Decoding The Bajaj Allianz Life Insurance coverage Share Value Chart: A Complete Evaluation

By admin / July 12, 2024 / No Comments / 2025

Decoding the Bajaj Allianz Life Insurance coverage Share Value Chart: A Complete Evaluation

Associated Articles: Decoding the Bajaj Allianz Life Insurance coverage Share Value Chart: A Complete Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Bajaj Allianz Life Insurance coverage Share Value Chart: A Complete Evaluation. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Decoding the Bajaj Allianz Life Insurance coverage Share Value Chart: A Complete Evaluation

Bajaj Allianz Life Insurance coverage, a three way partnership between Bajaj Finserv and Allianz SE, is a distinguished participant in India’s quickly rising life insurance coverage sector. Understanding its share value chart requires analyzing varied elements, from its monetary efficiency and market positioning to broader financial circumstances and investor sentiment. This text delves deep into the intricacies of the Bajaj Allianz Life Insurance coverage share value chart, offering a complete overview and insightful evaluation. Notice that because of the dynamic nature of the inventory market, the evaluation introduced right here is predicated on data accessible on the time of writing and shouldn’t be thought-about monetary recommendation.

Understanding the Chart’s Elements:

Earlier than analyzing the Bajaj Allianz share value chart, it is essential to know its key parts:

- Value Axis (Y-axis): Represents the share value at totally different closing dates. Fluctuations on this axis replicate the market’s valuation of the corporate.

- Time Axis (X-axis): Represents the timeframe, usually displayed in days, weeks, months, or years. It permits monitoring value actions over a selected interval.

- Candlesticks/Line Graph: These visible representations illustrate value actions inside a particular time interval. Candlesticks present the opening, closing, excessive, and low costs, whereas line graphs merely join closing costs.

- Transferring Averages (MA): These are calculated averages of the share value over a particular interval (e.g., 50-day MA, 200-day MA). They clean out short-term value fluctuations and assist determine traits.

- Quantity: Signifies the variety of shares traded throughout a particular interval. Excessive quantity typically accompanies vital value actions.

- Indicators: Technical indicators like Relative Energy Index (RSI), Transferring Common Convergence Divergence (MACD), and Bollinger Bands present further insights into value momentum, development energy, and potential reversals.

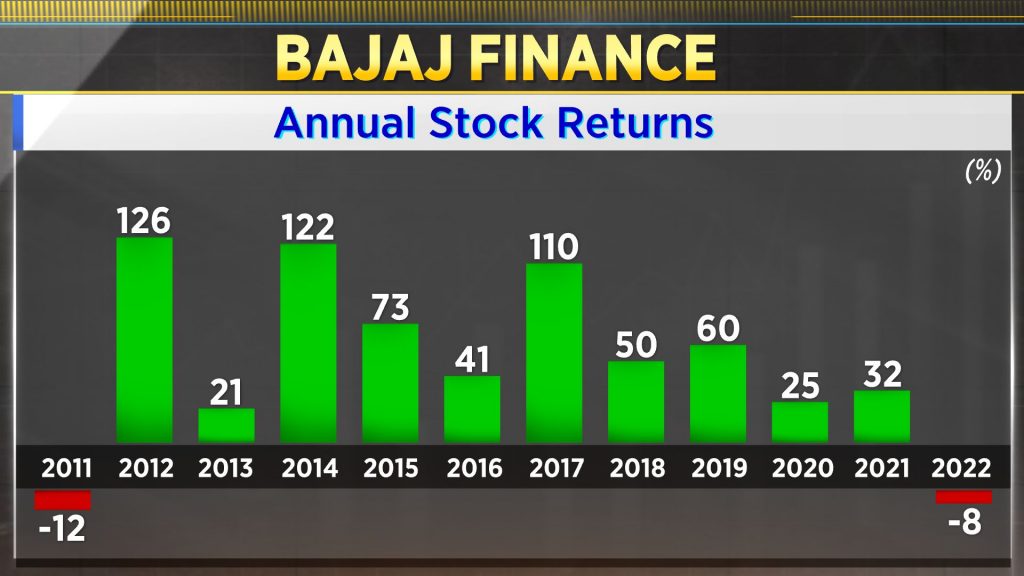

Analyzing Historic Efficiency:

An in depth evaluation of the Bajaj Allianz share value chart requires analyzing its historic efficiency throughout totally different timeframes:

- Quick-Time period (Days/Weeks): Quick-term actions are influenced by elements like information occasions, market sentiment, and short-term buying and selling methods. Analyzing each day or weekly charts may help determine short-term buying and selling alternatives, however it’s essential to concentrate on the upper threat concerned.

- Medium-Time period (Months): Medium-term charts reveal broader traits and patterns. Analyzing month-to-month knowledge permits for a extra complete understanding of the corporate’s efficiency in relation to its quarterly earnings bulletins, seasonal elements, and market cycles.

- Lengthy-Time period (Years): Lengthy-term charts present a perspective on the corporate’s total progress trajectory. This evaluation helps determine main traits, long-term funding alternatives, and the general well being and sustainability of the enterprise.

Components Influencing Bajaj Allianz Share Value:

A number of elements considerably affect the Bajaj Allianz share value:

- Monetary Efficiency: The corporate’s monetary well being, together with its premium progress, declare ratios, expense ratios, and profitability, instantly influences investor confidence and share value. Robust monetary outcomes usually result in greater share costs.

- Market Share and Competitors: The corporate’s market share throughout the life insurance coverage sector is a key indicator of its aggressive energy. Elevated market share and aggressive benefits usually translate to raised monetary efficiency and the next share value.

- Regulatory Surroundings: Modifications in authorities rules associated to the insurance coverage sector can considerably affect the corporate’s operations and profitability, consequently affecting the share value.

- Financial Situations: Broader financial elements, akin to rates of interest, inflation, and GDP progress, affect client spending and investor sentiment, which in flip impacts the insurance coverage sector and the share value.

- Investor Sentiment: Market sentiment performs an important position. Constructive information and investor confidence result in greater demand and elevated share costs, whereas detrimental information or uncertainty can set off sell-offs.

- Business Developments: Developments throughout the insurance coverage sector, such because the adoption of expertise, digitalization, and altering client preferences, affect the corporate’s strategic path and profitability.

Decoding Chart Patterns:

Analyzing the Bajaj Allianz share value chart includes figuring out and decoding varied chart patterns:

- Developments: Figuring out uptrends (sustained value will increase), downtrends (sustained value decreases), and sideways traits (consolidation durations) is essential for understanding the general path of the value.

- Help and Resistance Ranges: These are value ranges the place the value has traditionally struggled to interrupt via. Help ranges act as potential shopping for alternatives, whereas resistance ranges characterize potential promoting alternatives.

- Breakouts: A breakout happens when the value decisively breaks via a help or resistance degree, typically signaling a continuation of the development.

- Reversals: Reversal patterns counsel a possible change within the prevailing development. Figuring out these patterns may help buyers anticipate value actions.

Using Technical Indicators:

Technical indicators present further insights into the Bajaj Allianz share value chart:

- Transferring Averages: Transferring averages assist clean out value fluctuations and determine traits. Crossovers between totally different transferring averages (e.g., 50-day MA crossing above 200-day MA) can sign potential purchase or promote indicators.

- RSI (Relative Energy Index): RSI measures the magnitude of current value adjustments to judge overbought or oversold circumstances. RSI values above 70 typically counsel an overbought situation, whereas values beneath 30 counsel an oversold situation.

- MACD (Transferring Common Convergence Divergence): MACD identifies adjustments in momentum by evaluating two transferring averages. Crossovers and divergences can sign potential development adjustments.

- Bollinger Bands: Bollinger Bands measure value volatility and may help determine potential reversals. Value actions outdoors the bands typically counsel overbought or oversold circumstances.

Disclaimer:

This evaluation gives a normal overview of the Bajaj Allianz share value chart and its influencing elements. It’s not meant as monetary recommendation. Investing within the inventory market includes inherent dangers, and previous efficiency doesn’t assure future outcomes. Earlier than making any funding selections, it’s essential to conduct thorough analysis, seek the advice of with a certified monetary advisor, and perceive your personal threat tolerance. The data introduced right here is predicated on publicly accessible knowledge and should not replicate probably the most up-to-date market circumstances. All the time depend on probably the most present data when making funding selections.

Closure

Thus, we hope this text has supplied helpful insights into Decoding the Bajaj Allianz Life Insurance coverage Share Value Chart: A Complete Evaluation. We hope you discover this text informative and helpful. See you in our subsequent article!