Decoding The Double Prime And Double Backside: Highly effective Chart Patterns For Merchants

By admin / July 13, 2024 / No Comments / 2025

Decoding the Double Prime and Double Backside: Highly effective Chart Patterns for Merchants

Associated Articles: Decoding the Double Prime and Double Backside: Highly effective Chart Patterns for Merchants

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the Double Prime and Double Backside: Highly effective Chart Patterns for Merchants. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Decoding the Double Prime and Double Backside: Highly effective Chart Patterns for Merchants

The world of technical evaluation is wealthy with patterns that may assist merchants anticipate market actions. Amongst these, the double high and double backside formations stand out as dependable indicators of potential pattern reversals. These patterns, characterised by their distinct visible shapes, provide helpful insights into market sentiment and may considerably enhance buying and selling choices when accurately recognized and interpreted. This text will delve deep into the intricacies of double high and double backside patterns, exploring their formation, identification, affirmation, and sensible purposes.

Understanding the Double Prime Sample:

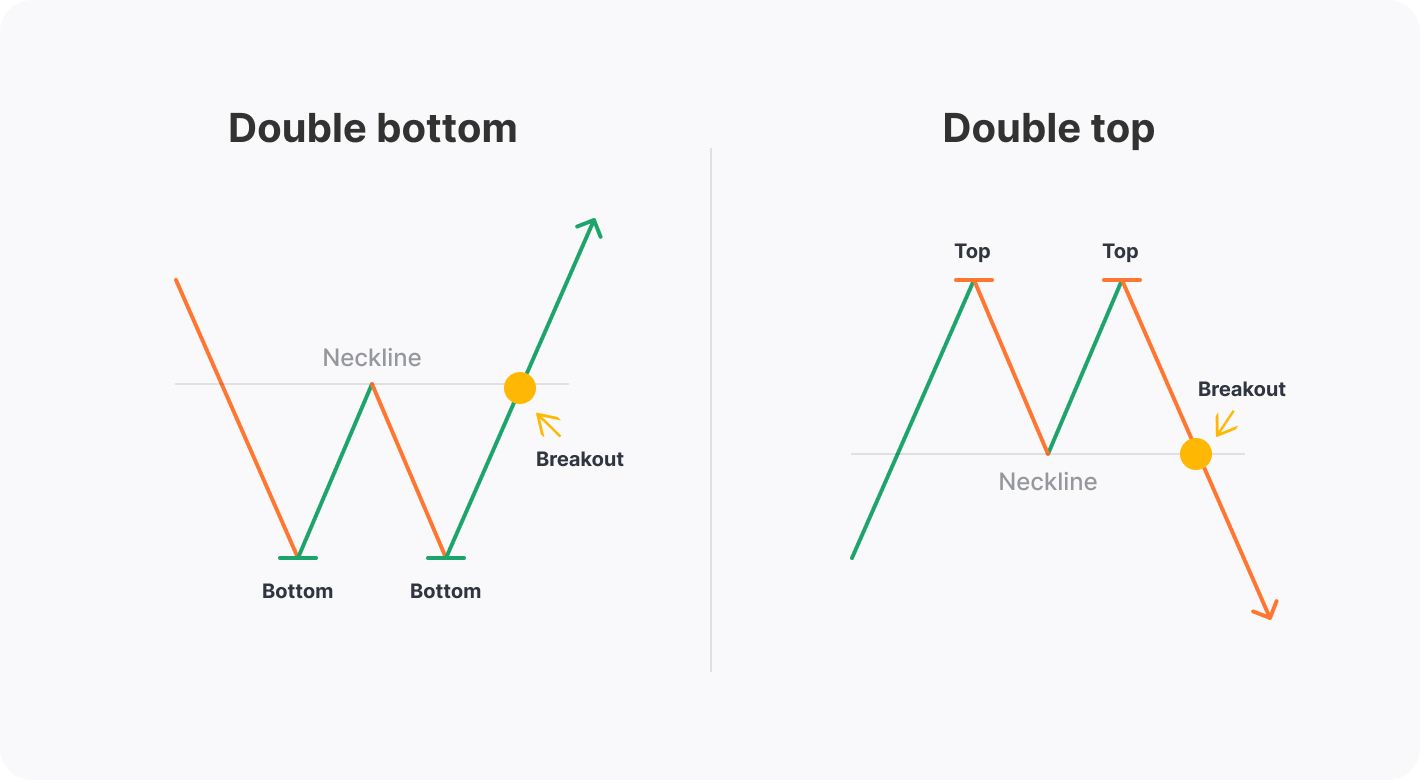

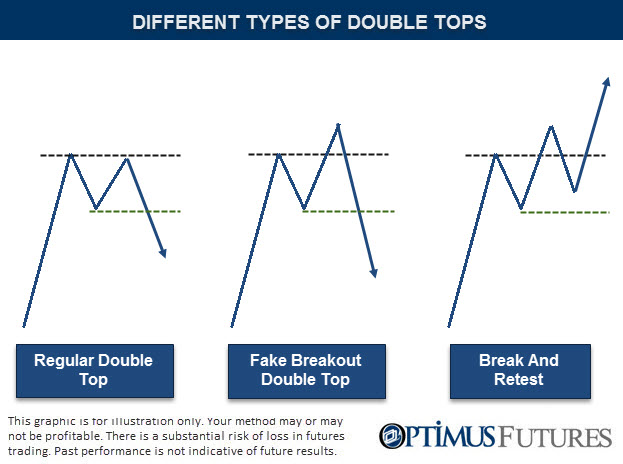

A double high sample is a bearish reversal sample, signifying a possible shift from an uptrend to a downtrend. It is visually represented by two distinct peaks of roughly equal top, adopted by a decrease trough. The sample’s formation suggests that purchasing strain has weakened, and sellers are gaining momentum, probably resulting in a worth decline.

Key Traits of a Double Prime:

- Two Peaks (Highs): The sample is outlined by two vital worth highs, comparatively shut in worth and time. These peaks characterize durations of robust shopping for strain that in the end didn’t push the value larger. The nearer these peaks are in worth, the stronger the sample.

- Neckline: A vital aspect of the double high is the neckline, a horizontal or barely sloping trendline connecting the troughs between the 2 peaks. This neckline acts as essential help in the course of the uptrend and serves as a possible resistance stage as soon as the sample is accomplished. A break beneath the neckline confirms the sample and triggers a bearish sign.

- Quantity: Whereas not a defining attribute, quantity can present helpful affirmation. Usually, quantity ought to be larger in the course of the formation of the 2 peaks, indicating robust shopping for exercise that ultimately falters. A lower in quantity in the course of the second peak is usually a bearish signal, suggesting weakening shopping for strain. Subsequently, elevated quantity in the course of the neckline breakout confirms the bearish sign.

- Worth Motion: The value motion throughout the sample ought to ideally be comparatively orderly, exhibiting a gradual decline from the second peak in direction of the neckline. Wild worth swings throughout the sample can weaken its reliability.

Figuring out a Double Prime:

Figuring out a double high requires cautious commentary of worth motion and the formation of the sample. Merchants usually use charting software program to attract trendlines and determine potential patterns. Nevertheless, it is essential to do not forget that not each double top-like formation is a dependable sign. A number of elements want consideration:

- Peak Similarity: The 2 peaks ought to be comparatively shut in worth. A major distinction in top can weaken the sample’s predictive energy.

- Neckline Readability: A clearly outlined neckline is essential for correct sample identification. A wavering or unclear neckline reduces the sample’s reliability.

- Timeframe: The timeframe used to determine the sample is essential. A double high recognized on a day by day chart might need completely different implications than one recognized on a weekly or month-to-month chart. Longer timeframes typically recommend extra vital worth actions.

- Context: Think about the broader market context. A double high formation in a strongly bullish market may not result in a major worth reversal.

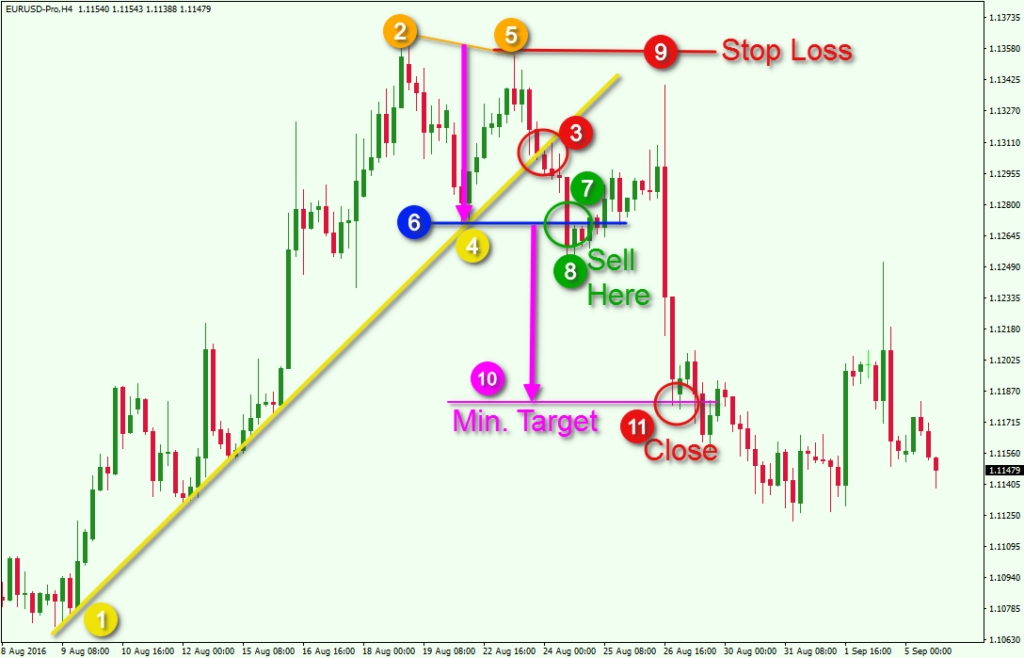

Affirmation and Buying and selling Methods:

As soon as a possible double high sample is recognized, affirmation is essential earlier than coming into a bearish commerce. A decisive break beneath the neckline, ideally accompanied by elevated quantity, confirms the sample’s validity. As soon as confirmed, numerous buying and selling methods may be employed:

- Brief Promoting: Brief promoting is the most typical technique employed after a double high breakout. Merchants intention to revenue from the anticipated worth decline.

- Cease-Loss Orders: A stop-loss order is essential to restrict potential losses. This order is positioned barely beneath the neckline, defending towards false breakouts or sudden worth fluctuations.

- Goal Worth: A goal worth is set primarily based on the sample’s top. The value distinction between the very best peak and the neckline is usually used to undertaking the potential worth decline.

Understanding the Double Backside Sample:

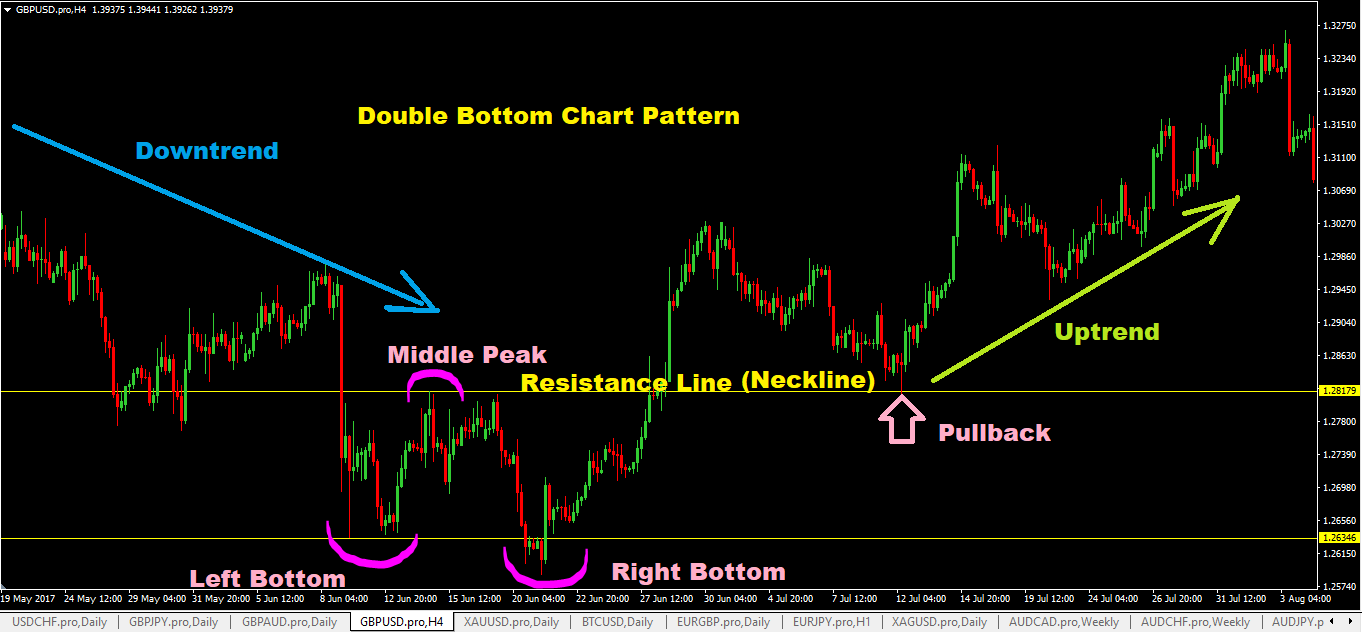

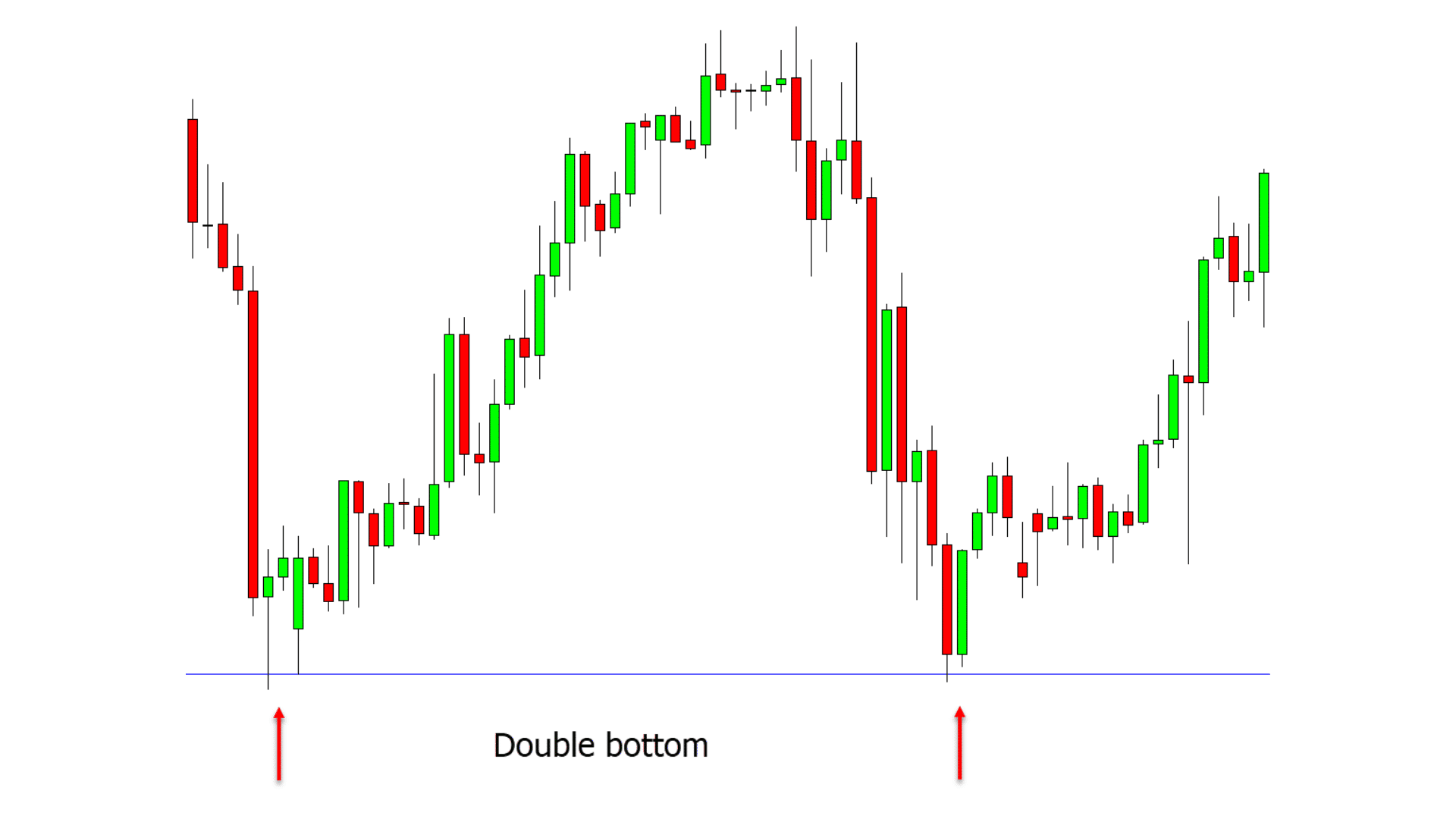

The double backside is the bullish counterpart of the double high. It is a bullish reversal sample that signifies a possible shift from a downtrend to an uptrend. Visually, it is characterised by two troughs of roughly equal depth, adopted by a better peak. The sample means that promoting strain has weakened, and consumers are gaining momentum, probably resulting in a worth improve.

Key Traits of a Double Backside:

- Two Troughs (Lows): The sample is outlined by two vital worth lows, comparatively shut in worth and time. These troughs characterize durations of robust promoting strain that ultimately faltered.

- Neckline: Just like the double high, the double backside has a neckline, a horizontal or barely sloping trendline connecting the peaks between the 2 troughs. This neckline acts as essential resistance in the course of the downtrend and serves as a possible help stage as soon as the sample is accomplished. A break above the neckline confirms the sample and triggers a bullish sign.

- Quantity: Quantity evaluation performs an analogous position in confirming the double backside. Increased quantity in the course of the formation of the 2 troughs signifies robust promoting strain that ultimately diminishes. Elevated quantity in the course of the neckline breakout confirms the bullish sign.

- Worth Motion: The value motion ought to present a gradual rise from the second trough in direction of the neckline.

Figuring out and Confirming a Double Backside:

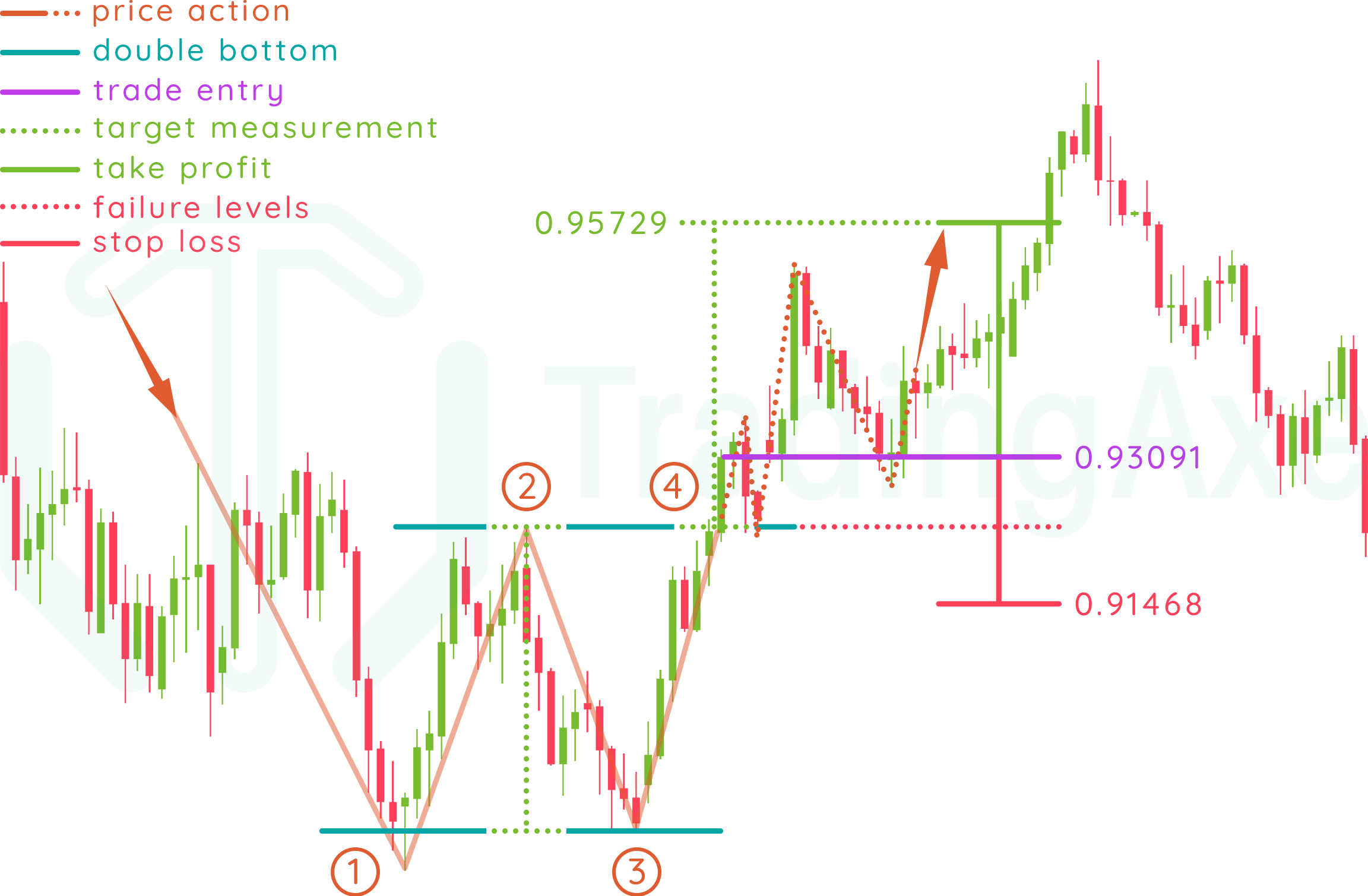

Figuring out a double backside follows comparable rules to figuring out a double high. Merchants ought to search for two comparatively shut troughs, a clearly outlined neckline, and acceptable quantity affirmation. A decisive break above the neckline, ideally with elevated quantity, confirms the sample and alerts a possible uptrend.

Buying and selling Methods for Double Bottoms:

As soon as a double backside is confirmed, a number of buying and selling methods may be carried out:

- Shopping for: The first technique is to purchase the asset after the neckline breakout.

- Cease-Loss Orders: A stop-loss order ought to be positioned barely beneath the neckline to guard towards false breakouts.

- Goal Worth: The value distinction between the neckline and the bottom trough is usually used to undertaking the potential worth improve.

Limitations and Issues:

Whereas double high and double backside patterns are helpful instruments, it is essential to acknowledge their limitations:

- Subjectivity: Figuring out these patterns may be subjective, with completely different merchants probably drawing completely different necklines or decoding the sample in another way.

- False Breakouts: False breakouts can happen, resulting in losses if not managed correctly with stop-loss orders.

- Affirmation is Essential: Relying solely on the sample with out affirmation from different technical indicators or elementary evaluation may be dangerous.

- Context Issues: The broader market context and the asset’s particular traits ought to be thought of earlier than making buying and selling choices.

Conclusion:

The double high and double backside patterns are highly effective instruments in a dealer’s arsenal. Nevertheless, mastering their identification and interpretation requires observe, endurance, and a complete understanding of technical evaluation. By combining sample recognition with different indicators and threat administration strategies, merchants can considerably enhance their buying and selling choices and improve their probabilities of success. Keep in mind that these patterns aren’t foolproof, and a radical threat administration technique is all the time important. All the time mix technical evaluation with elementary evaluation for a extra strong buying and selling method.

Closure

Thus, we hope this text has offered helpful insights into Decoding the Double Prime and Double Backside: Highly effective Chart Patterns for Merchants. We hope you discover this text informative and useful. See you in our subsequent article!