Decoding The 30-Yr Mortgage Fee Y Chart: A Two-Decade Journey By Housing Finance

By admin / July 2, 2024 / No Comments / 2025

Decoding the 30-Yr Mortgage Fee Y Chart: A Two-Decade Journey By Housing Finance

Associated Articles: Decoding the 30-Yr Mortgage Fee Y Chart: A Two-Decade Journey By Housing Finance

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the 30-Yr Mortgage Fee Y Chart: A Two-Decade Journey By Housing Finance. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding the 30-Yr Mortgage Fee Y Chart: A Two-Decade Journey By Housing Finance

The 30-year fixed-rate mortgage (FRM) is the cornerstone of the American dream of homeownership. Its stability, predictability, and comparatively lengthy amortization interval make it a well-liked selection for hundreds of thousands. Understanding the historic trajectory of its rates of interest, usually visualized in a Y chart, is essential for each potential homebuyers and seasoned traders. This text delves deep into the nuances of a 30-year mortgage price Y chart, exploring its fluctuations over the previous twenty years, the underlying financial forces driving these modifications, and the implications for debtors and the broader economic system.

The Y Chart: A Visible Illustration of Fee Volatility

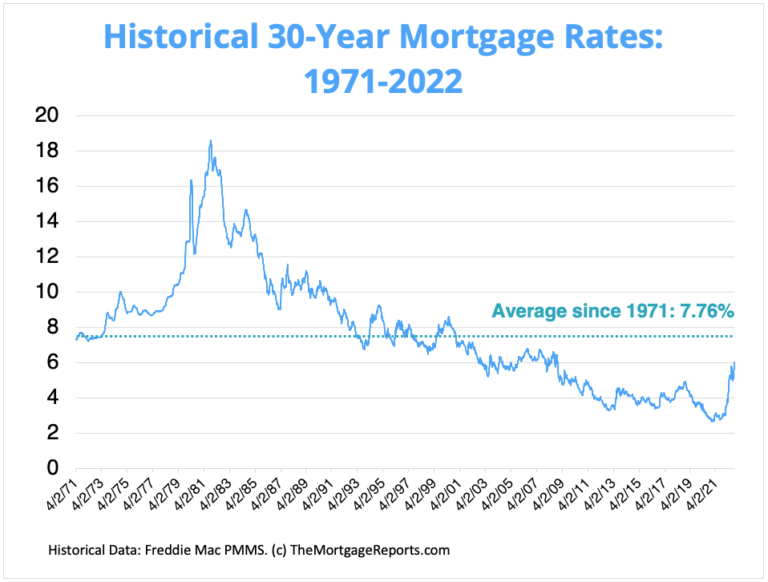

A typical 30-year mortgage price Y chart plots time (often years) alongside the X-axis and the rate of interest (proportion) alongside the Y-axis. The ensuing line graph visually represents the ebb and movement of mortgage charges over time. A pointy upward spike signifies a interval of rising charges, whereas a downward slope reveals a interval of falling charges. Analyzing this chart reveals vital patterns and cyclical tendencies that replicate broader macroeconomic circumstances.

The 2000s: A Rollercoaster Trip

The early 2000s started with comparatively secure, albeit excessive, mortgage charges. The aftermath of the dot-com bubble and the following financial slowdown contributed to a gradual decline in charges. Nonetheless, the interval main as much as the 2008 monetary disaster noticed a dramatic drop, fueled by free financial coverage and the proliferation of subprime mortgages. This era of artificially low charges masked underlying vulnerabilities within the housing market, in the end contributing to the catastrophic collapse. The Y chart throughout this era would present a steep downward development culminating in a near-vertical drop, adopted by a pointy rebound because the disaster unfolded and the Federal Reserve aggressively intervened. The post-crisis interval noticed charges stay comparatively low for a number of years, though the restoration was sluggish and uneven.

The 2010s: A Interval of Low Charges and Gradual Improve

The 2010s witnessed a chronic interval of traditionally low mortgage charges. The Federal Reserve’s quantitative easing packages, designed to stimulate the economic system after the monetary disaster, performed a major function in suppressing rates of interest throughout the board, together with mortgages. The Y chart throughout this decade would show a comparatively flat line, with minor fluctuations round a low common. This era noticed a surge in homebuying exercise, fueled by each inexpensive financing and pent-up demand. Nonetheless, this low-rate surroundings additionally contributed to considerations about asset bubbles and potential future inflation. In the direction of the latter half of the last decade, we started to see a sluggish and regular upward creep in charges because the economic system confirmed indicators of restoration and the Federal Reserve steadily began to unwind its quantitative easing insurance policies.

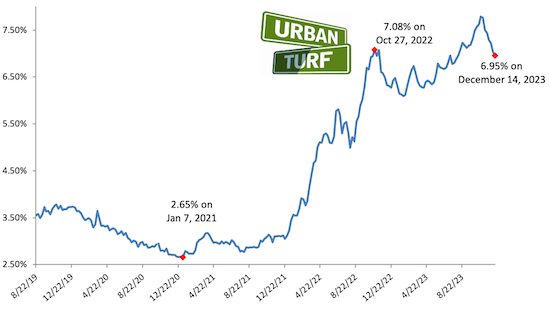

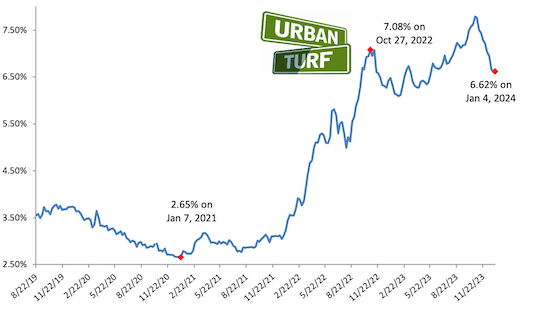

The 2020s: Pandemic Volatility and Subsequent Rise

The COVID-19 pandemic initially precipitated vital uncertainty within the mortgage market. The Federal Reserve responded with aggressive financial easing, pushing charges to file lows. The Y chart would present a dramatic plunge as charges plummeted to near-zero ranges. This era witnessed a surge in refinancing exercise as owners sought to reap the benefits of traditionally low charges. Nonetheless, the following financial restoration, coupled with inflationary pressures, led to a major enhance in mortgage charges all through 2021 and 2022. The Y chart throughout this era would present a pointy upward development, reflecting the affect of rising inflation and the Federal Reserve’s efforts to fight it by elevating rates of interest. This sharp enhance cooled the housing market considerably, impacting affordability for a lot of potential consumers.

Elements Influencing 30-Yr Mortgage Charges

A number of key elements affect the motion of 30-year mortgage charges as depicted on the Y chart:

-

Federal Reserve Coverage: The Federal Reserve’s financial coverage choices, significantly its goal federal funds price, have a profound affect on mortgage charges. Increased federal funds charges usually result in increased mortgage charges, and vice versa.

-

Inflation: Excessive inflation erodes the buying energy of cash, prompting the Federal Reserve to lift rates of interest to chill down the economic system. This, in flip, results in increased mortgage charges.

-

Financial Development: Robust financial progress can result in increased inflation and subsequently increased mortgage charges. Conversely, weak financial progress can result in decrease charges.

-

Authorities Laws: Authorities laws impacting the housing market, similar to these associated to lending requirements or housing finance companies, can affect mortgage charges.

-

World Financial Situations: World financial occasions and geopolitical uncertainty may affect mortgage charges by means of their affect on investor sentiment and market stability.

-

Provide and Demand: The availability and demand dynamics inside the mortgage market itself can affect charges. Excessive demand for mortgages can push charges upward, whereas low demand can push them downward.

Implications for Homebuyers and the Financial system

Understanding the historic tendencies depicted within the 30-year mortgage price Y chart is vital for a number of causes:

-

Affordability: Increased mortgage charges straight affect the affordability of houses. Rising charges make it costlier to finance a mortgage, probably lowering the quantity of people that can afford to purchase a house.

-

Housing Market Exercise: Mortgage charges considerably affect the general exercise within the housing market. Low charges stimulate demand, whereas excessive charges can dampen it.

-

Financial Development: The housing market is a significant factor of the general economic system. Adjustments in mortgage charges and housing market exercise can have broader ripple results on financial progress and employment.

-

Funding Methods: Understanding mortgage price tendencies is essential for traders concerned in actual property or mortgage-backed securities.

Conclusion: Navigating the Way forward for Mortgage Charges

Predicting future mortgage charges with certainty is unattainable. Nonetheless, by fastidiously analyzing historic tendencies depicted within the 30-year mortgage price Y chart and understanding the underlying financial forces at play, each homebuyers and traders could make extra knowledgeable choices. Staying knowledgeable about Federal Reserve coverage, inflation charges, and broader financial circumstances is essential for navigating the complexities of the housing market and making strategic decisions associated to financing and funding. The Y chart serves as a strong visible device, providing a concise but complete abstract of the dynamic and sometimes unpredictable world of mortgage charges. By understanding its nuances, we are able to higher put together for the challenges and alternatives that lie forward within the ever-evolving panorama of housing finance.

:max_bytes(150000):strip_icc()/BgXcd-average-mortgage-rates-over-the-last-year-feb-29-2024-0875eb9980bb4ece94169bb78b670b86.png)

Closure

Thus, we hope this text has offered useful insights into Decoding the 30-Yr Mortgage Fee Y Chart: A Two-Decade Journey By Housing Finance. We hope you discover this text informative and helpful. See you in our subsequent article!