Decoding The Copper Value Month-to-month Chart: A Deep Dive Into Market Dynamics

By admin / August 9, 2024 / No Comments / 2025

Decoding the Copper Value Month-to-month Chart: A Deep Dive into Market Dynamics

Associated Articles: Decoding the Copper Value Month-to-month Chart: A Deep Dive into Market Dynamics

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Copper Value Month-to-month Chart: A Deep Dive into Market Dynamics. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Decoding the Copper Value Month-to-month Chart: A Deep Dive into Market Dynamics

Copper, typically dubbed "Dr. Copper" for its purported capacity to foretell financial well being, boasts a wealthy historical past intertwined with world financial cycles. Analyzing its month-to-month value chart gives a novel perspective on macroeconomic tendencies, supply-demand dynamics, and the interaction of geopolitical elements. This text delves into the complexities of the copper value month-to-month chart, exploring its historic patterns, key indicators, and potential implications for buyers and companies alike.

Historic Perspective: A Rollercoaster Trip

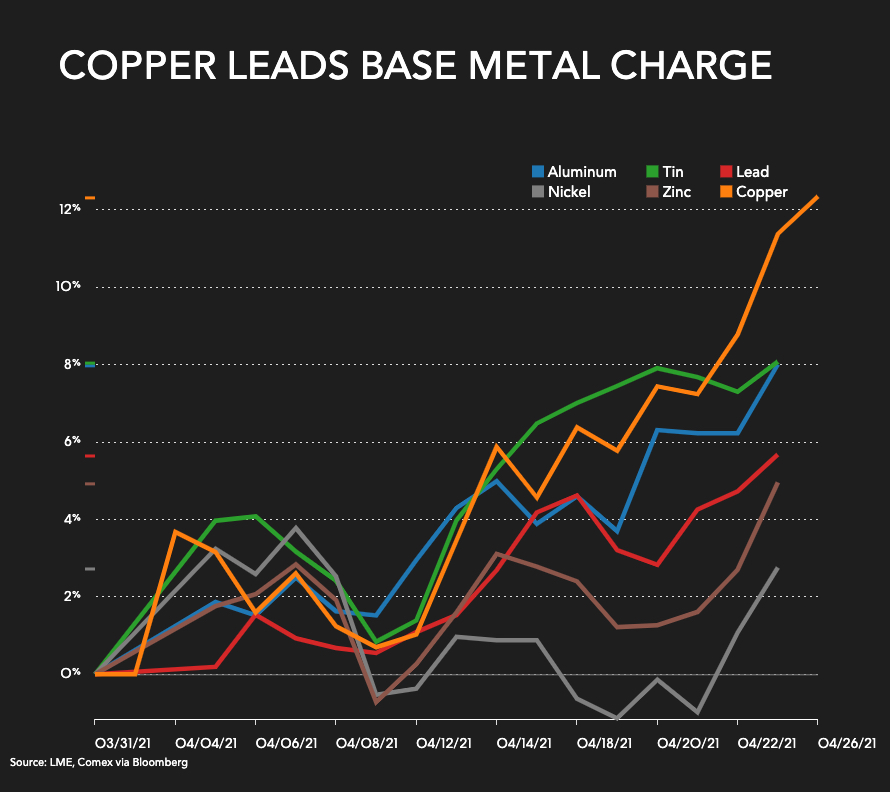

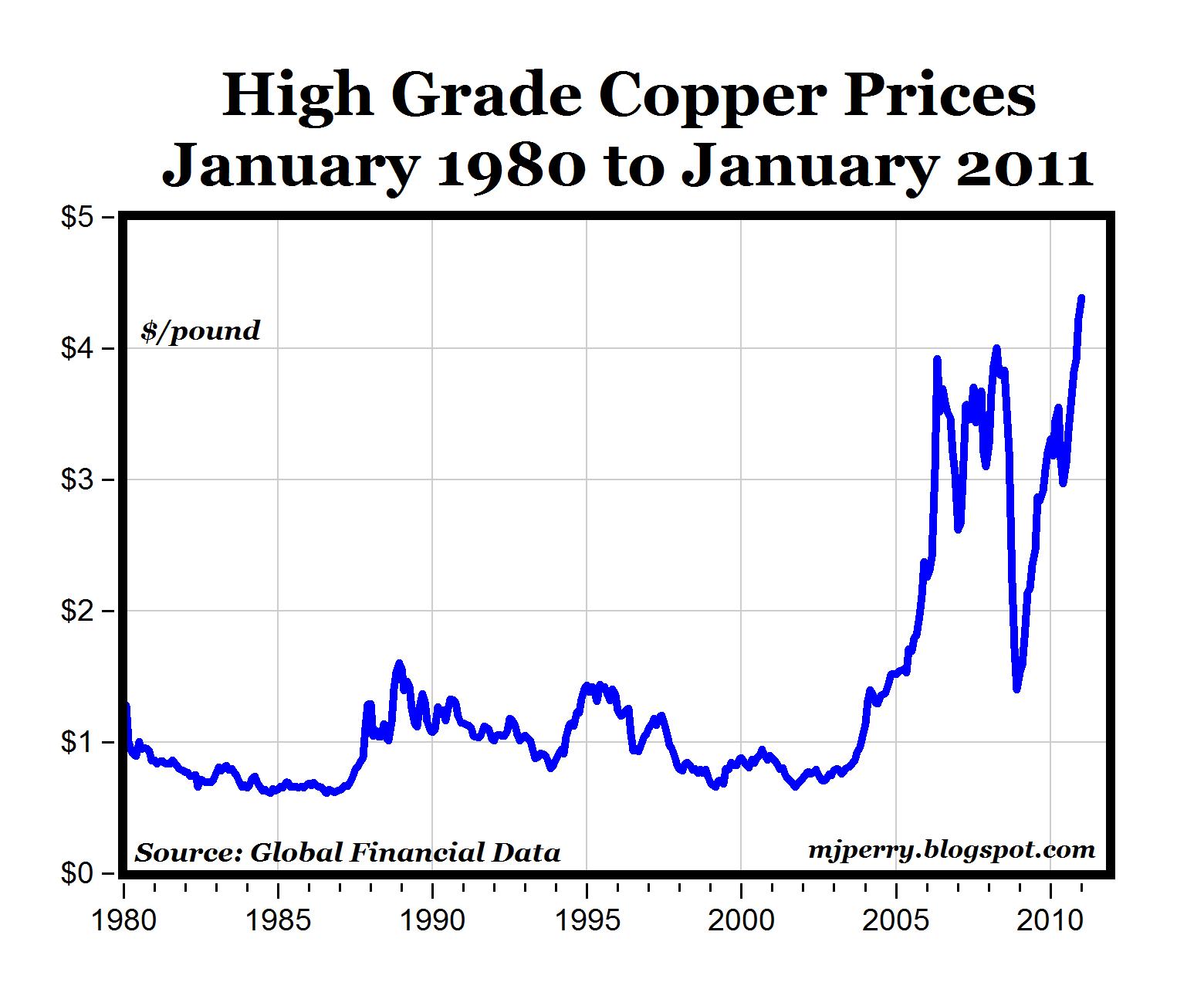

A look at a long-term copper value month-to-month chart reveals a captivating narrative of booms and busts, mirroring the fluctuating fortunes of the worldwide financial system. The early 2000s witnessed a interval of sustained development, fueled by fast industrialization in China and burgeoning demand from rising markets. This era noticed copper costs climb to unprecedented heights, attracting vital funding and driving enlargement within the mining sector. Nonetheless, the 2008 world monetary disaster introduced a pointy correction, highlighting the metallic’s sensitivity to financial downturns. The following restoration was uneven, punctuated by durations of volatility pushed by elements resembling fluctuating demand, geopolitical instability, and provide chain disruptions.

The chart reveals distinct cyclical patterns, characterised by durations of value appreciation adopted by corrections. These cycles aren’t all the time completely common, typically influenced by unexpected occasions. For instance, the COVID-19 pandemic initially triggered a value hunch as a result of widespread lockdowns and diminished industrial exercise. Nonetheless, the next financial restoration and large stimulus packages led to a exceptional rebound, showcasing copper’s resilience and its function as a key part in infrastructure growth and renewable power initiatives.

Key Indicators and Technical Evaluation:

Analyzing a copper value month-to-month chart successfully requires using varied technical evaluation instruments. These instruments assist determine tendencies, help and resistance ranges, and potential turning factors. Some key indicators embody:

-

Shifting Averages: Easy shifting averages (SMA) and exponential shifting averages (EMA) clean out value fluctuations, revealing underlying tendencies. Crossovers between completely different shifting averages (e.g., a 50-month SMA crossing above a 200-month SMA) can sign potential pattern reversals. The longer the time interval of the shifting common, the extra vital the sign.

-

Relative Power Index (RSI): The RSI measures the magnitude of current value modifications to guage overbought or oversold situations. Readings above 70 typically recommend the market is overbought, indicating a possible value correction, whereas readings under 30 recommend an oversold situation, hinting at a potential rebound. Nonetheless, it is essential to contemplate the RSI at the side of different indicators, as it could actually generate false indicators.

-

Assist and Resistance Ranges: These are value ranges the place the value has traditionally struggled to interrupt by means of. Assist ranges characterize costs the place shopping for stress is predicted to outweigh promoting stress, stopping additional declines. Resistance ranges characterize costs the place promoting stress is predicted to outweigh shopping for stress, hindering additional value will increase. Breaks above resistance ranges typically sign bullish momentum, whereas breaks under help ranges can sign bearish momentum.

-

Bollinger Bands: These bands plot customary deviations round a shifting common, visually representing value volatility. Large bands point out excessive volatility, whereas slim bands point out low volatility. Value bounces off the higher or decrease bands could be interpreted as potential reversal factors.

-

MACD (Shifting Common Convergence Divergence): This indicator identifies modifications in momentum by evaluating two shifting averages. Crossovers of the MACD line above the sign line typically recommend bullish momentum, whereas crossovers under recommend bearish momentum. Divergences between the MACD and value motion may present beneficial insights.

Basic Evaluation: The Larger Image

Whereas technical evaluation focuses on value patterns, basic evaluation considers the underlying financial elements driving copper costs. These elements embody:

-

World Financial Development: Sturdy financial development, notably in creating nations, sometimes interprets into elevated demand for copper, driving costs increased. Recessions or financial slowdowns have the other impact.

-

China’s Position: China’s huge infrastructure initiatives and industrial enlargement have traditionally been a significant driver of copper demand. Modifications in China’s financial insurance policies and development trajectory considerably influence copper costs.

-

Provide-Aspect Elements: Mining manufacturing, geopolitical dangers affecting main copper-producing nations, and disruptions to produce chains all affect copper availability and value. Strikes, environmental laws, and infrastructure limitations can constrain provide and push costs increased.

-

Technological Developments: The rising adoption of renewable power applied sciences, electrical automobiles, and different inexperienced initiatives boosts copper demand as it is a essential part in these applied sciences.

-

Foreign money Fluctuations: The US greenback’s energy relative to different currencies can have an effect on copper costs, as copper is primarily traded in US {dollars}. A stronger greenback could make copper costlier for patrons utilizing different currencies, probably dampening demand.

-

Stock Ranges: Modifications in copper inventories held by exchanges and producers present insights into provide and demand dynamics. Falling inventories typically recommend tightening provide and potential value will increase, whereas rising inventories recommend ample provide and potential value declines.

Deciphering the Month-to-month Chart: A Holistic Method

Successfully decoding a copper value month-to-month chart necessitates a holistic strategy, integrating each technical and basic evaluation. Technical indicators can assist determine potential buying and selling alternatives and predict short-term value actions. Nonetheless, basic evaluation offers the context for understanding the long-term drivers of copper costs and assessing the sustainability of any noticed tendencies.

For instance, a bullish technical setup (e.g., a golden cross on shifting averages, RSI above 50) could be additional validated by sturdy world financial development, elevated infrastructure spending in rising markets, or a tightening of copper provide. Conversely, a bearish technical sample could be bolstered by weakening financial indicators, diminished industrial exercise, or elevated copper inventories.

Implications for Buyers and Companies:

Understanding the dynamics of the copper value month-to-month chart holds vital implications for varied stakeholders:

-

Buyers: Copper could be a beneficial addition to a diversified funding portfolio, providing publicity to each financial development and inflation hedging potential. Nonetheless, it is essential to acknowledge the inherent volatility of the metallic and make use of applicable danger administration methods.

-

Mining Firms: Copper producers have to rigorously monitor value tendencies to optimize manufacturing ranges and handle their monetary dangers. Value forecasts based mostly on chart evaluation and basic elements are essential for funding choices and operational planning.

-

Manufacturing Industries: Firms utilizing copper as a uncooked materials have to hedge towards value fluctuations to guard their revenue margins. Understanding value tendencies permits them to barter favorable contracts with suppliers and handle their stock successfully.

-

Policymakers: Authorities policymakers can use copper value tendencies as an indicator of financial well being and to tell their coverage choices associated to infrastructure growth, industrial coverage, and useful resource administration.

Conclusion:

The copper value month-to-month chart serves as a robust software for understanding the advanced interaction of financial, geopolitical, and technological elements that form the worldwide financial system. By combining technical and basic evaluation, buyers, companies, and policymakers can achieve beneficial insights into potential value actions and make knowledgeable choices. Nonetheless, it is essential to keep in mind that predicting future costs with certainty is not possible. Steady monitoring, adaptation, and a radical understanding of the underlying elements are important for navigating the dynamic world of copper buying and selling. The chart offers a roadmap, however cautious interpretation and a complete strategy are key to efficiently navigating its intricacies.

.png)

.png)

Closure

Thus, we hope this text has offered beneficial insights into Decoding the Copper Value Month-to-month Chart: A Deep Dive into Market Dynamics. We thanks for taking the time to learn this text. See you in our subsequent article!