Decoding The BTC/USD Stay Chart: A Complete Information For Navigating The Bitcoin Market

By admin / August 10, 2024 / No Comments / 2025

Decoding the BTC/USD Stay Chart: A Complete Information for Navigating the Bitcoin Market

Associated Articles: Decoding the BTC/USD Stay Chart: A Complete Information for Navigating the Bitcoin Market

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the BTC/USD Stay Chart: A Complete Information for Navigating the Bitcoin Market. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Decoding the BTC/USD Stay Chart: A Complete Information for Navigating the Bitcoin Market

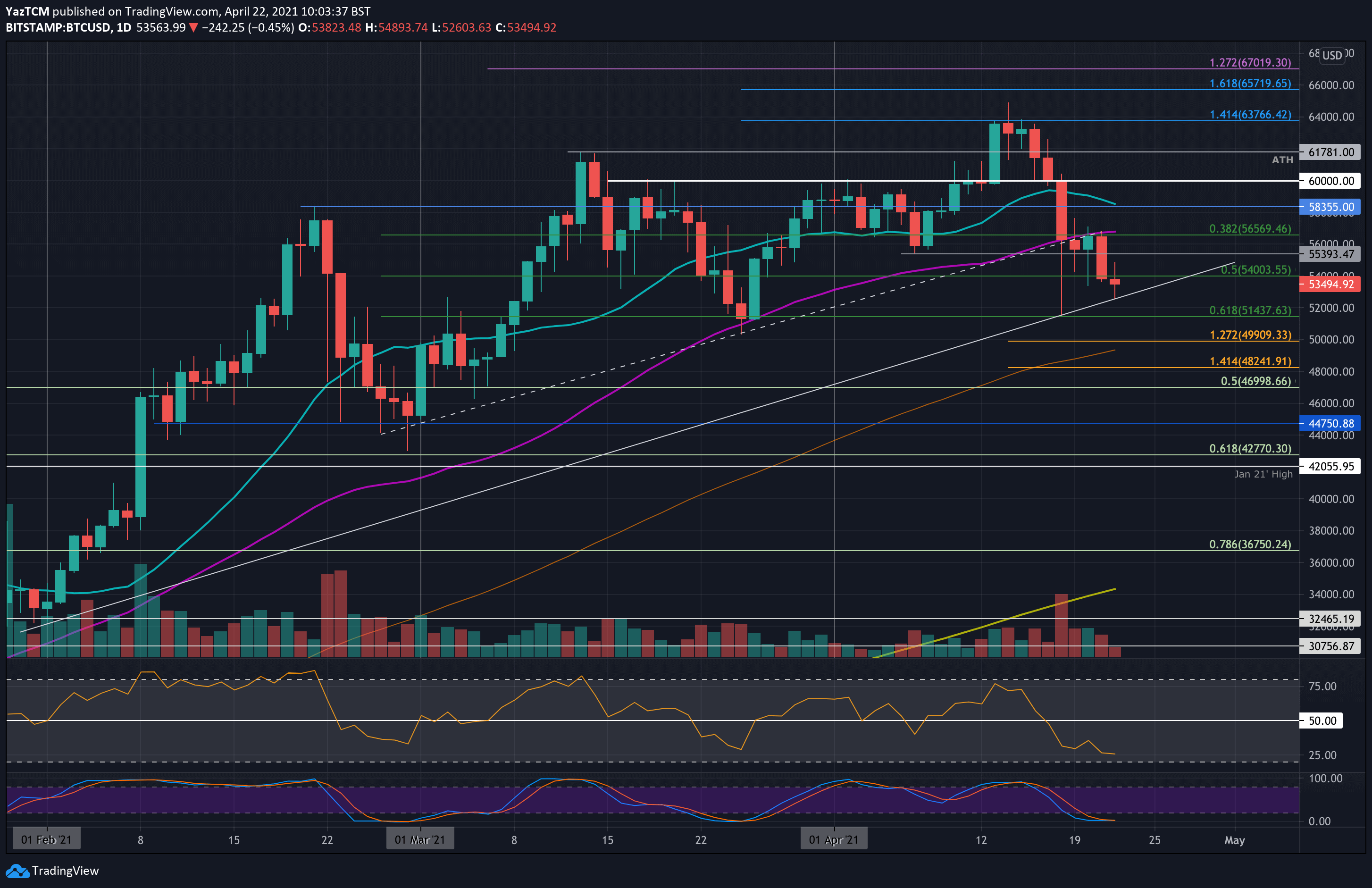

The Bitcoin/USD (BTC/USD) reside chart is the central nervous system of the Bitcoin market. This dynamic visible illustration shows the fluctuating worth of Bitcoin towards the US greenback in real-time, providing a snapshot of market sentiment and driving forces impacting the world’s most outstanding cryptocurrency. Understanding the right way to interpret this chart is essential for anybody concerned in Bitcoin buying and selling, investing, or just following its trajectory. This text will delve deep into the intricacies of the BTC/USD reside chart, masking its parts, analytical methods, and the contextual components that form its actions.

Understanding the Fundamentals of the BTC/USD Stay Chart

At its core, the BTC/USD reside chart is a graphical illustration of the Bitcoin worth over a selected time interval. Most platforms provide varied timeframes, starting from seconds and minutes to hours, days, weeks, months, and even years. The chart sometimes makes use of candlestick patterns or line graphs for instance worth actions.

-

Candlesticks: Every candlestick represents a selected time interval (e.g., one hour, in the future). The physique of the candlestick exhibits the worth vary between the opening and shutting costs. A inexperienced (or typically white) candlestick signifies a closing worth larger than the opening worth (an "up" candle), whereas a pink (or black) candlestick exhibits a closing worth decrease than the opening worth (a "down" candle). Wicks (or shadows) prolong above and beneath the physique, indicating the excessive and low costs reached throughout that interval.

-

Line Graphs: Line graphs current an easier visualization, connecting closing costs throughout the chosen timeframe with a steady line. Whereas much less detailed than candlestick charts, they’re helpful for figuring out total tendencies and momentum.

Key Parts of the BTC/USD Stay Chart

Past the candlesticks or strains themselves, a number of different components are essential for decoding the chart:

-

Value Axis (Y-axis): This vertical axis shows the worth of Bitcoin in US {dollars}.

-

Time Axis (X-axis): This horizontal axis represents the time interval lined by the chart, starting from seconds to years relying on the chosen timeframe.

-

Quantity: Many charts embrace a separate quantity indicator, often displayed beneath the worth chart. Quantity represents the quantity of Bitcoin traded throughout every time interval. Excessive quantity typically accompanies vital worth actions, suggesting sturdy market conviction. Low quantity might point out indecision or an absence of participation.

-

Shifting Averages: Shifting averages are calculated by averaging the worth over a selected variety of durations (e.g., 50-day shifting common, 200-day shifting common). They clean out worth fluctuations and assist establish tendencies. Generally used shifting averages embrace easy shifting averages (SMA) and exponential shifting averages (EMA).

-

Technical Indicators: An enormous array of technical indicators could be overlaid on the chart to offer extra insights into worth tendencies and momentum. These embrace Relative Power Index (RSI), Shifting Common Convergence Divergence (MACD), Bollinger Bands, and plenty of others. Every indicator has its personal interpretation and utility.

-

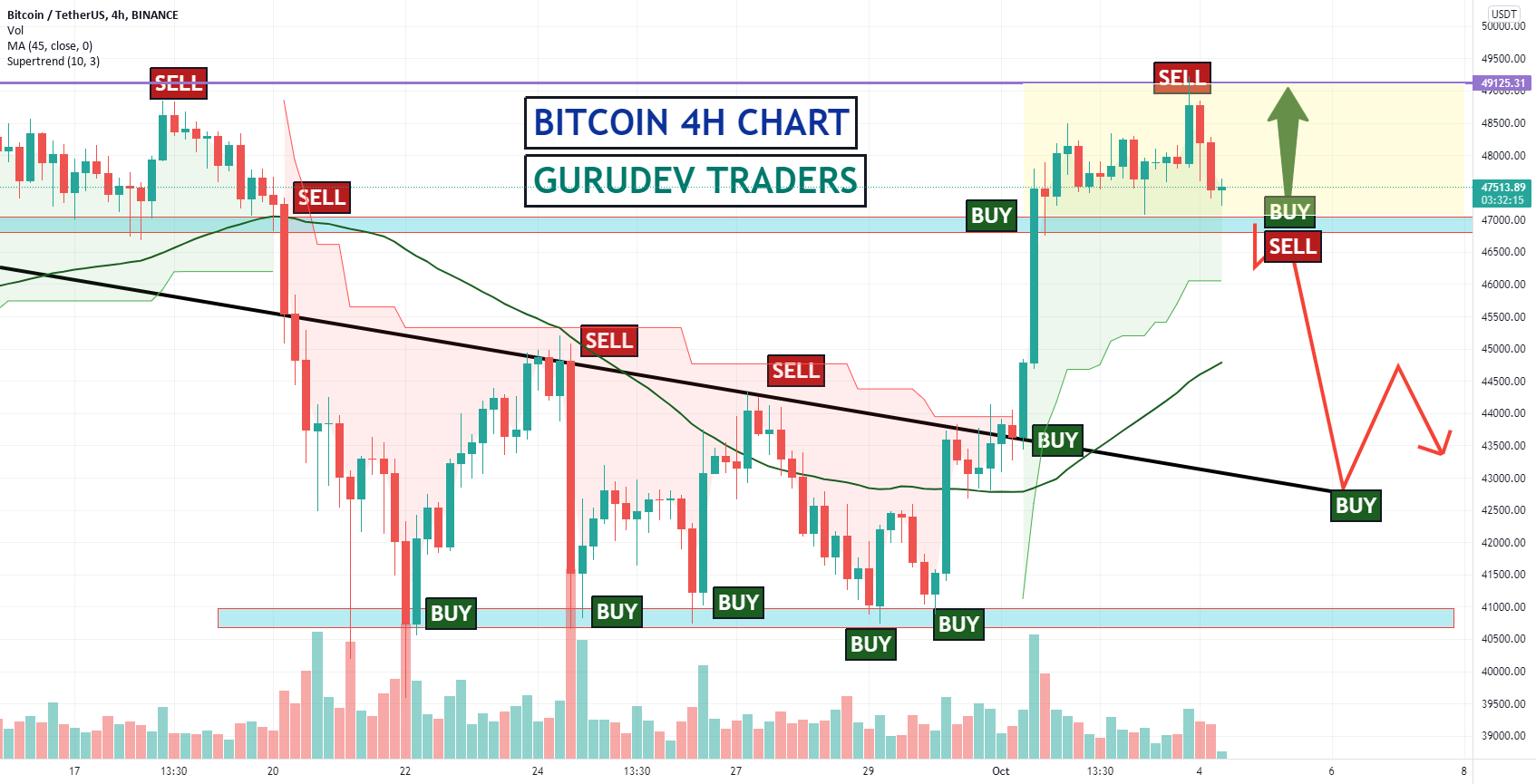

Assist and Resistance Ranges: These are worth ranges the place the worth has traditionally struggled to interrupt by. Assist ranges symbolize areas the place shopping for strain is powerful, whereas resistance ranges symbolize areas the place promoting strain is powerful. Breaks above resistance or beneath assist can sign vital worth actions.

Analyzing the BTC/USD Stay Chart: Strategies and Methods

Analyzing the BTC/USD reside chart requires a mixture of technical evaluation, basic evaluation, and an understanding of market sentiment.

-

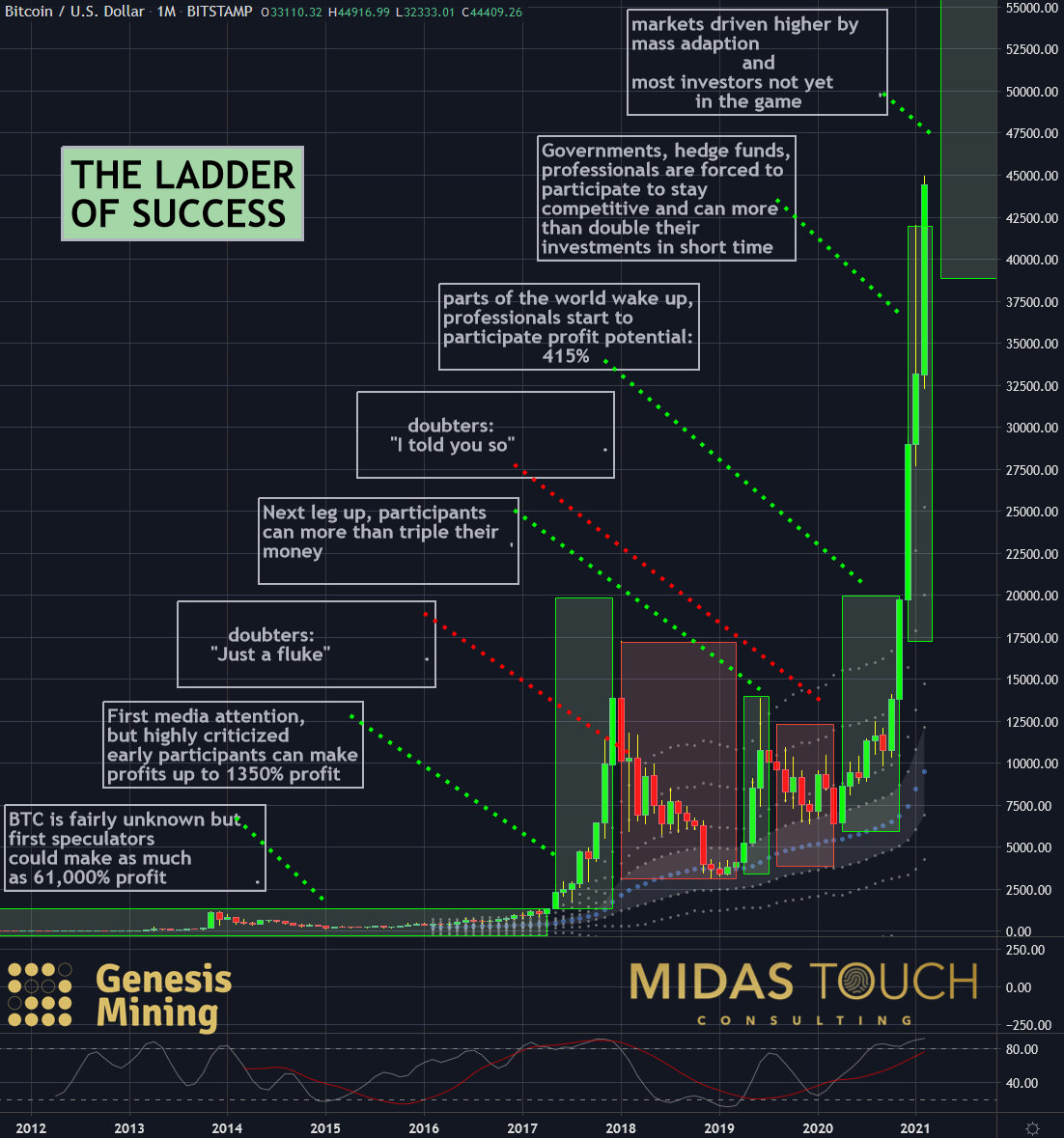

Development Evaluation: Figuring out the general pattern (uptrend, downtrend, or sideways) is essential. Uptrends are characterised by larger highs and better lows, whereas downtrends present decrease highs and decrease lows. Sideways tendencies, often known as consolidations, point out a interval of indecision or worth ranging.

-

Assist and Resistance Buying and selling: Figuring out and buying and selling round assist and resistance ranges is a typical technique. Merchants typically look to purchase close to assist ranges and promote close to resistance ranges, anticipating a worth reversal.

-

Shifting Common Crossovers: The intersection of various shifting averages can sign potential purchase or promote alternatives. A "golden cross" (short-term MA crossing above a long-term MA) is usually seen as a bullish sign, whereas a "dying cross" (short-term MA crossing beneath a long-term MA) is usually thought-about bearish.

-

Candlestick Sample Recognition: Sure candlestick patterns can point out potential worth reversals or continuations. For instance, a hammer candlestick can sign a possible backside in a downtrend, whereas a taking pictures star can point out a possible prime in an uptrend. Understanding these patterns requires vital expertise and follow.

-

Quantity Evaluation: Analyzing quantity together with worth motion can present beneficial insights. Excessive quantity throughout a worth enhance confirms the energy of the uptrend, whereas excessive quantity throughout a worth lower confirms the energy of the downtrend. Low quantity throughout worth actions suggests weak conviction and potential for reversal.

-

Basic Evaluation: Whereas technical evaluation focuses on worth charts, basic evaluation considers exterior components that may influence Bitcoin’s worth. These embrace regulatory developments, adoption charges, technological developments, macroeconomic situations, and total market sentiment. A robust understanding of those components is essential for long-term funding selections.

-

Threat Administration: Whatever the analytical methods used, danger administration is paramount. Setting stop-loss orders to restrict potential losses and diversifying investments are important for mitigating danger.

Elements Influencing the BTC/USD Stay Chart

Quite a few components contribute to the dynamic nature of the BTC/USD reside chart:

-

Market Sentiment: Investor confidence and total market sentiment considerably affect Bitcoin’s worth. Optimistic information and widespread adoption can drive costs larger, whereas damaging information or regulatory uncertainty can result in worth drops.

-

Regulatory Developments: Authorities rules and insurance policies relating to cryptocurrencies straight influence Bitcoin’s worth. Optimistic regulatory developments can increase investor confidence, whereas damaging developments can set off sell-offs.

-

Adoption Charges: Elevated adoption by companies, establishments, and people fuels demand and drives costs larger. Conversely, decreased adoption can result in worth declines.

-

Technological Developments: Developments in Bitcoin’s underlying know-how, equivalent to scaling options and upgrades, can influence its worth.

-

Macroeconomic Elements: International financial situations, equivalent to inflation, rates of interest, and geopolitical occasions, can affect investor urge for food for danger property like Bitcoin.

-

Competitors: The emergence of different cryptocurrencies and blockchain applied sciences can have an effect on Bitcoin’s market share and worth.

Conclusion:

The BTC/USD reside chart is a robust instrument for understanding the Bitcoin market, but it surely’s not a crystal ball. Efficiently navigating this unstable market requires a complete understanding of technical and basic evaluation, danger administration ideas, and a eager consciousness of the broader financial and geopolitical panorama. Constant studying, follow, and a disciplined method are key to creating knowledgeable selections and maximizing alternatives within the dynamic world of Bitcoin buying and selling and investing. Bear in mind to at all times conduct thorough analysis and contemplate in search of recommendation from certified monetary professionals earlier than making any funding selections.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the BTC/USD Stay Chart: A Complete Information for Navigating the Bitcoin Market. We thanks for taking the time to learn this text. See you in our subsequent article!