Decoding The Forex Energy Meter: A Reside Chart Foreign exchange Dealer’s Important Software

By admin / October 13, 2024 / No Comments / 2025

Decoding the Forex Energy Meter: A Reside Chart Foreign exchange Dealer’s Important Software

Associated Articles: Decoding the Forex Energy Meter: A Reside Chart Foreign exchange Dealer’s Important Software

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Decoding the Forex Energy Meter: A Reside Chart Foreign exchange Dealer’s Important Software. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Decoding the Forex Energy Meter: A Reside Chart Foreign exchange Dealer’s Important Software

The international change (foreign exchange) market, a colossal area of world foreign money buying and selling, operates with breathtaking velocity and complexity. For merchants navigating this dynamic panorama, instruments that supply clear, concise insights are invaluable. Amongst these, the foreign money power meter, usually displayed as a dwell chart, stands out as an important asset for gauging relative foreign money efficiency and figuring out potential buying and selling alternatives. This text delves into the intricacies of foreign money power meters, explaining their performance, deciphering their knowledge, and exploring their limitations throughout the context of dwell foreign exchange charts.

Understanding the Mechanics of a Forex Energy Meter

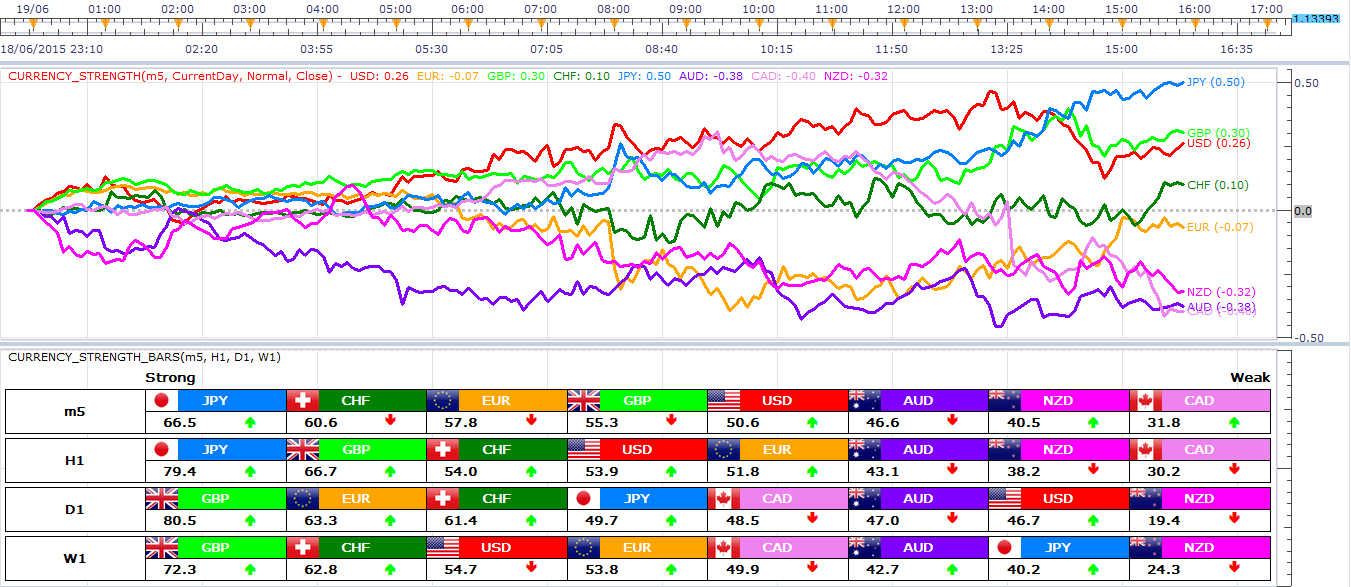

A foreign money power meter is actually a visible illustration of the relative efficiency of assorted currencies in opposition to a basket of different currencies, usually over a particular time interval (e.g., the final hour, day, week, or month). As a substitute of monitoring particular person foreign money pairs instantly, it aggregates the efficiency of a foreign money in opposition to a number of others, offering a holistic view of its power or weak spot. This aggregated view helps merchants determine broader developments and keep away from the noise of particular person pair fluctuations.

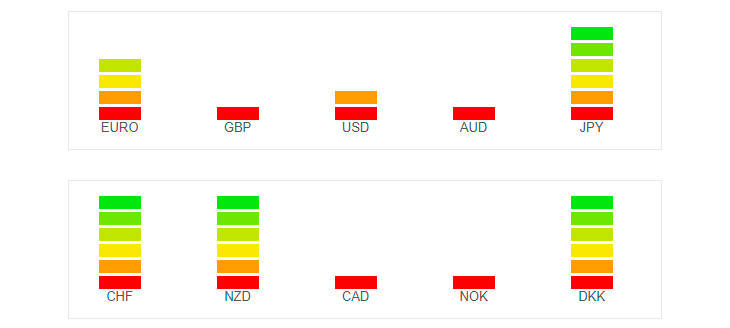

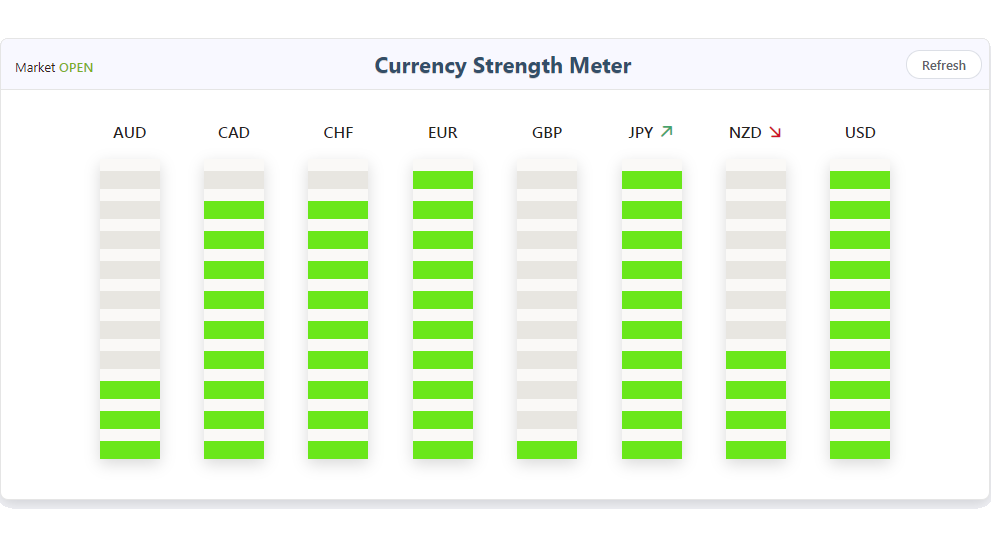

The meter usually shows currencies as ranked lists or bar charts, with the strongest foreign money on the prime and the weakest on the backside. The rating is usually based mostly on a weighted common of the foreign money’s efficiency in opposition to a number of main pairs. For instance, the USD power could be calculated by averaging its efficiency in opposition to EUR/USD, GBP/USD, USD/JPY, and USD/CHF. The weighting of every pair can differ relying on the particular meter’s algorithm, reflecting the relative significance of every pair out there.

Decoding the Reside Chart Information

The dwell facet of the foreign money power meter is essential. It permits merchants to watch real-time shifts in foreign money power, offering rapid suggestions on market dynamics. A foreign money transferring quickly up the rating suggests rising demand and potential for additional appreciation. Conversely, a foreign money constantly falling signifies weakening demand and a possible for depreciation.

Nonetheless, merely observing the rating is not enough for efficient buying and selling. Merchants want to think about a number of components alongside the meter’s knowledge:

-

Timeframe: The chosen timeframe considerably impacts the meter’s readings. A brief-term (e.g., hourly) meter will present risky fluctuations, reflecting short-term market noise. An extended-term (e.g., weekly) meter will spotlight extra vital developments, doubtlessly revealing underlying market sentiment. Merchants ought to choose a timeframe in keeping with their buying and selling technique.

-

Correlation vs. Causation: The meter reveals correlation, not causation. A powerful foreign money does not robotically indicate that every one pairs involving that foreign money will respect. Different market components, similar to financial information, geopolitical occasions, and central financial institution insurance policies, can considerably affect particular person foreign money pairs, overriding the final pattern indicated by the power meter.

-

Divergence: Discrepancies between the power meter and the efficiency of particular foreign money pairs can sign potential buying and selling alternatives. As an example, if a foreign money is ranked as robust by the meter, however a particular pair involving that foreign money is displaying weak spot, it may counsel a brief dip or a chance for a contrarian commerce (although this requires cautious danger administration).

-

Contextual Evaluation: The power meter ought to by no means be utilized in isolation. It must be complemented by elementary evaluation (inspecting financial indicators, political stability, and central financial institution insurance policies) and technical evaluation (figuring out chart patterns, help/resistance ranges, and different technical indicators). Combining these approaches gives a extra complete view of the market and reduces reliance on any single indicator.

Kinds of Forex Energy Meters and Their Variations

Totally different platforms and software program suppliers provide variations of foreign money power meters. Some frequent sorts embody:

-

Weighted Common Meters: These meters calculate a weighted common of a foreign money’s efficiency in opposition to a number of different currencies, as described earlier. The weighting scheme can differ, influencing the meter’s sensitivity to completely different pairs.

-

Easy Rating Meters: These meters merely rank currencies based mostly on their efficiency in opposition to a basket of currencies, with out assigning weights. They provide a less complicated, much less advanced view of relative power.

-

Visible Meters: These meters use visible representations like bar charts or heatmaps to show foreign money power, providing a fast and intuitive understanding of the market’s dynamics.

-

Interactive Meters: Some superior meters enable merchants to customise parameters, such because the currencies included within the basket, the timeframe, and the weighting scheme. This flexibility permits merchants to tailor the meter to their particular buying and selling model and preferences.

Integrating the Forex Energy Meter right into a Reside Foreign exchange Buying and selling Technique

The foreign money power meter is a precious device, but it surely’s not a standalone buying and selling system. It must be built-in right into a broader buying and selling technique, used together with different analytical strategies. This is how it may be included:

-

Figuring out Potential Forex Pairs: The meter can spotlight currencies displaying vital power or weak spot, suggesting potential pairs for additional investigation. For instance, a constantly robust USD would possibly lead a dealer to discover USD-based pairs like EUR/USD or GBP/USD.

-

Confirming Buying and selling Alerts: The meter can verify indicators generated by different technical indicators. As an example, if a breakout sample is noticed on a chart, a powerful rating for the concerned foreign money on the power meter can improve confidence within the commerce.

-

Danger Administration: The meter may help assess total market danger. If a number of currencies are displaying weak spot, it would point out a broader market downturn, prompting merchants to cut back their total publicity.

-

Divergence Buying and selling: As talked about earlier, discrepancies between the meter and particular person pair efficiency can sign potential divergence buying and selling alternatives. Nonetheless, these trades require cautious danger administration and a radical understanding of market dynamics.

Limitations and Issues

Whereas foreign money power meters are useful, they don’t seem to be with out limitations:

-

Lagging Indicator: The meter displays previous efficiency, not future motion. Market situations can change quickly, rendering the meter’s knowledge much less related in dynamic conditions.

-

Oversimplification: The meter simplifies advanced market interactions. It does not account for all of the nuances of financial components, geopolitical occasions, or central financial institution interventions.

-

Algorithm Dependence: The accuracy and effectiveness of the meter rely closely on the algorithm used to calculate foreign money power. Totally different algorithms can produce completely different outcomes.

-

False Alerts: The meter can generate false indicators, particularly in risky market situations. Merchants ought to at all times use it together with different analytical instruments and train warning.

Conclusion:

The foreign money power meter, displayed as a dwell chart, is a robust device for foreign exchange merchants. It gives a concise overview of relative foreign money efficiency, aiding in figuring out potential buying and selling alternatives and managing danger. Nonetheless, it is essential to grasp its limitations and combine it right into a broader buying and selling technique that includes elementary and technical evaluation. Through the use of the meter judiciously and together with different instruments, merchants can improve their decision-making course of and enhance their total buying and selling efficiency within the dynamic world of foreign exchange. Keep in mind that accountable buying and selling practices, together with thorough analysis and danger administration, are essential for achievement in any market.

Closure

Thus, we hope this text has supplied precious insights into Decoding the Forex Energy Meter: A Reside Chart Foreign exchange Dealer’s Important Software. We hope you discover this text informative and helpful. See you in our subsequent article!