Decoding The Market: A Complete Information To Chart Evaluation For Inventory Investing

By admin / July 31, 2024 / No Comments / 2025

Decoding the Market: A Complete Information to Chart Evaluation for Inventory Investing

Associated Articles: Decoding the Market: A Complete Information to Chart Evaluation for Inventory Investing

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the Market: A Complete Information to Chart Evaluation for Inventory Investing. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Decoding the Market: A Complete Information to Chart Evaluation for Inventory Investing

Chart evaluation, also called technical evaluation, is a robust device for buyers in search of to know market developments and predict future value actions. In contrast to elementary evaluation, which focuses on an organization’s monetary well being, chart evaluation examines value and quantity knowledge to establish patterns and indicators that may inform buying and selling choices. This text gives a complete overview of chart evaluation, protecting key ideas, indicators, and techniques for newcomers and skilled buyers alike.

The Basis: Worth and Quantity

The bedrock of chart evaluation lies in decoding value and quantity knowledge. Worth represents the market’s collective valuation of a inventory at a given time, reflecting the interaction of provide and demand. Quantity, the variety of shares traded, gives essential context to cost actions. Excessive quantity accompanying a value enhance suggests sturdy shopping for stress, whereas excessive quantity with a value lower signifies important promoting stress. Low quantity actions, conversely, can recommend indecision or an absence of conviction available in the market.

Chart Sorts: Visualizing Market Dynamics

A number of chart varieties are utilized in technical evaluation, every providing a novel perspective on value motion:

-

Line Charts: The only kind, displaying solely the closing value for every interval (each day, weekly, month-to-month). Helpful for figuring out long-term developments.

-

Bar Charts: Show the opening, excessive, low, and shutting costs for every interval. The visible illustration of the worth vary gives a extra detailed image of value volatility.

-

Candlestick Charts: A complicated model of bar charts, utilizing "candles" to symbolize value ranges. The physique of the candle represents the vary between the opening and shutting costs, whereas the "wicks" (higher and decrease shadows) present the excessive and low costs for the interval. Candlestick patterns supply a wealthy vocabulary for decoding value motion, figuring out potential reversals or continuations of developments.

-

Level & Determine Charts: These charts focus solely on value actions, ignoring time. Worth adjustments of a predetermined magnitude set off a brand new "X" (for value will increase) or "O" (for value decreases) on the chart. This strategy filters out noise and highlights important value adjustments.

Key Technical Indicators: Unveiling Hidden Alerts

Quite a few technical indicators are derived from value and quantity knowledge to reinforce chart evaluation. These indicators present quantitative indicators that may affirm or contradict value motion interpretations:

-

Transferring Averages (MAs): Calculated by averaging costs over a particular interval (e.g., 50-day, 200-day MA). MAs clean out value fluctuations, highlighting developments and potential assist/resistance ranges. Crossovers between totally different MAs (e.g., a 50-day MA crossing above a 200-day MA, a "golden cross") are sometimes thought-about bullish indicators.

-

Relative Energy Index (RSI): A momentum indicator that measures the magnitude of current value adjustments to guage overbought or oversold circumstances. RSI values above 70 are usually thought-about overbought, whereas values under 30 recommend oversold circumstances. Nevertheless, RSI divergence (value making new highs whereas RSI fails to take action) could be a highly effective reversal sign.

-

Transferring Common Convergence Divergence (MACD): A trend-following momentum indicator that compares two shifting averages to establish adjustments in momentum. MACD crossovers (the MACD line crossing its sign line) can sign potential development adjustments.

-

Bollinger Bands: Envelopes plotted round a shifting common, sometimes two commonplace deviations above and under. They assist visualize value volatility and potential reversals. Worth bouncing off the higher or decrease band can recommend overbought or oversold circumstances, respectively.

-

Quantity Indicators: Resembling On-Steadiness Quantity (OBV) and Chaikin Cash Move (CMF), measure the connection between value and quantity to gauge shopping for and promoting stress. Divergence between value and quantity indicators could be a sturdy sign.

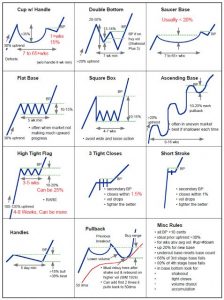

Chart Patterns: Recognizing Predictable Market Conduct

Chart patterns are recurring formations on value charts that always precede particular value actions. Recognizing these patterns can present precious insights into potential future value motion:

-

Head and Shoulders: A reversal sample suggesting a possible development change from uptrend to downtrend.

-

Inverse Head and Shoulders: A bullish reversal sample, mirroring the Head and Shoulders sample.

-

Triangles: Consolidation patterns that may precede a breakout in both course. Symmetrical, ascending, and descending triangles are frequent variations.

-

Flags and Pennants: Continuation patterns suggesting a brief pause in a development earlier than its resumption.

-

Double Tops and Bottoms: Reversal patterns indicating potential development adjustments.

Assist and Resistance Ranges: Figuring out Key Worth Zones

Assist ranges symbolize value zones the place shopping for stress is anticipated to outweigh promoting stress, stopping additional value declines. Resistance ranges are zones the place promoting stress is anticipated to beat shopping for stress, hindering additional value will increase. These ranges are sometimes shaped by earlier highs and lows, in addition to psychological value factors (e.g., spherical numbers). Breakouts above resistance or under assist can set off important value actions.

Fibonacci Retracements and Extensions: Making use of Mathematical Ratios

Fibonacci retracements and extensions make the most of the Fibonacci sequence (0, 1, 1, 2, 3, 5, 8, 13…) to establish potential assist and resistance ranges inside a development. Retracements measure the potential pullback inside a development, whereas extensions undertaking potential goal costs for a continuation.

Threat Administration and Place Sizing: The Essential Aspect

Chart evaluation is only one piece of the puzzle. Profitable investing requires a sturdy threat administration technique and applicable place sizing. By no means make investments greater than you possibly can afford to lose, and at all times use stop-loss orders to restrict potential losses. Diversification throughout totally different property can be essential to mitigate threat.

Limitations of Chart Evaluation:

Whereas chart evaluation could be a precious device, it is important to acknowledge its limitations:

-

Subjectivity: Deciphering chart patterns and indicators will be subjective, resulting in differing conclusions amongst analysts.

-

Self-fulfilling Prophecies: Widespread perception in a specific chart sample can affect market conduct, probably making the prediction self-fulfilling.

-

False Alerts: Indicators and patterns can generate false indicators, resulting in incorrect buying and selling choices.

-

Ignoring Fundamentals: Relying solely on chart evaluation with out contemplating elementary components can result in overlooking essential details about an organization’s long-term prospects.

Conclusion:

Chart evaluation is a robust approach for understanding market dynamics and predicting potential value actions. Nevertheless, it ought to be used along side elementary evaluation and sound threat administration practices. By mastering the ideas of value motion, technical indicators, chart patterns, and assist/resistance ranges, buyers can considerably improve their buying and selling methods and enhance their probabilities of success. Steady studying, apply, and disciplined execution are key to mastering the artwork of chart evaluation and reaching constant profitability within the inventory market. Bear in mind to at all times conduct thorough analysis and take into account in search of recommendation from a professional monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered precious insights into Decoding the Market: A Complete Information to Chart Evaluation for Inventory Investing. We admire your consideration to our article. See you in our subsequent article!