Decoding Canada’s GDP Chart: A Two-Decade Journey Of Financial Development And Volatility

By admin / June 27, 2024 / No Comments / 2025

Decoding Canada’s GDP Chart: A Two-Decade Journey of Financial Development and Volatility

Associated Articles: Decoding Canada’s GDP Chart: A Two-Decade Journey of Financial Development and Volatility

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding Canada’s GDP Chart: A Two-Decade Journey of Financial Development and Volatility. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Decoding Canada’s GDP Chart: A Two-Decade Journey of Financial Development and Volatility

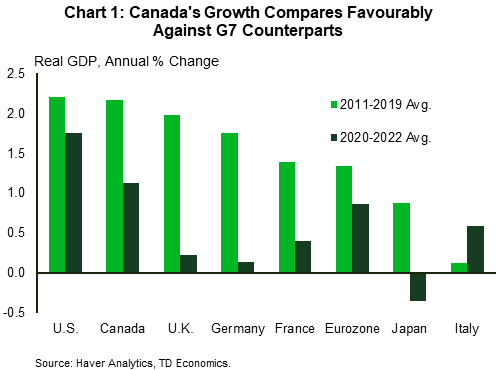

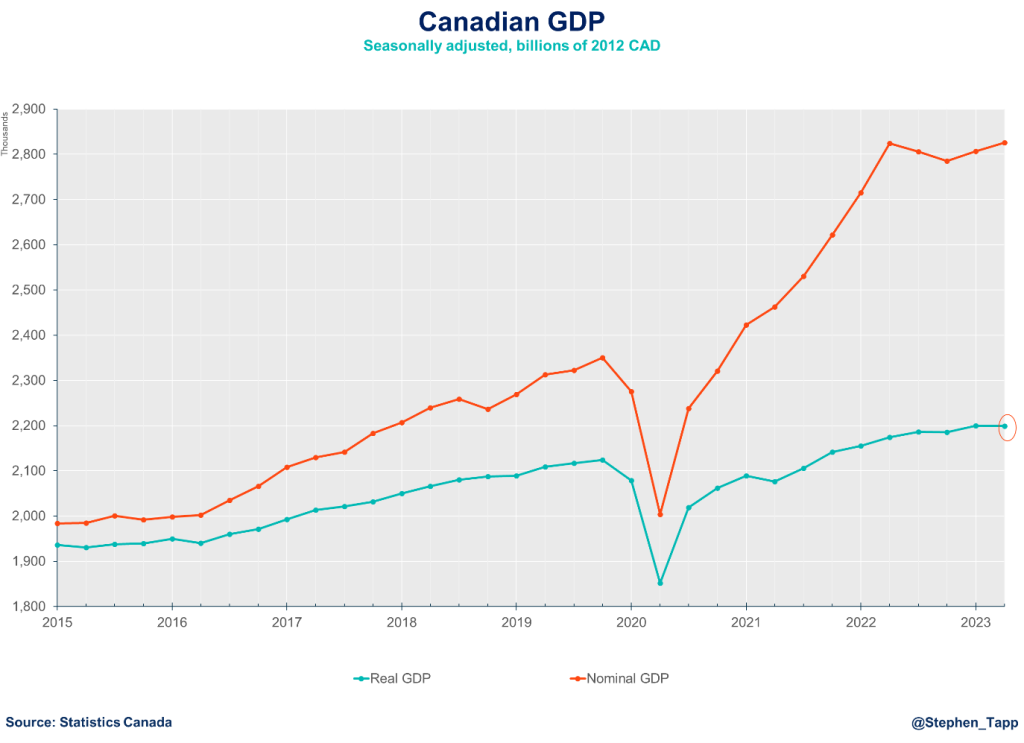

Canada’s Gross Home Product (GDP) chart, spanning the previous twenty years, tells a compelling story of financial development punctuated by durations of growth and contraction, reflecting world tendencies, home coverage choices, and unexpected shocks. Analyzing this chart gives essential insights into the nation’s financial well being, resilience, and future potential. This text delves into an in depth examination of Canada’s GDP efficiency since 2000, highlighting key tendencies, contributing elements, and potential implications for the long run.

The Broad Image: A Decade of Regular Development, Adopted by Fluctuations

A look on the GDP chart reveals a interval of comparatively constant development from roughly 2000 to 2008, adopted by a pointy recession triggered by the worldwide monetary disaster. The next restoration was gradual, marked by durations of sturdy development and slower growth, culminating within the challenges posed by the COVID-19 pandemic. The post-pandemic restoration has been uneven, with sure sectors experiencing sturdy development whereas others grapple with lingering results.

The Pre-2008 Growth: Commodity Costs and Robust Home Demand

The early 2000s witnessed a interval of sturdy financial growth fueled by a number of elements. Excessive commodity costs, notably for oil and pure fuel, considerably boosted Canada’s export sector. The nation benefited from its plentiful pure assets, experiencing a "commodity increase" that contributed considerably to GDP development. Concurrently, sturdy home demand, pushed by low rates of interest and rising client confidence, additional fueled financial exercise. This era noticed important funding in infrastructure initiatives and a strong housing market, contributing to general financial growth. Nevertheless, this reliance on commodity costs additionally highlighted a vulnerability – a dependence on exterior elements past Canada’s direct management.

The 2008-2009 World Monetary Disaster and its Influence:

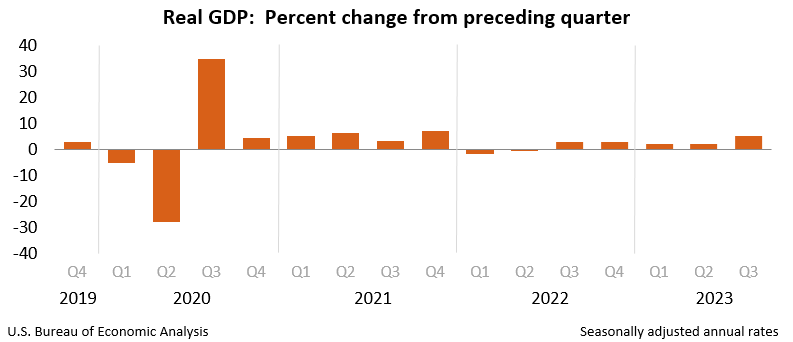

The 2008-2009 world monetary disaster dealt a big blow to the Canadian financial system. The sharp decline in world demand, coupled with the collapse of the US housing market, triggered a recession in Canada. GDP contracted considerably, reflecting the interconnectedness of the worldwide financial system and Canada’s shut ties with america. The Canadian authorities responded with fiscal stimulus measures, together with tax cuts and infrastructure spending, aimed toward mitigating the influence of the disaster and stimulating financial restoration. The effectiveness of those measures is a topic of ongoing debate, with some arguing that they prevented a deeper recession whereas others level to potential long-term fiscal penalties.

Submit-Disaster Restoration and Diversification Efforts:

The restoration from the 2008-2009 recession was gradual and uneven. Whereas the financial system ultimately rebounded, the tempo of development various throughout sectors. The Canadian authorities pursued insurance policies aimed toward diversifying the financial system, decreasing reliance on commodity costs, and fostering innovation in sectors like expertise and renewable vitality. These efforts, whereas displaying some progress, have been sluggish to totally materialize, highlighting the challenges of structural financial transformation. The restoration additionally noticed a resurgence within the housing market, resulting in issues about potential bubbles and affordability points.

The Influence of the COVID-19 Pandemic:

The COVID-19 pandemic introduced an unprecedented problem to the Canadian financial system. Lockdowns, social distancing measures, and disruptions to world provide chains led to a pointy contraction in GDP within the first half of 2020. The pandemic disproportionately impacted sure sectors, akin to tourism, hospitality, and retail, whereas others, like expertise and e-commerce, skilled development. The Canadian authorities carried out important fiscal assist packages, together with wage subsidies and emergency advantages, to mitigate the financial fallout. These packages performed a vital function in stopping widespread job losses and supporting companies, but in addition contributed to a big improve in authorities debt.

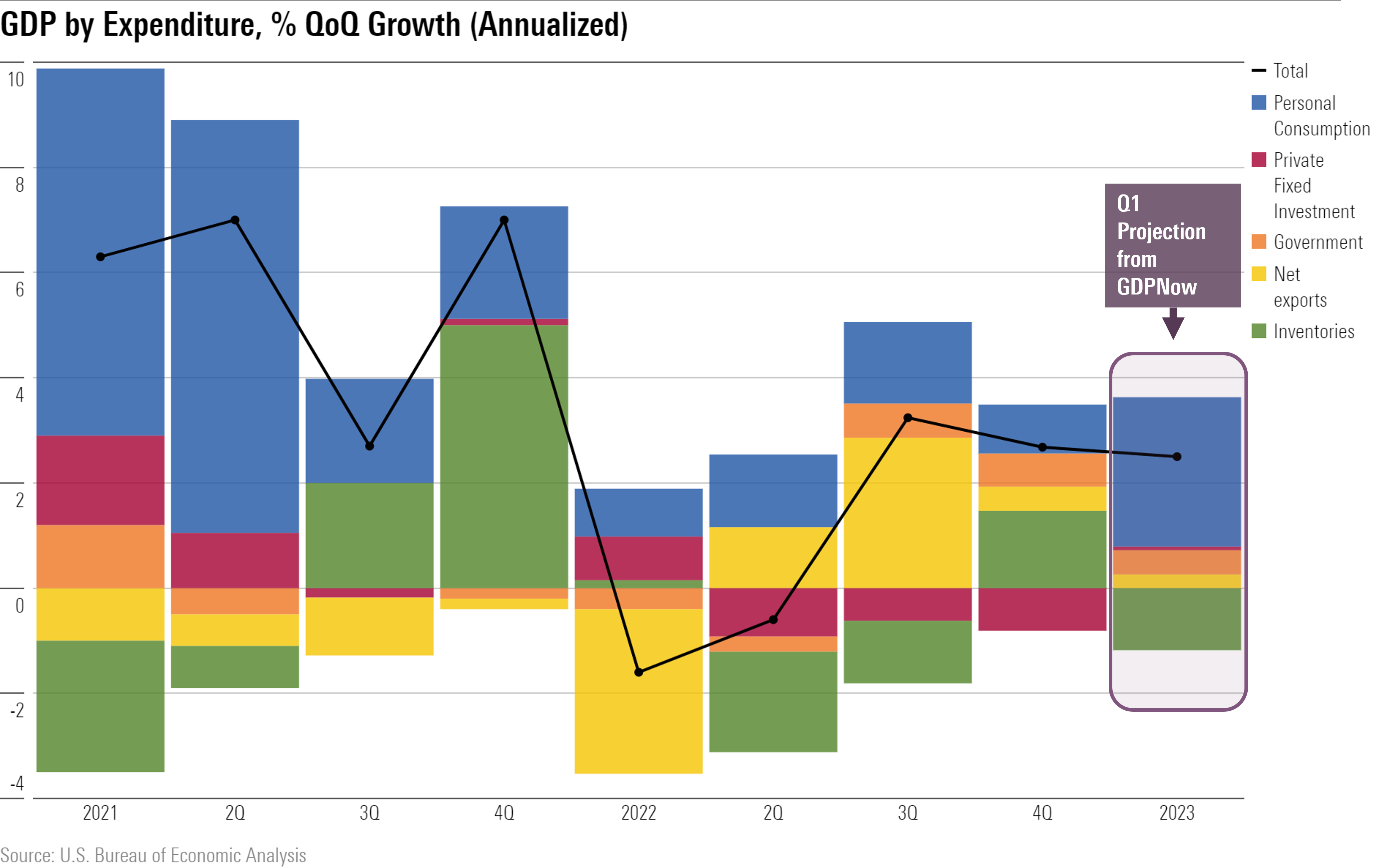

Submit-Pandemic Restoration and Rising Challenges:

The post-pandemic restoration has been characterised by uneven development and chronic challenges. Whereas some sectors have rebounded strongly, others proceed to battle. Inflation has emerged as a serious concern, pushed by world provide chain disruptions and elevated demand. The rising price of residing has put strain on households and companies, impacting client spending and funding. The struggle in Ukraine has additional exacerbated inflationary pressures and added to world financial uncertainty. Canada’s financial system faces the problem of navigating excessive inflation, provide chain disruptions, and a doubtlessly slowing world financial system.

Analyzing the Chart: Key Indicators and Interpretations

Analyzing the GDP chart requires contemplating a number of key indicators and their interrelationships. These embody:

-

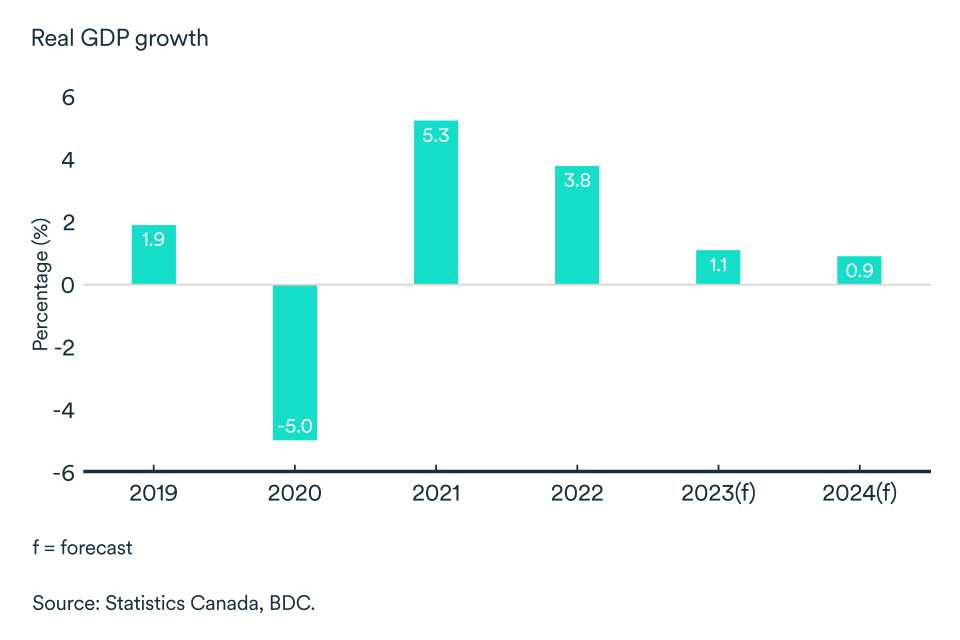

Actual GDP Development Charge: This displays the change in GDP adjusted for inflation, offering a extra correct image of financial development. Fluctuations on this fee spotlight durations of growth and contraction.

-

Nominal GDP: This represents the whole worth of products and providers produced with out adjusting for inflation. It gives a measure of the general dimension of the financial system.

-

GDP per Capita: This indicator displays the common earnings per particular person, offering insights into residing requirements and financial well-being.

-

Sectoral Contributions to GDP: Analyzing the contribution of various sectors (e.g., manufacturing, providers, pure assets) gives a deeper understanding of the drivers of financial development and vulnerability.

-

Correlation with World Financial Traits: Inspecting the connection between Canada’s GDP and world financial indicators helps to know the influence of worldwide elements on the home financial system.

Conclusion: Navigating Future Uncertainties

The Canadian GDP chart over the previous twenty years reveals a fancy narrative of financial development, resilience, and vulnerability. Whereas Canada has demonstrated the flexibility to navigate financial shocks, the long run presents important challenges. Sustaining financial development whereas addressing inflation, diversifying the financial system, and fostering innovation shall be essential for guaranteeing long-term prosperity. Efficient policymaking, funding in human capital, and adaptation to world financial shifts shall be important for Canada to proceed its path of sustainable financial growth. Cautious monitoring of key financial indicators and a proactive method to addressing rising challenges shall be very important in navigating the uncertainties that lie forward. The way forward for Canada’s GDP will rely upon its potential to adapt, innovate, and construct a extra resilient and diversified financial system. Additional evaluation, incorporating detailed information on employment, funding, and client spending, will present a extra complete understanding of the forces shaping Canada’s financial trajectory.

Closure

Thus, we hope this text has supplied priceless insights into Decoding Canada’s GDP Chart: A Two-Decade Journey of Financial Development and Volatility. We thanks for taking the time to learn this text. See you in our subsequent article!