Decoding The Blueprint: A Complete Information To Pattern Enterprise Chart Of Accounts

By admin / May 31, 2024 / No Comments / 2025

Decoding the Blueprint: A Complete Information to Pattern Enterprise Chart of Accounts

Associated Articles: Decoding the Blueprint: A Complete Information to Pattern Enterprise Chart of Accounts

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Decoding the Blueprint: A Complete Information to Pattern Enterprise Chart of Accounts. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Decoding the Blueprint: A Complete Information to Pattern Enterprise Chart of Accounts

A chart of accounts (COA) is the spine of any profitable enterprise’s monetary administration. It is a structured listing of all of the accounts utilized by an organization to file its monetary transactions. Consider it as an in depth blueprint of your monetary life, guiding the way you categorize and monitor each penny earned and spent. With out a well-organized COA, monetary reporting turns into a chaotic mess, hindering correct monetary evaluation, decision-making, and tax compliance. This text explores the intricacies of a pattern enterprise chart of accounts, offering a complete understanding of its construction, widespread account sorts, and greatest practices for implementation.

Understanding the Construction of a Chart of Accounts

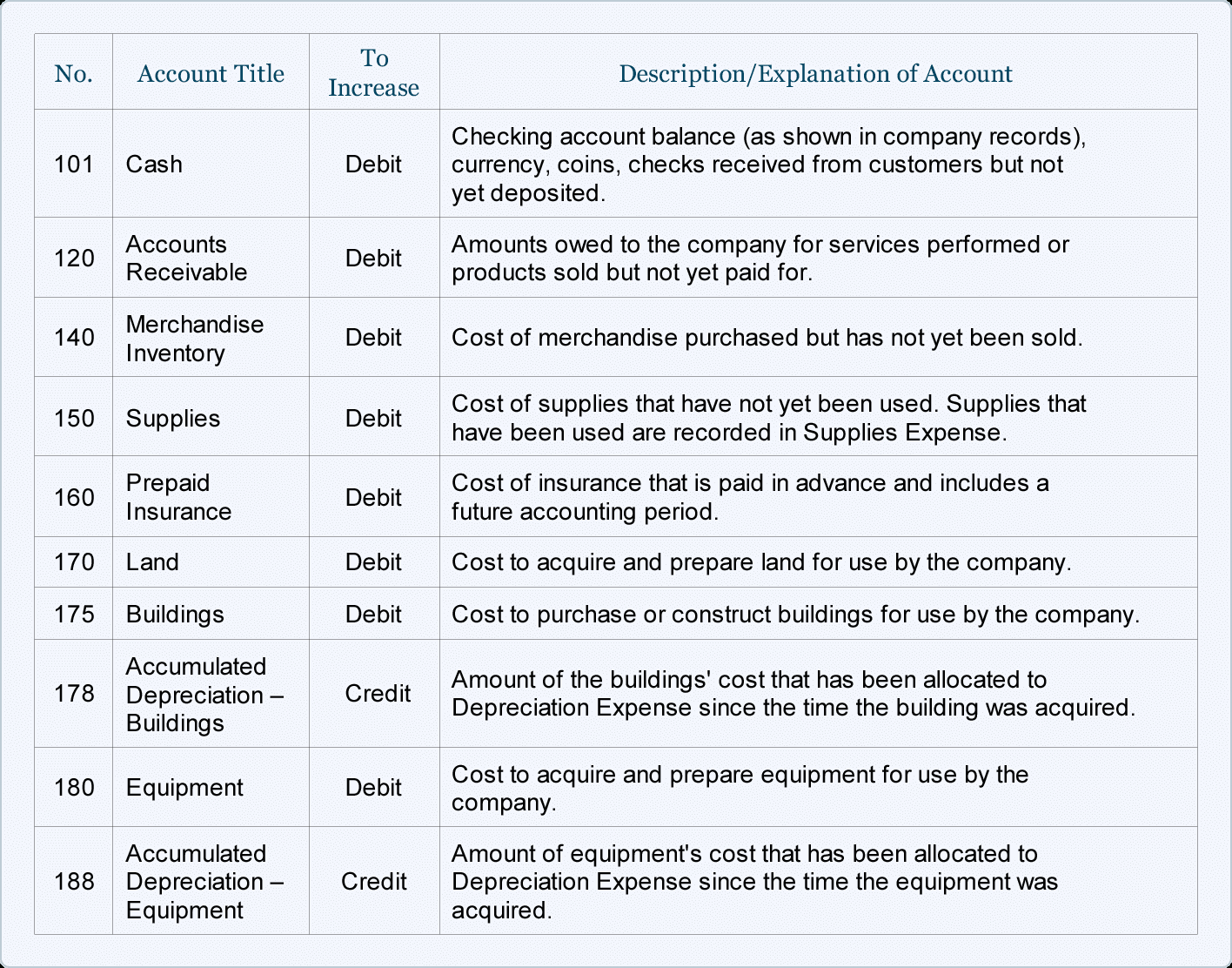

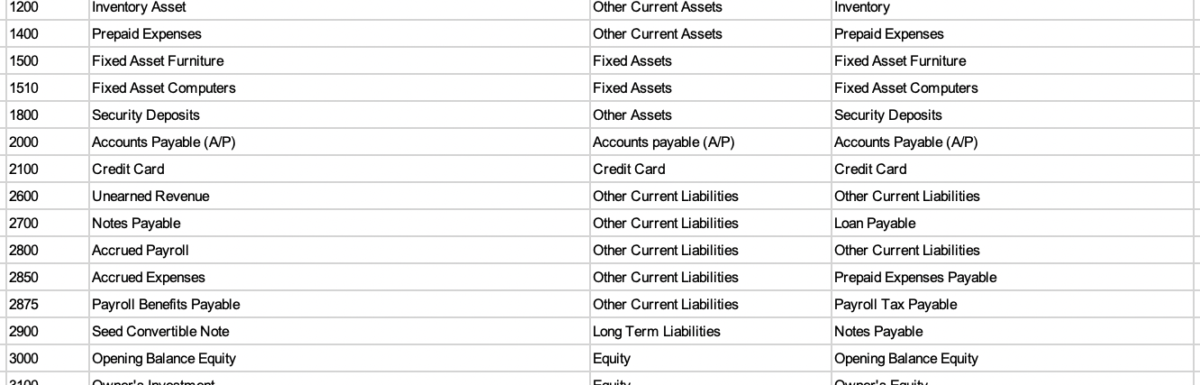

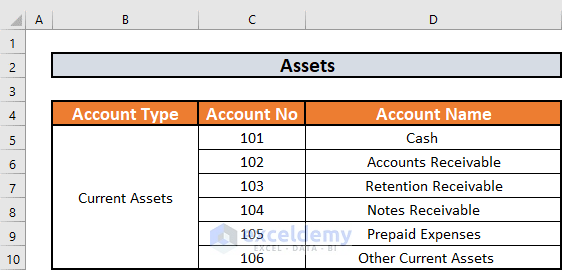

A chart of accounts usually follows a hierarchical construction, categorizing accounts into broader teams after which additional subdividing them for higher specificity. This hierarchical association permits for a transparent and arranged view of an organization’s monetary actions. The commonest construction employs a numbering system, typically utilizing a multi-digit code to symbolize every account. This method permits for growth and modification because the enterprise grows and its monetary actions develop into extra advanced.

A typical construction may appear like this:

- Property (1000-1999): These are assets owned by the corporate that present future financial profit.

- Liabilities (2000-2999): These are obligations the corporate owes to others.

- Fairness (3000-3999): This represents the homeowners’ stake within the firm.

- Revenues (4000-4999): Revenue generated from the corporate’s core operations.

- Bills (5000-5999): Prices incurred in producing income.

A Pattern Chart of Accounts: A Small Retail Enterprise

Let’s think about a small retail enterprise, "The Cozy Nook," promoting handcrafted dwelling items. Beneath is a pattern chart of accounts tailor-made to their wants. It is a simplified instance, and a real-world COA would seemingly be extra intensive.

I. Property (1000-1999)

- 1000 Money: Cash available and in financial institution accounts.

- 1100 Accounts Receivable: Cash owed to the enterprise by prospects.

- 1200 Stock: The worth of products out there on the market.

- 1300 Pay as you go Bills: Bills paid prematurely (e.g., insurance coverage).

- 1400 Property, Plant, and Gear (PP&E): Tangible property utilized in enterprise operations (e.g., retailer fixtures, gear).

- 1500 Collected Depreciation: The accrued depreciation of PP&E.

II. Liabilities (2000-2999)

- 2000 Accounts Payable: Cash owed by the enterprise to suppliers.

- 2100 Salaries Payable: Unpaid salaries owed to workers.

- 2200 Loans Payable: Excellent mortgage balances.

- 2300 Utilities Payable: Unpaid utility payments.

III. Fairness (3000-3999)

- 3000 Proprietor’s Fairness: The proprietor’s funding within the enterprise.

- 3100 Retained Earnings: Collected earnings reinvested within the enterprise.

IV. Revenues (4000-4999)

- 4000 Gross sales Income: Income from the sale of products.

- 4100 Different Income: Income from sources apart from core operations (e.g., rental earnings).

V. Bills (5000-5999)

- 5000 Value of Items Offered (COGS): Direct prices related to producing items bought.

- 5100 Lease Expense: Lease funds for the enterprise premises.

- 5200 Salaries Expense: Salaries paid to workers.

- 5300 Utilities Expense: Electrical energy, water, and different utility prices.

- 5400 Advertising Expense: Prices related to selling the enterprise.

- 5500 Insurance coverage Expense: Insurance coverage premiums.

- 5600 Depreciation Expense: Depreciation of PP&E.

- 5700 Provides Expense: Prices of workplace and different provides.

Sub-Accounts and Element:

The above instance offers a fundamental framework. Every account will be additional subdivided to supply higher element. For instance, "Stock" (1200) might be damaged down into sub-accounts for various product classes (e.g., 1210 Candles, 1220 Diffusers, 1230 Residence Decor). Equally, "Advertising Expense" (5400) might embrace sub-accounts for internet marketing, print promoting, and social media advertising and marketing. This stage of element is essential for correct monetary evaluation and reporting.

Greatest Practices for Implementing a Chart of Accounts

- Select a constant and logical numbering system: This ensures straightforward identification and group of accounts.

- Use descriptive account names: Ensure that account names clearly mirror the character of the transactions they symbolize.

- Preserve consistency: As soon as established, persist with the COA as a lot as attainable to make sure information integrity.

- Recurrently evaluate and replace: Because the enterprise grows and evolves, the COA could must be up to date to mirror modifications in operations and monetary actions.

- Think about using accounting software program: Accounting software program automates many points of economic administration, together with the creation and upkeep of a chart of accounts.

Conclusion:

A well-designed chart of accounts is a important part of any profitable enterprise. It offers a structured framework for recording and monitoring monetary transactions, facilitating correct monetary reporting, evaluation, and decision-making. Whereas the particular accounts wanted will range relying on the character and dimension of the enterprise, the elemental ideas stay the identical: a logical construction, clear and descriptive account names, and constant utility. By fastidiously contemplating the wants of their enterprise and following greatest practices, corporations can create a COA that serves as a helpful instrument for monetary success. Bear in mind, this pattern COA is a place to begin; adapting it to your particular enterprise necessities is essential for correct and significant monetary reporting. Seek the advice of with an accountant or monetary skilled to make sure your COA is tailor-made to your distinctive circumstances.

Closure

Thus, we hope this text has supplied helpful insights into Decoding the Blueprint: A Complete Information to Pattern Enterprise Chart of Accounts. We thanks for taking the time to learn this text. See you in our subsequent article!