Decoding The Copper Worth Chart On Yahoo Finance: A Complete Information

By admin / August 8, 2024 / No Comments / 2025

Decoding the Copper Worth Chart on Yahoo Finance: A Complete Information

Associated Articles: Decoding the Copper Worth Chart on Yahoo Finance: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Copper Worth Chart on Yahoo Finance: A Complete Information. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Decoding the Copper Worth Chart on Yahoo Finance: A Complete Information

Copper, usually dubbed "Dr. Copper" for its purported potential to foretell financial well being, holds a major place in international markets. Its worth fluctuations, readily accessible by platforms like Yahoo Finance, mirror a fancy interaction of provide, demand, and macroeconomic elements. This text delves deep into decoding the copper worth chart on Yahoo Finance, exploring its historic tendencies, influencing elements, and implications for buyers and companies alike.

Understanding the Yahoo Finance Copper Worth Chart:

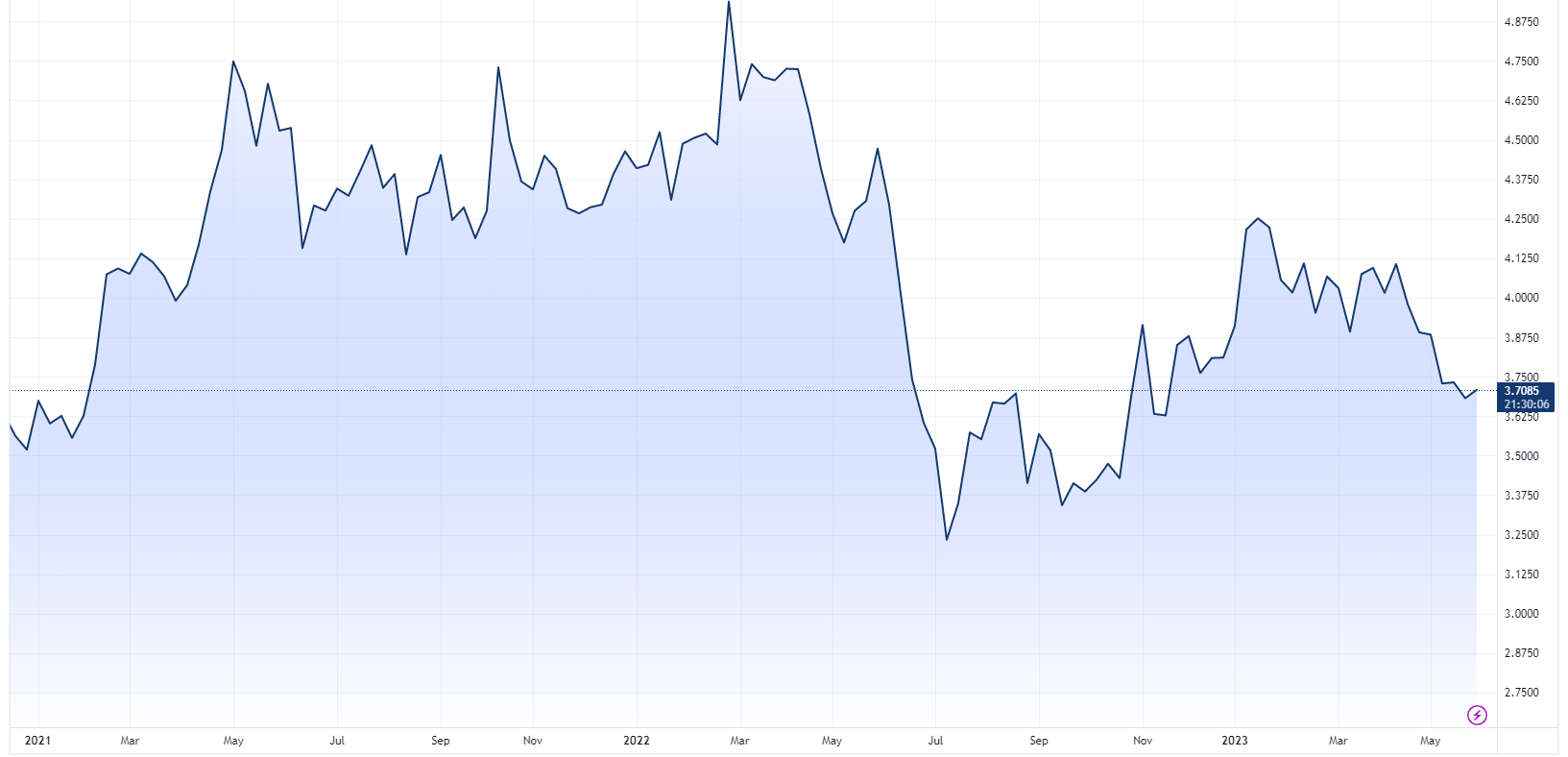

The Yahoo Finance copper worth chart, sometimes displaying the COMEX copper futures contract (often probably the most actively traded contract), presents a visible illustration of worth actions over numerous timeframes. Customers can customise the chart to show totally different durations, from intraday fluctuations to long-term historic information spanning many years. Key options to know embrace:

- Worth Axis (Y-axis): Reveals the worth of copper, often expressed in US {dollars} per pound.

- Time Axis (X-axis): Shows the time interval, starting from minutes to years, relying on the person’s choice.

- Candlestick/Line Chart: The chart sometimes makes use of candlestick or line graphs as an instance worth actions. Candlesticks present the opening, closing, excessive, and low costs for a selected interval (e.g., day by day, weekly), whereas line charts merely join the closing costs.

- Technical Indicators: Yahoo Finance permits customers to overlay numerous technical indicators (transferring averages, RSI, MACD, and so forth.) to assist in figuring out tendencies and potential buying and selling indicators. These indicators are mathematical calculations based mostly on historic worth information.

- Quantity: The chart might show buying and selling quantity, indicating the variety of contracts traded throughout every interval. Excessive quantity usually accompanies important worth actions.

Historic Traits and Key Worth Drivers:

Analyzing the historic copper worth chart on Yahoo Finance reveals a number of key tendencies and influencing elements:

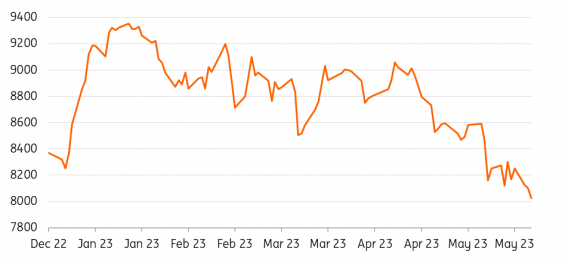

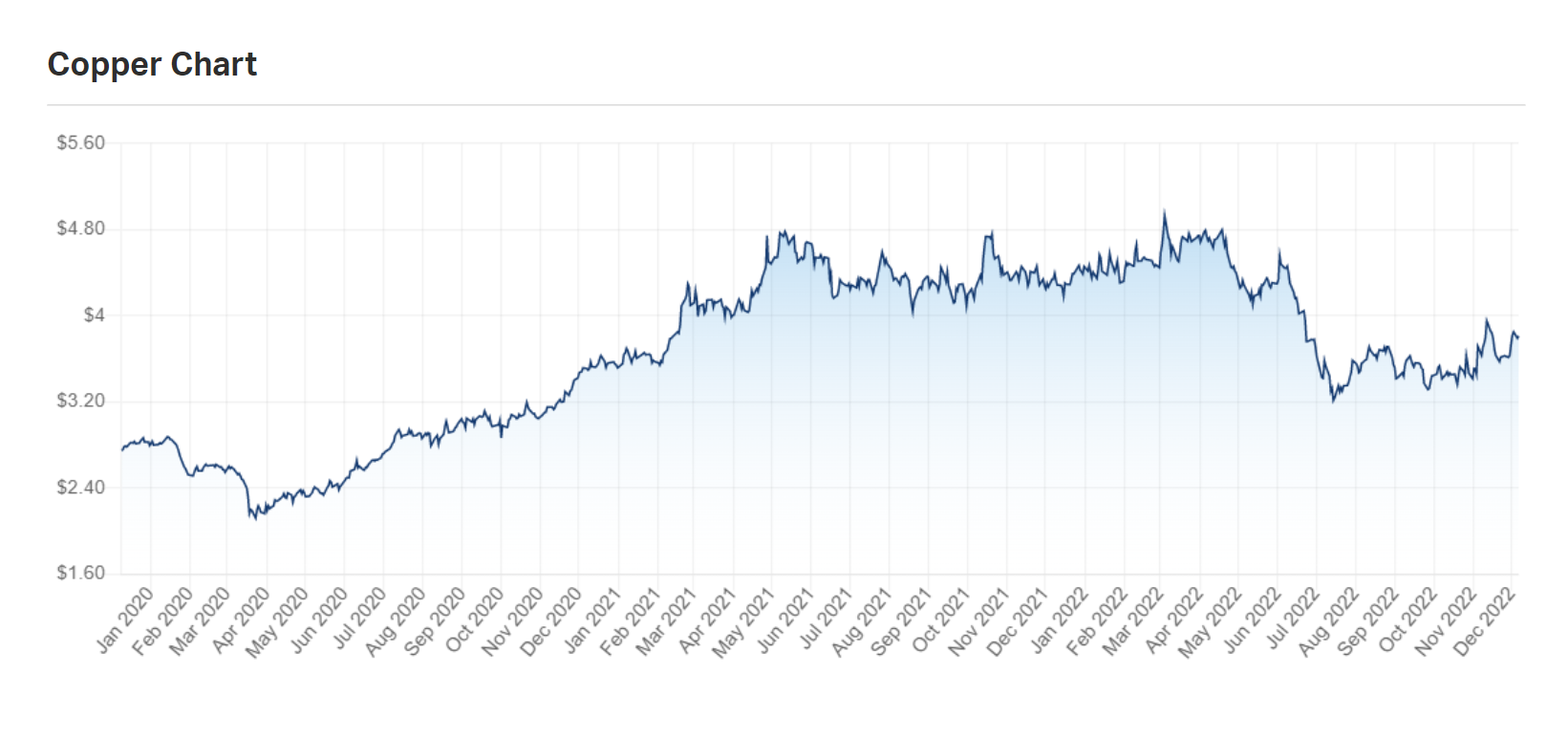

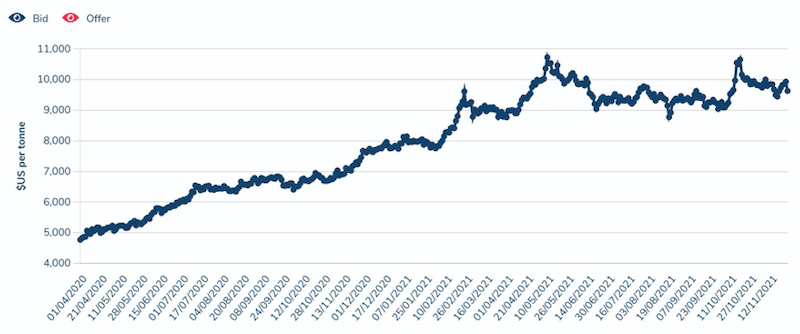

- Commodity Cycle: Copper costs, like different commodities, are cyclical. Durations of robust financial progress sometimes drive up demand and costs, adopted by durations of decrease demand and worth corrections. The chart vividly illustrates these cycles, with peaks and troughs reflecting the ebb and move of world financial exercise.

- International Financial Development: Copper is an important element in development, manufacturing, and infrastructure growth. Sturdy international GDP progress, notably in rising markets like China, considerably boosts demand, pushing costs greater. Conversely, financial slowdowns or recessions sometimes result in decrease demand and worth declines. The Yahoo Finance chart will mirror this correlation, exhibiting worth will increase during times of strong international progress and reduces throughout recessions.

- China’s Function: China’s huge infrastructure tasks and industrial manufacturing account for a good portion of world copper consumption. Adjustments in Chinese language financial coverage, infrastructure spending, and industrial output instantly impression copper demand and costs. Inspecting the chart alongside Chinese language financial information gives priceless insights into worth actions.

- Provide-Facet Components: Copper manufacturing is influenced by elements akin to mine output, geopolitical occasions, and technological developments in mining and extraction. Strikes, mine closures, or disruptions to produce chains can result in worth will increase, even within the face of weaker demand. The chart might present sharp worth spikes akin to such supply-side shocks.

- Greenback Power: Copper is priced in US {dollars}. A robust greenback makes copper dearer for patrons utilizing different currencies, decreasing demand and doubtlessly reducing costs. Conversely, a weaker greenback can increase demand and costs. Observing the greenback index alongside the copper worth chart can reveal this relationship.

- Inflation and Curiosity Charges: Inflationary pressures and rising rates of interest can affect copper costs. Increased inflation can enhance manufacturing prices, pushing costs up. Increased rates of interest can curb funding and financial exercise, doubtlessly decreasing demand and reducing costs. Analyzing the chart together with inflation and rate of interest information is essential.

- Technological Developments: The event of recent applied sciences and supplies can impression copper demand. For instance, the expansion of renewable power applied sciences, which regularly make the most of copper extensively, can increase demand. Conversely, developments that result in the substitution of copper with different supplies may negatively impression costs.

Deciphering the Chart: Technical Evaluation and Basic Evaluation:

Analyzing the Yahoo Finance copper worth chart successfully requires a mixture of technical and basic evaluation:

- Technical Evaluation: This entails utilizing chart patterns, indicators, and different technical instruments to foretell future worth actions. Transferring averages, relative energy index (RSI), and transferring common convergence divergence (MACD) are generally used indicators. Figuring out assist and resistance ranges, trendlines, and chart patterns will help in figuring out potential entry and exit factors for merchants.

- Basic Evaluation: This focuses on evaluating the underlying financial and market elements that affect copper costs. Analyzing international financial progress, Chinese language financial information, supply-demand dynamics, geopolitical dangers, and forex fluctuations gives a broader context for decoding worth actions.

Implications for Buyers and Companies:

Understanding the copper worth chart on Yahoo Finance has important implications for numerous stakeholders:

- Buyers: Copper might be a gorgeous funding for these searching for publicity to commodities and the worldwide financial system. Nevertheless, it is essential to know the inherent volatility of commodity costs and make use of applicable threat administration methods. Technical and basic evaluation will help buyers make knowledgeable funding selections.

- Producers: Copper mining firms are instantly affected by worth fluctuations. Increased costs translate to elevated profitability, whereas decrease costs can squeeze margins and impression funding selections. Monitoring the chart helps producers handle their operations and monetary planning.

- Customers: Companies that use copper of their manufacturing processes are delicate to cost adjustments. Fluctuations in copper costs can impression manufacturing prices and pricing methods. Monitoring the chart permits companies to anticipate worth actions and regulate their procurement methods accordingly.

Conclusion:

The copper worth chart on Yahoo Finance gives a priceless device for understanding the dynamics of the copper market. By combining technical and basic evaluation, buyers, producers, and customers can acquire insights into worth tendencies and make knowledgeable selections. Nevertheless, it is essential to keep in mind that predicting commodity costs with certainty is unattainable. The chart serves as a information, however cautious consideration of assorted financial and market elements is important for navigating the complexities of the copper market. Common monitoring of the chart, coupled with a complete understanding of the underlying elements influencing copper costs, is vital to efficiently navigating this dynamic and vital market.

Closure

Thus, we hope this text has supplied priceless insights into Decoding the Copper Worth Chart on Yahoo Finance: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!