Decoding Silver’s Value Chart: A Journey By way of Market Forces And Funding Alternatives

By admin / October 2, 2024 / No Comments / 2025

Decoding Silver’s Value Chart: A Journey By way of Market Forces and Funding Alternatives

Associated Articles: Decoding Silver’s Value Chart: A Journey By way of Market Forces and Funding Alternatives

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Decoding Silver’s Value Chart: A Journey By way of Market Forces and Funding Alternatives. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Decoding Silver’s Value Chart: A Journey By way of Market Forces and Funding Alternatives

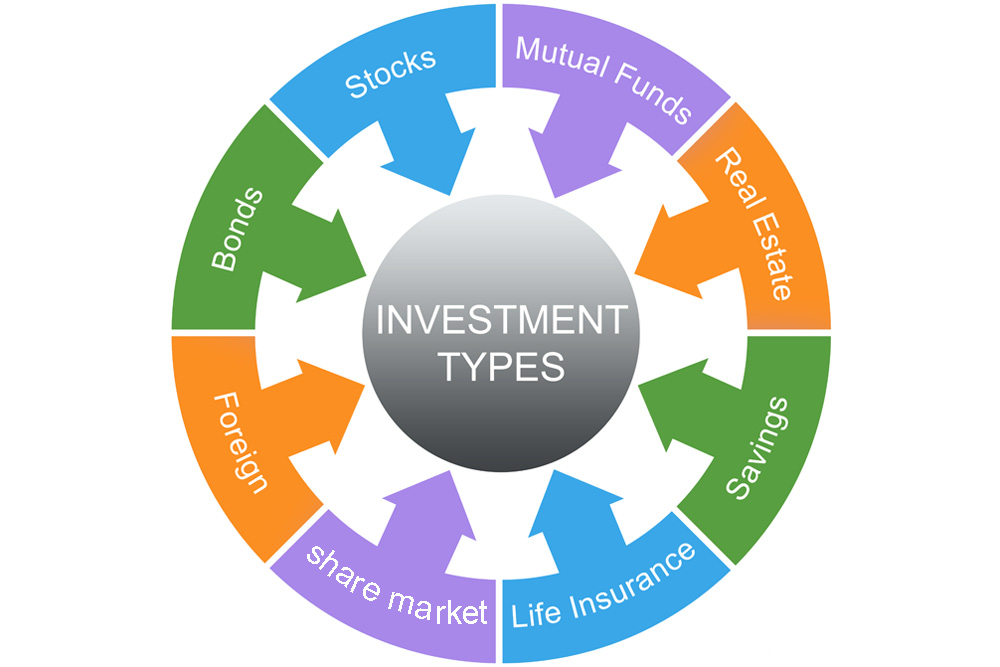

Silver, a lustrous steel prized for its magnificence and industrial functions, boasts a wealthy historical past interwoven with human civilization. Its value, nonetheless, is much from static, fluctuating wildly in response to a fancy interaction of financial, geopolitical, and technological elements. Analyzing silver’s value chart reveals an enchanting narrative, providing insights into market dynamics and potential funding methods. This text delves deep into the intricacies of silver’s value actions, exploring the important thing drivers and shedding mild on how traders can navigate this dynamic market.

Historic Perspective: A Century of Volatility

A look at a long-term silver value chart reveals a narrative of dramatic swings. From the comparatively secure costs of the early twentieth century, the steel skilled intervals of serious progress, punctuated by sharp corrections. The post-World Conflict II period noticed a gradual improve, adopted by the enduring silver bull market of the Seventies, fueled by inflation and rising industrial demand. This era noticed costs soar to unprecedented heights, solely to crash dramatically within the subsequent years. The late twentieth and early twenty first centuries witnessed a extra unstable sample, with costs influenced by elements starting from forex fluctuations to technological developments. Understanding this historic context is essential for deciphering present value actions and anticipating future developments.

Key Components Influencing Silver Costs:

A number of interwoven elements contribute to silver’s value volatility. These might be broadly categorized as:

-

Industrial Demand: Silver’s industrial functions are huge, spanning electronics, photo voltaic vitality, pictures, and medical gadgets. Elevated demand from these sectors, notably in rising economies, usually interprets to greater silver costs. Technological developments, such because the rising adoption of renewable vitality applied sciences, can considerably influence this demand. Conversely, financial downturns or technological shifts can result in decreased industrial demand and decrease costs.

-

Funding Demand: Silver is taken into account a treasured steel and a safe-haven asset. During times of financial uncertainty or inflation, traders usually flock to silver as a hedge in opposition to danger. This surge in funding demand can drive up costs, notably if coupled with restricted provide. The recognition of exchange-traded funds (ETFs) backed by bodily silver has additional amplified this impact, making it simpler for traders to achieve publicity to the market.

-

Foreign money Fluctuations: The value of silver, like most commodities, is often quoted in US {dollars}. A weakening US greenback usually results in elevated demand for silver from worldwide traders, pushing costs greater. Conversely, a strengthening greenback can put downward strain on silver costs. The interaction between international currencies and silver’s worth is a vital aspect to contemplate when analyzing value charts.

-

Provide and Demand Dynamics: The basic precept of provide and demand performs a major position in shaping silver costs. Restricted mine manufacturing, geopolitical instability in main silver-producing areas, and disruptions to the provision chain can all result in value will increase. Conversely, an oversupply of silver available in the market can push costs downward. Understanding the stability between provide and demand is essential for making knowledgeable funding choices.

-

Authorities Insurance policies and Rules: Authorities insurance policies, together with these associated to mining, taxation, and environmental laws, can considerably influence silver manufacturing and availability. Adjustments in these insurance policies can affect silver costs, generally dramatically. For instance, stricter environmental laws may improve mining prices, resulting in greater silver costs.

-

Hypothesis and Market Sentiment: Market sentiment and speculative buying and selling play a major position in silver value fluctuations. Optimistic information about silver’s industrial functions or its potential as a hedge in opposition to inflation can set off a shopping for frenzy, main to cost spikes. Conversely, destructive information or a shift in market sentiment can set off sell-offs, leading to value declines. Analyzing market sentiment and figuring out potential catalysts for value actions is essential for profitable buying and selling.

Decoding Silver’s Value Chart: Technical Evaluation and Elementary Evaluation

Analyzing silver’s value chart requires a multi-faceted strategy, incorporating each technical and elementary evaluation.

-

Technical Evaluation: Technical evaluation focuses on figuring out patterns and developments in value actions utilizing charts and indicators. Methods like transferring averages, relative energy index (RSI), and help and resistance ranges can assist establish potential entry and exit factors for merchants. Nonetheless, it is essential to keep in mind that technical evaluation will not be foolproof and needs to be used along side different types of evaluation.

-

Elementary Evaluation: Elementary evaluation includes analyzing the underlying financial and industrial elements that affect silver costs. This consists of analyzing provide and demand dynamics, industrial demand forecasts, geopolitical dangers, and macroeconomic developments. A powerful understanding of elementary elements is crucial for making long-term funding choices.

Funding Methods and Danger Administration:

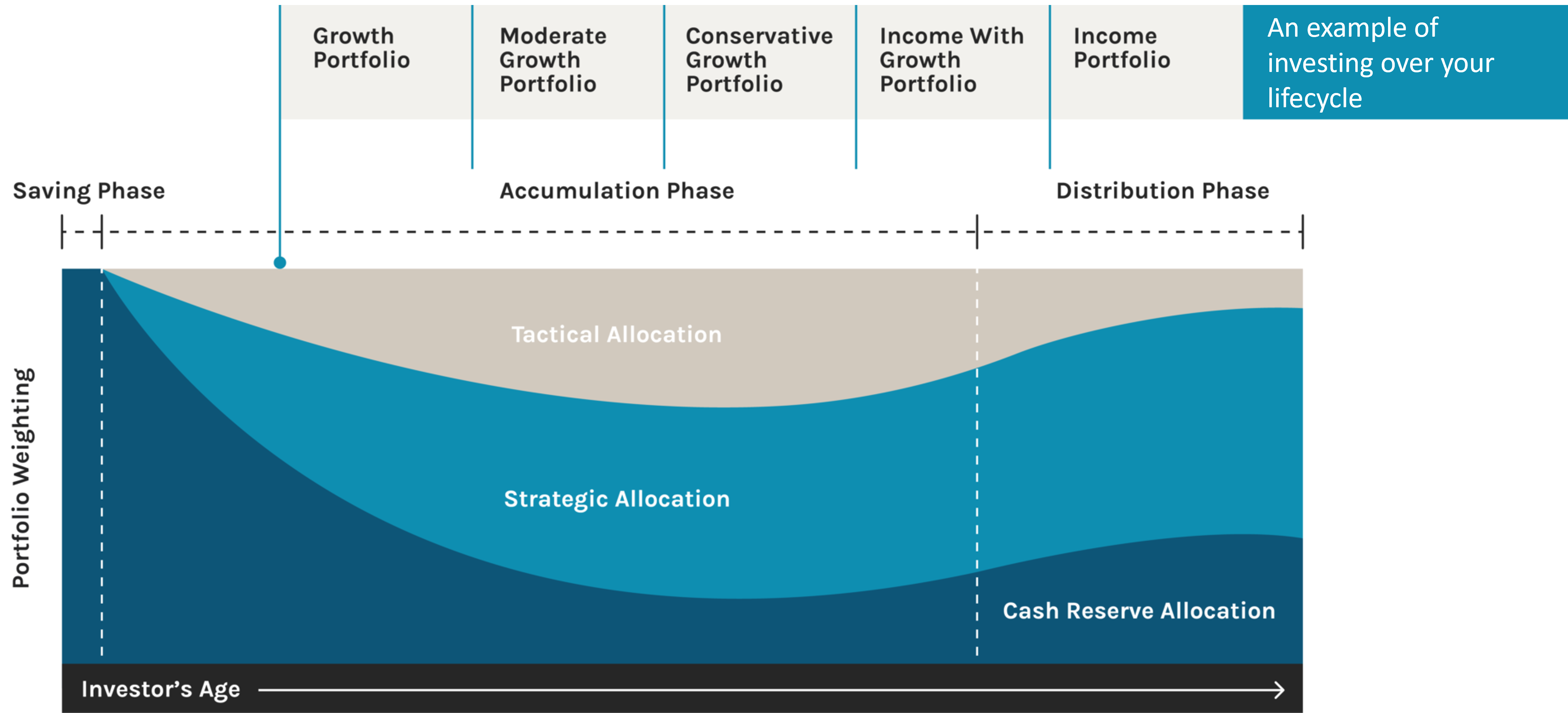

Investing in silver can supply vital potential returns, nevertheless it additionally carries inherent dangers. Traders ought to rigorously take into account their danger tolerance and funding targets earlier than making any choices. A number of methods might be employed:

-

Bodily Silver: Investing in bodily silver, reminiscent of bars or cash, affords a tangible asset with inherent worth. Nonetheless, this requires safe storage and includes prices related to buying and storing the steel.

-

Silver ETFs: Silver ETFs present publicity to silver costs with out the necessity for bodily storage. They provide liquidity and ease of buying and selling however might contain administration charges.

-

Silver Mining Shares: Investing in silver mining firms gives leveraged publicity to silver costs. Nonetheless, this technique carries greater danger because of the volatility of mining firms’ efficiency.

-

Futures Contracts: Futures contracts permit traders to take a position on future silver costs. This technique affords excessive leverage but additionally carries vital danger, notably for inexperienced merchants.

Conclusion:

Silver’s value chart is a dynamic tapestry woven from numerous threads of financial, industrial, and geopolitical forces. Understanding these forces and using a complete evaluation strategy, combining technical and elementary evaluation, is essential for navigating this unstable market. Traders ought to rigorously assess their danger tolerance, diversify their portfolios, and develop a well-defined funding technique earlier than venturing into the world of silver buying and selling. Whereas the potential for vital returns exists, it is important to keep in mind that silver investing will not be with out danger, and thorough analysis and cautious planning are paramount to success. By diligently learning the chart and understanding the underlying elements, traders can probably capitalize on the alternatives offered by this fascinating and dynamic steel.

:max_bytes(150000):strip_icc()/impact_daily_trades_final-42b1576eadce41d1a88379fff9dbba87.png)

Closure

Thus, we hope this text has supplied beneficial insights into Decoding Silver’s Value Chart: A Journey By way of Market Forces and Funding Alternatives. We admire your consideration to our article. See you in our subsequent article!