Decoding The AUD/USD Reside Chart: A Complete Information For Foreign exchange Merchants

By admin / August 18, 2024 / No Comments / 2025

Decoding the AUD/USD Reside Chart: A Complete Information for Foreign exchange Merchants

Associated Articles: Decoding the AUD/USD Reside Chart: A Complete Information for Foreign exchange Merchants

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Decoding the AUD/USD Reside Chart: A Complete Information for Foreign exchange Merchants. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Decoding the AUD/USD Reside Chart: A Complete Information for Foreign exchange Merchants

The Australian greenback (AUD) versus the US greenback (USD), or AUD/USD, is a significant forex pair within the foreign exchange market, recognized for its excessive volatility and liquidity. Understanding the reside AUD/USD chart is essential for merchants seeking to revenue from its worth fluctuations. This text will present a complete overview of the AUD/USD pair, its influencing components, chart evaluation methods, and techniques for profitable buying and selling.

Understanding the AUD/USD Pair

The AUD/USD represents the change fee between the Australian greenback and the US greenback. A quote of 0.7000 implies that one US greenback should buy 0.70 Australian {dollars}. The AUD is taken into account a commodity forex, that means its worth is intently tied to the efficiency of Australia’s commodity exports, primarily iron ore, gold, and coal. The USD, however, is a safe-haven forex, that means traders are likely to flock to it throughout occasions of financial uncertainty.

This inherent relationship between a commodity forex and a safe-haven forex makes the AUD/USD pair notably delicate to international financial occasions. Elements impacting the AUD embrace:

- Commodity Costs: Fluctuations in international commodity costs instantly influence the AUD’s worth. Larger commodity costs usually strengthen the AUD, whereas decrease costs weaken it.

- Curiosity Fee Differentials: The Reserve Financial institution of Australia (RBA) and the Federal Reserve (Fed) affect the AUD/USD via their financial insurance policies. Larger rates of interest in Australia relative to the US have a tendency to draw international funding, strengthening the AUD.

- Financial Knowledge Releases: Key financial indicators from each Australia and the US, akin to GDP progress, inflation, employment knowledge, and shopper confidence, considerably influence the AUD/USD. Optimistic knowledge usually boosts the forex, whereas adverse knowledge weakens it.

- Geopolitical Occasions: International political occasions, akin to commerce wars, political instability, and pure disasters, can considerably have an effect on the AUD/USD. Uncertainty usually results in a flight to security, weakening the AUD.

- Market Sentiment: General market sentiment performs an important function. Optimism concerning the Australian financial system or international progress can strengthen the AUD, whereas pessimism can weaken it.

Analyzing the AUD/USD Reside Chart

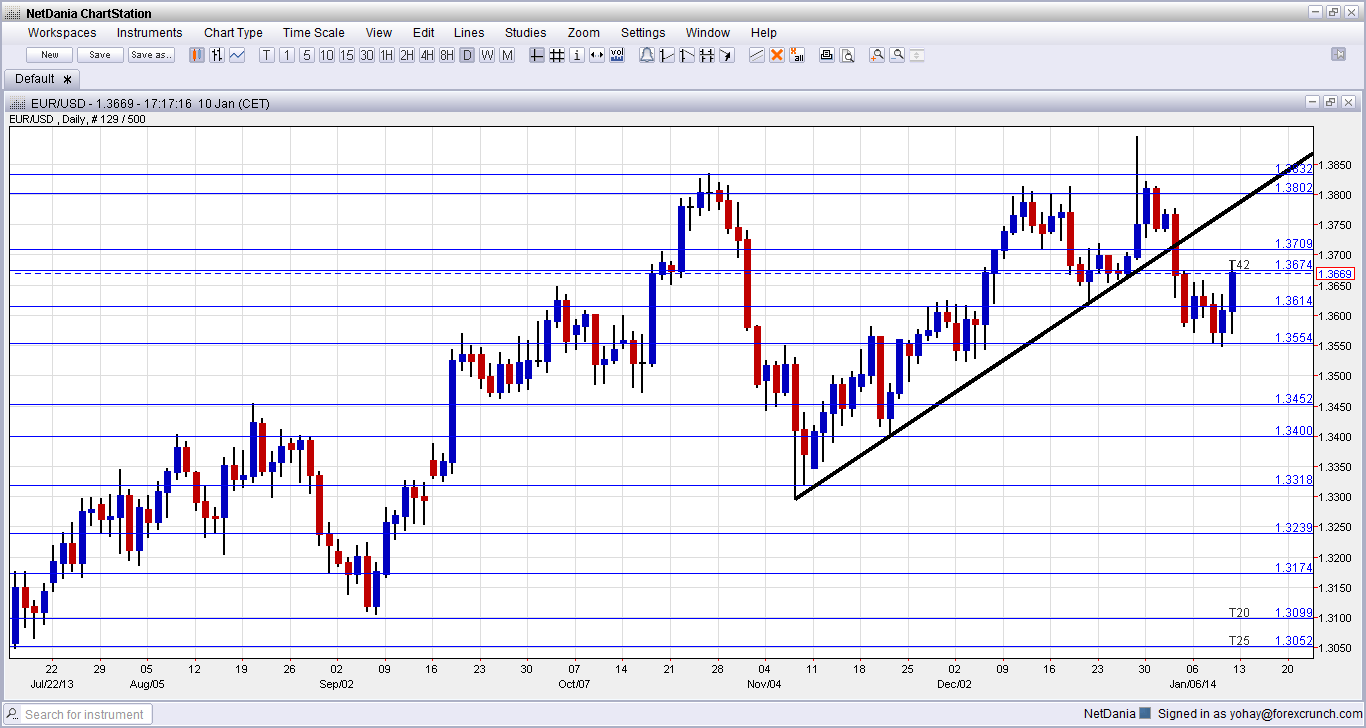

The reside AUD/USD chart offers a real-time illustration of the pair’s worth actions. Efficient chart evaluation entails utilizing numerous technical indicators and instruments to establish potential buying and selling alternatives. Generally used methods embrace:

-

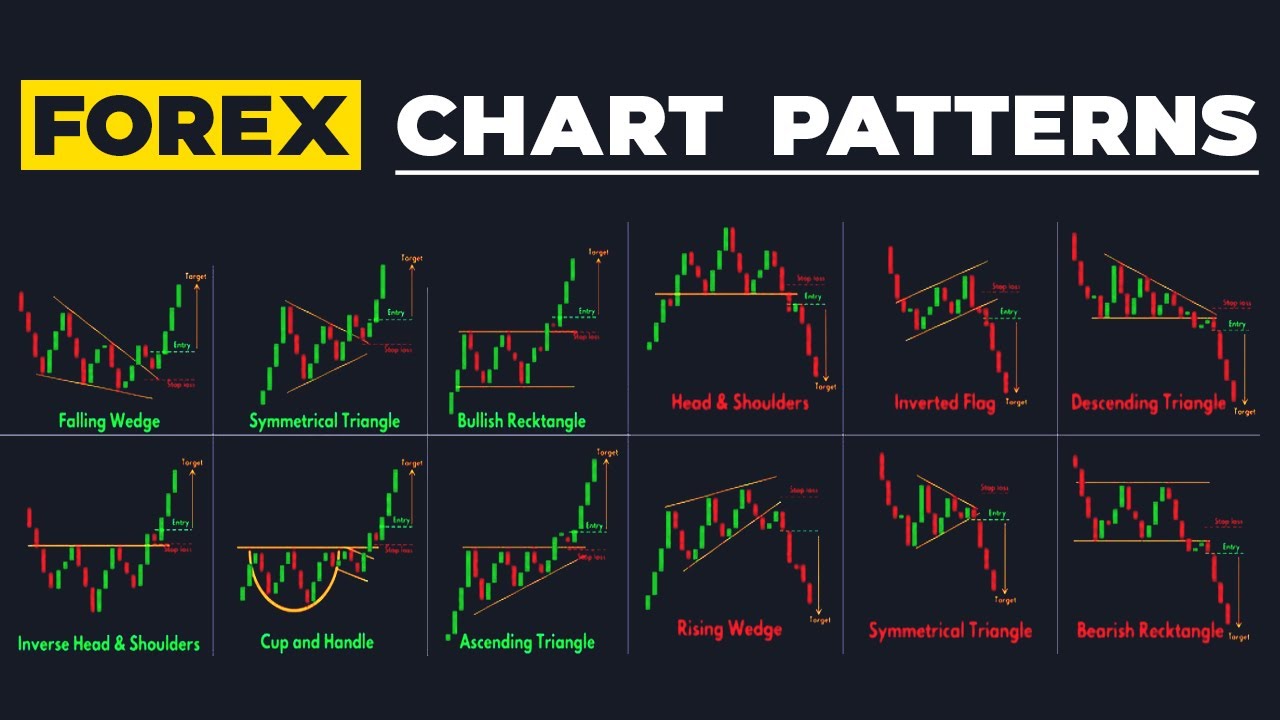

Worth Motion Evaluation: This entails finding out the value actions themselves, in search of patterns like candlestick formations (e.g., hammer, engulfing patterns), assist and resistance ranges, and trendlines. Understanding worth motion offers insights into the market’s momentum and potential future worth actions.

-

Technical Indicators: Quite a few technical indicators could be overlaid on the chart to supply extra insights. Fashionable indicators embrace:

- Transferring Averages (MA): MAs easy out worth fluctuations, serving to establish traits and potential reversal factors. Generally used MAs are easy transferring averages (SMA) and exponential transferring averages (EMA).

- Relative Power Index (RSI): The RSI measures the magnitude of current worth modifications to judge overbought or oversold circumstances. Readings above 70 are usually thought of overbought, whereas readings beneath 30 are thought of oversold.

- MACD (Transferring Common Convergence Divergence): The MACD identifies modifications in momentum by evaluating two transferring averages. Crossovers of the MACD strains can sign potential purchase or promote alternatives.

- Bollinger Bands: Bollinger Bands measure volatility and potential worth reversals. Worth actions outdoors the bands usually point out overbought or oversold circumstances.

-

Help and Resistance Ranges: Help ranges characterize worth factors the place the value is more likely to discover shopping for stress, whereas resistance ranges characterize worth factors the place the value is more likely to discover promoting stress. These ranges could be recognized utilizing earlier worth highs and lows, or via technical indicators.

-

Trendlines: Trendlines join a sequence of worth highs or lows to visually characterize the prevailing pattern. Breakouts from trendlines can sign vital worth actions.

Buying and selling Methods for the AUD/USD

A number of buying and selling methods could be employed when buying and selling the AUD/USD, relying on the dealer’s danger tolerance, buying and selling model, and market outlook. Some widespread methods embrace:

-

Pattern Following: This technique entails figuring out the prevailing pattern (uptrend or downtrend) and putting trades within the route of the pattern. Technical indicators like transferring averages and trendlines can be utilized to establish the pattern.

-

Imply Reversion: This technique entails figuring out overbought or oversold circumstances and anticipating a worth reversal again in the direction of the typical. Indicators like RSI and Bollinger Bands can be utilized to establish these circumstances.

-

Scalping: Scalping entails benefiting from small worth actions inside a brief timeframe. This technique requires fast decision-making and a excessive stage of market consciousness.

-

Swing Buying and selling: Swing buying and selling entails holding positions for a number of days or perhaps weeks, aiming to seize bigger worth swings. This technique requires an intensive understanding of elementary and technical evaluation.

-

Information Buying and selling: Information buying and selling entails anticipating worth actions based mostly on the discharge of financial knowledge or different information occasions. This technique requires a deep understanding of the components influencing the AUD/USD and the power to interpret information releases rapidly and precisely.

Threat Administration in AUD/USD Buying and selling

Efficient danger administration is essential for profitable AUD/USD buying and selling. Key points of danger administration embrace:

-

Place Sizing: Figuring out the suitable quantity to spend money on every commerce based mostly in your general buying and selling capital. By no means danger greater than a small proportion of your capital on any single commerce.

-

Cease-Loss Orders: Setting stop-loss orders to restrict potential losses if the commerce strikes towards you. Cease-loss orders routinely shut your place when the value reaches a predetermined stage.

-

Take-Revenue Orders: Setting take-profit orders to lock in income when the commerce reaches a predetermined stage. Take-profit orders routinely shut your place when the value reaches a predetermined stage.

-

Diversification: Diversifying your portfolio by buying and selling a number of forex pairs or asset courses to scale back general danger.

Conclusion

The AUD/USD reside chart is a dynamic and complicated panorama providing each vital alternatives and appreciable dangers. Success in buying and selling this pair requires an intensive understanding of the underlying components influencing its worth actions, proficient chart evaluation abilities, and disciplined danger administration. By combining technical evaluation, elementary evaluation, and a sturdy danger administration technique, merchants can enhance their probabilities of reaching profitability within the risky but profitable world of AUD/USD buying and selling. Keep in mind that foreign currency trading entails substantial danger, and it is essential to conduct thorough analysis and take into account in search of recommendation from a professional monetary advisor earlier than partaking in any buying and selling exercise. At all times apply accountable buying and selling and by no means make investments greater than you’ll be able to afford to lose.

Closure

Thus, we hope this text has offered beneficial insights into Decoding the AUD/USD Reside Chart: A Complete Information for Foreign exchange Merchants. We thanks for taking the time to learn this text. See you in our subsequent article!