short-term tendencies. Longer-term MAs, such because the 50-day and 200-day MAs, can determine longer-term tendencies. Crossovers between totally different MAs can sign potential purchase or promote alerts.

-

Relative Energy Index (RSI): The RSI is a momentum oscillator that measures the pace and alter of worth actions. An RSI above 70 is taken into account overbought, suggesting a possible worth reversal, whereas an RSI beneath 30 is taken into account oversold, suggesting a possible worth bounce.

-

MACD (Transferring Common Convergence Divergence): The MACD is one other momentum indicator that identifies modifications in development. A bullish crossover (MACD line crossing above the sign line) can point out a possible upward development, whereas a bearish crossover can sign a possible downward development.

-

Assist and Resistance Ranges: As talked about earlier, figuring out historic help and resistance ranges on the chart is essential for figuring out potential entry and exit factors.

-

Candlestick Patterns: Candlestick patterns present precious insights into worth motion and can assist predict future worth actions. Figuring out patterns like hammers, engulfing patterns, and taking pictures stars can enhance buying and selling choices.

Methods for Buying and selling and Investing in MCX Silver:

Profitable buying and selling and investing in MCX silver require a well-defined technique that includes basic and technical evaluation. Listed here are some methods:

-

Pattern Following: This technique includes figuring out the prevailing development (uptrend or downtrend) and taking positions accordingly. Technical indicators like transferring averages can assist determine the development.

-

Imply Reversion: This technique includes figuring out overbought or oversold circumstances and anticipating a worth reversal again in direction of the imply. Indicators like RSI and MACD can assist determine these circumstances.

-

Scalping: This includes taking short-term positions, benefiting from small worth fluctuations. It requires fast decision-making and a eager understanding of market dynamics.

-

Swing Buying and selling: This technique includes holding positions for a number of days or even weeks, benefiting from bigger worth swings. It requires a very good understanding of technical evaluation and danger administration.

-

Lengthy-Time period Investing: This includes holding silver for an extended interval, usually years, benefiting from long-term worth appreciation. It requires persistence and a perception in silver’s long-term worth.

Danger Administration:

Buying and selling and investing in MCX silver includes important danger. Implementing efficient danger administration methods is essential:

-

Place Sizing: By no means danger greater than a small share of your buying and selling capital on any single commerce.

-

Cease-Loss Orders: At all times use stop-loss orders to restrict potential losses.

-

Diversification: Diversify your portfolio by investing in different belongings to cut back total danger.

-

Emotional Self-discipline: Keep away from making impulsive buying and selling choices primarily based on worry or greed.

Conclusion:

The MCX silver worth chart gives a wealth of data for merchants and traders. By understanding the historic tendencies, influencing components, technical evaluation strategies, and implementing efficient danger administration methods, one can enhance their probabilities of profitable buying and selling and investing on this dynamic market. Nevertheless, it’s essential to do not forget that no technique ensures success, and market circumstances can change quickly. Steady studying, cautious evaluation, and disciplined execution are important for navigating the complexities of the MCX silver market. At all times conduct thorough analysis and contemplate searching for recommendation from a professional monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered precious insights into Deciphering the MCX Silver Worth Chart: A Complete Information for Merchants and Traders. We thanks for taking the time to learn this text. See you in our subsequent article!