Decoding The Hammer: A Complete Information To This Highly effective Reversal Chart Sample

By admin / July 11, 2024 / No Comments / 2025

Decoding the Hammer: A Complete Information to This Highly effective Reversal Chart Sample

Associated Articles: Decoding the Hammer: A Complete Information to This Highly effective Reversal Chart Sample

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to Decoding the Hammer: A Complete Information to This Highly effective Reversal Chart Sample. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Decoding the Hammer: A Complete Information to This Highly effective Reversal Chart Sample

The world of technical evaluation is wealthy with patterns, every whispering potential clues in regards to the future path of a monetary instrument. Amongst these, the hammer stands out as a visually distinct and doubtlessly highly effective reversal sample, hinting at a bullish shift in momentum. This text will delve deep into the intricacies of the hammer candlestick sample, exploring its formation, variations, affirmation methods, danger administration, and sensible functions.

Understanding the Hammer’s Anatomy:

A hammer is a single candlestick characterised by a small or nonexistent physique and a protracted decrease shadow, no less than twice the size of the physique. This signifies a battle between patrons and sellers, the place sellers initially push the worth down (creating the lengthy decrease shadow), however patrons ultimately step in, pushing the worth again as much as shut close to the opening value or barely larger. The visible illustration resembles a hammer, therefore the title.

Key Traits of a Hammer:

- Small Physique: The true physique (the distinction between the opening and shutting costs) is comparatively quick. It may be bullish (white/inexperienced) or bearish (black/crimson), though bullish hammers are typically thought-about stronger reversal indicators.

- Lengthy Decrease Shadow: The decrease shadow (the space between the low of the candle and the physique) is considerably longer than the physique, ideally no less than twice its size. This means sturdy shopping for stress that prevented the worth from falling additional.

- Small or No Higher Shadow: Whereas not strictly obligatory, a small or absent higher shadow strengthens the hammer’s bullish sign. A protracted higher shadow may recommend indecision and weaken the sample’s predictive energy.

- Placement: The best placement for a hammer is on the backside of a downtrend. This means that the promoting stress is waning, and patrons are beginning to acquire management.

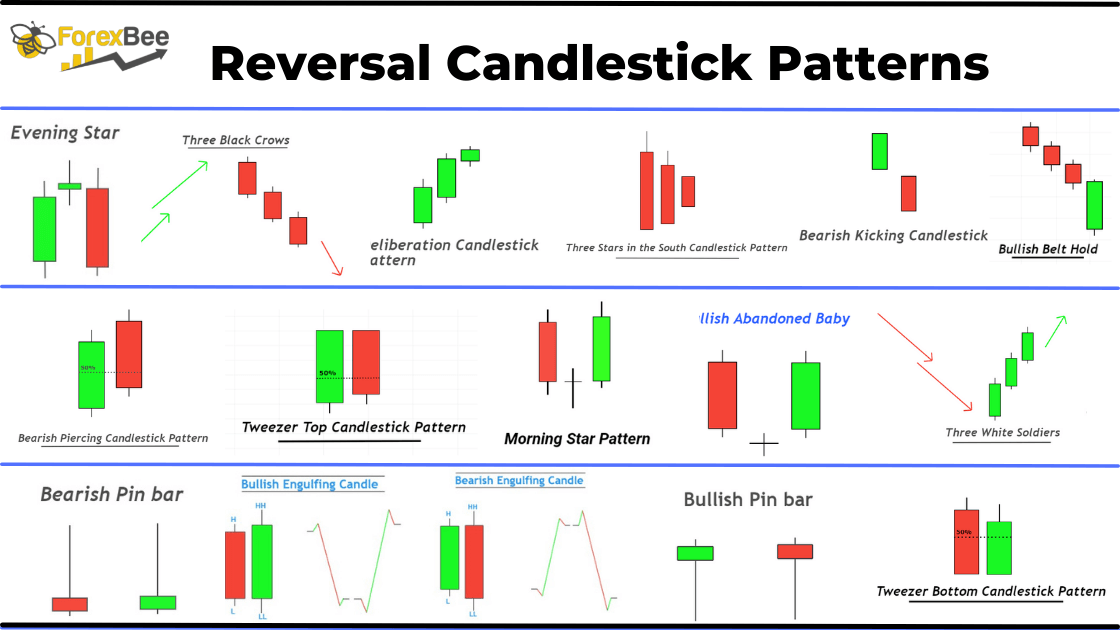

Variations of the Hammer Sample:

Whereas the traditional hammer has the traits described above, a number of variations exist:

- Inverted Hammer: That is the bearish counterpart of the hammer. It contains a small physique with a protracted higher shadow, indicating that sellers initially pushed the worth up, however patrons had been unable to maintain the upward momentum. Inverted hammers are thought-about bearish reversal indicators.

- Hanging Man: It is a bearish hammer that seems on the high of an uptrend. Whereas visually much like a hammer, its context inside an uptrend makes it a bearish sign, indicating potential reversal.

- Capturing Star: Much like the inverted hammer, a capturing star is a bearish candle with a small actual physique and a protracted higher wick. It signifies a rejection of upper costs. The important thing distinction usually lies within the context throughout the prevailing pattern.

- Doji Star: A doji star is a particular case the place the opening and shutting costs are just about the identical, leading to a really small physique with higher and decrease shadows. When a doji seems after a downtrend, it might probably act as a hammer-like sign, hinting at a doable reversal.

Affirmation Methods for Hammer Patterns:

Figuring out a hammer is simply step one. Affirmation from different technical indicators strengthens the sign and reduces the danger of false indicators. Frequent affirmation methods embrace:

- Quantity Evaluation: A rise in quantity in the course of the hammer candle confirms the power of the shopping for stress. Excessive quantity suggests extra conviction behind the worth reversal.

- Transferring Averages: A bullish crossover of short-term transferring averages (e.g., 50-day MA crossing above the 20-day MA) after the hammer suggests a strengthening uptrend.

- Relative Energy Index (RSI): An RSI studying in oversold territory (sometimes under 30) earlier than the hammer formation provides additional weight to the bullish reversal potential.

- MACD: A bullish divergence, the place the worth makes decrease lows however the MACD makes larger lows, suggests weakening bearish momentum and potential for a bullish reversal.

- Help Ranges: A hammer forming close to a big assist degree provides credibility to the reversal sign, because the assist acts as a shopping for zone.

Danger Administration and Commerce Entry:

Even with affirmation, buying and selling based mostly on chart patterns entails danger. Efficient danger administration is essential:

- Cease-Loss Order: Place a stop-loss order under the low of the hammer candle. This limits potential losses if the reversal fails.

- Take-Revenue Order: Set a take-profit order based mostly in your danger tolerance and the potential reward. This might be based mostly on a selected value goal, a a number of of the stop-loss, or a mix of technical indicators.

- Place Sizing: By no means danger greater than a small proportion of your buying and selling capital on a single commerce. This protects your general portfolio from vital losses.

- False Alerts: Bear in mind that hammer patterns can produce false indicators. Use affirmation methods and danger administration methods to attenuate the impression of those false indicators.

Sensible Functions of the Hammer Sample:

The hammer sample could be utilized throughout varied monetary markets, together with shares, foreign exchange, futures, and cryptocurrencies. Its effectiveness is determined by the context, the market’s volatility, and the affirmation indicators. Think about the next functions:

- Figuring out Potential Reversal Factors: The hammer may also help merchants determine potential turning factors in a downtrend, providing a possibility to enter lengthy positions.

- Setting Cease-Loss and Take-Revenue Orders: The low of the hammer candle gives a pure degree for putting a stop-loss order, whereas technical evaluation and value targets can decide take-profit ranges.

- Combining with Different Indicators: Utilizing the hammer along side different technical indicators (e.g., transferring averages, RSI, MACD) can considerably improve the accuracy of buying and selling choices.

- Buying and selling in Completely different Timeframes: The hammer sample could be recognized on varied timeframes (e.g., each day, weekly, month-to-month charts), permitting merchants to adapt their buying and selling methods to their most popular time horizon.

Limitations of the Hammer Sample:

Whereas the hammer is a invaluable device, it is essential to acknowledge its limitations:

- Subjectivity: Figuring out a hammer can generally be subjective, as there is not any universally agreed-upon definition for the size of the shadow relative to the physique.

- False Alerts: Like every other technical indicator, the hammer can generate false indicators. Affirmation from different indicators and correct danger administration are important to mitigate this danger.

- Context Issues: The hammer’s significance relies upon closely on the general market context and pattern. A hammer in a robust downtrend is perhaps a short lived bounce quite than a big reversal.

- Affirmation is Key: Relying solely on the hammer sample for buying and selling choices is dangerous. Affirmation from different indicators and evaluation is essential for elevated accuracy.

Conclusion:

The hammer candlestick sample is a robust device for technical merchants, providing invaluable insights into potential market reversals. Nonetheless, it is not a standalone indicator and ought to be used along side different technical evaluation instruments and sound danger administration methods. By understanding its formation, variations, affirmation strategies, and limitations, merchants can leverage the hammer sample to enhance their buying and selling choices and doubtlessly improve their profitability whereas minimizing danger. Constant follow, thorough analysis, and a disciplined method are key to efficiently incorporating the hammer right into a complete buying and selling technique. Keep in mind that previous efficiency will not be indicative of future outcomes, and buying and selling all the time entails danger.

Closure

Thus, we hope this text has offered invaluable insights into Decoding the Hammer: A Complete Information to This Highly effective Reversal Chart Sample. We respect your consideration to our article. See you in our subsequent article!