Decoding The Chart Of Accounts: A Complete Information

By admin / October 8, 2024 / No Comments / 2025

Decoding the Chart of Accounts: A Complete Information

Associated Articles: Decoding the Chart of Accounts: A Complete Information

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the Chart of Accounts: A Complete Information. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the Chart of Accounts: A Complete Information

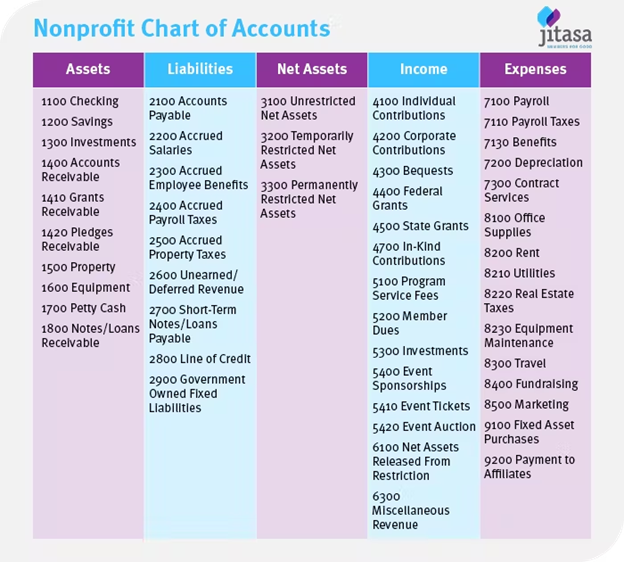

The chart of accounts (COA) is the spine of any group’s monetary system. It is a structured listing of all of the accounts used to file monetary transactions, offering a complete overview of an organization’s monetary actions. Understanding its construction, operate, and implementation is essential for correct monetary reporting, efficient budgeting, and knowledgeable decision-making. This text delves deep into the intricacies of the chart of accounts, exploring its design, key parts, and greatest practices for its efficient administration.

What’s a Chart of Accounts?

A chart of accounts is actually an in depth index of all of the accounts utilized by a enterprise to categorise and file its monetary transactions. Every account represents a particular component of the corporate’s funds, resembling money, accounts receivable, stock, bills, and liabilities. These accounts are organized hierarchically, permitting for a granular breakdown of monetary knowledge. Consider it as a extremely organized submitting system for all of the monetary data of a enterprise. With no well-defined COA, monetary knowledge could be chaotic and unimaginable to interpret meaningfully.

The Construction of a Chart of Accounts:

The construction of a COA can range relying on the scale and complexity of the group, trade rules, and accounting requirements adopted (e.g., GAAP, IFRS). Nonetheless, most COAs comply with a constant framework based mostly on the accounting equation: Belongings = Liabilities + Fairness. This elementary equation underpins the group of accounts into main classes:

-

Belongings: These signify what an organization owns, together with:

- Present Belongings: Belongings anticipated to be transformed into money or used up inside one yr (e.g., money, accounts receivable, stock, pay as you go bills).

- Non-Present Belongings: Belongings with a lifespan exceeding one yr (e.g., property, plant, and tools (PP&E), intangible belongings, long-term investments).

-

Liabilities: These signify what an organization owes to others, together with:

- Present Liabilities: Obligations due inside one yr (e.g., accounts payable, salaries payable, short-term loans).

- Non-Present Liabilities: Obligations due past one yr (e.g., long-term loans, bonds payable).

-

Fairness: This represents the house owners’ stake within the firm, together with:

- Contributed Capital: Investments made by house owners.

- Retained Earnings: Collected earnings reinvested within the enterprise.

Inside every of those main classes, accounts are additional subdivided into extra particular sub-accounts. For instance, "Accounts Receivable" could be damaged down into "Accounts Receivable – Buyer A," "Accounts Receivable – Buyer B," and many others., offering a extra detailed view of excellent receivables. Equally, "Bills" could be categorized into "Value of Items Bought," "Promoting Bills," "Administrative Bills," and additional sub-categorized by particular expense varieties (e.g., hire, salaries, utilities).

Numbering Techniques within the Chart of Accounts:

A well-designed COA makes use of a numbering system to make sure constant and logical group. This technique usually employs a hierarchical construction, typically utilizing a mix of digits and letters to signify completely different account ranges. For instance:

- 1000 – Belongings

- 1100 – Present Belongings

- 1110 – Money

- 1120 – Accounts Receivable

- 2000 – Liabilities

- 3000 – Fairness

This technique permits for straightforward identification and retrieval of particular accounts, making monetary reporting and evaluation extra environment friendly.

Advantages of a Effectively-Outlined Chart of Accounts:

A well-structured and maintained COA presents quite a few advantages:

- Correct Monetary Reporting: Supplies a constant framework for recording transactions, making certain correct monetary statements.

- Improved Budgeting and Forecasting: Facilitates the event of real looking budgets and monetary forecasts by categorizing bills and revenues successfully.

- Enhanced Monetary Evaluation: Permits for detailed evaluation of monetary efficiency, figuring out tendencies and areas for enchancment.

- Streamlined Auditing: Simplifies the audit course of by offering a transparent and arranged file of monetary transactions.

- Higher Resolution-Making: Supplies managers with the required monetary data to make knowledgeable enterprise choices.

- Improved Inside Controls: A well-defined COA contributes to a strong inside management system, decreasing the chance of errors and fraud.

- Facilitates Compliance: Ensures adherence to accounting requirements and regulatory necessities.

Challenges in Managing a Chart of Accounts:

Regardless of its significance, managing a COA can current sure challenges:

- Sustaining Consistency: Guaranteeing constant utility of the COA throughout the group requires cautious coaching and ongoing monitoring.

- Adapting to Change: The COA must be commonly reviewed and up to date to replicate modifications within the enterprise, accounting requirements, and regulatory necessities.

- Integration with Accounting Software program: The COA must be correctly built-in with the group’s accounting software program to make sure correct knowledge seize and reporting.

- Knowledge Migration: Migrating to a brand new COA or accounting system may be advanced and time-consuming.

- Lack of Standardization: Inconsistent COA design throughout completely different departments or places can hinder monetary consolidation and reporting.

Finest Practices for Chart of Accounts Administration:

- Common Overview and Updates: The COA ought to be reviewed and up to date periodically to make sure it stays related and correct.

- Clear and Concise Account Descriptions: Account descriptions ought to be clear, concise, and unambiguous to keep away from confusion.

- Constant Numbering System: A well-defined numbering system ensures constant group and simple identification of accounts.

- Correct Segregation of Duties: Totally different people ought to be accountable for completely different facets of COA administration to forestall errors and fraud.

- Coaching and Documentation: Workers ought to obtain satisfactory coaching on using the COA, and complete documentation ought to be accessible.

- Use of Standardized Chart of Accounts: Trade-specific standardized charts of accounts can simplify the method and guarantee compliance.

- Common Reconciliation: Usually reconcile the COA with the final ledger to make sure accuracy and establish discrepancies.

Conclusion:

The chart of accounts is a elementary component of any group’s monetary infrastructure. A well-designed and meticulously maintained COA is important for correct monetary reporting, efficient decision-making, and general enterprise success. By understanding its construction, operate, and greatest practices for administration, organizations can leverage the COA to its full potential, gaining useful insights into their monetary efficiency and reaching larger effectivity and management over their monetary operations. Investing time and sources in growing and sustaining a strong COA is an important step in direction of constructing a robust monetary basis for any enterprise.

Closure

Thus, we hope this text has offered useful insights into Decoding the Chart of Accounts: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!