Decoding The Language Of The Market: A Complete Information To Chart Sample Inventory Buying and selling

By admin / October 27, 2024 / No Comments / 2025

Decoding the Language of the Market: A Complete Information to Chart Sample Inventory Buying and selling

Associated Articles: Decoding the Language of the Market: A Complete Information to Chart Sample Inventory Buying and selling

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the Language of the Market: A Complete Information to Chart Sample Inventory Buying and selling. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Decoding the Language of the Market: A Complete Information to Chart Sample Inventory Buying and selling

Chart patterns, the visible representations of value motion over time, are a cornerstone of technical evaluation. They provide merchants a robust device to anticipate potential value actions, establish entry and exit factors, and handle danger. Whereas not foolproof predictors of future value motion, understanding and successfully using chart patterns considerably enhances buying and selling methods. This complete information delves into the world of chart patterns, exploring their formation, interpretation, and sensible purposes in inventory buying and selling.

Understanding the Fundamentals: What are Chart Patterns?

Chart patterns emerge from the interaction of provide and demand available in the market. They visually depict the collective conduct of consumers and sellers, revealing potential shifts in momentum and pattern course. These patterns are shaped by connecting a sequence of value highs and lows on a chart, creating recognizable shapes that usually precede vital value adjustments. The reliability of a sample is commonly influenced by elements just like the timeframe thought of (every day, weekly, month-to-month), the quantity accompanying the value motion, and the general market context.

Categorizing Chart Patterns: Continuation vs. Reversal

Chart patterns are broadly categorized into two most important teams: continuation and reversal patterns.

-

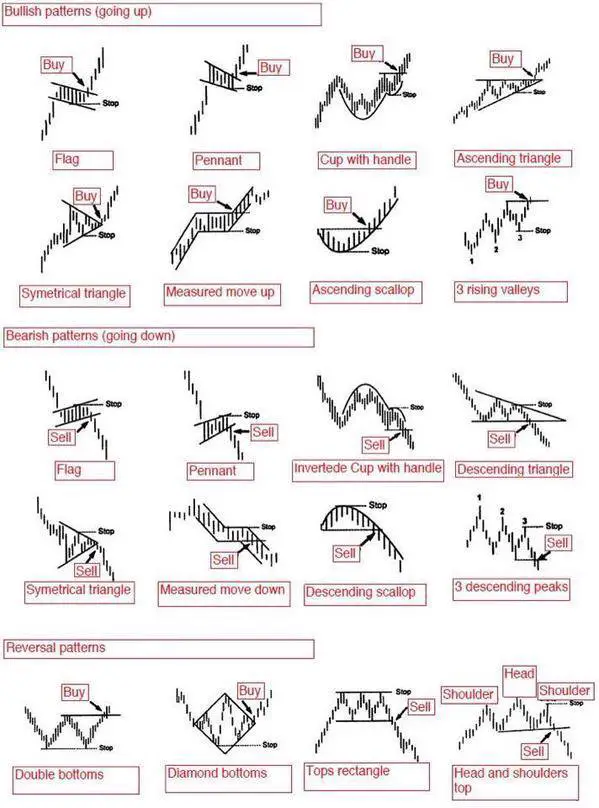

Continuation Patterns: These patterns counsel a brief pause in an current pattern earlier than the value resumes its unique course. They point out a interval of consolidation or sideways motion, permitting the value to collect momentum earlier than persevering with its upward or downward trajectory. Examples embody triangles, flags, pennants, and rectangles.

-

Reversal Patterns: These patterns sign a possible change within the prevailing pattern. They counsel that the present upward or downward motion is prone to reverse. Examples embody head and shoulders, double tops and bottoms, and inverse head and shoulders.

Exploring Frequent Chart Patterns:

Let’s delve into a few of the most steadily encountered and dependable chart patterns:

1. Continuation Patterns:

-

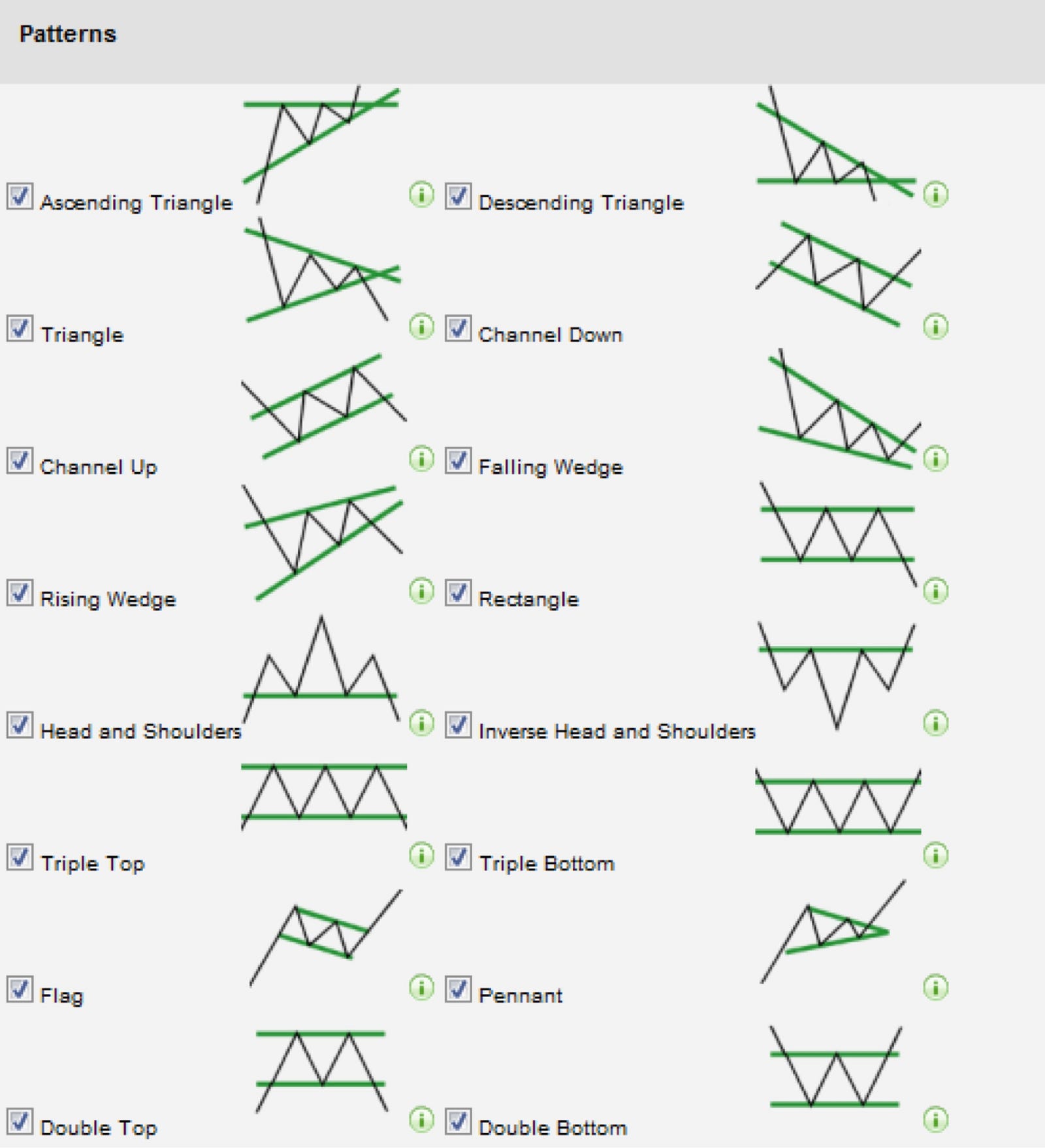

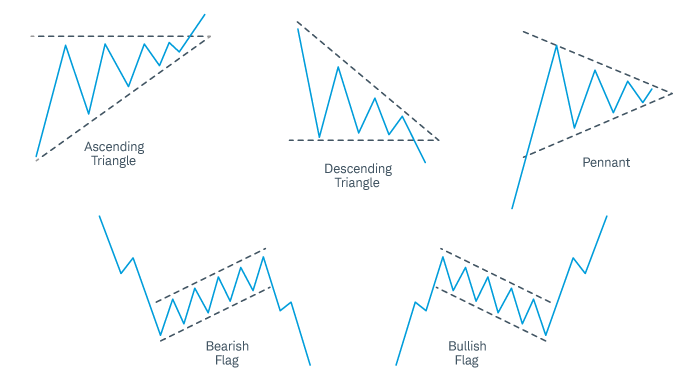

Triangles: Triangles are characterised by converging trendlines, forming a triangular form on the chart. They symbolize a interval of consolidation the place consumers and sellers are locked in a battle. The breakout from a triangle often happens within the course of the previous pattern. There are three most important sorts: symmetrical, ascending, and descending triangles.

-

Flags and Pennants: These patterns resemble flags or pennants hooked up to a flagpole. The flagpole represents a pointy value motion, whereas the flag or pennant depicts a interval of consolidation. Breakouts from flags and pennants usually happen within the course of the flagpole. Pennants are typically extra symmetrical than flags.

-

Rectangles: Rectangles are characterised by parallel horizontal trendlines, indicating a interval of sideways consolidation. Breakouts from rectangles can happen in both course, however the course of the breakout typically signifies the long run pattern.

2. Reversal Patterns:

-

Head and Shoulders: This traditional reversal sample consists of three peaks, with the center peak (the top) being considerably larger than the opposite two (the shoulders). A neckline connects the troughs between the peaks. A break beneath the neckline confirms the bearish reversal.

-

Inverse Head and Shoulders: That is the mirror picture of the top and shoulders sample, indicating a bullish reversal. It consists of three troughs, with the center trough (the top) being considerably decrease than the opposite two (the shoulders). A break above the neckline confirms the bullish reversal.

-

Double Tops and Bottoms: Double tops are shaped by two consecutive peaks at roughly the identical value degree, adopted by a decline. Double bottoms are shaped by two consecutive troughs at roughly the identical value degree, adopted by an increase. These patterns sign potential pattern reversals.

Deciphering Chart Patterns: Key Concerns:

Whereas chart patterns present helpful insights, it is essential to think about a number of elements for correct interpretation:

-

Quantity: The amount accompanying a breakout from a sample is essential. Excessive quantity confirms the energy of the transfer, whereas low quantity suggests weak conviction and a possible false breakout.

-

Affirmation: It is important to search for affirmation of a sample breakout utilizing different technical indicators, resembling transferring averages, RSI, or MACD. This helps to filter out false breakouts.

-

Assist and Resistance Ranges: Figuring out help and resistance ranges along with chart patterns might help pinpoint potential entry and exit factors.

-

General Market Context: The broader market surroundings considerably impacts the reliability of chart patterns. Throughout sturdy market tendencies, patterns could also be much less dependable.

-

Timeframe: The timeframe used for evaluation impacts sample identification and interpretation. A sample that seems vital on a every day chart is perhaps insignificant on a weekly chart.

Sensible Functions in Inventory Buying and selling:

Chart patterns are invaluable instruments for varied points of inventory buying and selling:

-

Figuring out Entry and Exit Factors: Breakouts from chart patterns can present clear entry indicators, whereas pullbacks to help ranges throughout the sample can provide further entry alternatives. Conversely, breakouts in the wrong way can sign exit factors.

-

Setting Cease-Loss Orders: Cease-loss orders might be strategically positioned beneath the neckline in head and shoulders patterns or beneath help ranges in different patterns, minimizing potential losses.

-

Managing Danger: By understanding the potential dangers related to a specific sample, merchants can modify their place sizing and danger administration methods accordingly.

-

Combining with Different Indicators: Chart patterns are handiest when used along with different technical indicators, making a extra complete buying and selling technique.

Limitations and Misinterpretations:

It is essential to acknowledge the restrictions of relying solely on chart patterns:

-

Subjectivity: Figuring out and decoding chart patterns might be subjective, resulting in differing opinions amongst merchants.

-

False Breakouts: Patterns can expertise false breakouts, resulting in deceptive indicators. Subsequently, affirmation from different indicators is crucial.

-

Not a Standalone Technique: Chart patterns shouldn’t be used as a standalone buying and selling technique. They need to be built-in right into a broader buying and selling plan that comes with danger administration, cash administration, and different technical and basic evaluation.

Conclusion:

Chart patterns provide a robust visible language for understanding market dynamics and anticipating potential value actions. By mastering the identification and interpretation of assorted chart patterns, merchants can considerably improve their buying and selling methods. Nevertheless, it is essential to keep in mind that chart patterns will not be foolproof predictors, and their effectiveness depends upon cautious evaluation, affirmation from different indicators, and a sturdy danger administration plan. Steady studying, observe, and a disciplined strategy are important for efficiently incorporating chart patterns right into a worthwhile buying and selling technique. All the time bear in mind to conduct thorough analysis and take into account consulting with a monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has offered helpful insights into Decoding the Language of the Market: A Complete Information to Chart Sample Inventory Buying and selling. We hope you discover this text informative and helpful. See you in our subsequent article!