Decoding The Market: A Complete Information To Chart Studying For Inventory Market Success

By admin / June 29, 2024 / No Comments / 2025

Decoding the Market: A Complete Information to Chart Studying for Inventory Market Success

Associated Articles: Decoding the Market: A Complete Information to Chart Studying for Inventory Market Success

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Market: A Complete Information to Chart Studying for Inventory Market Success. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the Market: A Complete Information to Chart Studying for Inventory Market Success

The inventory market can really feel like a chaotic, unpredictable realm, however beneath the floor lies a wealth of knowledge available to those that know find out how to interpret it. Chart studying, also referred to as technical evaluation, is an important talent for navigating this panorama. It permits buyers to determine traits, predict potential value actions, and make knowledgeable buying and selling selections. Whereas it is not a foolproof system, mastering chart studying considerably enhances your probabilities of success within the inventory market. This text gives a complete information that can assist you embark in your journey to changing into a proficient chart reader.

I. Understanding the Fundamentals: Chart Varieties and Timeframes

Earlier than diving into particular chart patterns, it is important to grasp the several types of charts and timeframes utilized in technical evaluation.

-

Line Charts: The only kind, displaying solely the closing value of a safety for every interval (each day, weekly, month-to-month, and many others.). They’re good for visualizing long-term traits however lack the element of different chart varieties.

-

Bar Charts: Every bar represents a selected time interval (e.g., a day). The bar’s excessive, low, open, and shutting costs are visually represented. This gives extra info than a line chart, displaying the worth vary inside the interval.

-

Candlestick Charts: These are the most well-liked chart kind amongst technical analysts. They supply the identical info as bar charts however in a extra visually intuitive method. The "physique" of the candlestick represents the worth vary between the open and shut. A inexperienced (or white) candlestick signifies a closing value larger than the opening value (bullish), whereas a pink (or black) candlestick signifies a closing value decrease than the opening value (bearish). The "wicks" or "shadows" lengthen from the physique to point out the excessive and low costs for the interval. Candlestick patterns, mentioned later, are essential for figuring out potential value reversals or continuations.

-

Timeframes: The timeframe refers back to the interval every knowledge level represents. Widespread timeframes embody:

- Intraday: Charts displaying value actions inside a single buying and selling day (e.g., 1-minute, 5-minute, 15-minute, hourly charts). Helpful for short-term buying and selling.

- Each day: Charts displaying value actions for every day. Appropriate for each short-term and medium-term buying and selling.

- Weekly: Charts displaying value actions for every week. Helpful for medium-term and long-term buying and selling methods.

- Month-to-month: Charts displaying value actions for every month. Primarily used for long-term pattern evaluation.

Selecting the best chart kind and timeframe depends upon your buying and selling model and funding horizon. Quick-term merchants usually use intraday charts, whereas long-term buyers might concentrate on weekly or month-to-month charts.

II. Key Technical Indicators: Including Context to Charts

Whereas chart patterns themselves present helpful insights, technical indicators add one other layer of study, confirming or contradicting potential value actions. Some generally used indicators embody:

-

Transferring Averages (MA): These clean out value fluctuations and spotlight traits. Widespread varieties embody easy shifting averages (SMA) and exponential shifting averages (EMA). Crossovers of various shifting averages (e.g., a 50-day MA crossing above a 200-day MA) can sign potential pattern adjustments.

-

Relative Power Index (RSI): This momentum indicator measures the magnitude of latest value adjustments to guage overbought or oversold situations. RSI values above 70 usually recommend an overbought market, whereas values beneath 30 point out an oversold market. These ranges can sign potential value reversals.

-

MACD (Transferring Common Convergence Divergence): This trend-following momentum indicator identifies adjustments within the power, route, momentum, and period of a pattern. It consists of two shifting averages and a sign line, with crossovers indicating potential purchase or promote indicators.

-

Bollinger Bands: These bands plot normal deviations round a shifting common, indicating value volatility. Worth bounces off the higher or decrease bands can sign potential reversals.

-

Quantity: Analyzing buying and selling quantity alongside value actions gives essential context. Excessive quantity throughout value will increase confirms the power of an uptrend, whereas excessive quantity throughout value decreases confirms a downtrend. Low quantity throughout value actions suggests weak momentum.

It is essential to notice that indicators needs to be used together with chart patterns, not in isolation. No single indicator is ideal, and relying solely on one can result in inaccurate predictions.

III. Mastering Chart Patterns: Figuring out Potential Worth Actions

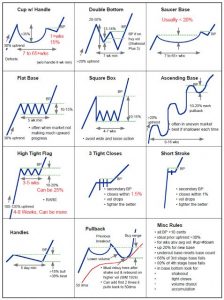

Chart patterns are recurring formations on value charts that usually predict future value actions. Recognizing these patterns is an important talent for any chart reader. Some key patterns embody:

-

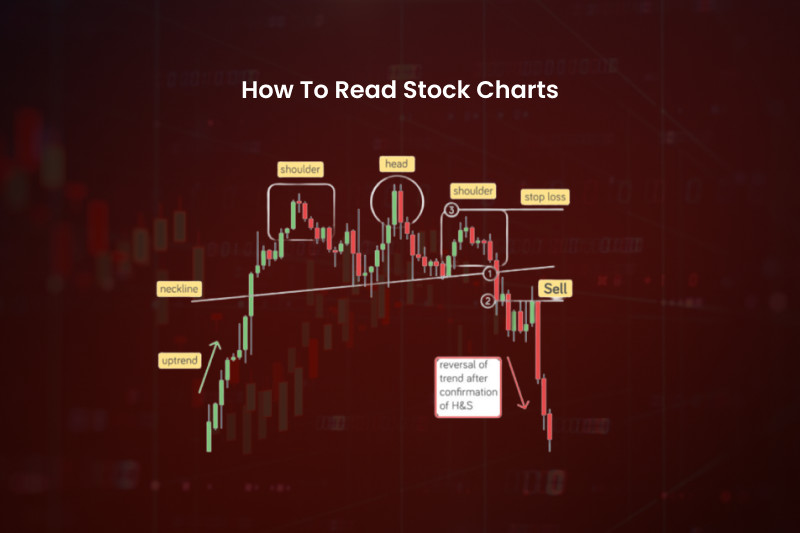

Head and Shoulders: A bearish reversal sample characterised by three peaks, with the center peak (the "head") being the best. A break beneath the neckline confirms the sample and suggests a possible value decline.

-

Inverse Head and Shoulders: A bullish reversal sample, the mirror picture of the top and shoulders sample. A break above the neckline suggests a possible value improve.

-

Triangles: These patterns symbolize intervals of consolidation earlier than a possible breakout. Symmetrical triangles usually result in breakouts in both route, whereas ascending triangles recommend an upward breakout and descending triangles recommend a downward breakout.

-

Flags and Pennants: These are short-term continuation patterns that seem throughout sturdy traits. Flags are rectangular patterns, whereas pennants are triangular patterns. Breakouts from these patterns usually proceed the present pattern.

-

Double Tops and Double Bottoms: These patterns point out potential reversals. A double prime suggests a possible value decline after the worth fails to interrupt above a resistance degree twice, whereas a double backside suggests a possible value improve after the worth fails to interrupt beneath a help degree twice.

-

Cup and Deal with: A bullish continuation sample resembling a cup with a deal with. A breakout above the deal with suggests a continuation of the uptrend.

Studying to determine these and different chart patterns requires follow and expertise. Begin by specializing in just a few key patterns and progressively broaden your information as you grow to be extra comfy.

IV. Help and Resistance Ranges: Figuring out Key Worth Factors

Help and resistance ranges are essential ideas in technical evaluation.

-

Help Stage: A value degree the place shopping for strain is powerful sufficient to stop additional value declines. The worth usually "bounces" off this degree.

-

Resistance Stage: A value degree the place promoting strain is powerful sufficient to stop additional value will increase. The worth usually "bounces" off this degree.

These ranges are sometimes recognized by horizontal traces drawn throughout earlier value highs (resistance) and lows (help). Breaks above resistance ranges usually sign bullish momentum, whereas breaks beneath help ranges usually sign bearish momentum.

V. Combining Chart Studying with Basic Evaluation:

Whereas technical evaluation gives helpful insights into value actions, it should not be utilized in isolation. Basic evaluation, which focuses on an organization’s monetary well being, business place, and administration crew, gives essential context. Combining each approaches creates a extra sturdy funding technique.

VI. Sensible Steps to Enhance Your Chart Studying Expertise:

-

Begin with a Demo Account: Apply chart studying on a demo account earlier than risking actual cash. This lets you experiment with completely different indicators and methods with out monetary penalties.

-

Give attention to a Few Key Indicators and Patterns: Do not attempt to study all the pieces without delay. Grasp just a few key indicators and patterns earlier than shifting on to extra superior ideas.

-

Backtest Your Methods: Take a look at your buying and selling methods on historic knowledge to guage their effectiveness.

-

Hold a Buying and selling Journal: Doc your trades, together with your reasoning, entry and exit factors, and the outcomes. This helps you study out of your errors and enhance your decision-making course of.

-

Keep Up to date: The inventory market is consistently evolving, so it is essential to remain up to date on the newest information and traits.

-

Search Mentorship: Take into account searching for mentorship from skilled merchants or becoming a member of on-line communities to study from others.

VII. Conclusion:

Chart studying is a robust software for navigating the complexities of the inventory market. By mastering the basics, understanding key indicators and patterns, and mixing technical evaluation with basic evaluation, you possibly can considerably enhance your funding decision-making. Do not forget that chart studying is a talent that requires time, follow, and persistence. Do not count on to grow to be an knowledgeable in a single day, however with constant effort and dedication, you possibly can unlock the potential of chart studying and improve your probabilities of success within the inventory market. At all times do not forget that investing entails threat, and previous efficiency is just not indicative of future outcomes. Conduct thorough analysis and contemplate searching for skilled monetary recommendation earlier than making any funding selections.

Closure

Thus, we hope this text has supplied helpful insights into Decoding the Market: A Complete Information to Chart Studying for Inventory Market Success. We hope you discover this text informative and helpful. See you in our subsequent article!