Decoding The Apex Silver Spot Value Chart: A Complete Information

By admin / October 11, 2024 / No Comments / 2025

Decoding the Apex Silver Spot Value Chart: A Complete Information

Associated Articles: Decoding the Apex Silver Spot Value Chart: A Complete Information

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Decoding the Apex Silver Spot Value Chart: A Complete Information. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Decoding the Apex Silver Spot Value Chart: A Complete Information

The silver spot worth, a continually fluctuating worth reflecting the present market worth of bodily silver, is an important indicator for traders, merchants, and companies concerned within the valuable metals market. Understanding its motion, as depicted on charts just like the Apex Silver Spot Value Chart (or any comparable real-time chart), requires a grasp of varied financial, geopolitical, and market-specific elements. This text delves deep into decoding the Apex Silver Spot Value Chart, explaining its elements, influencing elements, and sensible functions for various stakeholders.

Understanding the Apex Silver Spot Value Chart (or Related Charts):

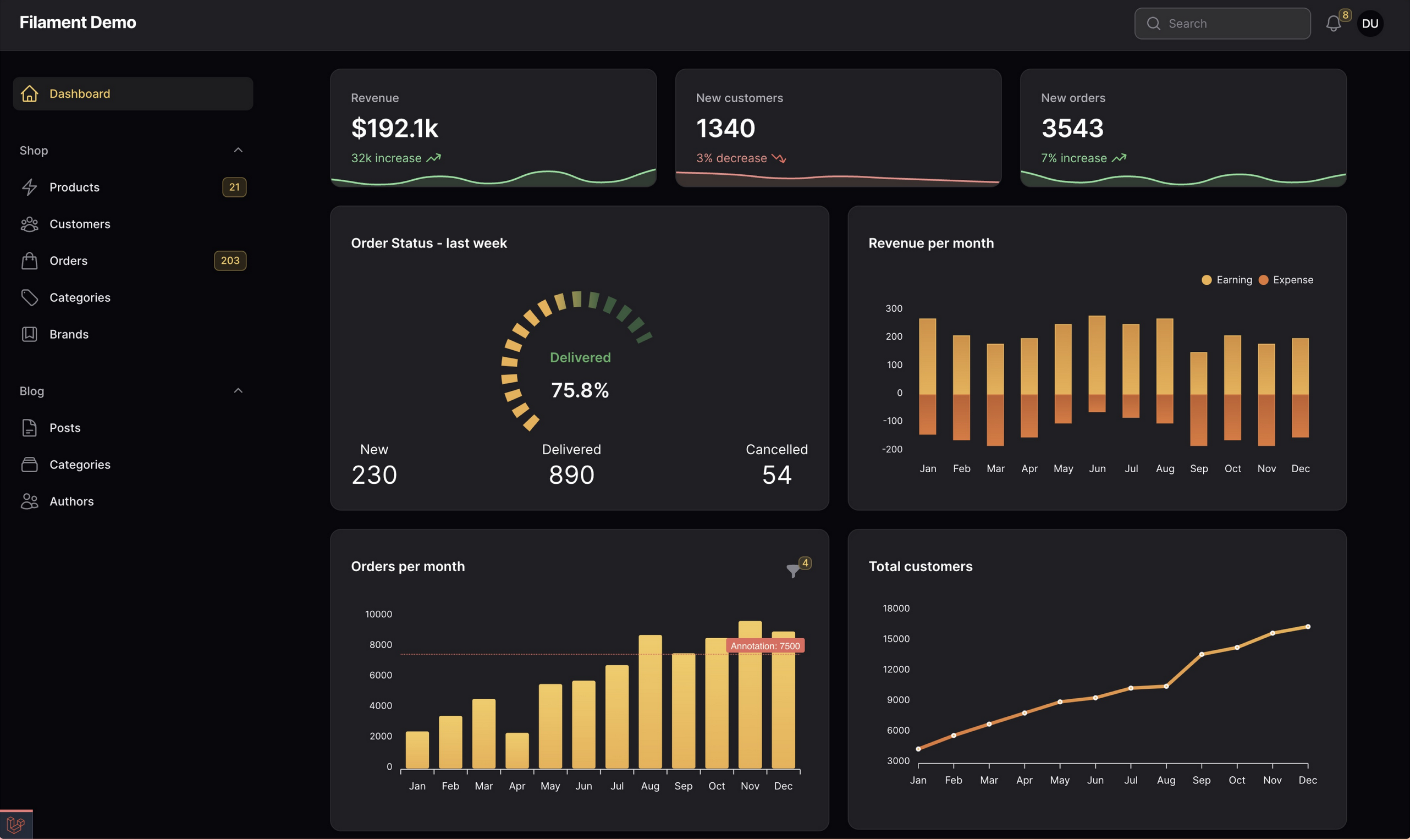

The Apex Silver Spot Value Chart, or any equal chart from a good supply like Bloomberg, Kitco, or Buying and selling Economics, visually represents the worth of silver over a selected timeframe. The chart sometimes shows:

- Value Axis (Y-axis): This vertical axis exhibits the worth of silver, normally expressed in US {dollars} per troy ounce (USD/oz).

- Time Axis (X-axis): This horizontal axis represents the time interval, starting from minutes to years, relying on the chart’s settings. Widespread timeframes embody intraday, each day, weekly, month-to-month, and yearly charts.

- Value Knowledge: The chart itself depicts the silver spot worth’s motion over time, usually utilizing a line graph to attach the worth factors. Candlestick charts are additionally widespread, providing further data on opening, closing, excessive, and low costs for every interval.

- Indicators (Non-obligatory): Many charts enable customers so as to add technical indicators like transferring averages (e.g., 50-day, 200-day), Relative Power Index (RSI), Bollinger Bands, and MACD, which assist establish tendencies, assist/resistance ranges, and potential purchase/promote alerts.

- Quantity (Non-obligatory): Some charts embody quantity information, indicating the quantity of silver traded at every worth level. Excessive quantity usually signifies stronger worth actions.

Elements Influencing the Apex Silver Spot Value Chart:

The silver spot worth is very dynamic, responding to a fancy interaction of things:

1. Provide and Demand: The elemental precept governing the worth of any commodity, together with silver, is the steadiness between provide and demand.

- Provide: Mining output, recycled silver, and authorities reserves considerably affect provide. Modifications in mining prices, technological developments in extraction, and geopolitical instability in mining areas can affect provide.

- Demand: Industrial demand (electronics, photo voltaic panels, images), funding demand (cash, bars, ETFs), and jewellery demand are key drivers. Financial development, technological developments, and investor sentiment closely affect demand.

2. US Greenback Power: Silver is priced in US {dollars}. A stronger greenback typically results in decrease silver costs (and vice versa) because it makes silver dearer for holders of different currencies.

3. Inflation and Curiosity Charges: Silver is commonly thought-about an inflation hedge. In periods of excessive inflation, traders are likely to flock to valuable metals like silver, pushing its worth increased. Conversely, rising rates of interest could make holding non-yielding belongings like silver much less enticing, doubtlessly placing downward strain on costs.

4. Geopolitical Occasions: Political instability, wars, and commerce disputes can create uncertainty available in the market, impacting investor confidence and main to cost volatility. Occasions affecting main silver-producing or consuming international locations can have vital impacts.

5. Investor Sentiment and Hypothesis: The silver market is vulnerable to speculative buying and selling. Information, rumors, and analyst predictions can set off vital worth swings, usually regardless of elementary elements. Giant institutional traders and hedge funds can exert appreciable affect.

6. Industrial Functions: Silver’s industrial functions are an important driver of demand. Development in sectors like electronics, photo voltaic vitality, and medical gadgets immediately impacts silver consumption and costs.

7. Authorities Insurance policies: Authorities rules, taxes, and subsidies associated to mining, buying and selling, and funding in silver can affect its worth. Modifications in financial coverage also can not directly have an effect on silver costs.

8. Seasonality: Whereas much less pronounced than in another commodities, silver costs can exhibit some seasonality, usually influenced by jewellery demand throughout festive durations.

Deciphering the Apex Silver Spot Value Chart for Completely different Stakeholders:

1. Buyers: Buyers use the chart to establish tendencies, assist and resistance ranges, and potential entry and exit factors. Technical evaluation instruments and indicators assist in making knowledgeable funding choices. Lengthy-term traders might give attention to broader tendencies, whereas short-term merchants would possibly consider intraday or weekly worth actions.

2. Merchants: Merchants make the most of the chart extensively, using varied technical evaluation strategies to foretell worth actions and revenue from short-term fluctuations. They could use leverage and derivatives to amplify their returns, however this additionally will increase threat.

3. Companies: Companies concerned in silver manufacturing, refining, or manufacturing use the chart to handle their stock, hedge in opposition to worth dangers, and make strategic choices concerning procurement and pricing. Hedging methods, like utilizing futures contracts, may help mitigate worth volatility.

4. Central Banks and Governments: Central banks and governments monitor the silver spot worth to grasp financial situations, handle their reserves, and formulate insurance policies associated to financial stability and inflation management.

Dangers and Limitations:

It is essential to acknowledge the inherent dangers related to decoding the Apex Silver Spot Value Chart:

- Volatility: Silver costs are notoriously risky, vulnerable to sudden and vital worth swings.

- Manipulation: The silver market, although comparatively giant, shouldn’t be proof against manipulation by giant gamers.

- Info Asymmetry: Entry to real-time data and market insights may be uneven, creating a bonus for some members.

- Technical Evaluation Limitations: Technical indicators aren’t foolproof and may generate false alerts. Elementary evaluation ought to complement technical evaluation for a extra holistic view.

Conclusion:

The Apex Silver Spot Value Chart is a robust software for understanding and navigating the dynamic silver market. Nevertheless, its efficient utilization requires a deep understanding of the elements influencing silver costs, a sound grasp of technical and elementary evaluation, and an consciousness of the inherent dangers concerned. By combining chart evaluation with thorough analysis and threat administration methods, traders, merchants, and companies can leverage the data offered by the chart to make knowledgeable choices and navigate the complexities of the silver market efficiently. Bear in mind to at all times depend on respected sources for real-time worth information and seek the advice of with monetary professionals earlier than making any vital funding choices.

Closure

Thus, we hope this text has offered invaluable insights into Decoding the Apex Silver Spot Value Chart: A Complete Information. We admire your consideration to our article. See you in our subsequent article!