Decoding The Bangladesh Inventory Market Chart: A 20-Yr Retrospective And Future Outlook

By admin / October 31, 2024 / No Comments / 2025

Decoding the Bangladesh Inventory Market Chart: A 20-Yr Retrospective and Future Outlook

Associated Articles: Decoding the Bangladesh Inventory Market Chart: A 20-Yr Retrospective and Future Outlook

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the Bangladesh Inventory Market Chart: A 20-Yr Retrospective and Future Outlook. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Decoding the Bangladesh Inventory Market Chart: A 20-Yr Retrospective and Future Outlook

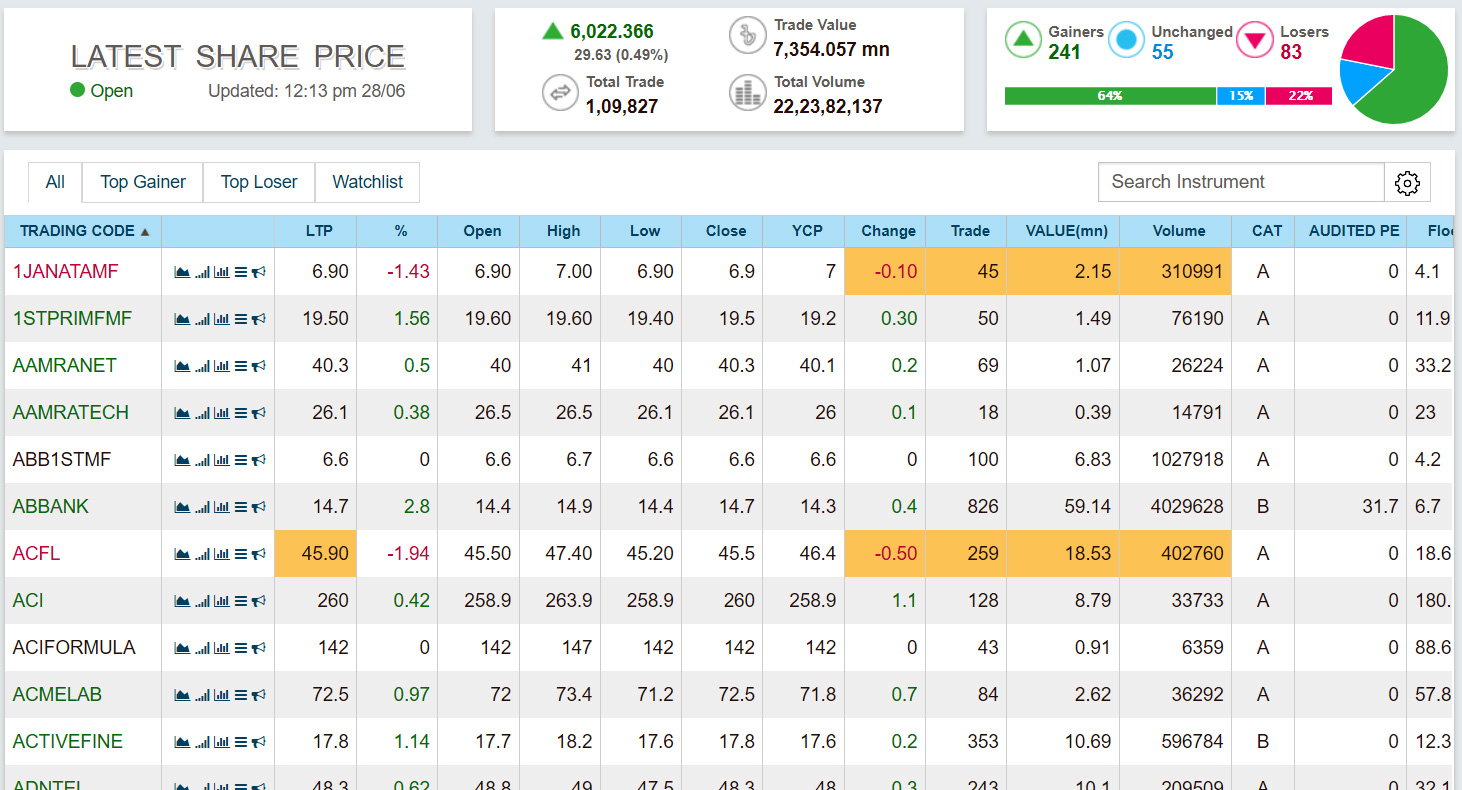

The Bangladesh inventory market, represented primarily by the Dhaka Inventory Change (DSE) and the Chittagong Inventory Change (CSE), has skilled a rollercoaster journey over the previous 20 years. Its trajectory displays the nation’s financial development, political stability, and world market influences. Analyzing the chart reveals a posh interaction of bullish and bearish traits, providing useful insights into funding methods and future potential. This text will delve into an in depth evaluation of the Bangladesh inventory market chart, analyzing key intervals, influencing components, and potential future situations.

Early 2000s: A Interval of Consolidation and Gradual Development:

The early 2000s witnessed a comparatively gradual and regular development within the DSE Normal Index (DSEX), the benchmark index of the Dhaka Inventory Change. This era was characterised by cautious investor sentiment, influenced by political instability and issues about financial reforms. The market lacked the depth and liquidity seen in additional developed markets, resulting in unstable swings primarily based on restricted buying and selling quantity. A number of components contributed to this subdued development:

- Restricted Overseas Funding: Overseas institutional buyers had been hesitant to enter the market on account of perceived regulatory hurdles and political dangers.

- Lack of Transparency and Regulatory Framework: The regulatory framework was nonetheless evolving, with issues about company governance and transparency impacting investor confidence.

- Financial Challenges: Bangladesh was nonetheless grappling with poverty and infrastructure limitations, hindering its total financial development and, consequently, the inventory market’s efficiency.

Regardless of these challenges, the market confirmed indicators of resilience. Sure sectors, just like the ready-made garment (RMG) trade, started to carry out nicely, reflecting the nation’s rising export prowess. This era highlights the significance of understanding the underlying financial components that affect inventory market efficiency. A cautious evaluation of macroeconomic indicators, similar to GDP development, inflation, and overseas alternate reserves, is essential for decoding the market’s trajectory throughout this part.

Mid-2000s to Early 2010s: A Bull Run Interrupted by World Crises:

The mid-2000s marked a major turning level. A surge in investor confidence, fueled by bettering financial fundamentals and authorities initiatives to spice up the capital market, led to a considerable bull run. The DSEX skilled vital beneficial properties, attracting each home and, to a restricted extent, overseas buyers. A number of components contributed to this development spurt:

- Financial Development: Bangladesh’s economic system skilled sturdy development, pushed by the RMG sector and different rising industries.

- Authorities Initiatives: The federal government carried out varied insurance policies to advertise the inventory market, together with enhancements to the regulatory framework and infrastructure.

- Elevated Investor Participation: Rising consciousness about inventory market funding led to elevated participation from retail buyers.

Nonetheless, this bull run was interrupted by the worldwide monetary disaster of 2008. The disaster triggered a pointy correction out there, mirroring the worldwide downturn. The influence was amplified by the comparatively underdeveloped nature of the Bangladesh market, resulting in heightened volatility. This era underscores the interconnectedness of world and home markets, highlighting the vulnerability of rising markets to exterior shocks. The restoration from the 2008 disaster was gradual, emphasizing the necessity for sturdy danger administration methods in unstable market situations.

2010s to Current: A Interval of Volatility and Development with Rising Challenges:

The 2010s witnessed a interval of fluctuating development, punctuated by intervals of each vital beneficial properties and sharp corrections. Whereas the market displayed resilience and continued development in the long run, a number of components contributed to the volatility:

- Political Uncertainty: Political occasions and instability often impacted investor sentiment, resulting in market corrections.

- Regulatory Adjustments: Adjustments in regulatory insurance policies and enforcement typically created uncertainty out there.

- World Financial Fluctuations: World financial occasions, together with the European debt disaster and the COVID-19 pandemic, influenced the market’s efficiency.

- Rise of IPOs: A surge in Preliminary Public Choices (IPOs) injected each new capital and volatility into the market, with some firms experiencing vital development whereas others underperformed.

- Elevated use of know-how: The introduction of on-line buying and selling platforms and larger use of know-how elevated accessibility to the market and contributed to elevated volatility at occasions.

The COVID-19 pandemic initially induced a major market downturn, however a swift restoration adopted, pushed by authorities stimulus packages and a rebound in financial exercise. Nonetheless, inflation and rising rates of interest have offered new challenges in recent times.

Analyzing the Chart: Key Indicators and Technical Evaluation:

Analyzing the Bangladesh inventory market chart requires contemplating varied indicators:

- DSEX (Dhaka Inventory Change Normal Index): The first benchmark index, reflecting the general efficiency of the market.

- Buying and selling Quantity: Signifies investor exercise and market liquidity. Excessive quantity typically suggests stronger traits.

- Market Breadth: The ratio of advancing to declining shares, indicating the general market sentiment.

- Value-to-Earnings Ratio (P/E): A valuation metric that compares an organization’s inventory value to its earnings per share.

Technical evaluation instruments, similar to shifting averages, relative power index (RSI), and help and resistance ranges, will help determine potential traits and buying and selling alternatives. Nonetheless, technical evaluation needs to be used along with elementary evaluation to realize a complete understanding of the market.

Future Outlook: Alternatives and Challenges:

The way forward for the Bangladesh inventory market presents each alternatives and challenges. Continued financial development, infrastructure growth, and authorities help are optimistic components. Nonetheless, challenges stay:

- Regulatory enhancements: Additional strengthening of the regulatory framework is crucial to reinforce investor confidence and appeal to overseas funding.

- Company governance: Improved company governance practices are essential to make sure transparency and accountability.

- Infrastructure growth: Continued funding in market infrastructure, together with know-how upgrades, is important to reinforce effectivity and liquidity.

- World financial uncertainty: The influence of world financial fluctuations must be fastidiously thought of.

- Inflation and rates of interest: Managing inflation and rate of interest fluctuations shall be essential for sustaining market stability.

Conclusion:

The Bangladesh inventory market chart tells a narrative of development, resilience, and volatility. Whereas challenges stay, the long-term outlook seems optimistic, pushed by the nation’s financial progress and potential. Buyers have to undertake a long-term perspective, conduct thorough analysis, and diversify their portfolios to navigate the market’s complexities and capitalize on the alternatives it presents. Understanding the historic context, analyzing key indicators, and contemplating each elementary and technical components are essential for making knowledgeable funding selections within the dynamic Bangladesh inventory market. Common monitoring of macroeconomic indicators and political developments will stay important for profitable navigation of this evolving market.

![]()

Closure

Thus, we hope this text has supplied useful insights into Decoding the Bangladesh Inventory Market Chart: A 20-Yr Retrospective and Future Outlook. We recognize your consideration to our article. See you in our subsequent article!