Decoding The Bricks: A Complete Information To Renko Chart Buying and selling Technique

By admin / June 14, 2024 / No Comments / 2025

Decoding the Bricks: A Complete Information to Renko Chart Buying and selling Technique

Associated Articles: Decoding the Bricks: A Complete Information to Renko Chart Buying and selling Technique

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Decoding the Bricks: A Complete Information to Renko Chart Buying and selling Technique. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Decoding the Bricks: A Complete Information to Renko Chart Buying and selling Technique

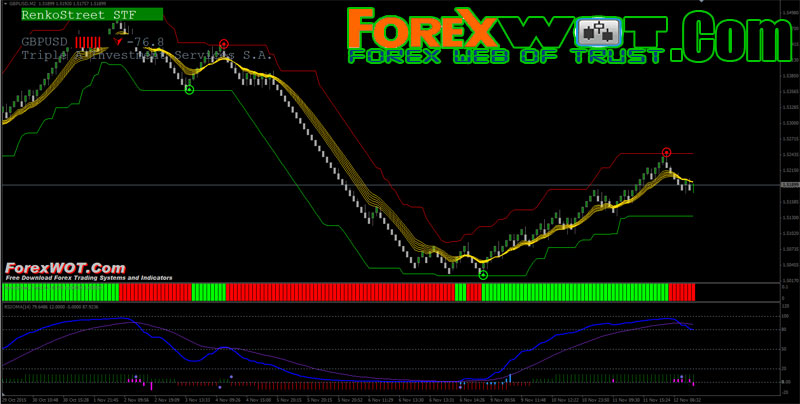

Renko charts, derived from the Japanese phrase "renga" which means "brick," supply a singular perspective on worth motion, filtering out the noise inherent in conventional candlestick charts. As an alternative of plotting worth adjustments over fastened time intervals, Renko charts depict worth actions utilizing bricks of a set measurement, reflecting solely important worth adjustments. This attribute makes them a compelling instrument for merchants looking for to establish developments and potential reversals, minimizing the impression of minor worth fluctuations. This text delves deep into the Renko chart buying and selling technique, exploring its benefits, disadvantages, limitations, and varied buying and selling methods.

Understanding the Fundamentals of Renko Charts

The core precept of a Renko chart lies in its brick measurement. This measurement, decided by the dealer, represents a predetermined worth motion. For instance, a brick measurement of $0.10 means a brand new brick is added solely when the worth strikes up or down by $0.10. Because of this the time axis isn’t uniform; the chart’s horizontal axis represents worth motion, whereas the vertical axis represents the variety of bricks. Consequently, durations of excessive volatility will end in many bricks shut collectively, whereas durations of low volatility will present fewer bricks unfold aside. This inherent attribute filters out the "noise" of minor worth fluctuations that usually obscure important developments on conventional charts.

Benefits of Utilizing Renko Charts

-

Noise Discount: That is maybe essentially the most important benefit. Renko charts successfully remove the visible litter brought on by minor worth fluctuations, permitting merchants to concentrate on substantial worth actions and potential development adjustments. This readability can considerably enhance the identification of key assist and resistance ranges.

-

Development Identification: The constant brick measurement simplifies development identification. A sequence of consecutive up bricks signifies an uptrend, whereas a sequence of down bricks signifies a downtrend. The size and consistency of those brick sequences present visible cues to the power of the development.

-

Improved Entry and Exit Factors: The absence of whipsaws and minor worth fluctuations permits for extra exact entry and exit factors. Merchants can confidently enter trades when a transparent development emerges and exit when the development exhibits indicators of weakening or reversal.

-

Higher Danger Administration: By specializing in important worth actions, Renko charts can support in higher threat administration. Merchants can set stop-loss orders based mostly on a a number of of the brick measurement, providing a extra goal and constant method to threat administration.

-

Adaptability to Totally different Timeframes: Whereas Renko charts are sometimes used with longer timeframes, they are often utilized to shorter timeframes as effectively, providing a variety of buying and selling kinds from scalping to swing buying and selling.

Disadvantages and Limitations of Renko Charts

-

Lagging Indicator: As a result of Renko charts solely react to important worth adjustments, they inherently lag behind the precise worth motion. This lag can generally result in missed alternatives, particularly in fast-moving markets.

-

Subjectivity in Brick Dimension Choice: The selection of brick measurement considerably impacts the chart’s look and interpretation. A smaller brick measurement will present extra particulars however would possibly improve noise, whereas a bigger brick measurement will filter out extra noise however may masks vital info. Optimizing brick measurement requires expertise and experimentation.

-

Problem in Predicting Brief-Time period Value Swings: The inherent filtering of minor worth actions makes Renko charts much less appropriate for short-term, high-frequency buying and selling methods. They’re higher suited to swing buying and selling and longer-term methods.

-

Lack of Time Dimension: The absence of a uniform time axis makes it difficult to include time-based indicators or methods. This limits the power to make use of sure technical evaluation instruments successfully.

-

Complexity for Rookies: Renko charts might be initially difficult for novice merchants to grasp and interpret. Mastering their use requires observe and an intensive understanding of worth motion.

Renko Chart Buying and selling Methods

Varied buying and selling methods might be employed with Renko charts, usually combining them with different technical indicators for affirmation. Some frequent approaches embody:

-

Development Following: Determine clear uptrends (sequences of consecutive up bricks) or downtrends (sequences of consecutive down bricks). Enter lengthy positions throughout uptrends and quick positions throughout downtrends. Use trailing stop-losses to guard earnings.

-

Help and Resistance Ranges: Determine important assist and resistance ranges shaped by the brick formations. Search for worth bounces off these ranges as potential entry factors.

-

Breakout Buying and selling: Monitor worth breakouts from established assist or resistance ranges. A decisive breakout above resistance suggests a bullish sign, whereas a breakout under assist signifies a bearish sign.

-

Mixture with Different Indicators: Mix Renko charts with different technical indicators akin to shifting averages, RSI, MACD, or Bollinger Bands for affirmation indicators. For instance, a bullish crossover of shifting averages coupled with a sequence of consecutive up bricks can present a robust purchase sign.

-

Utilizing Brick Dimension as a Danger Administration Instrument: Decide your stop-loss based mostly on a a number of of the brick measurement. For instance, a stop-loss of three bricks may restrict potential losses to three instances the chosen brick measurement.

Optimizing Brick Dimension Choice

Selecting the suitable brick measurement is essential for profitable Renko chart buying and selling. The optimum measurement is determined by the asset being traded, the timeframe, and the dealer’s threat tolerance. Experimentation is essential. Contemplate these components:

-

Volatility: In extremely unstable markets, a bigger brick measurement is perhaps essential to filter out extreme noise. In much less unstable markets, a smaller brick measurement would possibly present extra element.

-

Timeframe: Longer timeframes usually profit from bigger brick sizes, whereas shorter timeframes would possibly require smaller sizes.

-

Buying and selling Fashion: Swing merchants would possibly choose bigger brick sizes, whereas day merchants would possibly go for smaller sizes.

-

Backtesting: Backtesting completely different brick sizes on historic knowledge might help decide the simplest measurement for a specific buying and selling technique.

Conclusion:

Renko charts supply a singular and highly effective instrument for merchants looking for to filter out market noise and concentrate on important worth actions. Their means to simplify development identification and enhance entry/exit factors makes them a helpful addition to any dealer’s arsenal. Nonetheless, it is essential to grasp their limitations, together with the inherent lag and the subjectivity in brick measurement choice. By mastering the basics and mixing Renko charts with different technical indicators and sound threat administration methods, merchants can leverage their benefits to enhance buying and selling efficiency. Do not forget that constant observe, backtesting, and an intensive understanding of market dynamics are essential for profitable Renko chart buying and selling. The important thing lies not in blindly following indicators, however in utilizing the visible readability offered by Renko charts to boost your total buying and selling technique and decision-making course of.

![The Renko Trading Strategy [In-Depth Guide for 2024]](https://howtotrade.com/wp-content/uploads/2023/09/renko-strategy-chart.png)

:max_bytes(150000):strip_icc()/Renko-5c6597dec9e77c000175523b.png)

![]()

Closure

Thus, we hope this text has offered helpful insights into Decoding the Bricks: A Complete Information to Renko Chart Buying and selling Technique. We thanks for taking the time to learn this text. See you in our subsequent article!