Deciphering The Oracle: A Complete Information To Studying TradingView Charts

By admin / August 7, 2024 / No Comments / 2025

Deciphering the Oracle: A Complete Information to Studying TradingView Charts

Associated Articles: Deciphering the Oracle: A Complete Information to Studying TradingView Charts

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Deciphering the Oracle: A Complete Information to Studying TradingView Charts. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Deciphering the Oracle: A Complete Information to Studying TradingView Charts

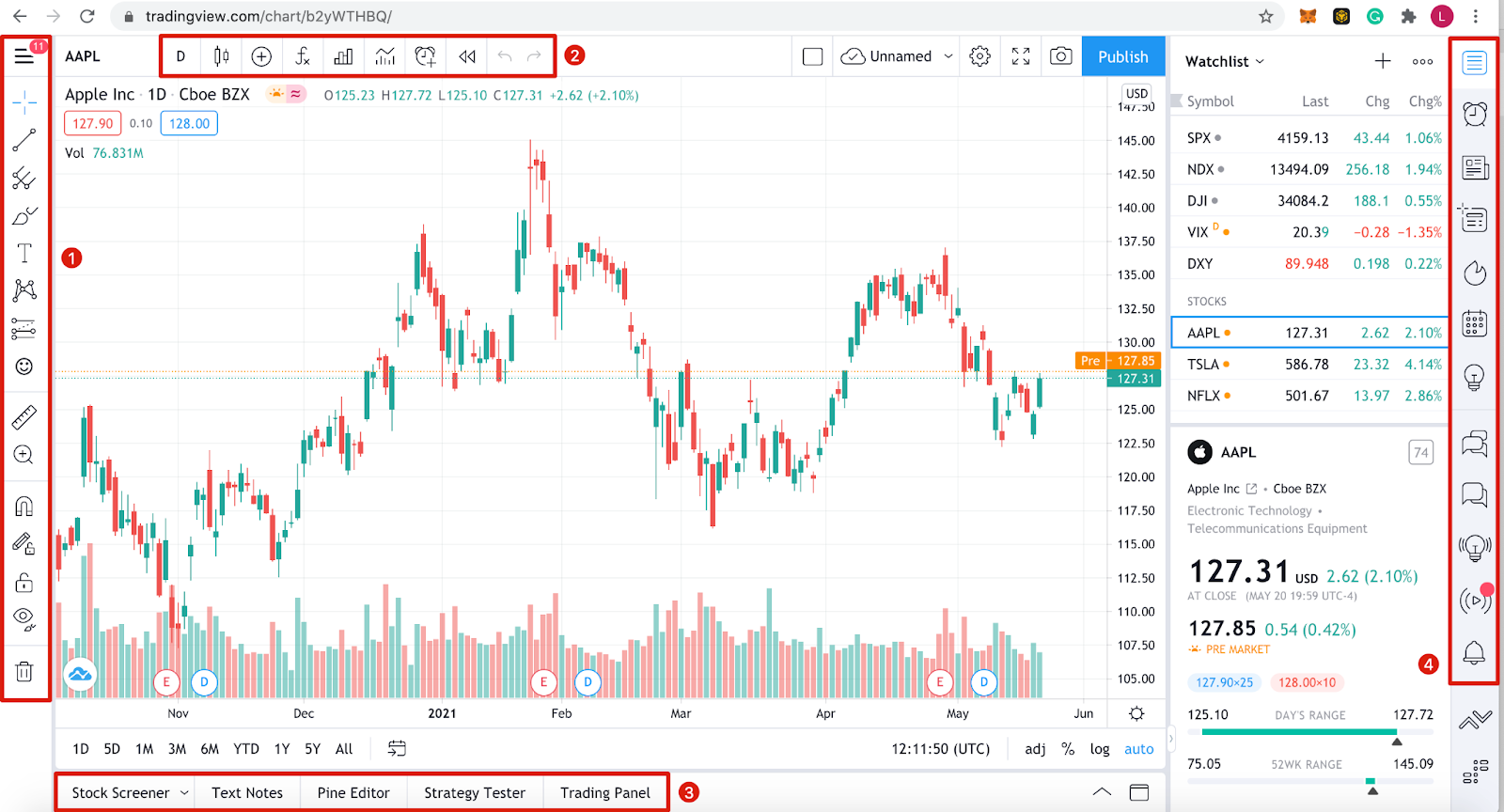

TradingView has develop into the go-to platform for numerous merchants, providing a strong suite of charting instruments and evaluation options. Nonetheless, the sheer variety of indicators, drawing instruments, and chart varieties can really feel overwhelming for inexperienced persons. This complete information will break down the necessities of studying TradingView charts, empowering you to unlock their potential and make knowledgeable buying and selling choices.

I. Understanding the Chart’s Basis: Value and Time

At its core, a TradingView chart shows the worth of an asset (inventory, cryptocurrency, foreign exchange pair, and so forth.) over time. The most typical chart varieties are:

-

Candlestick Charts: These characterize value actions over a selected interval (e.g., 1 minute, 5 minutes, 1 day). Every candlestick reveals the open, excessive, low, and shutting costs. A inexperienced (or typically white) candlestick signifies a closing value increased than the opening value (bullish), whereas a purple (or black) candlestick signifies a closing value decrease than the opening value (bearish). The physique of the candlestick represents the worth vary between the open and shut, whereas the wicks (shadows) prolong to the excessive and low costs.

-

Bar Charts: Just like candlestick charts, bar charts show the open, excessive, low, and shut costs for a given interval. Nonetheless, they use vertical bars as a substitute of candlesticks. The left fringe of the bar represents the open value, the best edge the shut value, and the highest and backside of the bar characterize the excessive and low costs respectively.

-

Line Charts: These charts merely join the closing costs of every interval with a line. They’re helpful for visualizing long-term traits however lack the detailed value data supplied by candlesticks or bar charts.

Understanding the time-frame is essential. A 1-minute chart reveals value motion minute by minute, providing excessive granularity however probably extra noise. A day by day chart reveals value motion over every day, offering a broader perspective however much less element. Choosing the proper timeframe will depend on your buying and selling type and technique.

II. Important Chart Components:

Past the essential value and time information, TradingView charts provide a number of key parts:

-

Value Axes: The vertical axis represents the worth, whereas the horizontal axis represents time.

-

Quantity: The quantity indicator normally sits beneath the worth chart. It reveals the variety of shares or contracts traded throughout every interval. Excessive quantity typically accompanies vital value actions, indicating robust conviction available in the market. Low quantity can counsel a scarcity of curiosity and probably weaker value motion.

-

Transferring Averages: These are traces that clean out value fluctuations, making it simpler to establish traits. Frequent transferring averages embody Easy Transferring Common (SMA), Exponential Transferring Common (EMA), and Weighted Transferring Common (WMA). The interval of the transferring common (e.g., 20-day SMA) determines its responsiveness to latest value adjustments. Longer intervals lead to smoother traces which are much less delicate to short-term fluctuations.

-

Relative Power Index (RSI): This momentum oscillator measures the magnitude of latest value adjustments to judge overbought or oversold situations. RSI values above 70 are usually thought of overbought, suggesting a possible value reversal, whereas values beneath 30 are thought of oversold, suggesting a possible bounce.

-

MACD (Transferring Common Convergence Divergence): This trend-following momentum indicator makes use of transferring averages to establish adjustments in momentum. The MACD line crossing above its sign line typically suggests a bullish sign, whereas a crossover beneath suggests a bearish sign. Divergence between the MACD and value motion may also be a major indicator of potential development reversals.

-

Bollinger Bands: These are bands plotted round a transferring common, usually a 20-period SMA. They present the worth volatility. Costs touching or breaking the higher band would possibly counsel overbought situations, whereas touching or breaking the decrease band would possibly counsel oversold situations.

III. Using Drawing Instruments:

TradingView offers a wealthy set of drawing instruments to reinforce chart evaluation:

-

Development Traces: These traces join vital value factors to establish traits. Uptrend traces join increased lows, whereas downtrend traces join decrease highs.

-

Help and Resistance Ranges: These are value ranges the place the worth has traditionally struggled to interrupt via. Help ranges characterize costs the place shopping for strain is powerful, whereas resistance ranges characterize costs the place promoting strain is powerful.

-

Fibonacci Retracements: These are primarily based on the Fibonacci sequence and are used to establish potential help and resistance ranges throughout a development.

-

Channels: These are parallel traces drawn to embody value actions inside a selected vary.

-

Rectangles: These can be utilized to spotlight particular value ranges or consolidation patterns.

-

Elliott Wave Principle: This technical evaluation instrument identifies patterns in value actions primarily based on a selected wave construction. Whereas complicated, mastering Elliott Wave can present useful insights into potential development extensions and reversals.

IV. Decoding Chart Patterns:

Recognizing chart patterns might help predict future value actions. Some frequent patterns embody:

-

Head and Shoulders: A bearish reversal sample characterised by three peaks, with the center peak (the pinnacle) being the best.

-

Inverse Head and Shoulders: A bullish reversal sample, the mirror picture of the pinnacle and shoulders sample.

-

Double Tops and Double Bottoms: These patterns point out potential development reversals.

-

Triangles: These patterns counsel consolidation earlier than a possible breakout.

-

Flags and Pennants: These patterns characterize short-term consolidations inside a bigger development.

V. Superior Strategies:

-

A number of Time Body Evaluation: Analyzing the identical asset throughout totally different time frames (e.g., day by day, hourly, 5-minute) can present a complete perspective on the worth motion. This enables merchants to establish potential confirmations or divergences throughout totally different time scales.

-

Order Move Evaluation: This superior approach focuses on understanding the underlying order guide and the way massive orders impression value actions.

-

Market Profile: This instrument visualizes the distribution of buying and selling exercise over time and value, serving to merchants establish areas of worth and potential help and resistance ranges.

VI. Conclusion:

Mastering TradingView charts requires apply and persistence. Begin by specializing in the basics: understanding candlestick patterns, using fundamental indicators (like transferring averages and RSI), and working towards drawing development traces and figuring out help and resistance ranges. Steadily incorporate extra superior instruments and methods as your understanding grows. Keep in mind that chart evaluation is only one piece of the puzzle. Profitable buying and selling additionally requires threat administration, understanding market context, and disciplined execution. All the time apply on a demo account earlier than risking actual capital. By dedicating effort and time to studying, you’ll be able to unlock the facility of TradingView charts and enhance your buying and selling efficiency. Steady studying and adaptation are key to success within the dynamic world of buying and selling.

Closure

Thus, we hope this text has supplied useful insights into Deciphering the Oracle: A Complete Information to Studying TradingView Charts. We hope you discover this text informative and useful. See you in our subsequent article!