Decoding The Dogecoin Chart (USD): A Deep Dive Into The Meme Coin’s Worth Motion

By admin / June 25, 2024 / No Comments / 2025

Decoding the Dogecoin Chart (USD): A Deep Dive into the Meme Coin’s Worth Motion

Associated Articles: Decoding the Dogecoin Chart (USD): A Deep Dive into the Meme Coin’s Worth Motion

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Decoding the Dogecoin Chart (USD): A Deep Dive into the Meme Coin’s Worth Motion. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Decoding the Dogecoin Chart (USD): A Deep Dive into the Meme Coin’s Worth Motion

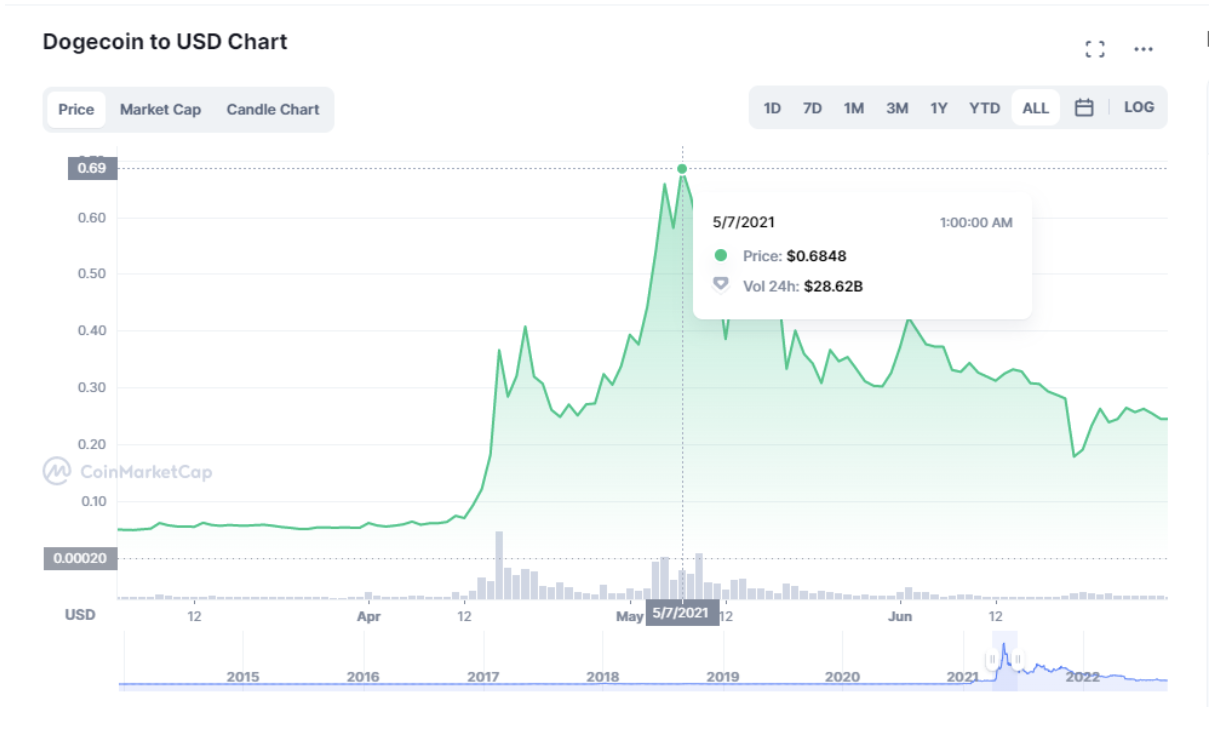

Dogecoin (DOGE), the cryptocurrency born as a joke, has defied expectations, reaching exceptional value swings and a devoted following. Understanding its value chart towards the US greenback (USD) requires extra than simply glancing on the traces; it calls for a nuanced method contemplating its distinctive traits, market influences, and the inherent volatility of the crypto house. This text will present a complete evaluation of the DOGE/USD chart, exploring its historic efficiency, key value actions, technical indicators, and the components contributing to its unpredictable nature.

Historic Efficiency: From Meme to Mainstream (and Again Once more?)

Dogecoin’s journey has been something however linear. Launched in 2013, it initially traded at negligible values, reflecting its playful origins. Nevertheless, its trajectory took a dramatic flip in 2021, propelled by fervent social media engagement, significantly from Elon Musk’s enthusiastic tweets. This era noticed DOGE’s value skyrocket, reaching an all-time excessive (ATH) of roughly $0.74. This explosive development underscored the facility of social media hype and the affect of outstanding figures on cryptocurrency markets.

The post-ATH interval witnessed a big correction, mirroring the broader cryptocurrency market downturn. The value tumbled, highlighting the inherent threat related to meme cash, whose worth is closely influenced by sentiment relatively than elementary components like technological innovation or utility. Analyzing the DOGE/USD chart throughout this era reveals durations of sharp rallies interspersed with equally dramatic drops, indicative of its extremely speculative nature.

Key Worth Actions and Influencing Elements:

A number of key occasions have considerably impacted the DOGE/USD chart:

-

Elon Musk’s Tweets: Musk’s pronouncements on Dogecoin have repeatedly brought about substantial value volatility. Optimistic mentions typically result in speedy value will increase, whereas detrimental feedback or perceived lack of assist set off sell-offs. This dependence on a single particular person’s pronouncements highlights the inherent fragility of a meme coin’s value stability.

-

Social Media Traits: Dogecoin’s value is extremely delicate to tendencies on platforms like Twitter, Reddit, and TikTok. Viral hashtags, optimistic group sentiment, and coordinated shopping for actions can all contribute to important value surges. Conversely, detrimental information or waning social media curiosity can result in sharp declines.

-

Crypto Market Sentiment: Broader cryptocurrency market tendencies additionally affect DOGE’s value. Intervals of normal market bullishness typically result in elevated demand for Dogecoin, whereas bearish sentiment can set off widespread promoting strain. The correlation between DOGE and Bitcoin (BTC), the dominant cryptocurrency, is commonly noticeable, although not at all times completely aligned.

-

Change Listings and Adoption: The itemizing of Dogecoin on main cryptocurrency exchanges expands its accessibility and liquidity, probably driving value will increase. Conversely, delistings or regulatory crackdowns can negatively influence its value.

Technical Evaluation of the DOGE/USD Chart:

Analyzing the DOGE/USD chart via the lens of technical evaluation requires acknowledging its limitations because of the coin’s excessive volatility and dependence on exterior components. Nevertheless, sure indicators can provide insights:

-

Shifting Averages: Easy Shifting Averages (SMAs) and Exponential Shifting Averages (EMAs) might help establish potential pattern reversals. Crossovers between totally different transferring averages can sign shopping for or promoting alternatives, though their reliability is questionable in such a risky asset.

-

Relative Power Index (RSI): The RSI is a momentum indicator that may assist establish overbought and oversold circumstances. Excessive RSI readings (above 70 or beneath 30) typically recommend potential value reversals, however false indicators are frequent in Dogecoin’s erratic value motion.

-

Help and Resistance Ranges: Figuring out historic assist and resistance ranges can present insights into potential value ranges. Nevertheless, these ranges are regularly damaged because of the coin’s volatility, rendering their predictive energy restricted.

-

Quantity Evaluation: Analyzing buying and selling quantity alongside value actions can present context. Excessive quantity throughout value will increase suggests robust shopping for strain, whereas excessive quantity throughout value decreases signifies important promoting strain. Low quantity throughout value actions suggests an absence of conviction and potential for value reversals.

Challenges in Chart Interpretation:

Decoding the DOGE/USD chart presents distinctive challenges:

-

Excessive Volatility: Dogecoin’s value is notoriously risky, making correct predictions extraordinarily troublesome. Sharp value swings can happen with out clear underlying causes, rendering conventional technical evaluation much less efficient.

-

Manipulation Potential: The coin’s susceptibility to manipulation via coordinated social media campaigns and whale exercise makes chart evaluation much less dependable. Massive holders can affect value actions disproportionately.

-

Lack of Elementary Worth: Not like some cryptocurrencies with established utility or technological developments, Dogecoin lacks robust elementary worth. Its value is primarily pushed by hypothesis and sentiment, making conventional valuation metrics much less relevant.

Investing in Dogecoin: A Dangerous Proposition

Investing in Dogecoin must be approached with excessive warning. Its value is extremely speculative and topic to important fluctuations. Traders ought to solely allocate a small portion of their portfolio to Dogecoin, and solely after thorough analysis and threat evaluation. It is essential to know that important losses are potential.

Conclusion:

The Dogecoin chart (USD) presents a captivating case research in cryptocurrency value motion. Its volatility, dependence on social media tendencies, and susceptibility to manipulation make it a difficult asset to research. Whereas technical indicators can present some insights, they’re removed from foolproof. Traders ought to prioritize a deep understanding of the dangers concerned earlier than contemplating any funding in Dogecoin. The coin’s future value stays extremely unsure, highlighting the significance of accountable funding practices and a practical evaluation of its inherent volatility. The chart itself is a mirrored image of the meme coin’s distinctive and sometimes unpredictable journey via the cryptocurrency panorama. It is a testomony to the facility of social media, the attract of hypothesis, and the inherent dangers related to investing in extremely risky belongings. In the end, understanding the DOGE/USD chart requires not simply technical talent, but additionally a eager consciousness of the broader social and market forces shaping its value.

Closure

Thus, we hope this text has supplied precious insights into Decoding the Dogecoin Chart (USD): A Deep Dive into the Meme Coin’s Worth Motion. We recognize your consideration to our article. See you in our subsequent article!