Decoding The Double Backside: A Complete Information With Actual-World Examples

By admin / August 23, 2024 / No Comments / 2025

Decoding the Double Backside: A Complete Information with Actual-World Examples

Associated Articles: Decoding the Double Backside: A Complete Information with Actual-World Examples

Introduction

With enthusiasm, let’s navigate by the intriguing matter associated to Decoding the Double Backside: A Complete Information with Actual-World Examples. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Decoding the Double Backside: A Complete Information with Actual-World Examples

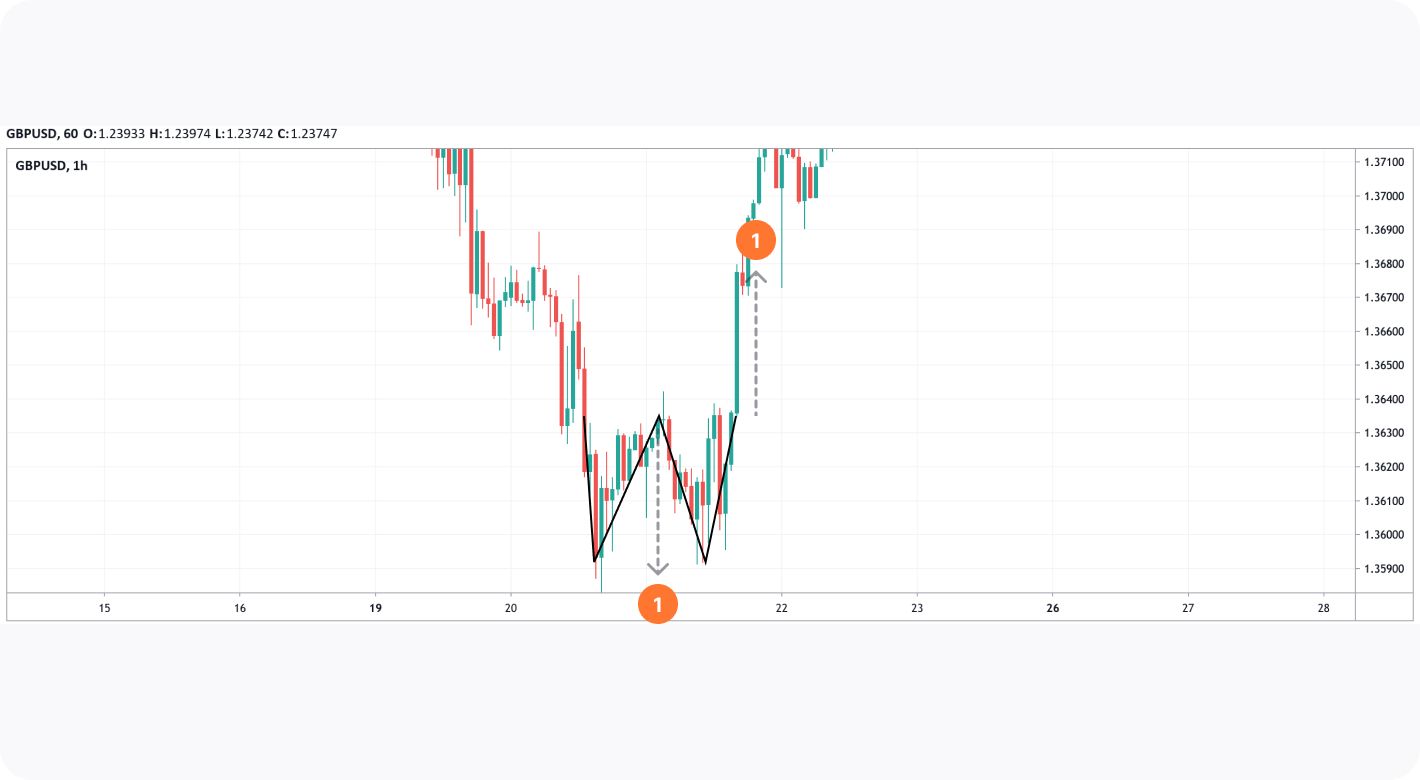

The double backside chart sample is a robust reversal indicator in technical evaluation, signaling a possible shift from a downtrend to an uptrend. Recognizing this sample requires understanding its construction, affirmation indicators, and potential pitfalls. This text will delve into the intricacies of the double backside, offering detailed explanations, real-world examples throughout varied asset courses, and essential concerns for profitable implementation in your buying and selling technique.

Understanding the Double Backside Sample

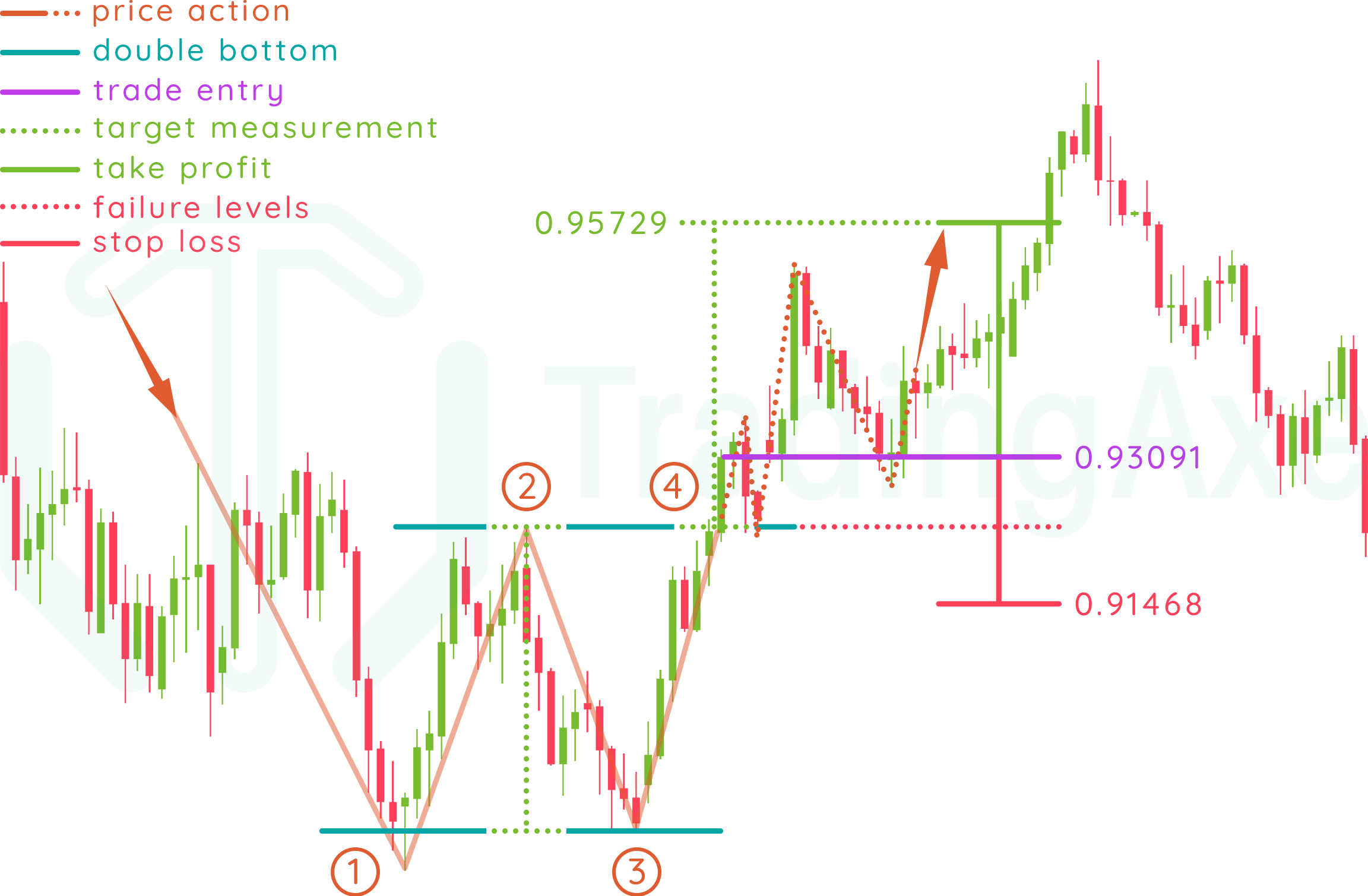

The double backside sample is a bullish reversal sample characterised by two distinct lows that kind a "W" form on a worth chart. It signifies that promoting stress has exhausted itself, and consumers are stepping in to push costs increased. The sample consists of three key parts:

-

The Left Low (or First Backside): This represents the preliminary vital drop in worth, marking the end result of a downtrend. It is characterised by a interval of sustained promoting stress.

-

The Rebound: After the primary low, the value rebounds, usually considerably. This rebound creates a brief worth restoration, giving the impression of a possible development reversal. Nevertheless, the rally often fails to interrupt by vital resistance ranges.

-

The Proper Low (or Second Backside): The value retraces again down, forming a second low that’s roughly on the similar degree as the primary low (or very shut). This second low confirms the potential for a reversal. The essential facet right here is that the second low ought to ideally be inside a small share vary of the primary low, usually inside 5-10%, to validate the sample. A considerably totally different second low weakens the sample’s predictive energy.

-

The Breakout: After the second low, a sustained worth enhance past the neckline (resistance degree) confirms the double backside sample and indicators a possible uptrend. The neckline is the excessive level connecting the 2 troughs of the "W" formation. A decisive breakout above this neckline is the important thing affirmation sign.

Affirmation Alerts:

Whereas the "W" form is the core of the double backside, a number of confirming indicators improve its reliability:

-

Rising Quantity: A notable enhance in buying and selling quantity throughout the breakout above the neckline strengthens the sample’s validity. Excessive quantity suggests robust shopping for stress driving the value increased. Conversely, low quantity throughout the breakout would possibly point out a weak reversal and a possible false sign.

-

Technical Indicators: RSI (Relative Power Index) and MACD (Shifting Common Convergence Divergence) can present corroborating proof. A bullish divergence, the place the value makes decrease lows however the RSI or MACD makes increased lows, suggests a possible reversal and reinforces the double backside sample.

-

Assist Degree: The value degree of the 2 lows acts as a robust assist zone. A bounce off this assist degree throughout the rebound and after the second low additional strengthens the sample’s reliability.

-

Chart Sample Context: The general market development and the context throughout the broader chart are essential. A double backside forming inside a long-term uptrend is extra dependable than one forming throughout a protracted bear market.

Actual-World Examples:

Let’s analyze some real-world examples throughout totally different asset courses as an example the double backside sample:

1. Apple (AAPL) Inventory: (Illustrative – Particular dates and costs would should be verified from a dependable monetary knowledge supply)

Think about a situation the place AAPL inventory experiences a big drop, forming a primary low. After a interval of consolidation and a rebound, the value retraces, forming a second low close to the primary low. A powerful breakout above the neckline with rising quantity would affirm the double backside, signaling a possible uptrend.

2. Gold (XAUUSD): (Illustrative – Particular dates and costs would should be verified from a dependable monetary knowledge supply)

Gold’s worth would possibly exhibit a double backside sample after a interval of decline. The 2 lows would mark durations of serious promoting stress. A subsequent breakout above the neckline, supported by rising quantity and bullish divergence in RSI, would affirm the sample and counsel a possible worth enhance.

3. Bitcoin (BTCUSD): (Illustrative – Particular dates and costs would should be verified from a dependable monetary knowledge supply)

Bitcoin’s unstable nature usually presents alternatives to establish double backside patterns. A major worth correction adopted by a rebound and a subsequent second low close to the primary low, coupled with a robust breakout and elevated quantity, may sign a possible bullish reversal.

4. EUR/USD Forex Pair: (Illustrative – Particular dates and costs would should be verified from a dependable monetary knowledge supply)

Within the overseas trade market, the EUR/USD foreign money pair would possibly present a double backside sample after a interval of weakening Euro. The breakout above the neckline, confirmed by rising buying and selling quantity and probably a bullish divergence in technical indicators, may point out a possible strengthening of the Euro in opposition to the US greenback.

Potential Pitfalls and Issues:

-

False Breakouts: The value would possibly break above the neckline however fail to maintain the upward momentum, resulting in a false breakout and a continuation of the downtrend. This underscores the significance of quantity affirmation and different supporting indicators.

-

Measurement of the Double Backside: The 2 lows do not must be completely similar. A slight variation is appropriate, however a big distinction weakens the sample’s predictive energy.

-

Time Body Issues: The timeframe chosen for evaluation considerably impacts the sample’s identification and interpretation. A double backside on a every day chart won’t be evident on a weekly chart, and vice versa.

-

Affirmation is Essential: Relying solely on the "W" form is inadequate. Affirmation by quantity, technical indicators, and total market context is essential to keep away from false indicators.

Conclusion:

The double backside chart sample is a priceless device in a dealer’s arsenal, however it ought to be used cautiously. Understanding its construction, affirmation indicators, and potential pitfalls is significant for profitable implementation. Combining the double backside sample with different technical evaluation instruments and an intensive understanding of market fundamentals results in a extra sturdy buying and selling technique. Keep in mind that no sample ensures success, and danger administration stays paramount in any buying and selling endeavor. The examples offered function illustrative eventualities; thorough analysis and evaluation of particular charts utilizing dependable knowledge sources are essential earlier than making any buying and selling selections. At all times conduct your personal due diligence earlier than implementing any buying and selling technique.

Closure

Thus, we hope this text has offered priceless insights into Decoding the Double Backside: A Complete Information with Actual-World Examples. We respect your consideration to our article. See you in our subsequent article!