Decoding The Candlestick Chart: A Complete Information For Inventory Market Buyers

By admin / November 9, 2024 / No Comments / 2025

Decoding the Candlestick Chart: A Complete Information for Inventory Market Buyers

Associated Articles: Decoding the Candlestick Chart: A Complete Information for Inventory Market Buyers

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Decoding the Candlestick Chart: A Complete Information for Inventory Market Buyers. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Decoding the Candlestick Chart: A Complete Information for Inventory Market Buyers

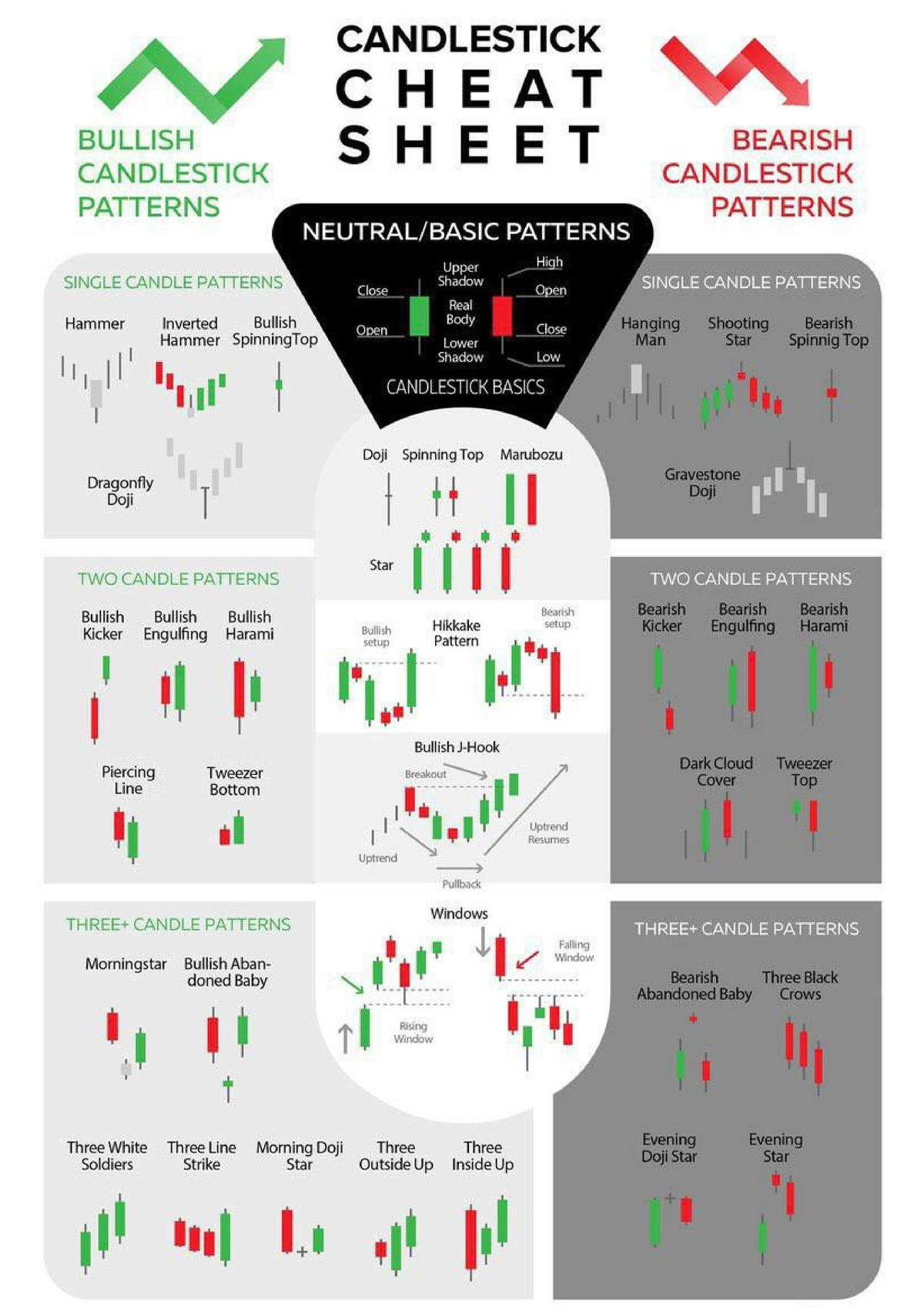

The inventory market, a dynamic panorama of fluctuating costs and unpredictable traits, requires refined instruments for evaluation. Among the many hottest and efficient of those instruments is the candlestick chart. Removed from being a mere visible illustration of value actions, candlestick charts supply a wealthy tapestry of knowledge, revealing not solely the opening and shutting costs of a safety but additionally its highs and lows, offering insights into market sentiment and potential future value motion. This text delves deep into the world of candlestick charts, explaining their building, interpretation, and software in inventory market evaluation.

Understanding the Anatomy of a Candlestick:

A single candlestick represents the value motion of a safety over a selected interval, usually a day, however it could actually additionally signify an hour, week, or perhaps a month. Every candlestick consists of a number of key elements:

-

The Physique: The oblong a part of the candlestick represents the vary between the opening and shutting costs. A "bullish" or "inexperienced" candlestick signifies that the closing value was increased than the opening value (a optimistic day). A "bearish" or "purple" candlestick signifies that the closing value was decrease than the opening value (a adverse day). The size of the physique displays the magnitude of the value change throughout the interval.

-

The Higher Shadow (Wick or Shadow): The skinny line extending from the highest of the physique represents the very best value reached throughout the interval. That is the purpose the place shopping for stress was robust sufficient to push the value up, however finally, promoting stress prevailed, resulting in a decrease closing value.

-

The Decrease Shadow (Wick or Shadow): The skinny line extending from the underside of the physique represents the bottom value reached throughout the interval. This exhibits the purpose the place promoting stress was strongest, however shopping for stress finally took over, leading to a better closing value.

Decoding Candlestick Patterns: Unveiling Market Sentiment:

The true energy of candlestick charts lies of their skill to disclose market sentiment by the mixture and association of particular person candlesticks. Many patterns have been recognized over time, every with its personal particular implications for future value motion. Listed below are a number of the commonest and important candlestick patterns:

1. Bullish Patterns: These patterns counsel an upward pattern or a possible value improve.

-

Hammer: A small physique with an extended decrease shadow, indicating robust shopping for stress close to the low of the interval. The absence of an higher shadow means that the consumers have been capable of push the value up however not maintain it. It is a bullish reversal sample, suggesting a possible pattern reversal from a downtrend to an uptrend.

-

Inverted Hammer: Much like a hammer, however with an extended higher shadow and a small physique. It indicators robust shopping for stress close to the excessive, however promoting stress prevented a better shut. Additionally a bullish reversal sample.

-

Morning Star: A 3-candlestick sample characterised by a bearish candle adopted by a small indecisive candle (doji or a small physique), and at last, a robust bullish candle. It suggests a possible bottoming out of the market and a reversal of the downtrend.

-

Engulfing Sample (Bullish): A two-candlestick sample the place a big bullish candle utterly engulfs the earlier bearish candle. This means a robust shift in momentum from bearish to bullish.

2. Bearish Patterns: These patterns counsel a downward pattern or a possible value lower.

-

Hanging Man: A small physique with an extended decrease shadow, showing on the prime of an uptrend. It means that consumers are dropping management and a possible reversal to a downtrend is probably going.

-

Capturing Star: Much like an inverted hammer, however showing on the prime of an uptrend. It indicators robust promoting stress close to the excessive and a possible reversal.

-

Night Star: A 3-candlestick sample, the other of a morning star, consisting of a bullish candle adopted by a small indecisive candle and a robust bearish candle. It indicators a possible prime and a reversal to a downtrend.

-

Engulfing Sample (Bearish): A two-candlestick sample the place a big bearish candle utterly engulfs the earlier bullish candle. This means a robust shift in momentum from bullish to bearish.

3. Impartial Patterns: These patterns point out indecision out there and do not essentially predict a selected directional transfer.

-

Doji: A candlestick with virtually equal opening and shutting costs, leading to a small or no physique. It represents indecision out there and may sign a possible reversal or continuation of the pattern, relying on its context.

-

Spinning High: A small-bodied candlestick with lengthy higher and decrease shadows, indicating indecision and a battle between consumers and sellers.

Combining Candlestick Patterns with Different Technical Indicators:

Candlestick patterns are handiest when used along side different technical indicators, resembling transferring averages, relative energy index (RSI), and quantity. For instance, confirming a bullish candlestick sample with rising buying and selling quantity can considerably strengthen the sign. Equally, a bearish sample accompanied by declining quantity may counsel a weakening pattern.

Benefits of Utilizing Candlestick Charts:

-

Visible Readability: Candlestick charts present a transparent and concise visible illustration of value motion, making it simpler to determine traits and patterns.

-

Market Sentiment Indication: They provide beneficial insights into market sentiment, permitting merchants to anticipate potential value actions.

-

Versatile Timeframes: They can be utilized throughout varied timeframes, from intraday to long-term evaluation.

-

Sample Recognition: The power to determine and interpret candlestick patterns gives a strong edge in buying and selling.

Limitations of Candlestick Charts:

-

Subjectivity: Interpretation of candlestick patterns may be subjective, and completely different merchants could have completely different interpretations.

-

Affirmation Wanted: Candlestick patterns needs to be confirmed with different technical indicators for higher accuracy.

-

Not a Standalone System: They shouldn’t be relied upon as a standalone buying and selling system, however moderately as a part of a broader buying and selling technique.

Conclusion:

Candlestick charts are a beneficial device for inventory market traders and merchants, offering a singular and insightful perspective on value motion and market sentiment. By understanding the anatomy of a candlestick, recognizing frequent patterns, and mixing this data with different technical indicators, traders can enhance their skill to investigate market traits and make extra knowledgeable buying and selling choices. Nevertheless, it is essential to do not forget that candlestick evaluation shouldn’t be foolproof, and profitable buying and selling requires a holistic method that includes danger administration, elementary evaluation, and a deep understanding of the market dynamics. Steady studying and observe are important to mastering the artwork of candlestick chart interpretation and leveraging its energy for worthwhile buying and selling.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the Candlestick Chart: A Complete Information for Inventory Market Buyers. We hope you discover this text informative and useful. See you in our subsequent article!