Decoding The Junk Silver Worth Chart: A Complete Information

By admin / July 13, 2024 / No Comments / 2025

Decoding the Junk Silver Worth Chart: A Complete Information

Associated Articles: Decoding the Junk Silver Worth Chart: A Complete Information

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the Junk Silver Worth Chart: A Complete Information. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Decoding the Junk Silver Worth Chart: A Complete Information

Junk silver, a time period encompassing pre-1965 US 90% silver cash, has grow to be a preferred funding and collectible merchandise. Its value, nevertheless, shouldn’t be static, fluctuating based mostly on a number of interconnected elements. Understanding these elements and the way they’re mirrored within the junk silver value chart is essential for anybody contemplating investing in or buying and selling this asset class. This text will present an in depth overview of junk silver, its value dedication, and find out how to interpret the value chart successfully.

What’s Junk Silver?

Earlier than diving into the value chart, it is important to know what constitutes "junk silver." This time period refers to US cash minted earlier than 1965, which have been composed of 90% silver and 10% copper. These cash embody:

- Half {Dollars} (50¢): These are arguably the most well-liked junk silver cash attributable to their comparatively excessive silver content material per coin.

- Quarters (25¢): Smaller and lighter than half {dollars}, they’re nonetheless a standard element of junk silver collections.

- Dimes (10¢): The smallest of the 90% silver cash, they’re typically bought in bigger portions attributable to their decrease particular person worth.

- Half Dimes (5¢): These are much less frequent than the opposite denominations however nonetheless maintain worth for collectors.

These cash are thought of "junk" not due to their inherent lack of high quality, however as a result of their face worth is considerably decrease than their soften worth (the worth of the silver contained inside). This distinction is vital to understanding their value fluctuations.

Components Affecting Junk Silver Costs

The worth of junk silver is primarily pushed by the spot value of silver. Nonetheless, a number of different elements affect its market worth:

-

Spot Silver Worth: That is probably the most important issue. The spot value of silver fluctuates continually based mostly on world provide and demand, industrial utilization, funding developments, and geopolitical occasions. An increase within the spot value immediately interprets to the next value for junk silver. Conversely, a drop within the spot value will decrease the junk silver value. Junk silver value charts usually present a robust correlation with silver spot value charts.

-

Numismatic Worth: Whereas "junk" implies a scarcity of serious collector worth, sure cash would possibly command a premium based mostly on their mint mark, situation, or rarity. A coin in distinctive situation, as an example, would possibly fetch the next value than a closely circulated one, even when the silver content material stays the identical. This premium is added to the soften worth.

-

Provide and Demand: Like all commodity, the availability and demand dynamics affect junk silver costs. Elevated demand from traders or collectors can drive costs up, whereas a surplus available in the market can result in value drops. Main financial occasions or shifts in investor sentiment can considerably affect provide and demand.

-

Seller Premiums: Sellers add a markup to the soften worth to cowl their prices and revenue margins. These premiums differ relying on the seller, the amount bought, and the present market circumstances. Bigger purchases typically appeal to decrease premiums per ounce.

-

Financial Situations: Broader financial elements, resembling inflation, rates of interest, and total market sentiment, can affect investor urge for food for valuable metals, together with junk silver. Throughout occasions of financial uncertainty, traders typically flip to valuable metals as a protected haven asset, driving up demand and costs.

-

Authorities Rules: Modifications in authorities rules regarding valuable metals can have an effect on the market. As an example, restrictions on silver exports or modifications in taxation insurance policies can affect the value of junk silver.

Decoding the Junk Silver Worth Chart

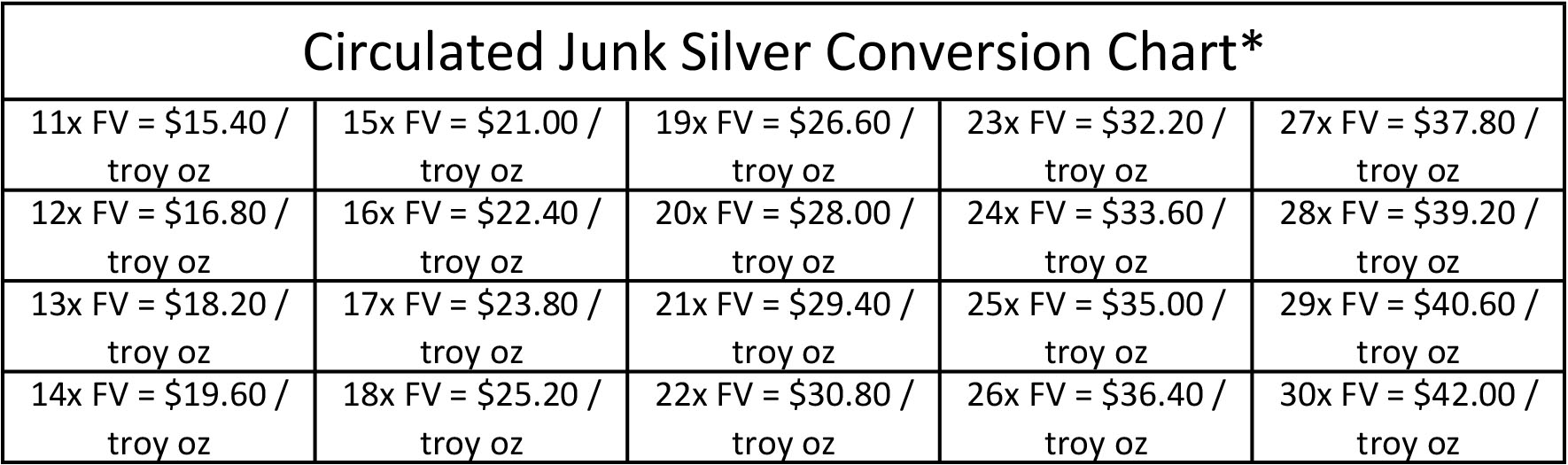

Junk silver value charts usually show the value per ounce of silver contained inside the cash. That is normally calculated by multiplying the burden of silver in a particular coin (e.g., 0.36 troy ounces in a half-dollar) by the present spot value of silver. The chart will then normally present the value per ounce plus the seller’s premium.

When decoding the chart:

-

Search for Traits: Establish long-term developments (upward or downward) to gauge the general market path. Are costs typically growing or reducing over time?

-

Analyze Volatility: Observe the fluctuations in value. How a lot does the value change from day after day or week to week? Excessive volatility suggests a extra dangerous funding.

-

Think about Help and Resistance Ranges: These are value ranges the place the value has traditionally struggled to interrupt by. Help ranges signify costs the place shopping for stress is powerful, whereas resistance ranges point out the place promoting stress is powerful.

-

Pay Consideration to Information and Occasions: Main information occasions, resembling modifications within the spot silver value, financial bulletins, or geopolitical instability, can considerably affect the value of junk silver. Keep knowledgeable about related information to raised anticipate value actions.

-

Examine to Spot Silver Worth: All the time evaluate the junk silver value to the spot value of silver. This helps decide the seller’s premium and assess whether or not the value is truthful.

-

Think about Transaction Prices: Think about any transaction prices, resembling brokerage charges or delivery expenses, when evaluating the general price of buying junk silver.

Investing in Junk Silver: Issues

Investing in junk silver gives a number of potential benefits:

-

Hedge towards Inflation: Silver is taken into account a hedge towards inflation, as its worth tends to extend during times of rising costs.

-

Tangible Asset: In contrast to shares or bonds, junk silver is a bodily asset which you could possess.

-

Liquidity: Whereas not as liquid as shares, junk silver is comparatively straightforward to purchase and promote, particularly by respected sellers.

Nonetheless, there are additionally potential drawbacks:

-

Storage Prices: Storing massive portions of junk silver requires safe storage options.

-

Worth Volatility: The worth of junk silver can fluctuate considerably, resulting in potential losses.

-

Seller Premiums: Seller premiums can add to the general price of buying junk silver.

Conclusion

The junk silver value chart is a robust software for understanding the dynamics of this distinctive asset class. By fastidiously analyzing the chart and contemplating the varied elements that affect costs, traders could make knowledgeable choices about shopping for, promoting, or holding junk silver. Do not forget that investing in valuable metals entails inherent dangers, and thorough analysis and a well-defined funding technique are important for achievement. All the time seek the advice of with a monetary advisor earlier than making any important funding choices. Understanding the interaction between the spot silver value, numismatic worth, and seller premiums is essential to navigating the complexities of the junk silver market and decoding its value chart successfully.

Closure

Thus, we hope this text has offered useful insights into Decoding the Junk Silver Worth Chart: A Complete Information. We respect your consideration to our article. See you in our subsequent article!