Decoding The Labyrinth: A Complete Information To Kind 5500 Due Dates With Chart

By admin / August 4, 2024 / No Comments / 2025

Decoding the Labyrinth: A Complete Information to Kind 5500 Due Dates with Chart

Associated Articles: Decoding the Labyrinth: A Complete Information to Kind 5500 Due Dates with Chart

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Decoding the Labyrinth: A Complete Information to Kind 5500 Due Dates with Chart. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Decoding the Labyrinth: A Complete Information to Kind 5500 Due Dates with Chart

Kind 5500, the annual return/report for worker profit plans, is a vital doc for plan sponsors, directors, and fiduciaries. Navigating its complexities, particularly understanding the assorted due dates, is usually a daunting job. This text goals to light up the intricacies of Kind 5500 due dates, offering a transparent, complete chart and detailed explanations to make sure compliance.

Understanding the Significance of Well timed Submitting

The well timed submitting of Kind 5500 isn’t merely a bureaucratic formality; it is a authorized obligation with important penalties for non-compliance. Failure to file on time can lead to substantial penalties, starting from lots of to hundreds of {dollars} per day, relying on the severity and length of the delay. Moreover, late filings can jeopardize the plan’s tax-exempt standing, expose fiduciaries to non-public legal responsibility, and hinder the plan’s means to function successfully. Due to this fact, a radical understanding of the relevant due dates is paramount.

Components Figuring out Kind 5500 Due Dates

A number of components affect the due date for submitting Kind 5500:

-

Plan Yr: The plan yr, not the calendar yr, determines the submitting deadline. Most plans function on a calendar yr (January 1st to December thirty first), however some could have totally different plan years.

-

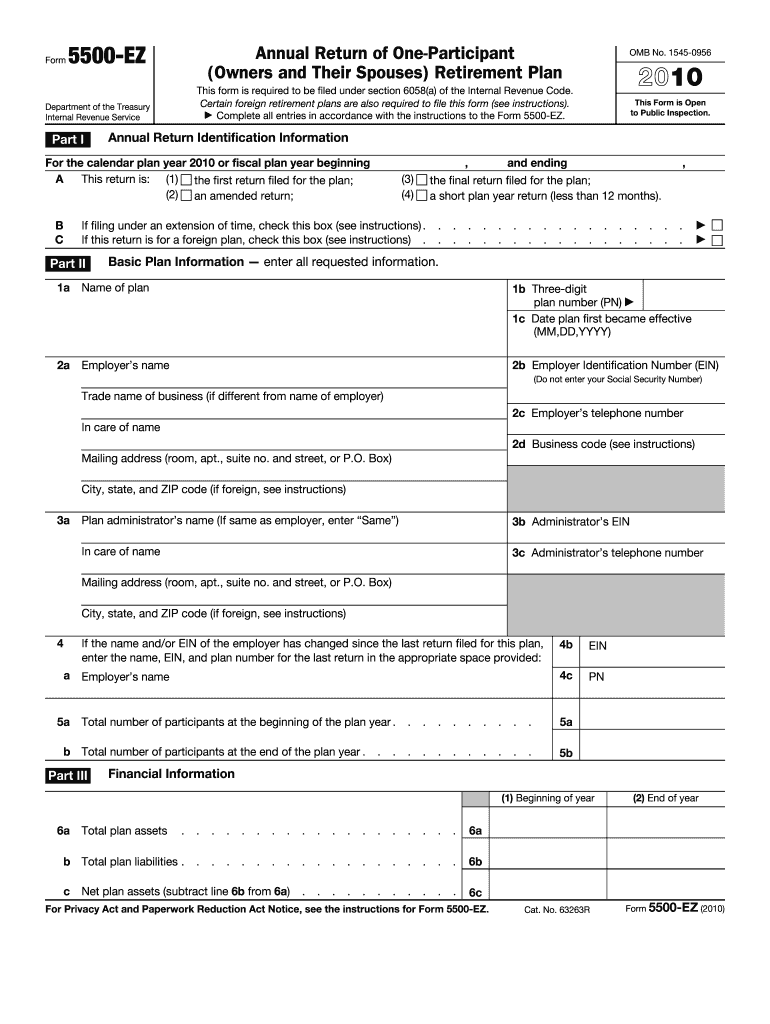

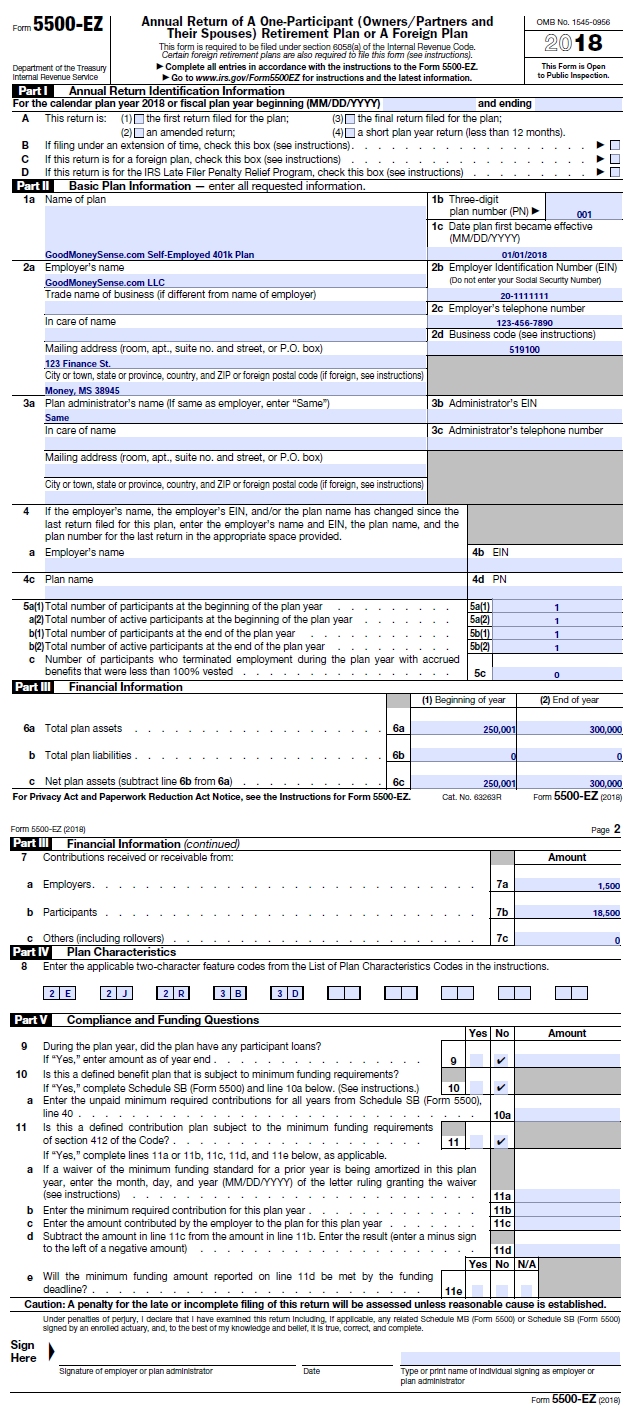

Plan Sort: Several types of worker profit plans have various due dates. This contains pension plans, profit-sharing plans, 401(okay) plans, and others. The particular plan sort dictates the relevant Kind 5500 collection (e.g., Kind 5500, 5500-EZ, 5500-SF).

-

Plan Asset Dimension: The full belongings of the plan on the finish of the plan yr affect the submitting necessities and, in some circumstances, the due date. Bigger plans typically face stricter deadlines and extra in depth reporting necessities.

-

Submitting Medium: Whether or not the shape is filed electronically or on paper additionally impacts the due date. Digital submitting is mostly inspired and infrequently provides prolonged deadlines in comparison with paper submitting.

The Kind 5500 Due Dates Chart:

The next chart gives a common overview of Kind 5500 due dates. It is essential to do not forget that this can be a simplified illustration and shouldn’t be thought of an alternative choice to skilled recommendation. All the time seek the advice of the official IRS directions and search steerage from a professional skilled to make sure compliance.

| Plan Sort | Plan Yr Finish (Instance) | Paper Submitting Due Date (Instance) | Digital Submitting Due Date (Instance) | Asset Dimension Consideration |

|---|---|---|---|---|

| Giant Plan (Over $100 Million Property) | December 31, 2023 | July 31, 2024 | October 15, 2024 | Important affect on deadlines |

| Giant Plan (Over $100 Million Property) | December 31, 2024 | July 31, 2025 | October 15, 2025 | Important affect on deadlines |

| Small Plan (Underneath $100 Million Property) | December 31, 2023 | July 31, 2024 | October 15, 2024 | Minimal affect on deadlines |

| Small Plan (Underneath $100 Million Property) | December 31, 2024 | July 31, 2025 | October 15, 2025 | Minimal affect on deadlines |

| Small Plan (Kind 5500-EZ) | December 31, 2023 | July 31, 2024 | October 15, 2024 | Minimal affect on deadlines |

| Small Plan (Kind 5500-EZ) | December 31, 2024 | July 31, 2025 | October 15, 2025 | Minimal affect on deadlines |

| A number of Employer Plans (MEPs) | Varies | Varies | Varies | Important affect on deadlines |

| Particular person Retirement Accounts (IRAs) | Not Relevant | Not Relevant | Not Relevant | N/A |

Be aware: This chart makes use of a December thirty first plan yr finish for example. Alter the dates accordingly for plans with totally different plan yr ends. The "Varies" entries spotlight that due dates for these plan varieties rely upon a number of different components and require cautious evaluate of the IRS pointers.

Understanding the Variations: Giant vs. Small Plans

The excellence between giant and small plans considerably impacts the due dates. Giant plans, usually outlined as these with belongings exceeding a sure threshold (at present $100 million), face earlier deadlines. That is because of the elevated complexity and scrutiny related to bigger plans. The IRS requires extra time to course of these filings, therefore the sooner deadline.

The Significance of Digital Submitting

Digital submitting is strongly inspired by the IRS and infrequently gives an extension to the due date in comparison with paper submitting. The IRS gives numerous digital submitting techniques, and using them can streamline the method and cut back the danger of errors. Nevertheless, at all times guarantee your chosen system is compliant with IRS rules.

Penalties of Non-Compliance

Failure to file Kind 5500 on time can lead to important penalties. These penalties are usually calculated on a per-day foundation for every day the submitting is late. The quantity of the penalty can range relying on the plan’s measurement, the size of the delay, and whether or not the failure was intentional or as a result of cheap trigger. Past monetary penalties, non-compliance also can result in authorized motion, reputational injury, and potential lack of tax-exempt standing for the plan.

In search of Skilled Steering

Given the complexity of Kind 5500 and its related due dates, in search of skilled steerage is very really useful. Skilled retirement plan professionals, comparable to enrolled brokers, CPAs, and actuaries, can present invaluable help in guaranteeing correct and well timed submitting. They will help navigate the intricacies of the rules, choose the suitable Kind 5500 collection, and guarantee compliance with all relevant necessities.

Staying Up to date on Adjustments

IRS rules and pointers are topic to vary. It is essential to remain up to date on any modifications to Kind 5500 necessities and due dates. Repeatedly verify the IRS web site and seek the advice of with professionals to make sure your compliance technique stays present and efficient.

Conclusion:

Navigating the complexities of Kind 5500 due dates requires cautious consideration to element and a radical understanding of the related rules. This text gives a foundational overview and a simplified chart to assist in comprehension. Nevertheless, it is important to do not forget that this data is for common steerage solely. All the time seek the advice of the official IRS directions and search skilled recommendation to make sure correct and well timed submitting, thereby avoiding potential penalties and safeguarding the plan’s integrity and tax-exempt standing. Proactive planning {and professional} steerage are key to efficiently managing the Kind 5500 submitting course of.

Closure

Thus, we hope this text has offered invaluable insights into Decoding the Labyrinth: A Complete Information to Kind 5500 Due Dates with Chart. We hope you discover this text informative and helpful. See you in our subsequent article!