Decoding The HDFC High 100 Fund Chart: A Complete Evaluation

By admin / November 9, 2024 / No Comments / 2025

Decoding the HDFC High 100 Fund Chart: A Complete Evaluation

Associated Articles: Decoding the HDFC High 100 Fund Chart: A Complete Evaluation

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Decoding the HDFC High 100 Fund Chart: A Complete Evaluation. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Decoding the HDFC High 100 Fund Chart: A Complete Evaluation

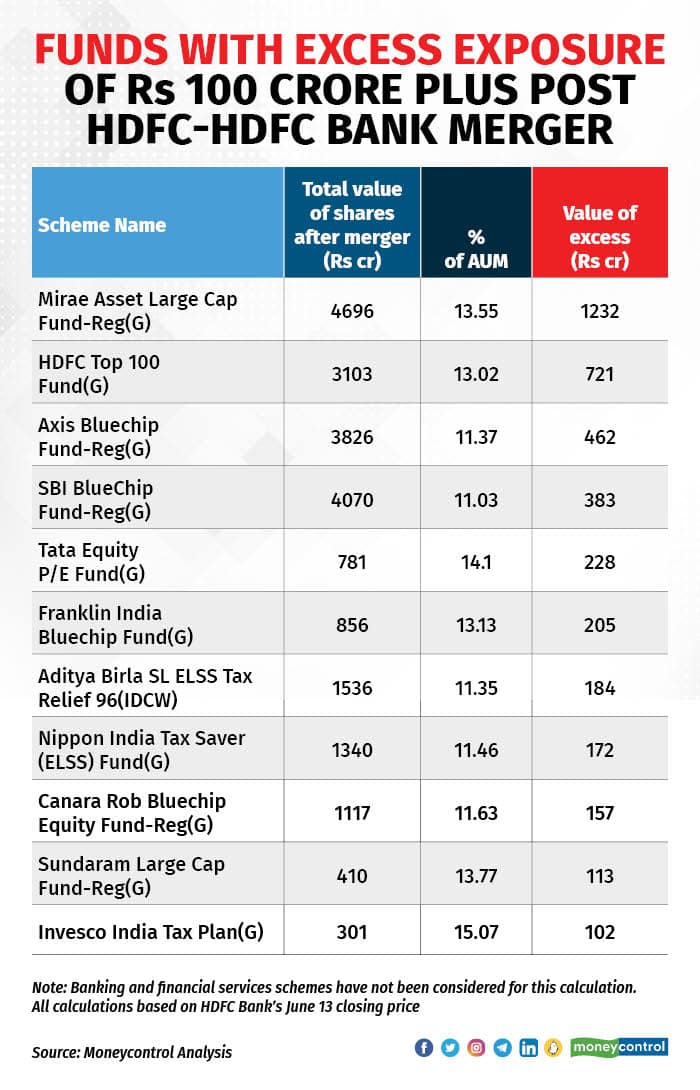

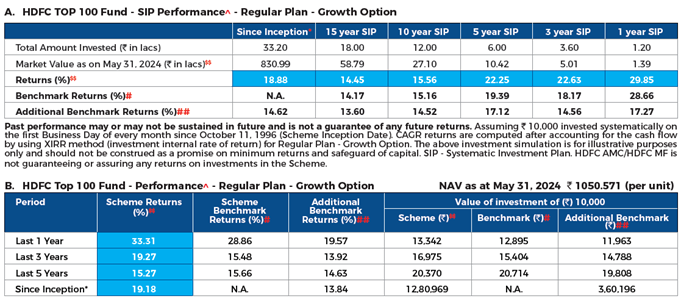

The HDFC High 100 Fund is a well-liked selection amongst Indian buyers in search of publicity to large-cap corporations. Its efficiency is carefully tracked, and understanding its chart can present helpful insights into market tendencies and the fund’s technique. This text delves deep into analyzing the HDFC High 100 Fund chart, exploring its historic efficiency, key components influencing its trajectory, and providing views for potential buyers.

Understanding the Fund’s Mandate:

Earlier than diving into the chart evaluation, it is essential to grasp the fund’s funding goal. The HDFC High 100 Fund goals to take a position primarily within the prime 100 corporations listed on the Nationwide Inventory Alternate (NSE) and the Bombay Inventory Alternate (BSE) by market capitalization. This huge-cap focus usually interprets to decrease volatility in comparison with funds investing in mid-cap or small-cap shares. Nevertheless, it does not eradicate threat solely; market fluctuations nonetheless affect the fund’s efficiency. The fund’s portfolio is actively managed, that means the fund supervisor always rebalances the holdings primarily based on market evaluation and company-specific components.

Analyzing the HDFC High 100 Fund Chart:

Analyzing the fund’s chart requires contemplating a number of components throughout totally different timeframes:

-

Lengthy-Time period Efficiency (5+ years): An extended-term perspective reveals the fund’s constant means to generate returns over prolonged durations. Study the general development – is it upward, indicating constant progress, or are there durations of serious drawdown? Evaluate the fund’s efficiency in opposition to its benchmark index (normally the Nifty 100 or an analogous large-cap index) to gauge its relative efficiency. A persistently outperforming fund signifies skillful administration. Search for durations of underperformance and analyze the explanations behind them – have been they market-wide downturns or fund-specific points?

-

Medium-Time period Efficiency (1-5 years): This timeframe highlights the fund’s means to navigate market cycles. Observe the volatility – how a lot does the NAV (Internet Asset Worth) fluctuate throughout this era? Increased volatility signifies greater threat, whereas decrease volatility suggests a extra steady funding. Evaluate the efficiency in opposition to its benchmark throughout this era, noting durations of outperformance and underperformance. This helps perceive the fund supervisor’s means to adapt to altering market circumstances.

-

Brief-Time period Efficiency (lower than 1 12 months): Brief-term fluctuations are much less vital for long-term buyers, however they’ll present insights into present market sentiment and the fund’s rapid response to occasions. Deal with the development – is the NAV rising or lowering? This must be interpreted cautiously, as short-term actions are sometimes influenced by market noise somewhat than long-term fundamentals.

Key Components Influencing the Chart:

A number of components affect the HDFC High 100 Fund chart:

-

Market Cycles: The fund’s efficiency is intrinsically linked to the general market. Bull markets usually result in optimistic returns, whereas bear markets may cause vital drawdowns. Understanding the prevailing market cycle is essential for deciphering the chart.

-

Sectoral Allocation: The fund’s portfolio is diversified throughout varied sectors. The efficiency of particular sectors considerably impacts the general fund efficiency. As an example, sturdy efficiency within the know-how sector can enhance the fund’s returns, whereas underperformance in a closely weighted sector can negatively affect it. Analyzing the fund’s sector allocation and the efficiency of these sectors is important.

-

Fund Supervisor’s Technique: The fund supervisor’s funding choices immediately affect the fund’s efficiency. Their means to determine promising corporations, handle threat successfully, and adapt to altering market circumstances determines the fund’s success. Researching the fund supervisor’s expertise and funding philosophy can provide helpful insights.

-

Financial Indicators: Macroeconomic components like inflation, rates of interest, GDP progress, and world financial circumstances considerably affect the inventory market and, consequently, the fund’s efficiency. Understanding these indicators helps in predicting future efficiency.

-

Geopolitical Occasions: World occasions like wars, political instability, and commerce disputes can create volatility and have an effect on market sentiment, influencing the fund’s chart.

Decoding the Chart for Funding Selections:

Analyzing the HDFC High 100 Fund chart is essential for making knowledgeable funding choices. Nevertheless, it is important to keep away from solely counting on the chart’s visible illustration. Contemplate the next:

-

Danger Tolerance: The fund’s historic volatility must be thought of in opposition to your private threat tolerance. In the event you’re a risk-averse investor, a persistently much less unstable fund could be a better option.

-

Funding Horizon: Lengthy-term buyers can tolerate higher short-term fluctuations, whereas short-term buyers ought to concentrate on stability and fewer volatility.

-

Diversification: The HDFC High 100 Fund must be a part of a diversified portfolio, not the only real funding. Diversification throughout totally different asset lessons and fund sorts reduces total portfolio threat.

-

Expense Ratio: Contemplate the fund’s expense ratio, because it immediately impacts the returns. A decrease expense ratio is usually most popular.

-

Previous Efficiency is just not indicative of future outcomes: Whereas analyzing historic efficiency is vital, do not forget that previous efficiency does not assure future returns. Market circumstances always change, and future efficiency can fluctuate considerably.

Conclusion:

The HDFC High 100 Fund chart gives helpful insights into the fund’s efficiency and market tendencies. Nevertheless, a complete evaluation requires contemplating varied components past simply the visible illustration of the chart. By understanding the fund’s mandate, analyzing its efficiency throughout totally different timeframes, figuring out key influencing components, and contemplating your private funding targets and threat tolerance, you may make knowledgeable funding choices. Keep in mind to seek the advice of with a monetary advisor earlier than making any funding decisions, as they’ll present personalised steerage primarily based in your particular monetary state of affairs and targets. The chart is a instrument, however knowledgeable decision-making requires a holistic method incorporating varied elements of economic evaluation and private circumstances.

Closure

Thus, we hope this text has offered helpful insights into Decoding the HDFC High 100 Fund Chart: A Complete Evaluation. We thanks for taking the time to learn this text. See you in our subsequent article!