Decoding The 91 Membership Chart Sample: A Complete Information

By admin / July 9, 2024 / No Comments / 2025

Decoding the 91 Membership Chart Sample: A Complete Information

Associated Articles: Decoding the 91 Membership Chart Sample: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding the 91 Membership Chart Sample: A Complete Information. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Decoding the 91 Membership Chart Sample: A Complete Information

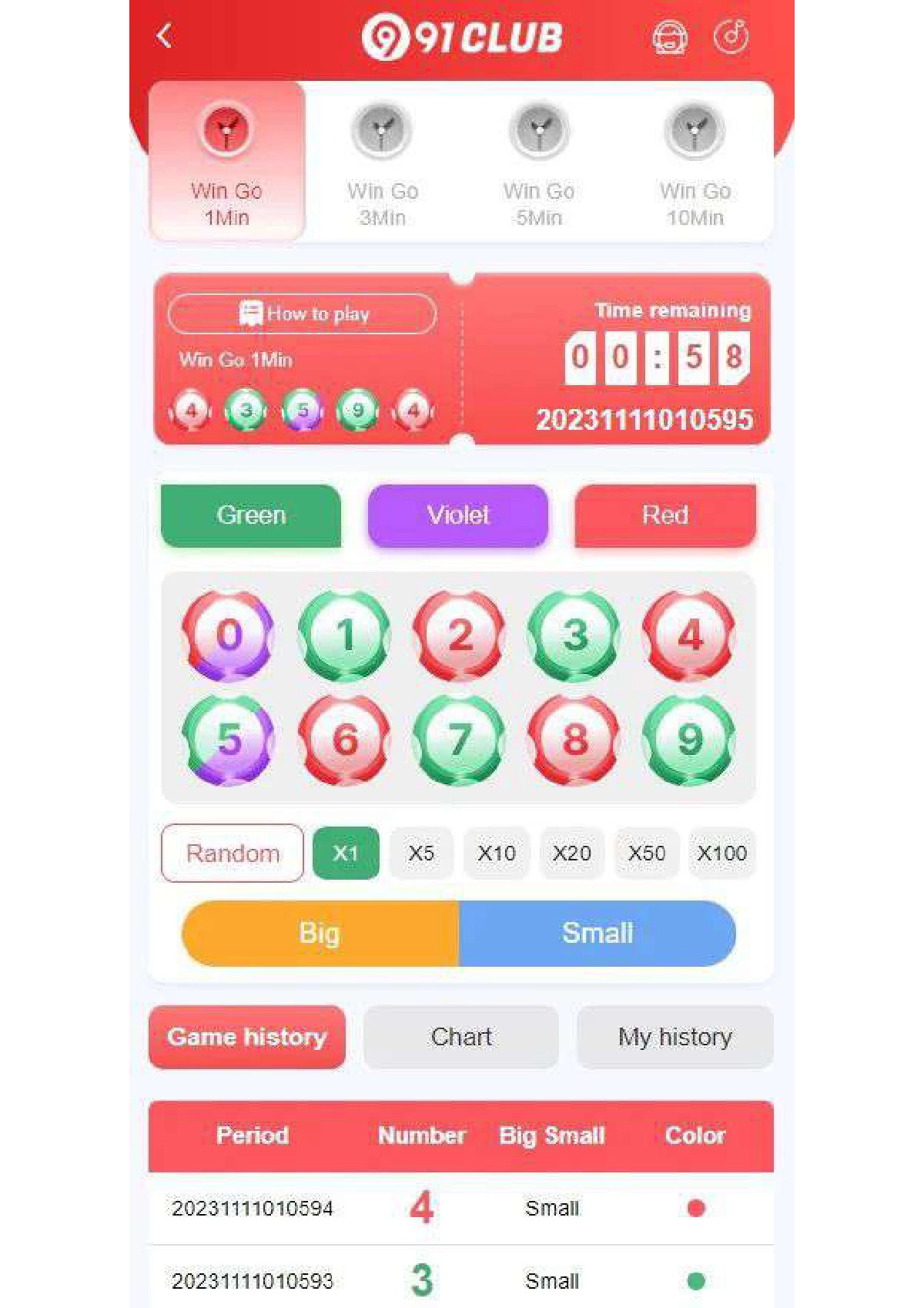

The 91 Membership chart sample, whereas not a formally acknowledged technical evaluation formation like head and shoulders or double bottoms, represents an enchanting and doubtlessly profitable buying and selling technique based mostly on noticed market conduct. This sample, characterised by a selected sequence of worth motion and quantity, focuses on figuring out potential reversals or robust continuations inside trending markets. This in-depth article explores the 91 Membership sample, its identification, interpretation, and danger administration issues, providing an in depth understanding past a easy PDF abstract.

Understanding the Core Precept:

The 91 Membership sample would not depend on a inflexible geometric form like different chart patterns. As an alternative, it is outlined by a sequence of 9 consecutive buying and selling days exhibiting a selected relationship between worth motion and quantity. The "9" represents the variety of days, and the "1" signifies an important pivot day inside that sequence. This pivot day, normally characterised by a major quantity spike and a worth reversal, is the important thing to decoding the sample’s potential.

The sample’s effectiveness stems from the premise that sustained worth actions, significantly these missing vital quantity affirmation, are sometimes unsustainable. The 91 Membership goals to determine factors the place the prevailing development is perhaps exhausting itself, resulting in a possible reversal or a interval of consolidation earlier than a continuation.

Figuring out the 91 Membership Sample:

Figuring out the 91 Membership sample requires meticulous commentary of each day worth charts, specializing in each worth motion and quantity. This is a step-by-step information:

-

The First Eight Days: The sample begins with eight consecutive buying and selling days exhibiting a constant development. This development will be both upward or downward. Importantly, the quantity throughout these eight days ought to usually be comparatively low or constant, suggesting a scarcity of robust conviction behind the value motion. This section represents a possible exhaustion of the present development.

-

The Pivot Day (Day 9): The ninth day is essential. This present day ought to function a major enhance in quantity in comparison with the earlier eight days. The worth motion on at the present time is the defining attribute. Ideally, it ought to present a reversal – a powerful bearish candlestick (like a long-bodied crimson candle) if the previous development was upward, and a powerful bullish candlestick (like a long-bodied inexperienced candle) if the previous development was downward. This reversal, coupled with excessive quantity, indicators a possible shift in market sentiment.

-

Affirmation: Whereas the nine-day sequence is the core of the sample, affirmation is crucial. This affirmation can are available varied types:

- Value Motion Affirmation: The worth motion within the days following the pivot day ought to ideally reinforce the reversal. For instance, if the sample signifies a bearish reversal, subsequent days ought to present decrease lows and decrease highs.

- Quantity Affirmation: Whereas the pivot day reveals a quantity spike, subsequent days ought to ideally present a lower in quantity, suggesting a possible exhaustion of the counter-trend transfer.

- Technical Indicators: Utilizing technical indicators like RSI (Relative Energy Index), MACD (Shifting Common Convergence Divergence), or Bollinger Bands can present further affirmation. Overbought or oversold situations on these indicators, coupled with the 91 Membership sample, can strengthen the sign.

Deciphering the 91 Membership Sample:

The interpretation of the 91 Membership sample is dependent upon the context of the broader market and the particular asset being analyzed.

-

Reversal Alerts: When the sample seems on the finish of a major uptrend, it typically suggests a possible bearish reversal. Conversely, showing on the finish of a downtrend, it will probably sign a possible bullish reversal. Nonetheless, it’s essential to keep in mind that the sample would not assure a reversal; it merely suggests a better chance of 1.

-

Continuation Alerts: In some instances, the 91 Membership sample can act as a continuation sign. That is very true if the sample happens throughout a powerful, established development. The excessive quantity on the pivot day would possibly symbolize a short lived pause or consolidation earlier than the development resumes. The next worth motion will assist differentiate between a reversal and a continuation.

Danger Administration and Buying and selling Methods:

Buying and selling based mostly on the 91 Membership sample requires cautious danger administration. Listed below are some key issues:

-

Place Sizing: By no means danger greater than a small proportion of your buying and selling capital on any single commerce. The 91 Membership sample, like another technical evaluation sample, isn’t foolproof.

-

Cease-Loss Orders: At all times use stop-loss orders to restrict potential losses. These orders ought to be positioned strategically, contemplating the sample’s context and potential help/resistance ranges.

-

Take-Revenue Orders: Equally, take-profit orders ought to be used to lock in earnings. The goal worth ought to be based mostly on the sample’s potential and the general market context.

-

False Alerts: The 91 Membership sample, like another buying and selling sign, is vulnerable to false indicators. It is essential to keep away from over-reliance on this sample and to make use of it along with different technical and basic evaluation methods.

-

Affirmation is Key: Relying solely on the 91 Membership sample with out affirmation from different indicators or worth motion can result in inaccurate buying and selling selections.

Superior Issues:

-

Quantity Evaluation: A deeper understanding of quantity evaluation is essential for decoding the 91 Membership sample successfully. Search for uncommon quantity spikes, quantity distribution, and the connection between worth and quantity.

-

Market Context: Contemplate the broader market situations. A sample which may sign a reversal in a bull market is perhaps a continuation sign in a bear market.

-

Timeframes: The 91 Membership sample will be utilized to numerous timeframes, from intraday to weekly charts. The interpretation would possibly differ relying on the timeframe used.

Conclusion:

The 91 Membership chart sample supplies a singular framework for figuring out potential reversals or continuations available in the market. Its concentrate on the interaction between worth and quantity makes it a worthwhile device for merchants. Nonetheless, it is essential to keep in mind that this isn’t a self-sufficient buying and selling system. Profitable implementation requires an intensive understanding of the sample, meticulous commentary, strong danger administration, and the mixing of different technical and basic evaluation methods. Whereas a easy PDF would possibly define the essential rules, mastering the 91 Membership sample requires diligent research, follow, and a disciplined method to buying and selling. Keep in mind, no buying and selling technique ensures earnings; constant success requires steady studying, adaptation, and a deep understanding of market dynamics.

![[ 100% Real ] 91 Club Chart Pdf Download 91 Club Colour Chart Pdf](https://91clubb.online/wp-content/uploads/2024/02/91-Club-Chart-Pdf-Download.png)

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the 91 Membership Chart Sample: A Complete Information. We hope you discover this text informative and useful. See you in our subsequent article!